gorodenkoff/iStock via Getty Images

Investment Summary

Here at HBI, we’ve debated at length on how to position against unprofitable biotech names. Market dynamics have been unkind to this basket of equities this year. Hence, after extensive debate, the crowd is divided here at HBI on positioning against Revolution Medicines, Inc. (NASDAQ:RVMD). However, considering all of the contributing and mitigating factors, our findings corroborate that now is an appropriate time for entry.

Our analysis will cover RVMD’s treatment market and detail its financial position as it continues advancing its pipeline of highly differentiated anti-tumor compounds. Noteworthy is that RVMD signed an exclusive worldwide partnership with Sanofi (SNY) in 2018 to develop and commercialize therapies targeting SH2 containing protein tyrosine phosphatase-2 (“SHP2”), an oncogenic phosphatase known to promote growth and survival signaling downstream of oncologic receptor inputs. We’d note this is already starting to pull through to the company’s top line growth, evidenced in Q3 FY22.

Net-net, we opine there is sufficient evidence surrounding the company’s phase 1–3 assets, and the market is beginning to recognize the same. We rate RVMD a buy, seeking an initial price objective of $29.

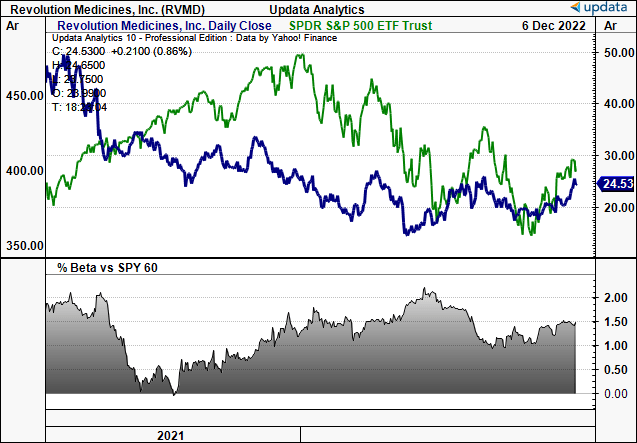

RVMD 2-year price evolution against the S&P 500

Note: This is a high-beta offering that provides additional upside volatility within a broad market rally.

Data: Updata

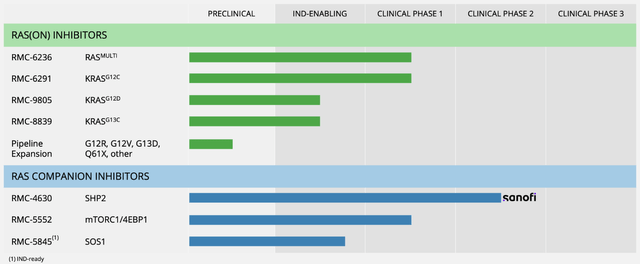

RVMD’s RAS-targeting portfolio

The hallmark of the RVMD investment debate is its highly differentiated approach to inhibiting the active form or RAS, known as RAS(ON). RVMD believes its RAS and RAS(ON) inhibitors can be used as combination therapy with other inhibitors, such as SHP2 or mTORC1, to “attack multiple targets within the RAS pathway simultaneously to extinguish cancer cell signaling and suppress resistance mechanisms.”

RAS isoforms are a group of protein molecules that regulate cellular activity, including cell growth and division, and have been found to be involved in a variety of diseases. The roles of RAS isoforms in health and disease are complex and not completely understood. Studies have shown that mutations in RAS isoforms have a causal role in cancers and other diseases, but the exact mechanism is still unclear. Simanshu and colleagues (2017) are widely cited in the nomenclature and provide a suitable “definition” [see: Abstract]:

“RAS proteins are binary switches, cycling between ON and OFF states during signal transduction. These switches are normally tightly controlled, but in RAS-related diseases, such as cancer, RASopathies, and many psychiatric disorders, mutations in the RAS genes or their regulators render RAS proteins persistently active.“

These proteins are part of the RAS superfamily, which includes three members: K–Ras, H–Ras, and N–Ras. Each RAS isoform has distinct properties and functions, and mutations in any of these isoforms can lead to a variety of diseases, including cancer.

K–Ras, also known as KRAS, is the most commonly studied of the RAS isoforms. It is involved in cell signaling pathways and plays a critical role in cell growth and division. Mutations in K–Ras can lead to cancer by allowing cells to grow and divide uncontrollably. For example, mutations in K–Ras are found in approximately 25–30% of all pancreatic cancer cases and 35–50% of all colorectal cancer cases.

H–Ras is another commonly studied RAS isoform. It is involved in cell signaling pathways and is essential for cell migration, which is important for wound healing and the immune response. Mutations in H–Ras have been linked to a variety of cancers, including lung, bladder, and prostate cancer.

N–Ras, also known as NRAS, is the least studied of the RAS isoforms. It is involved in cell signaling pathways and is essential for cell differentiation and metabolism. Mutations in N–Ras have been linked to leukemia and melanoma.

Exhibit 1. RVMD RAS and RAS(ON) pipeline

Image: RVMD Website, see “Pipeline”

The company has begun clinical development for two of its RAS inhibitor drug candidates. In a Phase IIb trial, RMC-6236, an oral RAS inhibitor, is being tested on patients with tumors containing common KRAS G12 cancer mutations, including KRAS G12D [the most common RAS cancer variant causing human cancer], KRAS G12V, and KRAS-G12R. RMC-6236 is the first oral direct RAS inhibitor to target these mutations to our understanding. In a Phase I/Ib trial, RMC-6291, an oral KRASG12C inhibitor, is being tested on patients with tumors containing the KRAS G12C mutation. RMC-6291 is a highly selective inhibitor of the activated KRAS G12C variant found in lung and gastrointestinal cancers.

