JHVEPhoto/iStock Editorial via Getty Images

Background and Offer

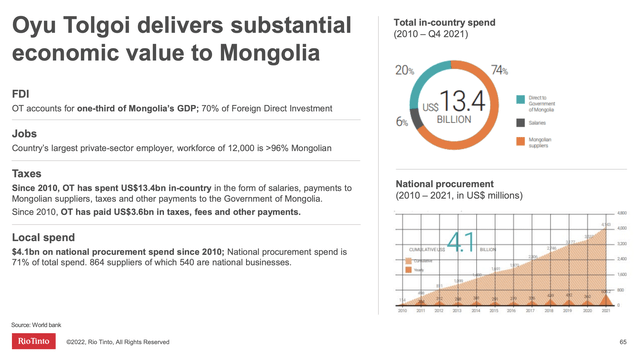

Rio Tinto (NYSE:RIO) is one of the top five metal and mining corporations worldwide. Rio Tinto specializes in extracting and commercializing iron, copper, diamond, gold, and uranium. Recently the company announced the buy-out of a much smaller mining organization. Turquoise Hill Resources (TRQ) is a small copper mining company that currently owns 66% of the Oyu Tolgoi copper mine in Mongolia. 34% of the stake in the mine is owned by an entity controlled by the Mongolian government. Rio has the infrastructure and the capability to update this mine and create value for mine shareholders and Rio Tinto.

How does Rio Tinto Benefit?

Rio Tinto would benefit in a variety of ways through the purchase of Turquoise Hill Resources. While the copper production itself is impressive, many analysts have not been shy in referring to Oyu Tolgoi as a tier-one copper asset. This will only improve as Rio Tinto will have the opportunity to gain control of production fully, make sure the mine is the most profitable, and take away many of the risks that their investments in Turquoise Hill Resources had before.

Rio Tinto 2021 Annual Report Earnings Presentation

One of the biggest problems with buying out the remaining stake of Turquoise Hill Resource is that that company would then be the majority shareholder of the Oyu Tolgoi mine. Rio Tinto would control 66% of the Mongolian governments 33%. This may potentially cause problems in Mongolia. However, I am not too concerned with the overall approval of the deal. Considering most of the copper in that mine will be exported to China, the Mongolian government is stuck between a rock and a hard place. Either they capitulate to Rio Tinto and still gain some royalty and the macro benefits of the mine. Or they could put up a fight, and the Chinese government may become involved.

Turquoise Hill Resources Q4 2021 Earnings Presentation

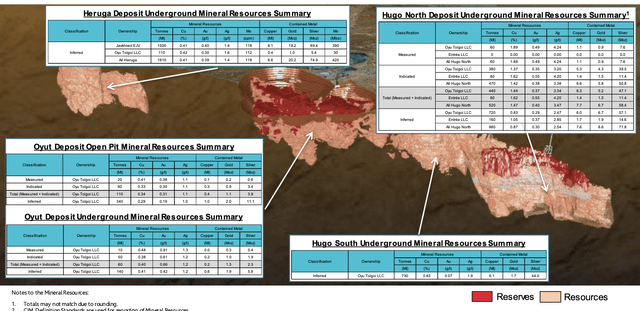

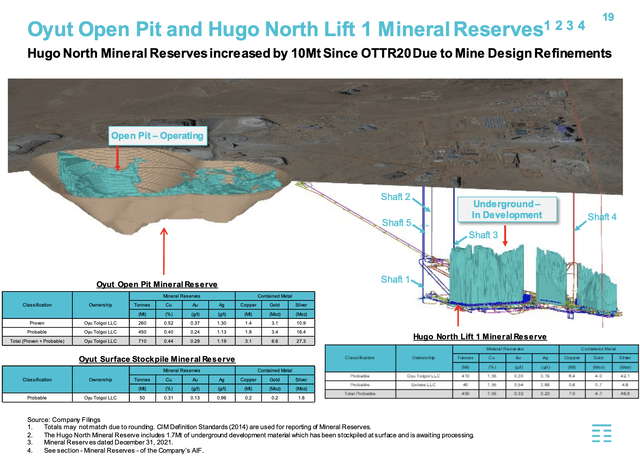

Rio has access to both the open pit and the underground copper deposits. Other precious minerals such as gold and silver have been discovered in these underground deposits. But the mine is prioritizing the exploration of copper. This is partly due to the recent price increase, the increased demand, and the overall undersupply of copper. There are a variety of locations within the Oyu Tolgoi mine site where Rio Tinto can take advantage of its size and influence to get the most out of the mine. With the ownership of Rio Tinto, the mine will be much better served due to the variety of financing options the mine will now have. Many stable revolving credit facilities are now available to the Oyu Tolgoi mine, which will boost shareholder enthusiasm for the stock.

Financially Feasible and Strategically Intelligent

The strategy is financially strategic and intelligent. It will serve to support Rio Tinto’s bottom line and help cement them as a true international conglomerate. The mine in Mongolia would help their international assets and show shareholders real growth outside of their core South American markets. A quote from the head of Rio Tinto’s copper division shows the company’s stance on prediction at Oyu Tolgoi.

