Justin Sullivan

Bankrupt Revlon’s (REV) formerly REV stock closed at $1.82 on Friday, which was down from $3.90 from the prior day. It traded as low as $1.55. The primary cause of the 53% plunge was that REV was delisted from the NYSE and now just trades REVRQ on the OTC pink sheets. There also have been a number of recent developments that have caused some confusion. This article will hopefully clarify these issues so REVRQ traders can make more irrational investment decisions.

NYSE Delisting

After a recent hearing, Revlon lost their appeal of NYSE’s decision last June to delist REV common stock. While it is common practice for stocks of bankrupt companies to be delisted, some thought that because REV was trading at prices in the $4-$7 range over the last few weeks on respectable amount of volume and there was no court filing of a RSA/plan that indicated no recovery for REV shareholders, that the NYSE would allow for continued trading on the NYSE. To some the fact that the NYSE still wanted the stock delisted indicates that the NYSE’s staff expects that shareholders will not get any recovery and the shares will eventually be cancelled under their Ch.11 bankruptcy plan. The NYSE almost always delists stocks that are getting no recovery under the plan.

Some traders will no longer be able to open new long/short REVRQ positions because their brokers do not allow new positions for “Q” stocks. For example, I don’t think Robinhood will allow new positions. These brokers, however, do allow those customers who currently have REVRQ positions to close them. I suggest you contact your broker about their policies. With much fewer potential REVRQ traders, it is much less likely that there will be massive meme trading in REVRQ on the OTC pink sheets market, in my opinion.

Trading in REVRQ options could be problematic. Some options traders like to open new option positions to hedge against their current option positions, but there could be restrictions on opening new option positions. Usually, most retail option customers can only close current positions and are not allowed to open ones for “Q” stocks. According to the Options Clearing Corporation:

Revlon, Inc. will change its trading symbol to REVRQ effective October 21, 2022, due to the listing of the company on an OTC market. As a result, option symbol REV will change to REVRQ effective at the opening of business on October 24, 2022. Strike prices and all other option terms will not change. Clearing Member input to OCC must use the new option symbol REVRQ commencing October 24, 2022.

The “terms” will not change, but that may not mean that trading regulations will continue to allow trading by retail options traders. Again, check with your own broker for updates.

RSA and Plan Filing Dates

Some Revlon investors may have been confused about an October 13 court filing (docket 860) of a motion to extend Revlon’s exclusive period to file a reorganization plan to February 15 from October 13 and to extend the period to solicit acceptance of that plan to April 17. Some traders thought this was a positive, but it was actually, in my opinion, a “nothing burger”. It was expected and often happens during a Ch.11 process. The reality is that the actual critical milestone dates did not change. These DIP loan milestones of filing a restructuring support agreement – RSA by November 15 and a reorganization plan by December 14 are still the dates that do not allow for holiday sales numbers to impact the plan. According to the court filing their business plan should be available to parties negotiating the RSA before the October 27 hearing on the motion to extend. (I don’t expect a hearing on that motion will be needed because if there are no objections filed, the motion will be approved without a hearing.)

I just do not see a RSA supported by most stakeholders will be filed by November 15. It is unclear at this point what the DIP lenders will do if there is not sufficient support for a proposed RSA by the November 15 milestone date. In theory, they may agree to extend it, but I would expect that they would require some type of major concession/fee payment for agreeing to that extension. These dates were already fought over during hearings a few months ago, which I “attended” via Zoom and covered in a prior article. Revlon shareholders really want a much longer time to file a RSA – the longer the better because it could allow Revlon to somehow get their turnaround plan moving forward. I also expect a very nasty fight and a lot of potential lengthy litigation over the 2020 debt restructuring and collateral modifications.

Some Revlon investors seem to feel that their net operating losses-NOLs are so valuable that these will impact the RSA and the reorganization plan. It is sort of odd because the huge NOLS that bankrupted Pantry Pride had really helped Ron Perelman when he bought control of Revlon in the 1980’s. Since Judge David Jones is a new bankruptcy judge it is unclear how much importance he gives to NOLs. While many judges consider them important, they often “dance around” trying to determine specific values for them. These NOLs, therefore, could be a non-issue during the negotiations and approval of a RSA and plan.