RVMD is also working on an oral inhibitor called RMC9805 that targets KRAS G12D. The company expects to begin clinical trials in mid-2023. We firmly believe the first round of RAS inhibitors, including RMC-6236, 6291, and 9805, could help many people with cancer caused by RAS gene mutations if safety, efficacy and reliability data holds up well.

In addition, the company is testing two RAS companion inhibitors, RMC-4630 and RMC-5552, which are designed to be used in combination with direct RAS inhibitors. Amgen, a clinical collaborator of RVMD, recently reported promising early results from its ”CodeBreak 101” study that combined RMC-4630 with sotorasib, a KRAS G12C inhibitor. The study showed potential benefits for patients with non-small cell lung cancer who had not received KRASG12C inhibitors before. RVMD is enrolling patients in a Phase II study of this combination for KRAS G12C non-small cell lung cancer. The company also plans to study its RAS companion inhibitors with its own RAS inhibitors in the future, which could be a meaningful tailwind to its share price down the line. We’d encourage investors to stay active on this.

In terms of upcoming catalysts for RVMD in this domain, it is set to provide top-line data from its 463003 study of RMC-4630 plus sotorasib in H2 FY23′, and it will present further evidence of the single-agent activity for RMC-5552 sometime next year. As above, we’d encourage investors to remain diligent in following updates for the same, in order to size in/scale-up positioning accordingly.

RVMD Q3 financials illustrate sufficient cash runway

Turning to the numbers, we note the company’s recent capital budgeting initiatives have lengthened its cash runway for financing operations and additional clinical trials downstream.

RVMD successfully upsized its public offering of common stock earlier this year, raising gross proceeds of $265mm. After deducting underwriting discounts, commissions, and estimated offering expenses, RVMD generated net proceeds of approximately $248mm. This infusion of capital allowed the company to strengthen its balance sheet and end the quarter with a cash balance of $655mm, which it expects to be sufficient to fund its planned operations through 2024.

In Q3 2022, RVMD‘s venture with Sanofi resulted in an income of $3.4mm, a large improvement from the $1.1mm revenue made in the same quarter the year prior. A non–cash GAAP accounting adjustment lowered the collaboration income to $4.6mm due to changes in the evaluation of the accounting transaction price and the percentage of work completed through the arrangement.

OpEx in Q3 2022 was $79.9mm, a 47% growth from the preceding year. This ascent was mostly due to the larger costs of creating RMC–6236 and RMC–6291, along with the personnel–related costs associated with the additional staff hired. Consequently, the net loss for Q3 2022 was $73.3mm, or $0.87 per share.

Despite these financial results, RVMD reaffirmed its previous guidance and continues to expect its full-year 2022 GAAP net loss to be between $260mm–$280mm.

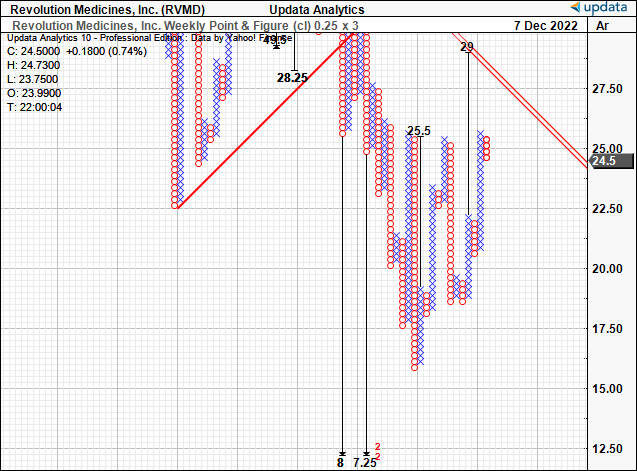

RVMD technicals suggest appropriate entry, price objectives

In the absence of profitability and earnings, we use our technical studies to guide price visibility down the line.

You can see below that RVMP has formed a 16-week cup and handle that has seen shares cross the 50DMA and 250DMA for the past 7 weeks.

At the same time, the volume trend has been ascending on average since the 50DMA and 250DMA cross. Shares now test previous highs and a break above the neckline here suggests further upside capture is warranted in our opinion.

Exhibit 2. RVMD 18-month weekly price evolution, 16-week cup and handle with 50DMA/250DMA cross.

Consequently we believe the rally has more legs to run yet, and have additional upside targets to $25.5 then $29, or ~18.4% upside potential as an initial price objective.

In combination with the above chart studies we believe now is a good time for entry. We look forward to any further potential price action to the upside, as we are confident this will lead to the formation of additional targets above $29.

Exhibit 3. Upside targets to $25.5 then $29, suggesting further upside capture is warranted.

Data: Updata

In short

We rate RVMD a buy given improving market data, technical studies and the company’s highly differentiated offering of RAS(ON) and RAS companion inhibitors. Already the market has begun to reward Revolution Medicines stock following developments in Q3 and there are multiple inflection points identified for 2023. With this in mind, we rate Revolution Medicines, Inc. a buy, initial price objective of $29.

Be the first to comment