Jeff Schear

Retailing is a tough business to be in, and that’s why most players in the space operate with thin margins. Luxury brands, however, are a different story, as they are not interested in catering to the masses, but rather to high end clientele that enables them to generate far better margins.

This certainly holds true for brands such as Louis Vuitton (OTCPK:LVMHF), and in the words of Buffett, “your brand had better deliver something special, or it’s not going to get the business.”

This brings me to the luxury furniture retailer, RH (NYSE:RH), who has seen its share price pummeled over the past 8 months. This article highlights what makes RH a solid buy for those seeking potentially strong capital gains, so let’s get started.

Why RH?

RH (formerly called Restoration Hardware) is a luxury retailer of domestic furniture and home furnishings, offering merchandise across multiple categories including furniture, lighting, textiles, bath, and decor, and has a growing presence in the hospitality industry.

Beyond its high end offerings, what also sets RH apart from traditional furniture retailers is its vertically integrated model of showcasing its products through its own physical stores, catalogs, and digital platform. This helps to protect RH’s brand image while also eliminating the middleman, thereby enabling attractive margins.

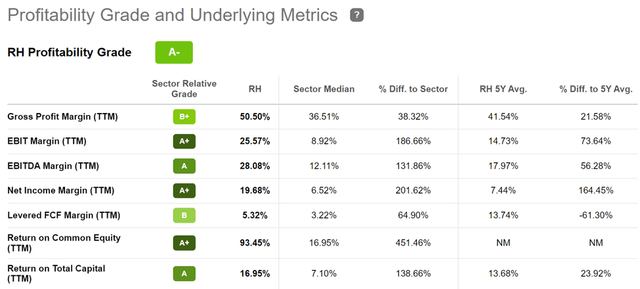

This is reflected by RH’s very strong margins, with an A- Profitability rating. As shown below, RH generates a sector leading gross profit margin of 50%, and impressive EBITDA and Net Income Margins of 28% and 19.7%, respectively.

RH Profitability (Seeking Alpha)

Meanwhile, RH has continued to impress with sales growth of 11% YoY to $957 million in the first quarter (ended April 30, 2022). It also expanded its gross margin by 480 basis points, driven primarily by price increases, as management has avoided discounting, with risk of tarnishing the brand, as demand trends begin to slow.

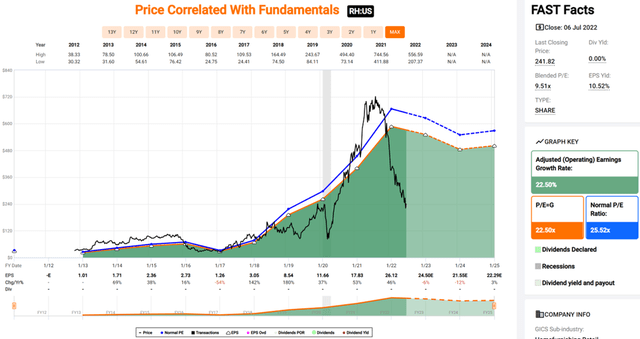

Investors, however, have been rather pessimistic on the stock, as it’s followed mostly a downward trajectory since November of last year. As shown below, RH is now trading well below its 52-week high of $744.

RH Stock (Seeking Alpha)

Perhaps some of the pessimism is warranted considering the macroeconomic risks that have come to surface in recent months. This had the management warning of softening demand, as noted earlier, and resulted in trimmed guidance for FY 2022. Now, the company expects a revenue decline in the range of -2% to -5% for the full fiscal year, down from the previously expected growth in the 0% to 2% range.

Nonetheless, many economists are forecasting just a mild recession, and RH retains multiple avenues for growth. This includes capturing market share in the $100+ billion U.S. furniture market, growth into the hospitality industry, as well as international expansion, as noted by Morningstar in its recent analyst report:

RH has gained share in the fragmented $118 billion (U.S. Census) domestic furniture and home furnishing market in recent years, curating differentiated offerings from specialized global artisans. The firm has broadened its brand awareness by expanding into underserved categories including modern, teen, and hospitality, where few peers have scale, helping capture incremental market share from boutique competitors.

Brand equity should remain stable given the pace of tailored store buildouts, category expansions, and consistency of pricing, but the diverse end-market expansions RH is pursuing could make it difficult to capture a cost advantage. Entry into $200 billion hotel industry and $1.7 trillion domestic housing market should help support high-single-digit top line growth.

RH’s e-commerce business helps enhance brand awareness, with the ability to market incremental SKUs (bolstered by the World of RH platform launch). We believe RH’s focus will be to strategically expand its global presence over the next decade via a wider set of luxury product offerings (yacht, plane), alongside a multipronged gallery strategy set to suit local market demands.

Lastly, RH appears to be rather cheaply valued at the current price of $255, with a forward 10.9, sitting well below its normal PE of 25.5 since its IPO in 2013. While RH should see some revenue and earnings headwinds in the near future, I see it coming out of a potential recession in good shape to continue its growth trajectory. Sell side analysts have a consensus Buy rating with an average price target of $317 and Morningstar has a fair value estimate of $390, implying potential one-year gains in the 24-53% range.

RH Valuation (FAST Graphs)

Investor Takeaway

Overall, I believe RH is a high-quality company that is positioned well for long-term growth. While the near-term outlook is somewhat uncertain, the company has multiple avenues for growth and I believe the stock is attractively valued at the current price. For investors with a long-term time horizon, I believe RH’s discounted stock presents a good opportunity here.

Be the first to comment