Justin Sullivan/Getty Images News

While operating results have improved somewhat over the last year, Revlon’s (REV) stock price has dropped about 19%. Investors are still waiting to see if the “new normal” means consumers will purchase fewer cosmetics than before the pandemic. Revlon also has a competition problem with new dynamic brands that are having a negative impact on Revlon’s stale brands and marketing campaigns. Because the company has so much debt, the prospect of bankruptcy is often a worry, but their 6.25% 8/1/24 unsecured notes (CUSIP 761519BF3) may warrant consideration by high risk traders because the notes are currently trading at a 49% yield to maturity.

High Stock Price Volatility

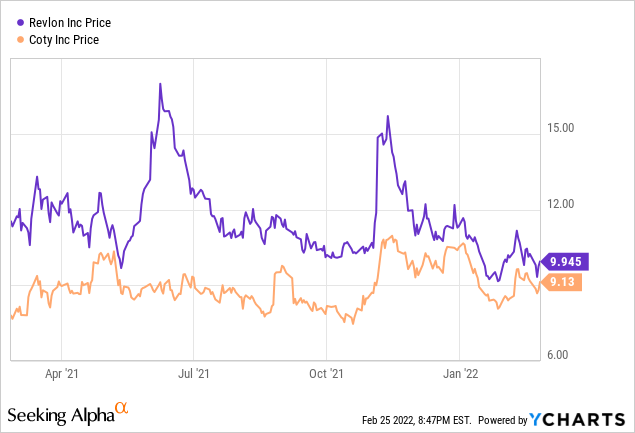

As the chart below of Revlon’s stock price shows there has been high volatility over the last year and it is about 19% lower over the last twelve months. When I look at Revlon’s stock I usually compare it against Coty Inc. (COTY), which is another cosmetic company that has some problems, but Coty’s stock price has been more stable than Revlon’s.

Revlon and Coty Stock Prices-One Year

3Q Quarter 2021 Results

Revlon should be filing their 4Q and 2021 annual results in mid-March and the latest results are from the 3Q that ended five months ago. Since Revlon is an extremely financially distressed company, metrics that investors normally look at such as EBITDA or EPS are not as important as changes in net debt and cash used /gained from operations to see if there is any improvement in their financial condition. Long-term debt, plus current portion of long-term debt, plus short-term borrowings, less cash increased to $3.3834 billion in 3Q 2021 from $3.3647 billion 3Q 2020-a $18.7 million increase. For the first nine months of 2021, net cash used for operations was $86.7 million.

Since the 4Q is usually their strongest quarter because of holiday shopping, this “cash used” figure should decrease. Management also asserted the same opinion during their 3Q conference call: “based on the seasonality of the business, we anticipate both free cash flow and liquidity will sequentially improve as we finish the year”. Management’s comments, however, were made before the Omicron variant impacted traditional holiday shopping and it is also unclear if they continued to have supply chain problems.

Latest Quarterly and Nine Months Income Statements

|

Three Months Ended September 30 |

Nine Months Ended September 30 | ||||||||||||||||||||||

| (millions) | 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||

|

Net sales |

$ | 521.1 | $ | 477.1 | $ | 1,463.5 | $ | 1,277.7 | |||||||||||||||

|

Cost of sales |

221.2 | 234.3 | 608.7 | 600.7 | |||||||||||||||||||

|

Gross profit |

299.9 | 242.8 | 854.8 | 677.0 | |||||||||||||||||||

|

Selling, general and administrative expenses |

256.1 | 253.4 | 796.0 | 739.1 | |||||||||||||||||||

|

Acquisition, integration and divestiture costs |

0.6 | 0.9 | 1.8 | 4.2 | |||||||||||||||||||

|

Restructuring charges and other, net |

9.0 | (0.7) | 22.8 | 44.8 | |||||||||||||||||||

| Impairment charges | — | — | — | 144.1 | |||||||||||||||||||

| Loss (GAIN) on divested assets | 0.1 | (1.1) | (1.7) | (0.5) | |||||||||||||||||||

