aluxum

Main Thesis & Background

The purpose of this article is to evaluate the Direxion Daily Retail Bull 3X Shares ETF (NYSEARCA:RETL) as an investment option at its current price. This fund offers exposure to the S&P Retail Select Industry Index, with an objective to deliver “a return that is 300% the return of its benchmark index for a single day”. In practice, this means the fund uses extensive leverage, so it is designed for traders with either a short-term objective, plenty of risk tolerance, or both.

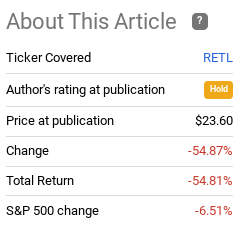

I keep an eye on RETL because I have been looking for an entry point to help me recoup my retail losses this year. I have a position in the SPDR S&P Retail ETF (XRT), which is deeply in the red this year. My thought is I can amplify this exposure on a short-term basis through RETL in order to get my overall retail position in the green for the year. So far, however, I have not found a great entry point for this fund. Case in point, when I last covered it in February, I didn’t like the value proposition and encouraged readers to avoid the fund. In hindsight, this was certainly the right call:

Fund Performance (Seeking Alpha)

Given how sharp this drop has been over the past six months, I thought it made sense to take another look at RETL. Perhaps this prolonged weakness has opened up a buy opportunity. After all, if it rebounds to the level where it started the year, that would be quite the gain!

Unfortunately, I still see too many headwinds on the consumer front to get excited about a triple leveraged play on retail. While I think there is some value in sector positions for the longer term (hence my position in XRT), I don’t see a real bullish backdrop in the short-term. With RETL’s structure, there is plenty of downside risk if we don’t get a meaningful bounce for the sector, and that isn’t how I want to position myself right now. As a result, I will keep my cautious view on this ETF in place for the second half of the year.

Is There A Bull Case? Potentially

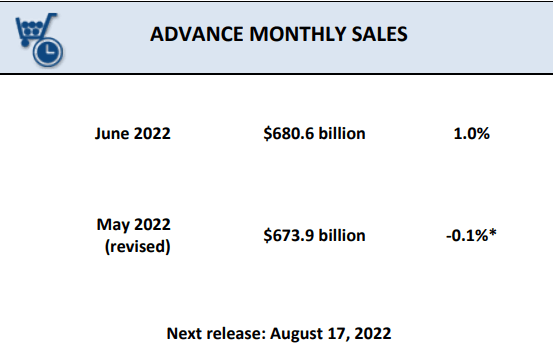

To begin, I want to give a quick update on the broader retail sales picture. Given that RETL is focused solely on the retail sector, consumer spending and retail sales are paramount for this fund. With its 3X leverage objective, if we see a rebound in this space RETL is going to perform extremely well. There are some out there who may be expecting this because retail sales have held up to a reasonable degree, rising 1% in June, after declining in May:

Retail Sales Growth (Month over Month) (U.S. Census Bureau )

Looking at this it might look like retail is rebounding and positions in RETL could be timely. The bottom-line is growing sales figures are what we want to see – right?

The answer is yes, but a conditional yes. The problem with unadjusted sales figures right now is they are not giving the whole story. What I mean is that sales numbers are up in totality, that is true, but a lot of this is because of inflation. As prices rise, sales revenues could be increasing but the amount of goods purchased may have dropped. That is how inflation works – consumers have less purchasing power. That is an important takeaway.

My thought here is that a positive metric is good to see, especially since May saw a decline. It does speak to some resilience on the part of American households and consumers. So it is not time to panic. But given how hot inflation has been, this number really should be a lot higher. The fact that it is not suggests consumers are cutting back, and that is not the right environment for an overly bullish play like RETL.

