ipopba/iStock via Getty Images

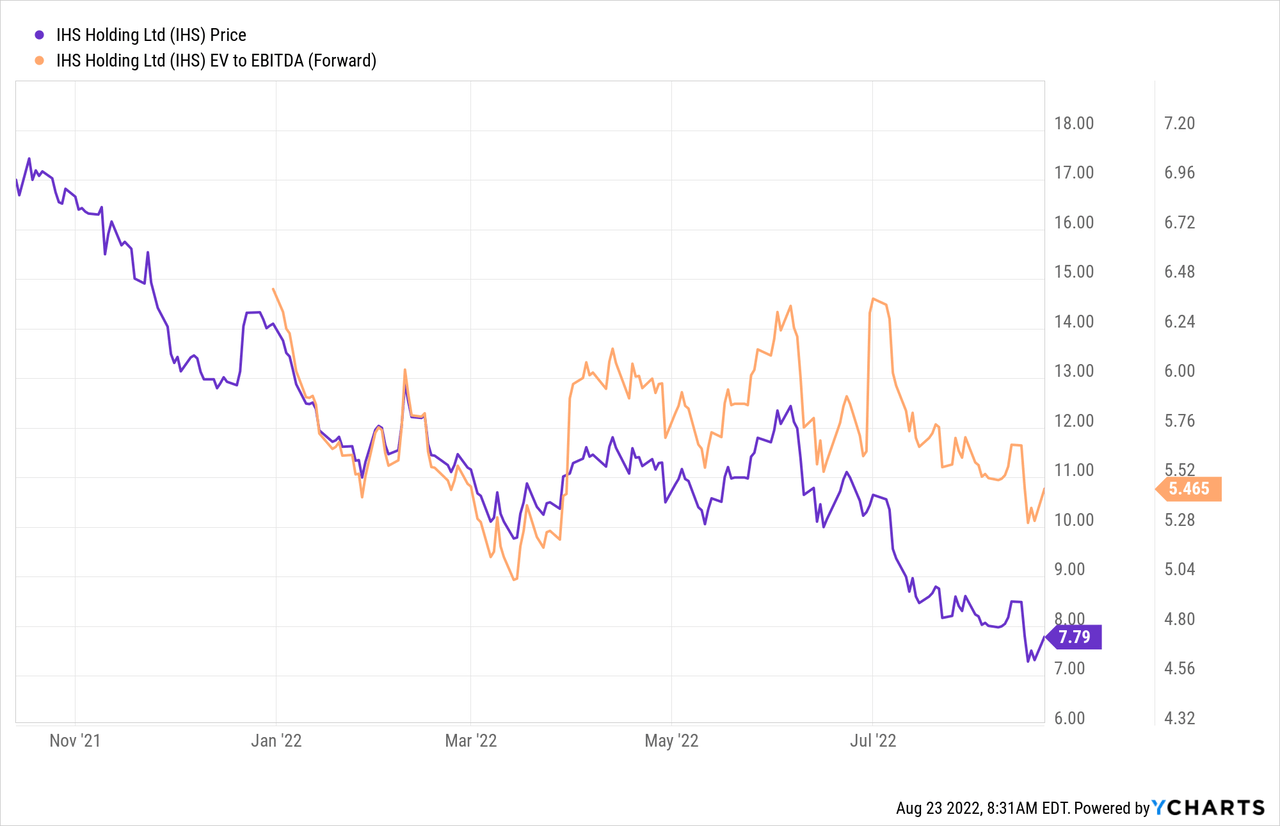

The publication of my first article on 7 June 2022 was ill-timed. First, IHS Holding Limited (NYSE:IHS) climbed from $10 a share to $12 and then plunged down to $8, where the stock has been trading for the past month. Now, Q2 results are taking the stock for another slide. Therefore, I find it relevant to go through the latest quarterly results, evaluate the investment thesis, and add further argumentation why current valuation makes only a little sense.

Commentary on Q2 results

The bad

In Q1 IHS surprised investors with a positive EPS. The opposite was true in Q2. The company posted a negative EPS of $0.53 for the second quarter, negative $177 million for the Q2 and negative $162 million for H1.

The loss was incurred due to several reasons. First, the fuel costs rose $38 million compared to the year before. Second, unrealized and realized foreign exchange losses were $127 million compared to $19 million the year before. Third, the comparable period last year included several one-time items in total of $53 million. Capital expenditures doubled to $147 million.