|

Operating income (loss) |

34.1 | (9.7) | 35.9 | (254.7) | |||||||||||||||||||

| Other expenses: | |||||||||||||||||||||||

|

Interest expense, net |

63.1 | 68.7 | 183.9 | 178.0 | |||||||||||||||||||

|

Amortization of debt issuance costs |

8.7 | 7.8 | 30.7 | 17.8 | |||||||||||||||||||

|

Gain on early extinguishment of debt |

— | (31.2) | — | (43.1) | |||||||||||||||||||

|

Foreign currency losses (gains), net |

9.9 | (9.8) | 11.5 | 9.1 | |||||||||||||||||||

|

Miscellaneous, net |

0.1 | (2.6) | 2.8 | 13.9 | |||||||||||||||||||

|

Other expenses |

81.8 | 32.9 | 228.9 | 175.7 | |||||||||||||||||||

| Loss from operations before income taxes | (47.7) | (42.6) | (193.0) | (430.4) | |||||||||||||||||||

| Provision for (benefit from) income taxes | 5.4 | 1.9 | 23.8 | (45.2) | |||||||||||||||||||

| Net loss | $ | (53.1) | $ | (44.5) | $ | (216.8) | $ | (385.2) | |||||||||||||||

| Other comprehensive income (loss): | |||||||||||||||||||||||

| Foreign currency translation adjustments | (0.6) | 2.2 | (6.0) | 7.3 | |||||||||||||||||||

|

Amortization of pension related costs, net of tax(A)(B) |

3.5 | 2.8 | 10.5 | 9.3 | |||||||||||||||||||

| Other comprehensive income, net | 2.9 | 5.0 | 4.5 | 16.6 | |||||||||||||||||||

|

Total comprehensive loss |

$ | (50.2) | $ | (39.5) | $ | (212.3) | $ | (368.6) | |||||||||||||||

| Basic and Diluted (loss) earnings per common share: | $ | (0.98) | $ | (0.83) | $ | (4.02) | $ | (7.22 | |||||||||||||||

After conducting many traditional analysis formulas on their 3Q report, there was one item that stands out and it is very positive. Δ EBITDA/Δ Revenue for the 3Q compared to the year before: $27.9 million/$44.0 million=63.4% . The 3Q Total EBITDA/3Q Total Revenue $82.4 million/$521.1 million=15.8%. This indicates that the EBITDA profit margin on the increase in revenue was much higher than the total EBITDA profit margin in the 3Q. It was not just a modest increase-it was a very large increase. This is because the variable cost to produce/sell an additional cosmetic item is very small compared to the additional revenue. This indicates that even with a modest increase in sales, EBITDA should rise significantly.

Boring Business Model

Revlon is really just a consumer advertising company. Most of their products are not now really based on some new invention or innovation. They are based on a new advertising and marketing campaign of newly designed packaging and brand name. The latest numbers for advertising are for 2020 and they spent $332.1 million or about 17.4% of their revenue on advertising. In 2019 they spent $446.8 million-18.5% of revenue.

There is a serious problem with Revlon’s operations and that is their brands might be well-known, but they are old and stall. Geoffrey Beene, Elizabeth Taylor, and Halston are all dead and so are those brands. Most of their other brands are just not dynamic enough for today’s consumers. Today, there are social media personalities with their own cosmetic brands that really don’t spend money to advertise in the traditional sense that now compete with Revlon. Unless Revlon can create a new really trendy, successful brand such as they did with Charlie in 1973, Revlon will continue to die.

Way Too Much Debt

There were legitimate worries whether or not Revlon could keep out of some in-court restructuring in 2020. As stated on page 40 of their annual report filed March 11, 2021: “The uncertainty as to Products Corporation’s ability to extend or refinance the Amended 2016 Revolving Credit Facility raised substantial doubt about the Company’s ability to continue as a going concern as of the end of the third quarter of 2020. As a result of the transactions that were completed during the fourth quarter of 2020 and the first quarter of 2021, substantial doubt about the Company’s ability to continue as a going concern no longer exists. As I covered in a prior article, Revlon had an exchange offer for their 5.75% 2/15/21 notes in 4Q 2020. This kept them out of bankruptcy court.

At this point, early June 2023 is the next critical financial threshold. If the $869 million term loans are still outstanding 91 days prior to their September 7, 2023 maturity, $232 million debt comes due. This debt was originally due September 7, 2021, then extended to June 8,2023, and extended again until May, 2024. There are a number of other factors that could cause a springing maturity of this debt, which I will post in the comment section below.