Inflation Is Still A Top Concern Of Mine

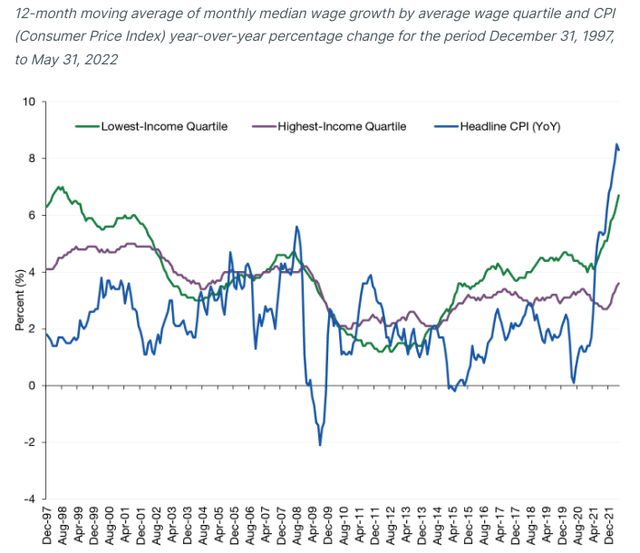

Expanding on the prior paragraph, let us examine why inflation is such a problem right now. We all know that inflation has been very high and persistent over the past year. The “transitory” messaging was one I never believed (see my prior articles for poor of that!) and most Americans now understand that inflation is going to be stickier than we hoped. But rising prices from inflation are not always bad, nor always good. It depends on other factors: how fast wages are rising, economic growth figures, consumer confidence, and many others. So we have to look at more than just headline inflation to understand the true story.

In this regard, it is important to recognize that while Americans are enjoying some wage increases, those increases are not keeping up with inflation. This is true across the board, for those in top income tiers as well as lower tiers:

Inflation Outpacing Income Gains (Lord Abbett)

This lays out pretty clearly why inflation is pressuring sales figures and the overall mood of the country. Price increases are going up fast and wages cannot keep up. This is a trend that has accelerated going into the year, so it doesn’t leave me with a lot of confidence. The good news is that wages are often a sticky attribute as well (employers have a difficult time with retention and morale if they try to cut existing salaries). So, if inflation peaks, moderates, or eases, then these wage figures will be a bull catalyst. But for now it just suggests Americans are struggling to stay above water. This, again, supports my caution on RETL.

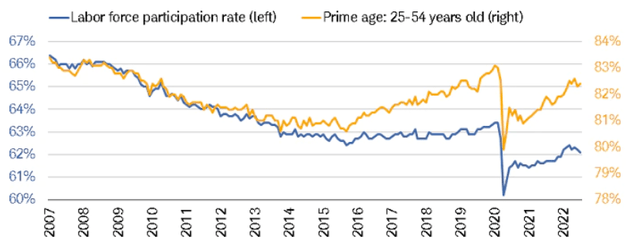

Labor Force Participation Remains Too Low

Another source of concern for me is the labor force dynamic. Ever since the Covid-19 pandemic hit, America has been struggling getting its populace back to work. While unemployment is very low, this is similar to the sales metric I discussed earlier. On the surface, it looks great, but a deeper dive illustrates some fundamental problems.

With the case of the labor market this is that too many people have dropped out of the labor force. That is how unemployment has stayed low even as fewer people are working. Once someone drops out of the labor market and/or stops looking for what, they are no longer counted as unemployed. This is a long-term issue with focusing solely on the unemployment rate, and justifies why we have to keep a close eye on labor force participation. The issue here is that overall labor force participation is still well below where it was pre-Covid, and that is even true for those in their prime working years:

Labor Force Participation (Charles Schwab)

The second attribute (those in their prime working years) is especially troubling. These are people that should be working. To be fair, some could be independently wealthy, making a living with side gigs, or simply retired early. But with cost of living rising as much as it has, I have trouble reconciling how such a large number of people in their prime working years have “dropped out” of the labor pool. At the very least fewer working, productive citizens means less discretionary income. That is a problem for all discretionary and cyclical sectors, but especially retail. Until I see a fundamental change here, RETL will continue to be on my “watch” list, not my “buy” list.

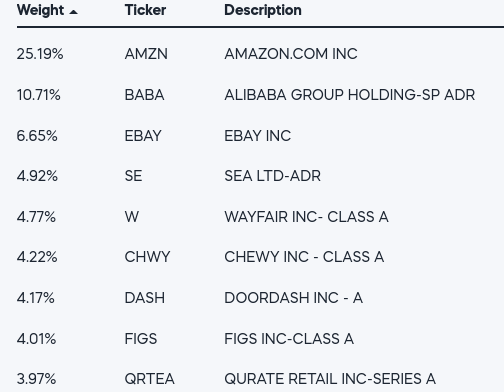

Very Top Heavy Fund

To manage expectations here I want to remind readers that if they are to embark on a position in RETL it should be for the short-term. A 3X leveraged fund has a lot of risk inherently, and that is probably not something retail investors want to hold on to for too long a stretch. I would not presume to talk someone out of doing so if they have their mind made up, but please be aware of the risks of doing so if that if something you want to attempt.