$500 Million Citibank “Error” – Update

The 2nd Circuit siding with Citibank in their appeal (In re Citibank August 11, 2020 Wire Transfers, 1:20-cv-06539-JMF) (litigation docket 282) of the $500 million payment “error” that was not returned by lenders disappointed Revlon investors but was not unexpected. The reality is, however, that this case is not actually over yet. The judgement was vacated and remanded back to the district court. Some of the lenders appealed the decision by circuit court requesting an en blanc hearing so that all the 2nd Circuit Court judges would hear this case [Citibank NA v. Brigade Capital Management LP, 21-487, 2nd US Circuit Court of Appeals (Manhattan)], but that was denied on October 12. The original district court judge signed an order (litigation docket 287) on October 20 reopening the original case. and “the parties shall submit a joint letter by October 27, 2022, addressing the Second Circuit’s decision and the next steps, if any, in this litigation”. I assume it is all over and that the parties will pay Citibank the cash but given this case has been so unusual to say the least, I am not sure what will happen next, especially since Citibank was involved in the 2020 restructuring and now could be party to potential new litigation.

Citibank and Revlon have agreed to a stipulation to stay adversary proceedings (adv docket 12) regarding the case Citibank brought against Revlon asserting their right to equitable subrogation for a $500 million claim (Case No. 22-01134, Citibank, N.A. v. Revlon, Inc., et al). If the $500 million issue is not finalized soon at the district level and Citibank does not actually get their money, this litigation would then continue.

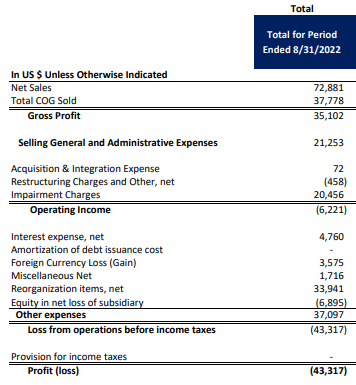

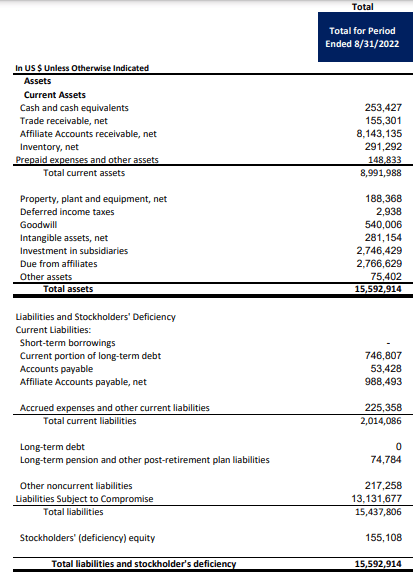

Latest Monthly Operating Report

On October 7 Revlon filed their latest monthly operating report – MOR for the month of August (use docket 791). In an unusual move, they filed a MOR for almost each entity in Ch.11. Often there is just one filing. The income statement and balance sheet below are for the combined entities. Investors need to understand that these numbers do not follow GAAP accounting. There are often issues with intercompany items that distort the report. For example, total assets shown on the MOR are $15.592 billion, but their latest 10-Q shows their total assets to $2.504 billion. In addition, the MOR shows $1551.1 million equity, but their 10-Q shows a negative equity of $2.348 billion. Most of the pre-bankruptcy debt is contained in “liabilities subject to compromise”. If you factor out the restructuring and impairment items it seems that they had a net income of a little over $11 million for August, which is usually a fairly slow month, but they are not paying interest on pre-petition debt.

August Income Statement from MOR

August Income Statement from MOR (cases.ra.kroll.com/revlon)

August Balance Sheet from MOR

August Balance Sheet from MOR (cases.ra.kroll.com/revlon)

Investors should compare this MOR to future MOR filings and see any trends. The MOR I want to see is for the month of November, which is the start of the holiday season to see how well they did. The November MOR should be filed in early January. The real reason for these reports is their cash. These MORs are filed for the U.S. Trustee to see the current cash and where any cash went.

Conclusion

Revlon stock traders were shocked that the NYSE would actually delist REV because the stock price has done well and there is no actual RSA/plan yet that states that shareholders will get no recovery/stock cancelled.

I expect a nasty fight over the reorganization plan. A long fight might actually be good for REVRQ shareholders because it would give Revlon more time to turnaround their disastrous operations impacted by prior severe vendor issues. Given the current price level of REVRQ I am changing my sell recommendation that I had at much higher prices back to neutral/hold. (I still own a modest amount of notes which I am holding to “see what happens”.)

Be the first to comment