Marco_de_Benedictis/iStock via Getty Images

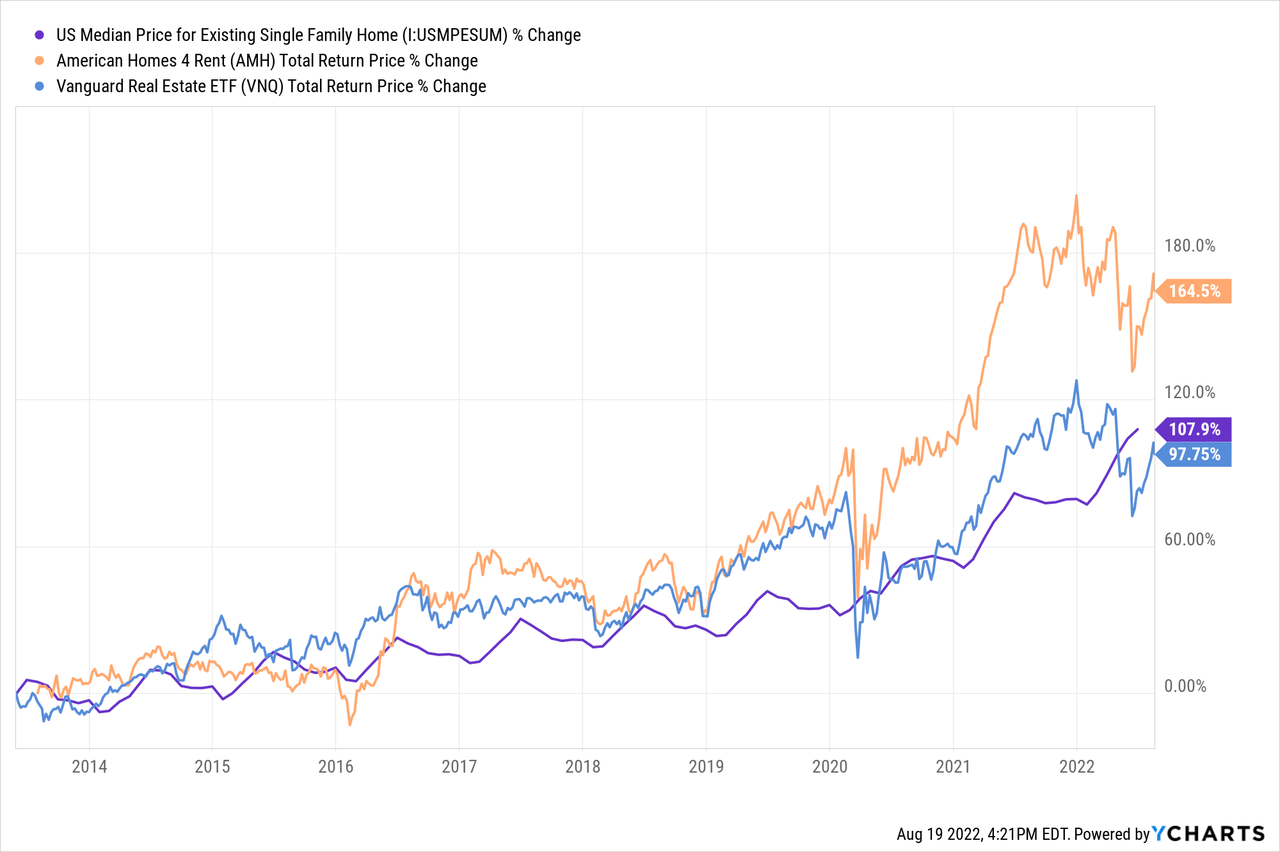

Rental property investing has proven to be extremely lucrative. This can be measured by a multitude of metrics, including looking at the performance of single-family rental real estate investment trusts (“REITs”) and the median home price in the United States. As the chart below illustrates, the performance of leading single-family rental REIT American Homes 4 Rent (AMH) and even the median price for existing single-family homes in the U.S. have outperformed the broader REIT sector (VNQ) since 2013:

When accounting for the rental income potential of single-family homes as well as the benefits of leverage to the return on equity, the performance difference between single family homes and VNQ becomes even greater. As a result, whether you had gone the route of owning your own individual properties and renting them out or merely investing passively into AMH over the past 9 years or so, you would have very likely outperformed the broader REIT sector.

While it is entirely possible that single-family rentals will continue to generate attractive returns and passive income for today’s investors well into the future, we believe that high yield stocks offer a better path to early retirement at the moment for the following reasons:

#1. Rental Properties Are In A Bigger Fed-Fueled Bubble

While it is likely true that virtually every investment asset class is in a fed-fueled bubble, it is hard to argue against the fact that single-family rentals are in the biggest bubble of all. The reasons for this are that:

1. Single-family homes have been on an epic price run up in recent years and have yet to experience a price correction, in contrast to publicly traded equities (SPY)(QQQ)(DIA) which have already seen a meaningful price pullback this year.