In the H1, fair value loss on embedded options was $162 million. Excluding this non-cash item would have meant a neutral financial result for the first six months. What is an embedded option? The investor relations team of IHS gave a following answer:

“The losses from embedded options are driven by arcane rules relating to bond accounting under IFRS (but don’t have any cash impact on our results or debt obligations) and result from decreases in market value of our 2026, 2027, and 2028 Notes, which in turn decreases the value of the call options. The so-called embedded options are purely the valuation of the bonds in totality including the interest coupons for the remaining periods. From Q1 to Q2, we saw a big widening in global bonds spread, so the implied yield on the underlying bonds moved up significantly. That is what’s being reflected on the embedded derivatives.” -IR, IHS.

Also, administrative expenses failed to lack scale effects as they increased by 26% in H1, of which one third was the effect of net loss of disposal of property, plant and equipment. Key management compensation increased by 125%, which is not an encouraging sign. The share of administrative expenses out of revenue grew from 20% to 21%. Although the numbers and companies are not entirely comparable, American Tower (AMT) reaches a ratio of 7-8%.

The good

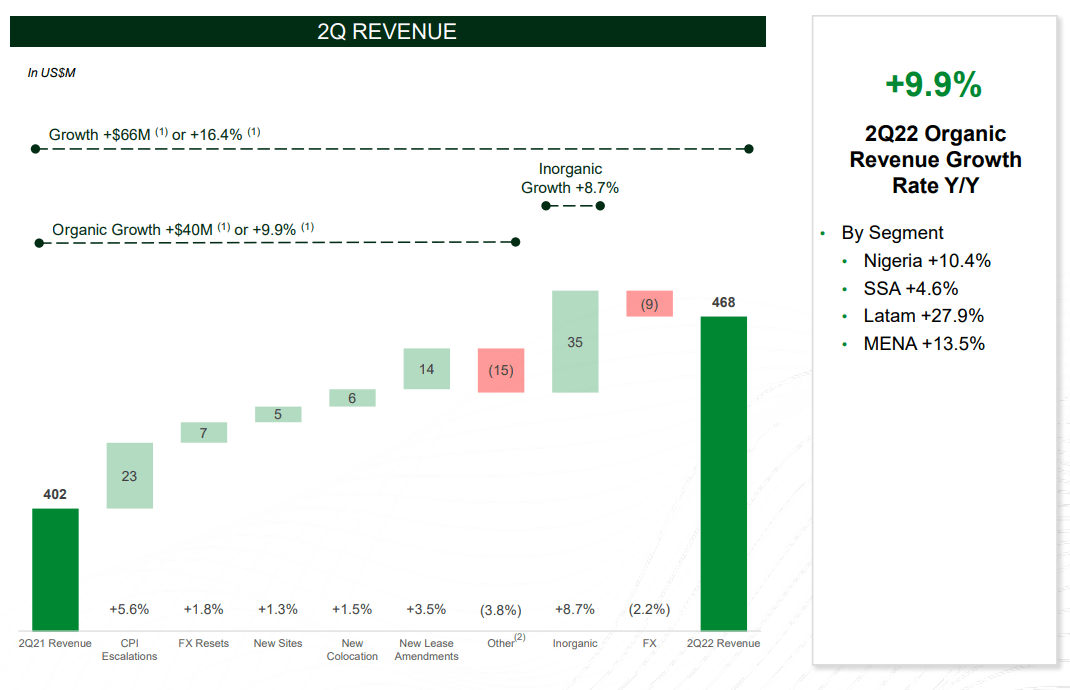

IHS exceeded revenue expectations and increased modestly its guidance for the full year. Organic revenue growth was 10% and total revenue growth was 16.4% in the second quarter. Revenue grew 23.8% if excluding the one-time items a year before. The growth outside Nigeria is fast, but comes out of a low base.

The guidance for adjusted EBITDA was maintained. Adjusted EBITDA declined 13.1% but grew 11.6% if excluding the one time items a year before. The good news is highlighted in the picture below. Although the effect is lagging, the company is able to pass on inflationary pressures and offset the effects of foreign currency depreciation. Organic growth is strong and the acquisitions should lead to scale effects.

Revenue bridge of Q2 2022. (IHS Q2 results presentation.)

After the Q2 earnings, several banks have raised their target prices for IHS. JPMorgan raised target price from $16 to $20, Cowen from $26 to $27, Goldman Sachs from $15 to $18, and Barclays from $17 to $21. Interestingly, the VP for Communications at IHS, Colby Synesael, previously worked at Cowen as a research analyst for telecommunications infrastructure.

Comparison to key competitors

American Tower, the main rival for IHS, exceeded analyst estimates by 100% during Q2. In Africa, AMT grew by 9%, whereas inorganic growth of IHS was 9.1% in the African continent. Europe and developing markets were the only geographies where AMT was able to grow. The United States and Canada declined due to a churn from consolidation among MNOs.

Another competitor, Helios Towers, which is listed in the London stock exchange, delivered similar numbers to IHS in the second quarter. Helios has a little over 10 000 towers mainly in Africa. The issues were generally the same for Helios. Power generation costs, changes in foreign exchange rates and fair value losses of derivatives decreased the earnings.

With forward adjusted EBITDA (author’s estimate) of $288 million and $2.76 billion enterprise value Helios Towers is trading with a multiple of 9.6, significantly above IHS despite several inferior metrics. According to Fitch:

“Helios Towers operates in some countries with weaker operating environments, has higher leverage than IHS, and a weaker FCF profile partly due to more organic investments leading to higher capex intensity.”

Evaluating the investment thesis

The tower business is relatively simple. In my first article about IHS, I highlighted three key actions for the company to play: reduce power generation costs, diversify its portfolio and add new tenants to existing towers. The company seems to be doing just that. Later in the journey, it is required to reduce debt in order to generate positive earnings.

Portfolio diversification

IHS closed an acquisition of 5700 towers in South Africa from MTN. Additionally IHS will provide power and security services for additional 7300 towers. The deal is expected to deliver $192 million of revenue and $85 million adjusted EBITDA for the first full year of operations. The deal was worth $412 million implying a multiple of 4.8x.

The deal placed IHS in a market leader position among the independent tower companies. The majority of the towers are still owned by mobile network operators (61%). I believe IHS reached the deal for a couple of major reasons. First, MTN is one of the largest owners of IHS. Second, IHS most likely was one of the only potential buyers. American Tower holds 12% share of the South African tower market and its market share could have risen too high if it would have been the buyer. Third, the competition authorities placed rather stringent requirements for the deal.

The main drawback of the requirements is that IHS needs to lower its ownership down to 70% and allow a 30% share to a “B-BBEE consortium.” One of the main risks involved with the acquisition is MTN’s pursuit to acquire Telkom, one of the five South African MNOs. Telkom is one of the new tenants of IHS and losing a tenant would push the already low colocation rate of 1.2 even lower. However, South African competition commission isn’t supportive of the deal.

After the deal American Tower will be the second largest tower company in South Africa. AMT has 2923 towers, with a balance sheet value of $125 000 dollars per tower and generating $56 000 dollars of revenue (figures FY2021). The figures for IHS are $72 000 and $34 000 per tower, without considering the value of managed services.

The deal will create an additional growth platform and further diversify IHS out of Nigeria where the company owns 16 000 towers out of the current 39 000 towers. In the second quarter the company also constructed 240 new towers.

Adding new tenants

In the second quarter and in all segments, excluding the Sub-Saharan Africa segment where the company made a large acquisition, the amount of tenants grew faster than the amount of towers. Even though the average average colocation rate decreased due to an acquisition, this tells that IHS is constantly adding new tenants to existing towers which will lead to improved profitability. In Q2, the company also made 2153 lease amendments, which increased revenues from existing towers.

In the end of July there was news about potential entry of Orange, a French MNO, to the Nigerian market. With a 60% market share in the country, IHS could be a beneficiary of a new entrant to the market. The piece of news is distant and partly speculation but if realized the entrance of Orange could improve the echo around Nigeria.

Reduction of power generation costs

IHS is launching an investment program called Project Green. The goal of the project is to reduce diesel and generator maintenance costs, which were $469 million in 2021 and likely to increase significantly in the current year. The project means adding renewable energy sources and batteries to the towers which don’t have access to the electric grid. IHS will provide additional information about the expenditures and potential savings in the Q3. Although the project will increase capex, it will eventually make the company’s financial performance more stable and most likely increase profitability.

Evaluating key risks

One of the key risks highlighted in my first article about the company was its concentrated ownership structure. In the Q1 earnings release the company informed that 78.2 million shares out of 332 million outstanding were released to be traded. This might have been one possible reason for the recent decline in the share price. In the longer term this is good news, because it allows larger institutional investors to build a position.

Looking at the largest owners of the company, we can see that Duquesne Family Office has built a position of over 700 000 shares. That’s the trading vehicle of legendary Stanley Druckenmiller. Although the position is just a small portion of Druckenmiller’s portfolio and he might already be out of the position, it’s a promising sign that one of the most successful traders sees value in IHS.

The key part of the investment thesis was, and still is, the valuation gap of IHS to its peers. Since my last article on IHS, there have been several private deals of tower assets. Most recently, a deal was made in New Zealand for a portfolio of approximately 1500 towers for an EV/EBITDA multiple of 33.8. Additionally, a consortium including Brookfield purchased a 51% stake in a portfolio of German and Austrian towers from Deutsche Telekom with a multiple of 26.5. Although these towers are located in developed markets and the towers are more valuable, IHS is trading at a forward EV/EBITDA multiple of 5.8x.