Since most of Revlon’s debt is based on LIBOR plus some number, when interest rates go up, their interest expense will rise. Already for the first nine months of 2021, interest rate expenses were 12.6% of revenue and that does not even include PIK interest. One of their biggest problems is a $938 million loan with L+10.50+2% PIK interest rate. The other debt issues have much lower rates, but all the debt matures before June 30, 2025.

Debt Structure

| September 30, 2021 | December 31, 2020 | ||||||||||

| Amended 2016 Revolving Credit Facility (Tranche A) due 2024 | $ | 134.5 | $ | 136.7 | |||||||

| SISO Term Loan Facility due 2024 | 125.8 | — | |||||||||

| 2021 Foreign Asset-Based Term Facility due 2024 | 70.7 | — | |||||||||

| 2020 ABL FILO Term Loans due 2023 | 50.0 | 50.0 | |||||||||

| 2020 Troubled-debt-restructuring: future interest | 46.2 | 57.8 | |||||||||

| 2020 BrandCo Term Loan Facility due 2025 | 1,742.9 | 1,719.8 | |||||||||

| 2016 Term Loan Facility: 2016 Term Loan due 2023 and 2025 | 869.2 | 874.8 | |||||||||

| 2018 Foreign Asset-Based Term Facility due 2021 | — | 57.7 | |||||||||

|

6.25% Senior Notes due 2024 |

426.5 | 425.4 | |||||||||

| Spanish Government Loan due 2025 | 0.3 | 0.3 | |||||||||

| Debt | $ | 3,466.1 | $ | 3,322.5 | |||||||

| Less current portion | (163.8) | (217.5) | |||||||||

| Long-term debt | $ | 3,302.3 | $ | 3,105.0 | |||||||

|

Short-term borrowings (*) |

$ | 0.6 | $ | 2.5 | |||||||

Source: 3Q 10-Q

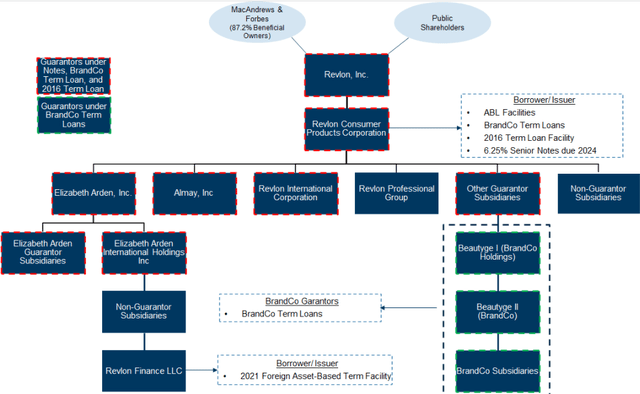

Revlon’s Corporate Structure

Revlon’s Corporate Structure (reorg-research.com)

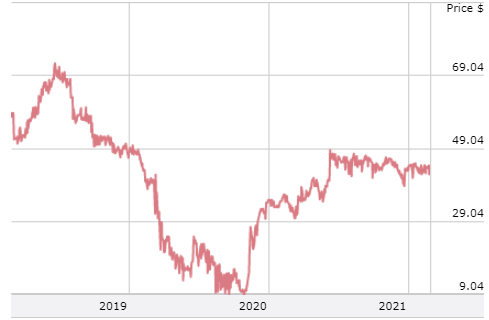

Unsecured Notes – A Very Speculative Trade

As I mentioned in my November 23, 2020, Revlon article, the 6.25% 8/1/24 unsecured notes might be an interesting play, especially for those who were bullish on the recovery from the pandemic. The price of the notes has risen from 22 when I wrote the article to about 42 now, plus there were interest payments. The current yield on the notes is 14.9% and the yield to maturity is 49%. (I am showing the yield to maturity interest rate, but as most readers already know, the yield to maturity assumes that coupon payments are reinvested at the yield to maturity rate, which is unlikely because the rate is so high. Investors should, therefore, estimate their expected reinvestment rate for the coupons to get a more accurate estimate of the yield to maturity.)These unsecured notes were issued by Revlon Consumer Products Corp. that is owned by the holding company, Revlon Inc. REV stockholders own shares issued by Revlon Inc. The $431 million notes are unsecured and rank lower than the rest of the $3.035 billion debt (long-term debt, short-term debt, and current long-term debt due within one year) as of September 30, 2021.

