zamrznutitonovi/iStock via Getty Images

Investment Thesis

In my last note on Merck (NYSE:MRK), the US’ fifth largest pharmaceutical by market cap ($234bn at the time of writing), in late March I argued that the company’s shares were arguably the best buy among the “big 8” US pharmaceuticals, which are, in order of size, Johnson & Johnson (JNJ), Eli Lilly (LLY), Pfizer (PFE), AbbVie (ABBV), Merck, Bristol Myers Squibb (BMY), Amgen (AMGN) and Gilead Sciences (GILD).

My prediction has proven to be partially correct, since Merck stock has risen in value by 13% since my note, and it’s the second best performing stock across the past three months, behind Eli Lilly, up 7.3%, and across the past six months, gaining 13%, behind only Lilly again, whose stock is +32%.

When investors think about Merck, they’re likely focusing on two main areas. Firstly, its mega-blockbuster cancer therapy Keytruda, an immune checkpoint inhibitor (“ICI”) that blocks the pathway of Programmed death-1, or PD-1, a type of receptor expressed on the surface of T-cells that can tell the immune system not to attack cancer cells.

Keytruda is the most successful of these types of immunotherapy drugs, and it has been approved to treat melanoma, non-small cell lung cancer (“NSCLC’), head and neck cancer, Hodgkin’s Lymphoma, B-cell lymphomas, bladder cancer, colon or rectal cancer, and types of stomach, throat, kidney, liver and breast cancers.

Keytruda made sales of $17.2bn in FY21 – its most successful year yet – which accounted for 35% of Merck’s total revenue generation of $48.7bn last year. Some analysts have forecast that by 2026, the drug could generate revenues of >$24bn, however, Keytruda looks to set to lose its patent exclusivity in 2028, meaning rival pharmas will be able to develop generic versions of Keytruda, which will drive down the drug’s sales volumes and its price point, meaning revenues will likely decline by ~25% per annum after 2028.

Besides Keytruda, Merck’s largest and most lucrative division is Vaccines, with Gardasil – a vaccine protecting against Human Papillomavirus (“HPV”) – making $5.7bn of sales in 2021, or ~11% of total revenues, and the division itself, which also includes >$2bn per annum selling Proquad / Varivax for prevention of measles, mumps, rubella, and varicella, accounting for 20% of all sales.

Merck has several other divisions – Hospital Acute Care, which accounted for 6% of revenues in 2021, Immunology, 2.3% of revenues, Neuroscience, 0.7%, Cardiovascular, 1.2%, Diabetes, 11%, Animal Health, 11.4%, and finally Virology, which includes the COVID-19 antiviral Molnupiravir, no branded as Lagevrio, which is expected to make sales of $5 – $5.5bn this year.

Most pharmaceuticals are valued as much on the assets in their pipelines as on the sales of their commercialized products – witness Eli Lilly, for example, which currently has a higher market cap than Pfizer, despite the former guiding for ~$28bn in revenues in FY22, and the latter ~$100bn.

That’s due to hype surrounding Lilly’s pipeline, including an Alzheimer’s therapy, but with a major loss of exclusivity (“LOE”) now just over five years away, what do Merck’s prospects for replacing potentially $15-$20bn of lost revenues per annum by the middle of the next decade?

Merck management is already beginning to discuss what the company needs to do to wean itself off Keytruda revenues and launch new products capable of keeping the company growing. There’s an acknowledgement that revenues will fall after the Keytruda LOE, but an assurance that there will be a return to growth after an initial dip.

Merck Q122 earnings presentation

In the remainder of this post I will provide some ballpark product sales forecasts for all of Merck’s drug products until the end of the decade, and try to map out new product launches and sources of revenue, to try to illustrate to readers how management are planning to maintain Merck’s status as a top 5 US pharmaceutical company, by sales and market cap valuation.

Finally, I will run these figures into a discounted cash flow analysis simulation to calculate a share price target for today, based on likely future sales. It’s important to stress these are ballpark figures only, and I have not addressed every drug in Merck’s pipeline – that would be too complex to map in a single post – however, I will address some key areas where revenues will be lost and new products introduced to compensate, and readers can make up their own minds whether my forecasts are accurate. Let’s begin with the Oncology division.

Oncology – Keytruda LOE, Potential Seagen Acquisition, and New Product Pipeline

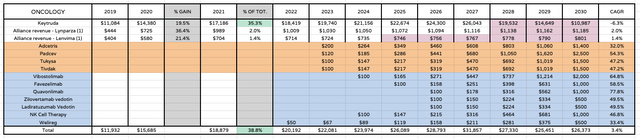

Merck Oncology revenue forecast to 2030

To explain the chart above, the first few columns show historical sales of Keytruda, and alliance revenues from Lynparza, a PARP inhibitor indicated for ovarian cancer marketed and sold by AstraZeneca (AZN), who pay royalties to Merck under a licensing deal, and Lenvima, a thyroid cancer drug marketed and sold by Japanese Pharma Eisai, who also pay royalties to Merck, after Merck invested $300m in Eisai and Lenvima, with >$5bn of milestones also on the table.

There are columns showing percent gain in revenues between 2020 and 2021, and percent of total revenues sales represent, and after that, I forecast sales out to 2030 based on a variety of different calculations. I also highlight in red where patent expiration occurs. The final column shows the overall compound annual growth rate of sales.

As we can see I use analyst’s estimates to show Keytruda revenues rising to $24.3bn at a CAGR of ~7%, and therefore to a peak of $26bn in 2027, before the LOE occurs in 2028. I then decrease sales by 25% per annum, so in 2030, revenues are ~$11bn.

The rows highlighted orange represent drugs currently marketed and sold by Seagen (SGEN), a commercial stage oncology focused pharma based in Seattle, with whom Merck has a close relationship, using Seagen’s products in combination with Keytruda and helping to develop pipeline asset Ladiratuzumab vedotin. Merck is said to be in late stage talks to acquire Seagen, for ~$40bn, or ~$217 per share, a 25% premium to Seagen’s current traded price.

Seagen’s drugs are antibody drug conjugates (“ADCs”) and the company has four approved products, Adcetris indicated for Hodgkin Lymphoma, Padcev for bladder cancer, Tukysa for breast cancer, and newly approved Tivdak for cervical cancer. Based on my research and analyst estimates I have set ballpark peak sales figures for 2030 of respectively $1.4bn, $2.5bn, $1.5bn, and $1.5bn – $7bn of revenues in total, and grown revenues based on the CAGR rate calculated using 2021 sales figures.

The Seagen acquisition – if it goes through – would represent the first major move by Merck management to try to compensate for the Keytruda LOE. $40bn seems a high figure to pay for $7bn of peak sales, but Merck also is working with Seagen on the pipeline asset Ladiratuzumab Vedotin, which targets LIV-1, a protein expressed in breast, melanoma, prostate and ovarian cancers amongst others.

It’s very hard to forecast sales data for an asset that is in Phase 2 clinical trials so I have opted for $2bn, which is probably less than half Merck is hoping for having invested >$1bn in the drug to date, but which also reflects the risk of an adverse efficacy or safety trial readout, which could see the drug fail to make it to market.

There are six more drugs that I have included in the table above, and I have estimated their years of approval, and peak sales figure, which I have elected to keep below $2bn in all cases, again to reflect the risk of trial failures.

Welireg already has been approved, as the drug acquired via the $1.1bn acquisition of Peloton Therapeutics received an FDA nod to treat von Hippel-Lindau (“VHL”) disease last year. Additional approvals in kidney cancer and in combo with Keytruda could make the drug a blockbuster (>$1bn sales per annum) analysts believe.

Merck management’s stated ambition is to secure 80 new approvals in oncology (including label expansions of existing drugs) by 2028, so I have included a number of other pipeline assets in my table and speculated peak sales. Vibostolimab uses an anti-TIGIT approach – TIGIT being expressed on tumor-infiltrating cytotoxic T cells in numerous cancers. Favezelimab is another immuno-oncology drug that is anti-LAG-3, like Bristol Myers Squibb’s recently approved Opdualag, whilst Quavonlimabis anti-CTLA4 – another popular target.

I also have included another ADC, Zilovertamab vedotin, and 1 NK-cell targeting allogeneic cell therapy. Cell therapy is an exciting growth space in oncology with three drugs approved in the past 18 months (Gilead’s Tecartus and BMY’s Breyanzi and Abecma) and I expect Merck to achieve success in this market.

Despite all of these new approvals, I still have Merck’s oncology revenues peaking at ~$33.2bn in 2027, although thanks to the new approvals, revenues only fall by $6bn from that high, coming in at ~$27.4bn in 2030.

That goes to show what an extraordinary, once-in-a-generation drug Keytruda is. Since AbbVie’s mega-blockbuster, the $20bn selling Humira goes off patent next year, Keytruda will likely become the world’s best selling drug. In that context, if Merck does drive oncology revenues >$27bn in 2030, it will be an outstanding achievement by the company, and that will likely be reflected in a rising share price.

Vaccines and Cardiovascular

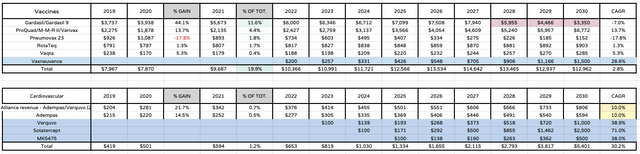

Merck Vaccines and Cardiovascular division sales to 2030

Merck’s Vaccine and Cardiovascular divisions are the other two divisions where I’m forecasting new drug approvals as well as already approved product growth.

Since Gardasil loses patent protection, like Keytruda, in 2028, I decrease revenues from that year, but HPV is estimated to grow from a $3.8bn, to a $12.7bn market by 2027, and although several companies working on HPV vaccines, not least the messenger-RNA giant and developer of $18bn per annum selling COVID vaccine SpikeVax, I make Gardasil the market incumbent, increasing its sales to nearly $8bn before LOE.

I also assume that Vaxneuvance’s approval as a pneumococcal vaccine by the FDA in July last year results in the drug becoming a $2bn peak seller as it takes on Pfizer’s $6bn per annum selling Prevnar. Pneumovax sales fall as Vaxneuvance sales increase, and I’m optimistic for ProQuad / Varivax increasing its sales to nearly $3.5bn by 2030, at a CAGR of 5%. That means that, like oncology, the vaccines division is at its most lucrative prior to the Gardasil LOE in 2028, delivering $13.3bn in 2027, but equally, the total revenues in 2030 of ~$10bn continue to ensure the division is a powerhouse for Merck.

Merck’s Cardiovascular division is small at the present, but appears marked for strong growth, given upcoming approvals. According to Merck there are eight potential approvals possible by 2030, although I have chosen to focus on the least speculative.

Verquvo, developed in collaboration with Bayer, already is approved for chronic heart failure could be approved for chronic heart failure and reduced ejection fraction, while Sotatercept is the jewel in the crown of Merck’s recent $11.5bn acquisition of Acceleron, could become a standard of care in Pulmonary Arterial Hypertension (“PAH”). I have speculatively awarded the pipeline asset MK5475 $500m peak sales by 2030 in PAH and other indications.

Merck themselves believe the cardiovascular franchise may be worth >$10bn per annum by 2035, while I’m forecasting for nearly $7bn revenues by 2030, the division growing at a CAGR of 34%.

Other Division Growth Estimates and Total Revenues

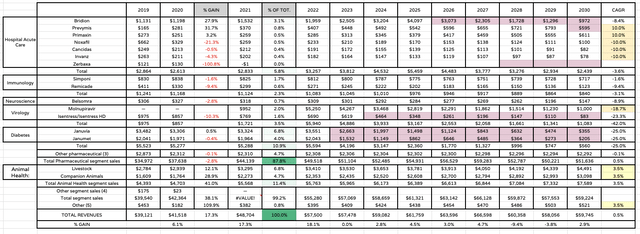

Merck other divisions revenue forecasts to 2030 (my table and assumptions)

This final table covers the remainder of Merck Divisions and as you can see I am not speculating pipeline assets here, partly since management’s focus appears to be on vaccines, oncology and cardiovascular, and partly due to time constraints.

