Rigel Pharmaceuticals (RIGL) recently reported their Q4/2019 earnings with a beat on EPS and revenue. The company posted a strong 2019 with respectable commercial numbers and focused effort on executing their 4 key value drivers (Figure 1). The company’s flagship product, TAVALISSE, continues to report strong sales growth in the U.S. and recorded $13.8M in net product sales, which was a 90% increase over Q4 of 2018. Altogether, the company was able to put together sequential growth for 2019 with full-year net product sales coming in at $43.8M. Despite the commercial progress, the share price has been stuck in the $2.00-$3.00 range and appears to be an undervalued stock. I believe the market will eventually have to recognize RIGL and the company’s latent value.

Figure 1: RIGL Value Drivers (Source: RIGL)

I intend to review Rigel’s Q4 earnings report and commercial numbers. In addition, I take a look at the company’s current valuation to determine if RIGL is still a buy.

Q4 and 2019 Numbers

In Q4, Rigel shipped 1,518 bottles to their specialty distributors that resulted in $13.8 net product sales, which is up from $11.7M in Q3 (Figure 2).

Figure 2: Net Revenue Quarterly (Source: RIGL)

Since launch, Rigel has sold nearly 7K bottles which have produced $57.7M in sales. The company’s full-year gross to net adjustment was approximately 17.5%.

In terms of OpEx, total Q4 cost and expenses came in at approximately $32.7M, which is down $35.3M in Q4 of 2018. Rigel ended 2019 with $98.1M in cash and short-term investments.

Overall, these numbers point to remarkable growth over the last year-and-a-half, which reveals the company’s commercial prowess. What is more, the company appears to be managing their expenses and still has a healthy cash position.

A Vital Metric

In addition to growing revenues, Rigel is also seeing an increase in the persistency rate for TAVALISSE. The drug’s label suggests that patients should continue to stay on TAVALISSE for at least 3 months, and if no improvements are observed, they should discontinue. The company is observing an improvement in fourth-month numbers, and the persistency rate has improved to 54% from 45%. So it looks as if patients are experiencing the benefit of using TAVALISSE.

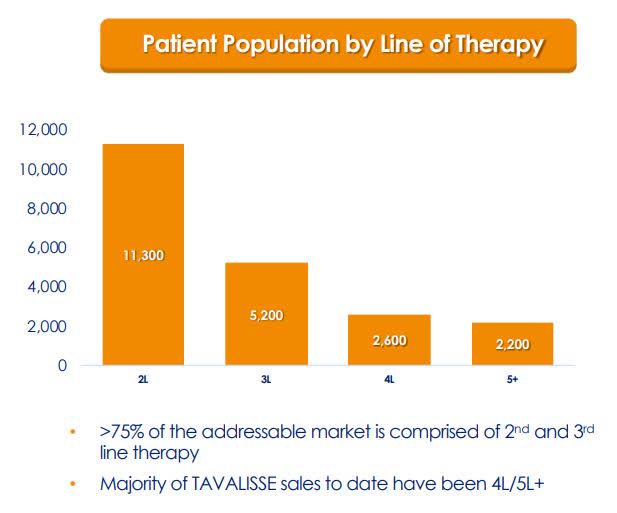

The company believes this improvement is due to the increase in use in earlier lines of therapy, where the patients are more likely to see the benefits of the treatment. In addition, Rigel believes that physicians are starting to gain experience with TAVALISSE and are understanding how to manage their ITP patients on TAVALISSE.

Can They Keep The Growth Up?

The first two years of a drug’s launch is critical and can often reveal if the drug will be a success or dud. So far, TAVALISSE looks to be a success and has launched into a sizeable 81K ITP patients in the U.S. TAVALISSE was launched into the later lines of therapy where the patients had failed several therapies and had limited selections because of the absence of novel advanced therapies. Now, Rigel is seeing an increase in TAVALISSE usage in the earlier lines of ITP therapy. As a result, Rigel is scheduling an observational study of TAVALISSE in the second-line later this year. This should provide Rigel with a piece of vital information that would support the implementation in earlier lines of therapy.

Figure 3: ITP Population By Lines of Therapy (Source: RIGL)

In addition to ITP, Rigel is currently enrolling TAVALISSE’s Phase III trial in warm autoimmune hemolytic anemia “AIHA”, which is an antibody-mediated block disorder. If approved, TAVALISSE would be the first FDA approved therapy for AIHA, allowing Rigel to access this unclaimed market.

In addition to the U.S. market, Rigel has secured partnerships in several major markets including Europe, Japan and Asia, and Canada and Israel. In Europe, TAVALISSE’s MMA was approved for ITP and the company’s partner, Grifols (GFRS), is expected to launch in Q2. With this approval, Grifols provided their $20M payment to Rigel, which consisted of a $17.5M milestone payment and a $2.5M advance royalty payment.

In Asia, the company’s partner, Kissei Pharmaceuticals, is working on their Phase III trial for ITP. The company Canadian and Israeli partner, Medison, has filed the NDS and expects to have Canadian approval in early 2021.

Overall, it looks as if Rigel will have additional sources of revenue in the coming years as the company continues to expand TAVALISSE into earlier lines of therapy and expand its label into other indications. What is more, the company and its partners are quickly moving TAVALISSE towards approval in ex-U.S. territories, which will provide supplemental revenue streams.

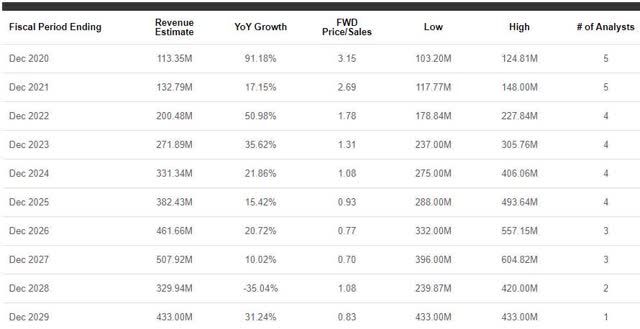

What Will They Total To? Street analysts have a positive outlook for the company in the coming years. Looking at figure 4, we can see that the Street expects Rigel to report year-over-year growth for at least five more years.

Figure 4: RIGL Revenue Estimates (Source: Seeking Alpha)

In fact, the Street expects Rigel to hit roughly $461M in 2026, which would be about a 400% increase from their expected 2020 revenue.

Is RIGL Still A Buy

The company’s ability to execute on their strategy has situated them to record growth in 2020 and beyond. The U.S. ITP market is a $1.1 billion and the ex-U.S. the ITP market is about $900M; so, the market and demand is there for Rigel to capitalize on. In addition to TAVALISSE, the company’s pipeline programs and partnerships will offer additional sources of revenue in the near-future (Figure 5).

Figure: RIGL Milestones (Source: RIGL)

So, it looks has the product and plan to grow…but is RIGL still worthy of a buy? Returning to figure 4, we can see that 2026’s expected revenue of ~$461M would be a 0.77x forward price-to-sales, which means the company would pull more revenue than its current market cap value of $357M. Considering the sector’s average price-to-sales is 5x, we should expect the share price to follow suit. Sadly, the share price is currently undervalued for its 2020 expected revenue. Therefore, I still see RIGL as a value buy for both short-term and long-term investors.

Disclosure: I am/we are long RIGL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment