PeopleImages/iStock via Getty Images

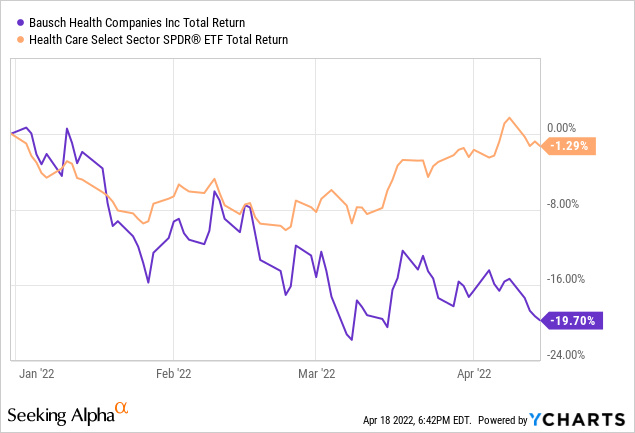

Bausch Health Companies (NYSE:BHC) has lost 25% of its equity value year to date in 2022, disappointing shareholders. There are interesting happenings fundamentally at the company which, unlike the infamous Valeant past, should be executed well and rely more on asset fundamentals than a reliance on robust capital markets.

This opportunity exists likely due to the market environment, as the healthcare sector year-to-date has lost a bit of value as well. Increasingly, the narrative in markets in recent weeks has been driven by a rising interest rate story and credit cycle discussions. Of course, as BHC carries a significant debt load, one might expect the company’s share price to be hit more than the sector overall. However, such a large delta is unwarranted and equity investors with a longer-term time horizon may find an opportunity at today’s share price levels.

Company Fundamentals Are Favorable

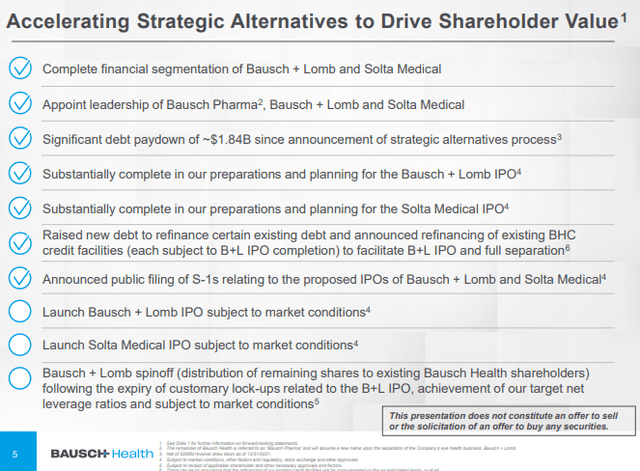

In February, BHC announced its Q4 2021 quarterly earnings results and presented an accompanying update on the company’s plan to drive shareholder value through strategic alternatives.

Slide from BHC’s latest earnings presentation discussing strategic alternatives (Bausch Health Companies)

While overall revenue dropped slightly by $17 million from the prior year comparable quarter, 2021 full year revenue came in 5% above 2020 levels, at $8.434 billion. Organic revenue actually increased by 6% compared with full year 2020, and CEO Joseph Papa continues to remain optimistic about company prospects.

$1 billion of this revenue came from the flagship Bausch & Lomb eyecare segment. BHC intends to spinoff this segment and the company is ready to IPO both B&L as well as Solta Medical as part of their overall strategic alternative/asset divestiture plans. These moves should allow the core business to continue to de-lever and return to sustainable go-forward levels of debt.

The company notably repaid $1.3 billion in debt overall in 2021 and saw several new product approvals. XIFAXAN and TRULANCE, two material revenue driver assets, reported revenue growth of 11% and 26% respectively year-over-year from 2020 to 2021.