2. Single-family homes – thanks to the 15 and 30 year mortgage financial products – are an extremely leveraged asset class. There are no assets that I know of that are as easy as the single-family home for the average person to acquire with such high leverage ratios over such long periods of time. As a result, the limiting factor for single-family housing demand is overwhelmingly influenced by interest rates to a degree that is unseen in other asset classes. The Federal Reserve has therefore massively subsidized the cost of single-family housing by pumping trillions of dollars into the mortgage market and ultimately taking possession of nearly a quarter of all outstanding residential mortgages in the United States. As the Mises Institute reported earlier this year:

Runaway house price inflation continues to characterize the U.S. market. House prices across the country rose 15.8% on average in October 2021 from the year before. U.S. house prices are far over their 2006 Bubble peak, and remain over the Bubble peak even after adjustment for consumer price inflation…Unbelievably, in this situation the Federal Reserve keeps on buying mortgages. It buys a lot of them and continues to be the price-setting marginal buyer or Big Bid in the mortgage market, expanding its mortgage portfolio with one hand, and printing money with the other…The Federal Reserve now owns on its balance sheet $2.6 trillion in mortgages. That means about 24% of all outstanding residential mortgages in this whole big country reside in the central bank, which has thereby earned the remarkable status of becoming by far the largest savings and loan institution in the world.

Now, with the Federal Reserve trying to reverse course and allow assets to naturally run off of its balance sheet, mortgage interest rates have spiked. As a result, housing is now at one of its most unaffordable levels in years. With buyer demand drying up rapidly, the near-term upside potential for single-family properties does not look attractive at all, and many industry analysts are expecting prices to begin falling meaningfully.

#2. Rental Properties Are Not Efficient Passive Income Generators

On top of simply offering investors a very negative risk-reward at the moment, rental properties are also relatively inefficient passive income generators when compared with high yield stocks. This is because high yield stocks are passive ownership stakes in large businesses that have considerable economies of scale.

In contrast, by buying rental properties you are effectively launching your own business from scratch and – given that it is virtually impossible for you to achieve the same scale as a publicly traded business – you are inevitably going to suffer from inferior economies of scale. This translates to a higher cost of capital, higher transaction costs, higher management and administrative costs (either in terms of your own time and stress or in terms of expensive property repair and tenant management costs), and higher property and tenant research and advertising costs.

While the initial numbers for a rental property – especially when you slap a ton of relatively cheap leverage on it – might sound compelling, once you factor in the dollar value of the time and stress spent dealing with tenants, toilets, and trash, the value add relative to simply buying passive ownership stakes in professionally managed businesses via high yield stocks is often not worth it. Besides, if you are wanting to retire, why shackle yourself with the extra work and stress that comes with a rental property?

#3. Rental Properties Are Riskier

Furthermore, with small portfolios of rental properties comes significant tenant, geographic, and property concentration risk. If just one of those investments goes bad due to physical problems with the property, bad tenant issues, or that particular region seeing its property values plummet, your overall net worth and passive income stream will be substantially impacted. In contrast, if you build a well-diversified portfolio of high yield stocks, if one of those (already large and typically well-diversified) businesses is impaired and/or cuts its dividend, your portfolio will be much less significantly impacted.

Investor Takeaway

While rental properties have made most investors a pile of money over the past decade, there is no guarantee that those returns will continue to be lucrative over the coming decade. If anything, the macro situation seems to imply that the party is over for rental investing for the near future at least.

By investing in a well-diversified portfolio of quality high yield stocks instead of rental properties, investors striving to build a passive income stream for early retirement will be better sheltered against the current Fed tightening cycle, generate more efficient passive income, and also reduce long-term portfolio and income stream risk.

Three of our favorite quality high yield picks for early retirees are Enterprise Products Partners (EPD), STORE Capital (STOR), and TFS Financial Corp (TFSL). A portfolio allocated 1/3 to each of these would be very well diversified across the energy infrastructure, real estate, and financial sectors, be backed by high quality management teams and very strong balance sheets, enjoy strong recession resistance and inflation protection, and enjoy a safe and growing 6.65% passive income yield. For investors looking to sleep well at night in early retirement while generating high yields to fund their desired lifestyle, these three picks are a great place to start. At High Yield Investor, we are filling our portfolio with dozens of similar stocks in order to minimize our risk while still generating a similarly high yield and very attractive total returns.

Be the first to comment