peshkov/iStock via Getty Images

Ring Energy (NYSE:REI) has been constrained by the company hedging program that materially helped company results in 2020. Now management has decided to reduce the hedging program so that production gains more exposure to current prices. That should tremendously increase first quarter cash flow and continue to be a huge benefit as long as oil prices remain strong. The risk with opportunistic hedging is that management may fail to see a future price downturn at a time when banks reduce lending to the cyclical industry. For the time being, investors can look forward far better results that raise the stock price.

The market may be concerned with a lack of cash flow growth caused by the hedging program. The fourth quarter earnings report did show a production increase. But the cash flow was disappointing because of that hedging program.

Many managements tend to cater to market accolades by reducing the hedging program only to be caught by things like the coronavirus demand destruction that can do serious damage to a balance sheet without that same hedging program. Therefore, deciding to reduce the hedging protection can have serious consequences for the company during an unexpected downturn. Stock price pressures can really significantly influence management to take more risk than is otherwise wise.

Ring Energy is a (primarily) central basin producer that has a conventional business. Even though the wells are considered conventional, the company still uses modern completion techniques to enhance well production. Investors benefit from the superior characteristics of both the conventional and unconventional part of the industry as a result.

Management raised the fourth quarter production guidance due to some unexpectedly excellent well results. The company has also initiated a full-time one rig program for the current fiscal year. That part of the program may increase as strong commodity prices persist.

Ring Energy was a company that began its corporate life by acquiring leases in desirable territory and drilling vertical wells on those leases for testing purposes. Management had just begun to drill for production increase purposes when the opportunity to acquire the Northwest Shelf came along. The previously long-term debt free company took on what was widely considered a nominal amount of debt to complete the transaction.

The coronavirus demand destruction changed that nominal debt assumption real fast. The asset story of the company became worthless during the downturn. All that mattered was the debt and the production cash generation. That changed the conservative debt load part of the equation very quickly. Now the current recovery may bring back the asset story at some part while the extremely profitable wells could allow the company to drill its way out of the debt constraints.

Note also that the market gave little to no credit to the hedging program that provided very necessary cash flow during the downturn. That cash flow is considered nonrecurring by the market. Hence the rather subdued participation of the stock in the industry recovery.

The Northwest Shelf acquisition was also expected to increase company production materially to meet a minimal operating amount that would help the company complete its transition to an operating company. Fiscal year 2020 had more than a few challenges that completely aborted the rest of the transition to an operating company. That transition should resume in the current fiscal year with the industry recovery underway.

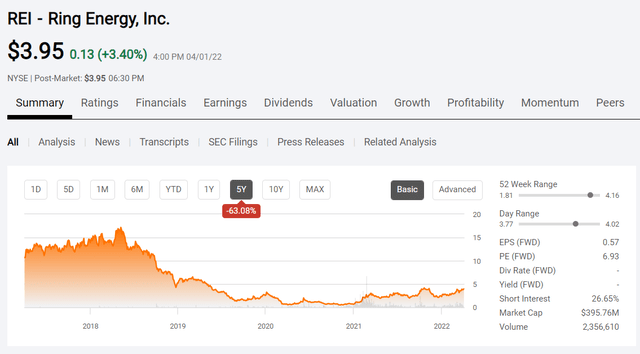

Ring Energy Five Year Stock Price History And Key Valuation Metrics (Seeking Alpha Website April 3, 2022)

The result of the interruption to an operating entity is shown above. The stock price was absolutely decimated. The Delaware Basin acreage sale fell apart. Management was forced to raise cash during an industry bottom. When I called the company, the investor relations department reinforced that had they seen fiscal year 2020 unfolding as it actually had, the purchase of the Northwest Shelf would have been done differently. Most likely there either would have been stock involved in the transaction or they would have sold stock immediately after. But not many foresaw that fiscal year 2020 would present the actual challenges that occurred.

The history here reinforces a key point that Mr. Market often misses. Back when the Northwest Shelf was purchased, the stock price was viewed as undervalued. Nonetheless, a sale of stock at that time still would have allowed the deal to be accretive and may have prevented what followed on the chart above. The evaluation of the risk of what happened is a key consideration that the market often ignores. But that same market will punish management severely when cash flow does not materialize at market bottoms from continuing operations (remember that hedging cash flow is considered nonrecurring by the market).

Now, the equally unforeseen strong industry recovery presents the company with the chance to complete the transition to a very profitable operating entity.