6.25% 8/1/24 Unsecured Notes

6.25% 8/1/24 Unsecured Notes (finra-markets.morningstar.com/BondCenter)

There seems to be a disconnect between the debt market and the equity market for Revlon. The debt market is pricing some of Revlon’s debt at very steep discounts from par, but the equity market by seems to be pricing REV shares at a much lower probability of a bankruptcy filing over the next few years since REV is not trading in the low single digits. With the 6.25% unsecured notes trading in the low 40’s, the market seems to estimating a 50-60% chance that Revlon files for bankruptcy before the note’s August 1, 2024 maturity- assuming no recovery under a Ch.11 reorganization plan. Since my current “guestimate” for a bankruptcy filing before the maturity date is 30-40%, I bought the notes. I bought them also based on the potential of actually getting a modest recovery under a reorganization plan because Citibank did something very stupid in 2020. (See below.)

Recoveries Under Ch.11 Reorganization Plan

If Revlon does eventually file for Ch.11 bankruptcy and if the waterfall method is actually used under their Ch.11 reorganization plan, REV shareholders and 6.25% unsecured noteholders are most likely not going to get any recovery, but there are two issues that could change that. First, Ron Perelman, via MacAndrews & Forbes, owns 86.4% of Revlon’s stock. I would expect an intense legal battle by him and his daughter who is Revlon’s current CEO. It is uncertain, of course, if the Perelmans would fight for all Revlon shareholders or just for their own interests.

Some Revlon shareholders think that the Perelmans would want to do some type of bankruptcy reorganization that would preserve their $969.3 million net operating losses as of December 30, 2020 ($692.2 million federal and $277.1 million foreign), but it is highly likely that cancellation of debt income from cancelling a significant amount of debt under a Ch.11 reorganization plan would offset all or almost all of the NOLs.

The second issue is much more complicated and it is based on a $893 million Citibank payment made in August 2020. As many readers already know, Citibank made a total of $893 million wire payments to various lenders on Revlon’s term loans on August 11, 2020 instead of $7.8 million for interest payments. This was Citibank’s money- not Revlon’s. Citibank claimed it was a mistake and all but about $504 million was sent back to Citibank. The lenders who kept the money assert that they thought it was an early prepayment on the September 7, 2023 maturity term loans. The lenders won in court. On February 16, 2021, Judge Furman ruled (20-CV-6539), based on the Banque Worms case, that they could keep it “because these lenders had no reason to think it was a mistake” and “because the discharge-for-value defense applies”. (The amounts received were the exact amounts owed to the penny.) Citibank appealed (21-0487 cv) to the Second Circuit and that appeal is currently pending. Revlon continues to pay interest on the entire loan amount because Revlon was not a direct party to these transactions. These term loans are currently trading at steep discount and Citibank was replaced by MidCap Trust as administrative agent for the term loans.

If Citibank does not win the appeal and if Revlon eventually files for bankruptcy before this loan matures in 2023, Citibank is expected to try to assert a $504 million subrogation claim and try to assert they have a secured claim in bankruptcy court. The other creditors would almost certainly fight against their claim. If (another if-lots of “if”s here) the bankruptcy court rules against Citibank’s claim, the 6.25% noteholders would move up the priority claim’s recovery ladder by $504 million. The result could mean that these unsecured noteholders might actually get a modest recovery under a Ch.11 reorganization plan.

Conclusion

Revlon is still struggling from the impact of the pandemic and needs to greatly improve their brand portfolio that had major problems even before the pandemic. The amount of debt is too way high compared to their cash-flow and EBITDA.

Many shareholders expect that Ron Perelman will keep Revlon out of bankruptcy court, but the debt market is more pragmatic. I am expecting a lower probability of a Ch.11 bankruptcy filing than is currently reflected in the price of the 6.25% unsecured notes. I also think there is chance of a modest recovery for the unsecured noteholders. Investors need to monitor the Second Circuit because the Citibank decision could impact the note prices. I rate REV common stock a hold and the 6.25% unsecured notes a buy for ONLY traders willing and able to afford to speculate.

Be the first to comment