anita2020

Overview of Bitfarms and Investment Thesis

Bitfarms (NASDAQ:BITF) is a Bitcoin (BTC-USD) mining company based out of Canada and has expanded its operations into countries such as the United States, Argentina, and Paraguay. They have been a vertically integrated, decentralized, self-mining operation since 2017. With its mining farms spread across these three countries, BITF now reportedly has 3.9 EH/s of hashing power and 166 total MW to power the rigs. Focusing on hydroelectricity to power its operations, Bitfarms is ahead of its peers in terms of the ESG side of mining. Competitors like Marathon Digital (MARA) and Riot Blockchain (RIOT) mainly source their operations through fossil fuels, which are held to more scrutiny and regulations by governments worldwide.

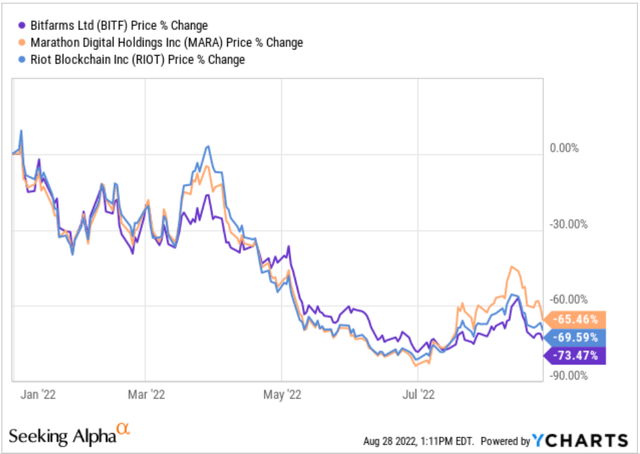

YTD Bitcoin Miner Stock Performance (YCharts)

Although Bitfarms primarily serves as a Canadian miner, they’ve substantially ramped its Paraguay location and are continuing to target higher estimates in the USA, Argentina, and Paraguay moving forward. BITF now projects a daily production of ~17 BTC per day, netting around $340,000 USD (BTC price of $20,000) in daily revenues. Powering its miners through 99% green hydroelectricity, Bitfarms can run a relatively low electricity cost of $0.04/kWh, which is much more efficient than the average electricity prices seen worldwide in this inflationary environment. Because of Bitfarms’ rapid developments and consistent drive to improve, I will reinstate my buy rating at an even lower share price than my original report.

Bitfarms’ Significant Quarter 2 Developments and Expansion Plans

Bitfarms has continued to impress me with its rapid expansion and plans to grow substantially faster than its peers. Per the official company Twitter and Q2 2022 Results Presentation, Bitfarms received and installed over 10,300 miners in the past quarter, which ended July 31st, which has added more than 900 PH/s in computational power to Bitfarms’ online hashrate. From the Q2 results presentation, management states that Bitfarms has achieved “135 BTC per operating EH/s in July and ~2% of the BTC Network.” The company surpassed 3.9 EH/s corporate hashrate at the beginning of August and reportedly mined 17+ BTC/day. Now with 166 MW compared to 137 MW as of June 30th, BITF grew its MW by ~21% month-over-month. These numbers illustrate significant strides in maintaining its status as a top-of-the-line miner in terms of efficiency.

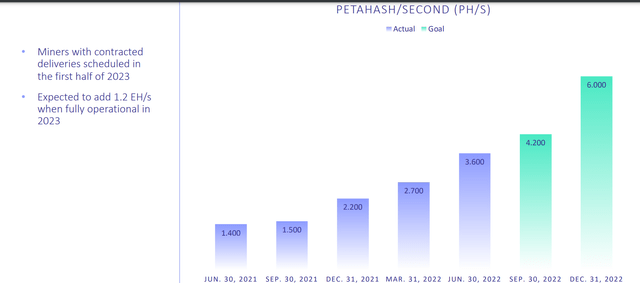

Company Expansion Plan (Q2 2022 Presentation )

Bitfarms has a vertically integrated Bitcoin mining strategy in terms of expansion, with nine production sites drawing power from 5 hydroelectricity providers. Bitfarms’ Sherbrooke, CA site is its most prominent, with 84 MW out of the total operational 166 MW for the company. Bitfarms projects to have at least 229 MW by year-end, as their contracts imply, which conveys a staggering 38% five-month increase. Per the company’s Twitter page, management expects its infrastructure construction contracts to provide 4.2 EH/s by the end of Q3 2022 and 6.0 EH/s by the end of the year (end of Q4). Moreover, Argentina is a location where they are looking to aggressively bolster their operations as they imply that “The Company already has 1.2 EH/s of miners contracted for 2023 for its Argentinian warehouses.” With a market capitalization of roughly 347 million CAD or around 266 million USD, Bitfarms is intrinsically positioned for a ton of room to run, in my opinion.