While the company certainly has progress to make on both R&D (new product approvals and indication expansion) and existing commercial sales, these results are encouraging and certainly do not merit the decrease in equity value that the market has perceived. Given these healthy growth trends, a $7.5 billion market capitalization or ~15% free cash flow yield is an attractive opportunity for longer-term shareholders to get exposure to a well-managed, diversified healthcare company that is focused on shareholder value creation.

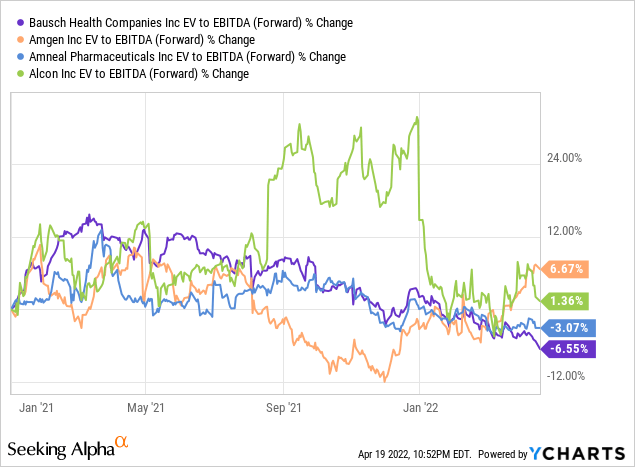

Relative to its peers, BHC also seems undervalued. The last years have seen competitors rerate slightly, but BHC has experienced multiple compression even relative to specialty pharmaceutical peers. The sector, along with its earlier, development-stage biotechnology peers, has been highly out of favor in today’s rising interest rate environment as free cash flows and profits are far out in the future and everyone’s discount rates in their models are rising, decreasing the value of the companies today (in theory). However, for patient shareholders, the value is there.

Several Wall Street analysts have recently decreased their ratings on the company as well, with price targets of $27, $42, and $30 respectively at Bank of America, RBC, and Piper Sandler. At today’s share price of ~$22, BHC seems undervalued relative to a deteriorating consensus view of the company’s equity value. However, at a reasonable industry P/FCF of 10x, today’s share price on BHC implies at least ~40% upside from current levels, or about in line with Piper Sandler’s target price. Market consensus is clearly mispricing the intrinsic value of BHC shares.

Risks

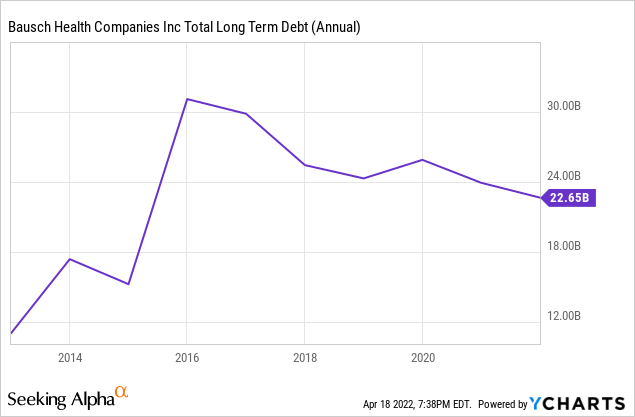

The dominant market narrative as it relates to risks at BHC is, of course, debt. The company’s debt load has been CEO Papa’s focus since he joined the legacy Valeant organization in 2016 to execute the turnaround.

With the strategic alternatives focus, some of the company’s debt should be reduced. What the market seems to be missing is that de-leveraging creates substantial equity value over a longer-term time horizon. This is especially true for heavily levered companies that are returning to more manageable debt levels – I would put BHC in this camp. As such, I believe the market is once again assigning more weight to the debt risk than is merited.

Conclusion

BHC represents an interesting opportunity at today’s $7.5 billion market capitalization for longer-term oriented shareholders. As management continues to execute on the strategic alternatives and asset divestitures, shareholder equity value should become apparent over the coming quarters. Best of luck to all investors.

Be the first to comment