Bold Baatar, the head of the Anglo-Australian group’s copper division, said the offer would create a “simpler and efficient ownership” structure for Oyu Tolgoi. – Financial Times Article

The corporate structure of the operations at Oyu Tolgoi would streamline inefficiencies and help support natural growth rather than relying on artificial development by raising debt through shares and then using that to pay off fixed costs. This is a very slippery slope and has the potential to put Turquoise Hill in a compromised position moving forward. I don’t believe this will be a significant issue and is one of the core reasons why Turquoise Hill Resources shareholders will likely vote in favor of the Rio takeover because of the value to shareholders that Rio Tinto inherently brings to the brand name that will help expand the mine and strengthen relationships with the government in place.

Turquoise Hill Resources Q4 2021 Earnings Presentation

Both underground and open pit deposits look very profitable, and they hold a variety of rare earth materials that help support the modern economy and infrastructure. While gold may be primarily used as a reserve asset such as oil or silver, copper has broad industrial uses outside the financial system. While that applies to gold and silver, the sheer amount of copper needed does not match the current supply. Many public copper and nickel producers have been skyrocketing in recent weeks. This is also due to the supply chain cuts in Eastern Europe, the overall scale, and the general world economy’s relation with Russia. This will continue to be a significant boon for Rio Tinto moving forward.

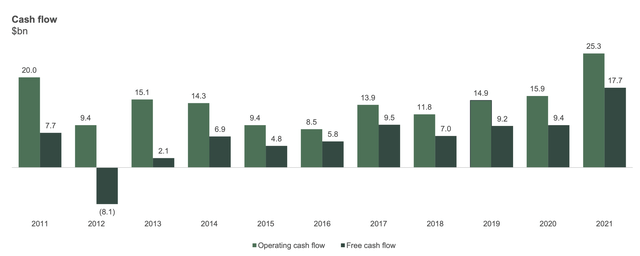

Rio Tinto 2021 Annual Report Earnings Presentation

Cash flows have been solid and are one of the many reasons Rio Tinto has been able to reward shareholders. The increasing cash flows and comprising earnings multipliers make for a good value stock, and with the addition of Turquoise Hill to the portfolio. There will be needed growth momentum that could help propel Rio Tinto into a new age of materials.

Risks of the Deal to Shareholders of Rio Tinto

Rio Tinto will also have a strategic asset because it will have a large copper mine next to Russia and China. While the geopolitical affiliations may cause some short-term uncertainty, Rio Tinto has been around since before World War II, so they have shown the capability to show up when it comes to cleaning up the skeletons they have in the closet. Sector risks mainly relate to the relationship advantage that Vale (VALE) has with many of the key OEMs in the US due to their lower fixed costs and favorable location distances. While Rio Tinto is UK and Australia-based, they make stiff competition for many of these contracts with large materials suppliers worldwide.

Valuing Rio Tinto After a Possible Deal

Rio Tinto needs to continue to show dedication toward growth for their thesis to work. They have been pressing many rival companies and making sure they have positioned themselves politically and economically to best take advantage of the deal for its full range of benefits. Even though Rio Tinto has stagnant revenue, I look at the potential acquisition as an excellent opportunity for Turquoise Hill Resource investors to continue investing in Oyu Tolgoi through Rio Tinto.

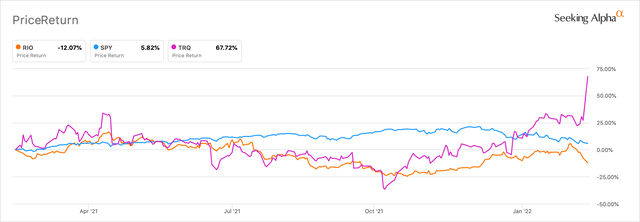

Rio Tinto Seeking Alpha Price Return Peer Comparison

The price return has not been too favorable. However, Turquoise Hill Resources has seen significant price improvement due to the Rio Tinto buy-out offer. This was partially baked into the shares as Rio Tinto already owned 49% of the company. The real opportunity at this point remains in shares of Rio Tinto.

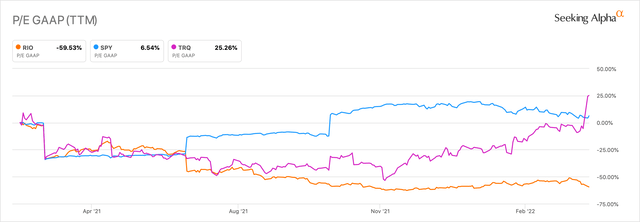

Rio Tinto Seeking Alpha Price-to-Earnings Peer Comparison

Rio Tinto will be in a strong earning position moving forward if the company is able to move through with the acquisition. The mine can bring Rio Tinto more exposure to their key markets and give the international presence to have political influence and macroeconomic influence on the spot prices of these commodities within their new markets.

Conclusion

There will remain good opportunity for growth in Rio Tinto shares for the foreseeable future. With the deals lined up and the potential M&A opportunities, this will be a great reward for Rio Tinto shareholders. I also believe that Turquoise Hill resources investors will leave happy as their investment has done very well and has improved immensely since the announcement of the acquisition. I look forward to covering this deal and any potential updates moving forward.

Be the first to comment