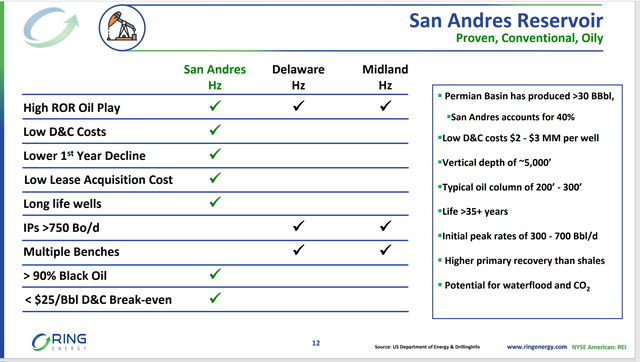

Ring Energy Oil Well Characteristic Summary (Ring Energy Presentation At Enercom Oil & Gas Conference August 2021.)

The difference between Ring Energy and a lot of companies that get themselves into a financial squeeze is the profitability of the Ring Energy wells. Anytime wells breakeven at a cost of $25 (management generally uses price received here instead of a WTI price), those are extremely profitable wells. These wells will have an extremely short payback in the current high oil pricing environment. That allows management to drill more than one well with the same capital money in a fiscal year for a faster cash flow build than is the case in much of the industry.

Furthermore, that low breakeven point allows this company to grow at times when much of the industry cannot profitably grow.

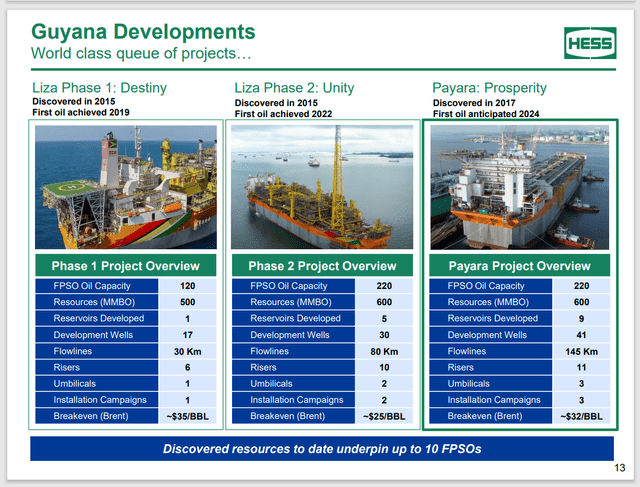

Hess Corporation Guyana Cash Flow Planning (Hess Corporation Presentation At SCOTIA HOWARD WEIL ENERGY & POWER CONFERENCE March 22, 2022)

To give you some idea as to how unusually profitable the Ring Energy wells are, an inexact comparison is made to the world class Guyana project as presented by Hess Corporation (HES) where Exxon Mobil (XOM) is the operator. In this case the breakeven points are based upon Brent pricing. Now normally Brent pricing has a premium to WTI pricing in the Permian and Ring Energy does present received prices. Still Ring Energy likely breaks even with Brent prices in the low $30’s range. That price range is in the middle of the three FPSOs shown above. Of course, that depends upon the relation of Brent prices to WTI prices, and those things remain the same for the received prices. Still, it gives the reader some idea of the value that Ring Energy management has with these wells.

World class projects the size of Guyana need to be unusually profitable for the amount of money spent. Otherwise, the risk of the offshore project is likely to result in subpar cash flow. Ring Energy does not have that offshore risk and it can raise or lower production easily because the wells are relatively low cost. But the company has the well profitability of an offshore project. Rarely can any company come close to the profitability of a world-class offshore project.

It would help if the currently strong prices of oil are maintained for a fiscal year or two. The company is also likely to sell at least one asset to reduce debt. But the worst appears to be over for this company. Should that outlook remain for a while, then the stock price could recover to its previous levels. This management owns a lot of acreage so the company can drill the current holdings for a very long time.

The nice part about this is the acreage costs for this particular interval are relatively cheap. So, management can acquire more acreage if the opportunity presents itself at a fraction of the far more desirable Permian acreage. The recovery opportunity is unusual due to the well profitability and the return of the asset story that powered the company in its earlier days.

The experience here also highlights the unusually low visibility of the oil and gas industry because industry conditions can change overnight. The experience also demonstrates that conservative management will allow a company to survive even in a scenario that went beyond the worst case in the eyes of many managements. Clearly this management is a survivor. Now it’s time to see what management can do with a very profitable proposition until the next inevitable cyclical downturn occurs.

Be the first to comment