Bitfarms’ Fundamentals and Industry Comparisons

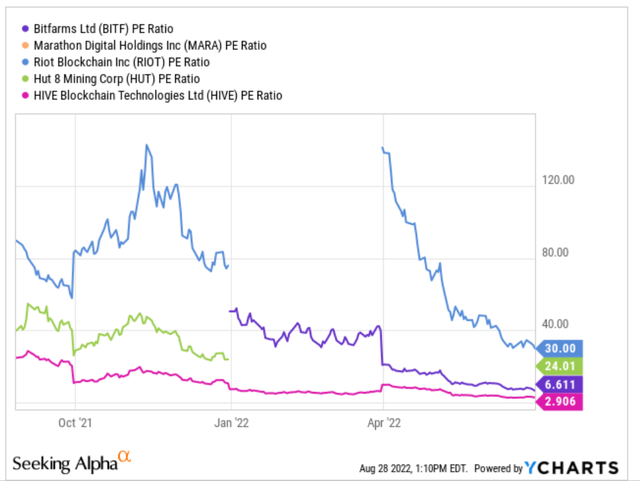

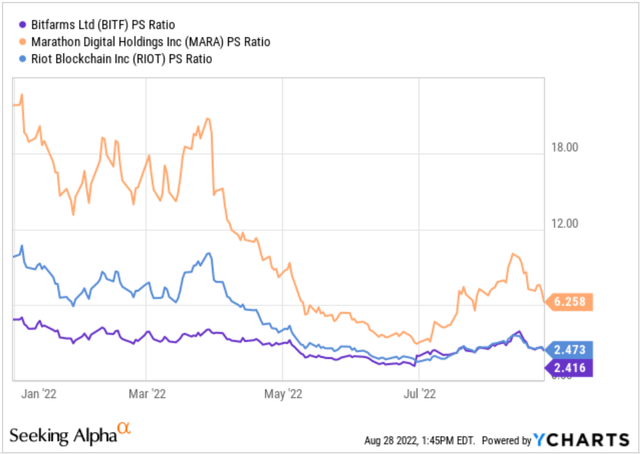

When looking at fundamentals within the crypto industry, Bitfarms holds some of the most robust numbers. Compared to the larger companies like MARA, RIOT, (HUT), and (HIVE), Bitfarms has great multiples and is positioned to withstand the recent tough times in the crypto market. From a price-to-earnings multiple perspective, Bitfarms has dramatically improved in this area, as they posted a 16.08x ratio back in my first article in May. Bitfarms is substantially increasing its efficiency, pumping out profitability at a superior rate. Also, when looking at the P/S ratios, BITF is once again at the top of the industry compared to some industry giants. This expresses how Bitfarms is potentially undervalued when looking at its market value, profit margins, and sales performance.

Industry P/E Comparisons (YCharts) P/S Multiple Industry Comps (YCharts)

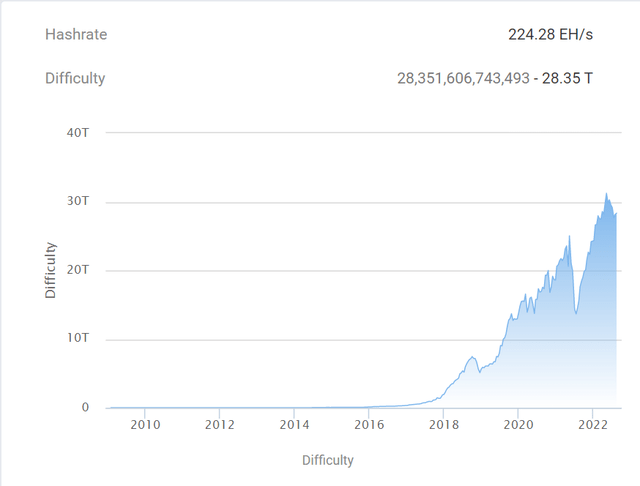

Some strong points moving forward, even though Bitcoin continues to lag, is that Bitfarms still only has a $9,900 average direct cost of production of BTC in Q2 2022, which is substantially lower than its ~$20,000 market price. With a production cost of less than 50% of the actual BTC cost, Bitfarms continues to position itself for success. Year-over-year, Bitfarms’ production cost is up 10%, which is attributed to the increase in average network difficulty. Bitfarms continues to generate positive cash flow regardless of Bitcoin’s collapse to 20k, and in Q2 2022, BITF posted an AEBITDA of 45% of sales.

Bitcoin Mining Difficulty Through The Years (BTC.com)

Bitfarms continues to strengthen its balance sheet with a current ratio of 2.84, dated back to December 31st, 2021, which is a very solid number that represents ample liquidity if needed. Furthermore, BITF has increased its financial flexibility by selling off some of its BTC, allowing them to have $46,000,000 in cash and around $62,000,000 in digital assets (BTC holdings). In July of 2022, Bitfarms reduced its credit facility further to $23,000,000 and had $17,000,000 available as a line of credit. All of these moves illustrate the management’s steps to propel Bitfarms ahead of its competition and remain one of the most efficient miners out there.

Risks Moving Forward and Final Remarks

Investing in a stock like Bitfarms poses a lot of risks since it involves cryptocurrency, a highly volatile market. With Bitcoin dropping down to around 20k, Bitcoin mining stocks have cratered since their peaks in Q1 2021 and Q3 2021. With their diversified production platform across two different continents and four countries, Bitfarms isn’t overexposed to areas with rapidly increasing energy costs. This mitigates some risks, which is significant in a tense market.

On their corporate website, they said, “Bitfarms is currently the only publicly traded pure-play crypto mining company audited by a Big Four accounting firm. This is another positive aspect of this investment as they are audited by a reputable firm, unlike its peers, giving it more exposure. With each facility being powered by 99% environmentally friendly hydropower secured with long-term power contracts, Bitfarms is highly motivated toward its ESG vision. This is huge in today’s market as the environment is something that governments are allocating a lot of their money and time to. By mining Bitcoin in a friendly way, Bitfarms is potentially positioning itself for governmental credits or subsidies. After viewing Bitfarms’ rapid Q2 expansion and end-of-the-year growth plans, I am reinstating my buy rating on BITF stock.

Be the first to comment