The important areas of focus here are diabetes – it seems both Januvia and Janumet are no longer patent protected, but I’m betting on Merck extending protection for Januvia until 2027 under a new patent covering “certain phosphate salt and polymorphic forms of sitagliptin” so revenues won’t entirely collapse, and immunology. Molnupriavir sales are reflected in immunology, and I’m massaging these down from $5.25bn in 2022, to just $1bn by 2030, due to the likelihood of declining cases of COVID.

Finally, then, we come to total revenues. Merck has guided for FY22 revenue of $57.5bn, but my calculated figure is a little lower, at $55.3bn – still an impressive 14% uplift. After that, sales grow in every year by an average of ~3.5%, as Keytruda sales keep rising, and the cardiovascular division begins to grow, offsetting Molnupiravir and Diabetes division losses.

In 2028 the dual LOEs for Keytruda and Gardasil arrive, and revenues fall by 10% to $61.7bn, from their 2027 peak of $68.5bn. They fall again in 2029, but by 2030, are back on the rise again, to $60.5bn.

Calculating a Target Price For Merck Stock

In another post I will discuss the discounted cash flow and integrated financial statements in some more detail, but for the purposes of this post, the important information is as follows. Total operating expenses are calculated as ~72% of revenues in 2022, falling to 68% by 2030, due to operational efficiencies i.e. the Organon spinout, and net profits in 2022 I calculate as ~$13bn in 2022, compared to $12.3bn in 2021, rising to $21.5bn by 2027, then averaging out at ~$19bn for the last three years of the decade.

I calculate a weighted average cost of capital for Merck of ~10.2%, based on a risk free rate of 1.7%, expected market return of 12%, and beta of 0.8, and after applying discount factors, my stock price target for Merck stock, based on my forecasts and my DCF calculations, comes out as $104. Using an EBITDA multiple analysis my calculated price is $111, for an average of $107.

Conclusion – Recent Run Up In MRK Stock May Not Have Too Much Momentum Left But $100 Is Achievable

I was a little surprised to see my target price come out so low, when my forecasts were reasonably optimistic, but it seems clear that the LOE for Keytruda, and Gardasil, that will occur in 2028 is going to rock Merck substantially, which is entirely understandable.

Investors rarely look more than 3-5 years ahead, and I will be the first to admit my forecasts are speculative and they will be subject to change, although as mentioned when I conducted a similar analysis of Gilead Sciences (GILD) (where I guesstimated there could be 75% upside), if you do not have some form of forecasting in place, then it will be very difficult to have a conviction about the direction of the share price.

I will doubtless be making numerous adjustments to my model over the coming months and years, although I feel that a share price of ~$107 feels about right for Merck at the present time. I expect there will be a dip if Merck goes ahead and acquires Seagen – and the $40bn fee does look steep to me. The company reported total liabilities of $43.6bn in FY21, and current liabilities of $23.8bn.

With leverage already >3.5x EBITDA in 2021, how much more of a load can Merck take on. BMY and AbbVie both spent >$65bn acquiring Celgene and Allergan respectively, but inherited a diverse set of assets and ~$15bn of additional revenues – Merck will not extract as much from Seagen, so on some levels I question the wisdom of the deal, although if any company knows how to develop an oncology blockbuster, it’s Merck, and I’m fan of the ADC approach.

Merck earned $15.7bn in revenues in Q122, and gross margin was 71%, which sets the company up for a strong year. If the Seagen deal goes through, I doubt the pharma will see its share price climb above $100, but in the years up to 2027, I think this target will be achieved, and a price of $105 offers a premium of ~17% to current price, plus there is the dividend, currently yielding 3%.

In summary, I don’t think there would be anything wrong with holding Merck at the present time, and over the years, shareholders ought to be rewarded for doing so. As we approach 2028, however, Merck management needs to start showing clearly, as e.g. AbbVie management has done in relation to the Humira LOE, that its pipeline conversion rate is going to be good enough to help the company survive two major LOEs, otherwise, the share price will begin to tumble.

Be the first to comment