Neme Jimenez/iStock Editorial via Getty Images

Despite stock market turmoil in 2022, Restaurant Brands (NYSE:QSR) shares have increased nearly 12% year-to-date as the company’s franchisor business model has produced stable results. Going forward the company sees opportunity for continued unit growth in its less mature Tim Horton’s and Popeye’s brands.

While the Restaurant Brands’s franchise business model has thus far been insulated from inflationary pressure, some franchisees are struggling. While this isn’t a cause for panic (yet), looking ahead continued pressure on franchisee economics could present problems (explored below) in the future.

Trading at 22x 2023e EPS, Restaurant Brands shares appear to price in steady growth going forward. I see downside risk if inflation persists and franchisee economics deteriorate further.

Current Results are Strong

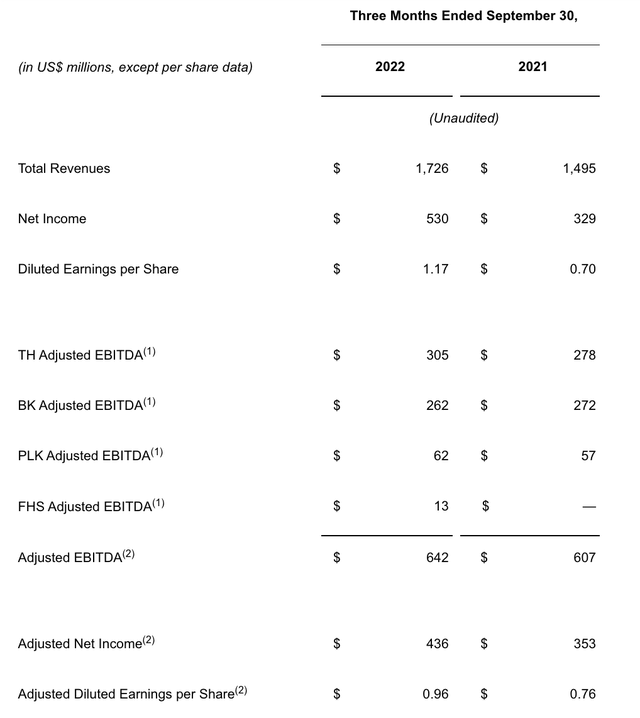

Restaurant Brands 3Q22 Earnings (QSR Earnings Release)

For the third quarter of 2022, QSR has reported solid results with revenue up and EBITDA increasing (reported EBITDA was up 6%, 9% excluding the impact of Russia). Inflation has lead to menu price increases at Burger King, Tim Horton’s, Popeye’s, and Firehouse which has lead to system-wide growth in revenue and EBITDA.

As a franchisor, Restaurant Brands charges franchisees a percentage of revenue (around 5%) so rising prices have bolstered its top line as system-wide comparable sales have increased 9% (while units have expanded more moderately).

While system-wide sales were up 9%, Burger King US has been a laggard with just a 4% increase. While menu price increases have bolstered the top line, transaction volumes have declined. Burger King customers tend to be lower-income and have been disproportionately impacted by inflationary pressure. While inflationary pressure has shown a slight negative impact (thus far) on Restaurant Brands, the same cannot be said for its franchisees.

But QSR’s largest US Burger King franchisee isn’t doing so well…

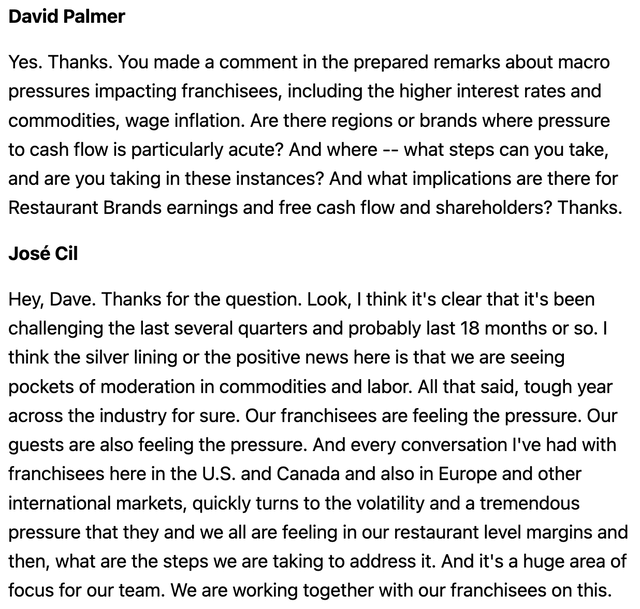

Restaurant Brands commentary on franchisee difficulties (3Q22 Restaurant Brands Conference call transcript from Seeking Alpha)