Benchmarking the balance sheet

Since the investment thesis for IHS rests largely on a massive and widening relative valuation gap, let’s bring in further analysis that were not included in the first article. Previously I used American Tower as a comparison in order to support the thesis for a valuation gap. The industry leader is a good benchmark in many ways, highlighted in my first article about IHS. Since then, I have made an effort to figure out if there’s something seriously wrong about IHS, but haven’t yet come out any serious red flags.

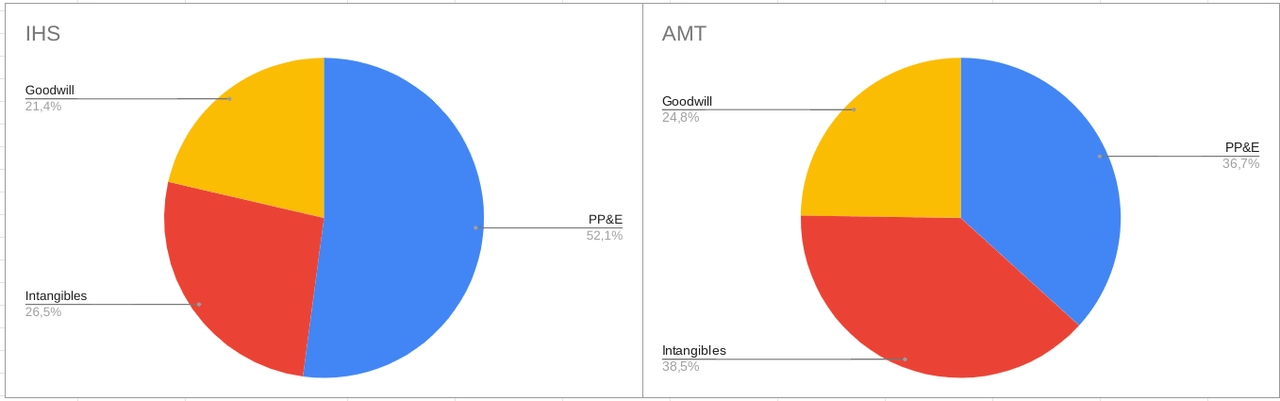

First, in terms of balance sheet quality, IHS has more meat on the bone. In the end of 2021 the balance sheet consisted of 52.1% of property, plant and equipment whereas the same figure for AMT was 36.7%.

Composition of balance sheets. (IHS 20-F 2021, AMT 10-K 2021)

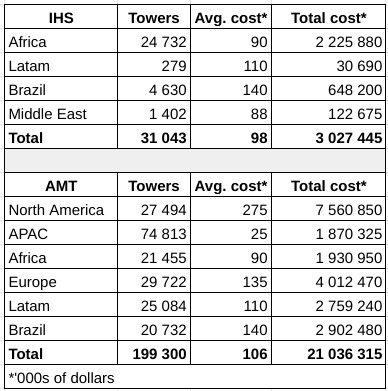

Second, although both companies generate similar amounts of revenue per tower, AMT has valuable towers in North America, a relevant question is how comparable the companies are. Based on information provided by Dgtl Inra, I produced a theoretical calculation of how much it would cost to build a portfolio of owned towers as of 2021.

The purpose of the calculation is to point out that the portfolio of IHS is relatively good when comparing to AMT and illustrate that the theoretical value of its portfolio is 53% of its enterprise value, whereas the value of the AMT portfolio is only 12% of its enterprise value. Adding the book value of AMT’s datacenters and fiber networks increases the share to a little over 16%. Naturally, the revenue and EBITDA derived out of the towers is more meaningful for the company and the shareholders.

Theoretical cost to build a tower portfolio. (Dgtl Inra, Author’s own calculation)

Third, although interest expenses are eating up a lot of profits, in comparison IHS has interest expenses under control in comparison. In Q2 IHS increased its leverage ratio from 2.5x to 3.1x, which is still within the company’s target. Net debt stood at $3.17 billion dollars with average cost of debt 7.8%, 63% with fixed interest rates and maturities well spread out to the future. Interest costs represent 12.3% for IHS, 15% for American Tower and 41.4% for Helios Towers out of adjusted EBITDA.

Conclusion

The growth story of IHS remains intact. On the surface, the latest quarterly results don’t look encouraging, but when looking under the hood one can get a slightly different picture. The Q2 results were burdened by non-cash items and the period year before included one time items. The recent developments support the original investment thesis, and due to the share price decline the expected returns are potentially higher if the stock rerates.

Again, in many ways inferior Helios Towers is trading at EV/EBITDA multiple of 9.6x and American Towers at a multiple of 28.7x. Still, the private deals have been done on similar multiples than AMT is trading. Despite the high costs of operations and risks involved with exposure to Nigeria, IHS appears as a great inflation protected opportunity below 8 dollars a share. IHS is still worth a multiple of EV/EBITDA of 12, implying a target price of $21.

Be the first to comment