In fairness, that is true for all double and triple leveraged funds, in my view. But it is especially true for RETL because not only is it going to move at a rate of 3X the retail index, it is also very top heavy. This concentration is just a few names makes me all but certain I will not hold on to this fund for long periods of time. It would be a short-term play for a quick bump and not much more:

RETL’s Holdings (ProShares)

What this is showing is that just nine companies make up roughly 75% of RETL’s total assets. And two names make up over one-third the entire position! This makes it hard to justify buying an ETF, leveraged or not, when I see this type of scenario. I would just buy the names directly if that is what I wanted. XRT, by contrast, doesn’t have the leveraged exposure, but it is much more diverse with its holdings list and is not top heavy. That is why I have held onto that retail option for the long-term, and will only consider RETL for short-term trading purposes.

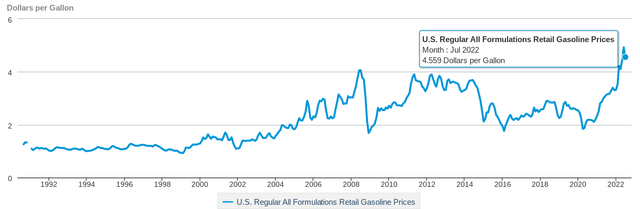

Energy Prices Make Me Concerned Going Into Year-End

To wrap up the review I will discuss why I am not bullish over the next few months either. This is important because while the retail picture is not very strong at this moment, we don’t want to wait until a recovery clearly materializes. From an investment standpoint, that is too wait to capture the “alpha” generating gains. On the other hand, we also don’t want to buy in too early, which is the scenario I see now. This is because losses can continue and then when a rebound catches hold, we may not end up with a profit based on our buy-in point. Timing can be key in this way.

With this in mind let me emphasize that I do not see the macro-picture changing for retail over the next quarter. While Q4 could see a bump from holiday spending, that is a ways away and a bit too uncertain at this time. For August – October, there are not a lot of catalysts that are going to change my outlook save for a clear moderation of inflation.

One the biggest drivers of inflation, and therefore pain points for the retail consumer, is rising energy costs. Fuel prices, especially at the pump, are what Americans see on a daily basis, and that is dinging confidence. Fortunately there has been a noticeable decline in fuel prices over the past month, but they still remain elevated from a historical perspective:

Average Price at Gas Pump (Energy Information Administration)

The thought here is that while prices are coming down a bit, they are still more than U.S. consumers are used to. The reality is they will continue to feel the pressure from this and cut back on other areas (like retail purchases).

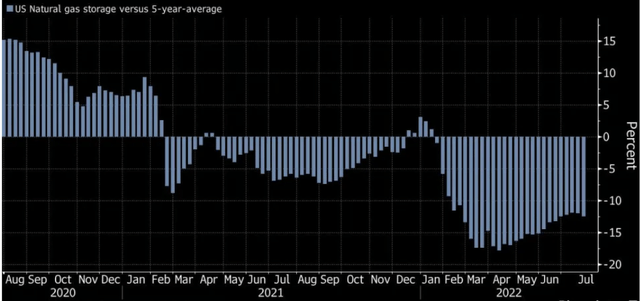

More worryingly to me is that other energy prices remain elevated as well. With the cooler fall and winter seasons coming up, I see a scenario where U.S. households will be spending more on utility bills as well. This is a longer term headwind that reverts back to my point that while we want to front-run an eventual retail rebound, that could be a ways off.

To understand why let us consider that natural gas helps to heat a lot of homes in the U.S., especially in the northeast. But prices have been rising and overall supply is low, meaning those prices are likely to stay elevated:

Natural Gas Storage Levels (Bloomberg)

The conclusion I reach here is that elevated energy prices are here to stay for the short-term. Even if fuel prices ease going into the winter, heating costs are going to go up and will counteract the (potential) easing at the pump. This will be a difficult backdrop for consumer spending.

Bottom-line

RETL has been punished in 2022. The broader market is down, but retail in particular has been harder hit due to rising inflation and declining consumer sentiment. While the drop over the past six months looks tempting for new positions, I see too much risk on the horizon to justify positions now. I will continue to be patient, and wait and see if another drawdown occurs to open up a better buying opportunity. Therefore, I will keep my “hold” rating on RETL in place, and suggest investors approach this ETF very selectively at this time.

Be the first to comment