While Restaurant Brands results have been resilient in the face of inflationary pressure, the same cannot be said for its franchisees. As shown above, on its 3Q22 earnings call, Restaurant Brands vaguely acknowledged that inflation is negatively impacting franchisee economics but didn’t get into the impact by brand (Popeye’s, Burger King, Tim Horton’s) the magnitude of EBITDA declines. Fortunately, Restaurant Brands’ largest US Burger King franchisee Carrols Restaurant Group (TAST) is publicly traded and offers a glimpse into just how difficult things have become for franchisees.

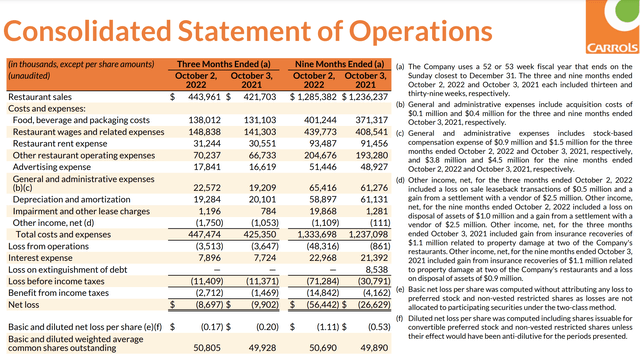

Carrols operates over 1,000 US Burger King Restaurants in the US (Carrols represents 14% of total US Burger King restaurants). While Carrols’ top-line has increased (and franchise fees paid to QSR have increased) due to price increases, as shown below, the company has seen profitability evaporate as costs, particularly labor, have increased at a faster rate. Through the first 9 months, Adjusted EBITDA has fallen 40% year-over-year and the company has been operating at a loss during 2022:

Carrols 2022 year-to-date Results (Carrols 3Q22 Investor Presentation)

It is important to note that not only is Carrols Burger King’s largest US franchisee but historically Carrols has been one of its best operators in terms of long-term same store sales performance. If Carrols is struggling it is likely that smaller franchisees are facing similar (if not greater) difficulties.

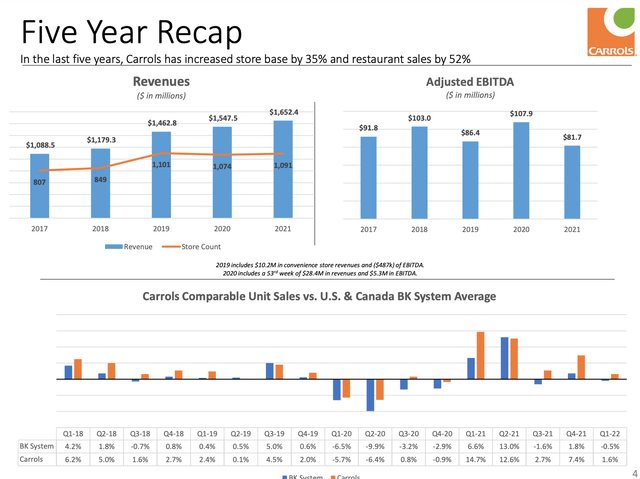

Carrols Long-term SSS performance (Carrols Investor Presentation)

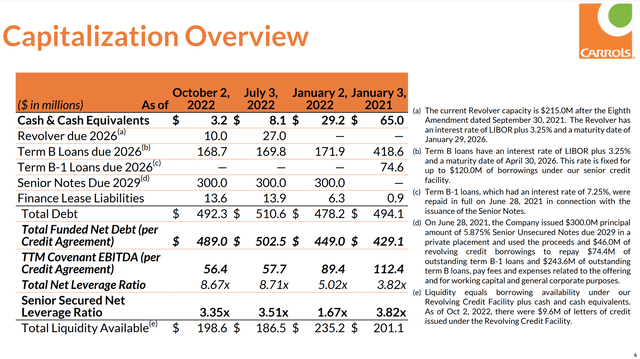

Further, as shown below, Carrols carries a significant debt load with net debt to trailing 12 month Adjusted EBITDA of nearly 9x. While we don’t have visibility into the operational performance and financial position of QSR’s other franchisees, I suspect that many are experiencing profitability challenges (given inflationary pressure) and some may be encountering even greater balance sheet strain.

Carrols Net Debt (Carrols 3Q22 Investor Presentation)

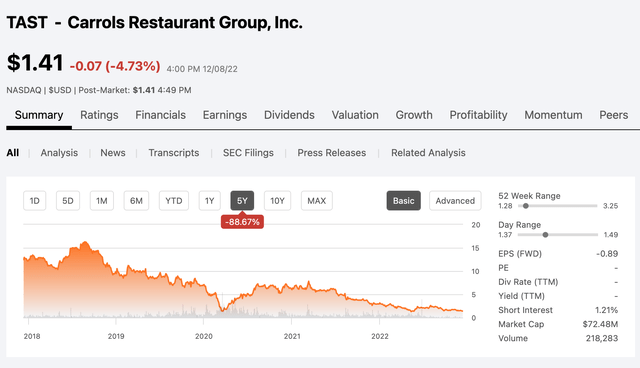

Further, as shown below, Carrols carries a significant debt load with net debt to trailing 12 month Adjusted EBITDA of nearly 9x. While we don’t have visibility into the operational performance and financial position of QSR’s other franchisees, I suspect that many are experiencing profitability challenges (given inflationary pressure) and some may be encountering even greater balance sheet strain. The dramatic deterioration in results has caused Carrols share price to fall 75% in the past 18 months.

Carrols 5 year share performance (Seeking Alpha)

How might Franchisee Struggles impact Restaurant Brands?

Should inflationary pressure on franchisees persist, this could have negative impacts on Restaurant Brands. While in the short run, Restaurant Brands can report stable results irrespective of the underlying profitability of its restaurants, in the long-term QSR’s success is inextricably linked to its franchisees. If conditions remain difficult or get worse, I expect we could see the following impact on Restaurant Brands:

- Providing assistance to franchisees – this could take many forms including: temporary suspension of franchise fees, guaranteeing franchisee debt, or loans to franchisees. These impacts would negatively impact revenue or potentially require capital (loans) from QSR.

- Closure of loss-making locations – while restaurant closures are an ongoing reality for franchisors (offset by opening), the large increase in inflation and corresponding collapse in profitability could lead to much larger than normal restaurant closures would reduce franchise fees paid to QSR.

- QSR may have to take over struggling locations – should this occur, QSR would become the owner of these restaurants (rather than a franchisor). If QSR becomes the owner of more restaurants, it is subject to inferior economics as rather than clipping franchise fees it would bear the full burden of restaurant ownership. This could damage operating profitability and also lead investors to place a lower P/E multiple on the business.

Valuation & Conclusion

At 22x 2023e EPS, Restaurant Brands stock is priced for continued steady growth in EPS. While it is possible that inflation will subside and franchisee profitability will rebound, I see downside to Restaurant Brands EPS and P/E multiple should franchisee difficulties become acute (either via restaurant closures or franchisee assistance). It is difficult to quantify precisely how franchisee struggles will impact QSR’s EPS given we don’t know the extent of franchisee difficulties and/or how the company would seek to mitigate these issues. For instance providing loan guarantees or actual loans wouldn’t necessarily impact EPS whereas restaurant closures (and loss of franchise fees) would have a direct impact.

That said, I think the P/E multiple (currently a 15-20% premium to the broader market) could revert to a market multiple (~18x) or worse if investors become more concerned about franchisee health. Assuming a 5% decline in EPS and taking into account a lower P/E multiple suggest 20-25% downside.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment