Madmaxer

Laughter is poison to fear.” – George R.R. Martin

Today, we take a deeper look at a small financial services firm that has delivered solid revenue growth but is facing an increasingly difficult economic environment. The stock has seen some insider purchases recently. A full analysis follows in the paragraphs below.

Company Overview:

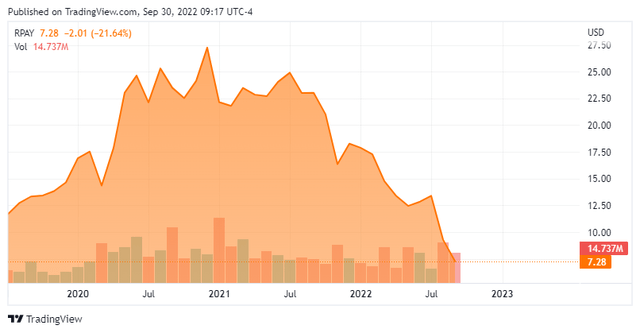

Repay Holdings Corporation (NASDAQ:RPAY) is an Atlanta-based integrated payment processor focused on providing solutions primarily to the loan repayment and B2B verticals. The company boasts over 21,000 clients through 230 software integrations as of June 30, 2021. Repay was formed in 2006 and went public through a merger into special purpose acquisition company (SPAC) Thunder Bridge Acquisition Ltd. in 2019, with its first trade executed at $13.75 a share. Its stock trades near $7.25 a share, translating to a market cap of approximately $730 million.

May Company Presentation

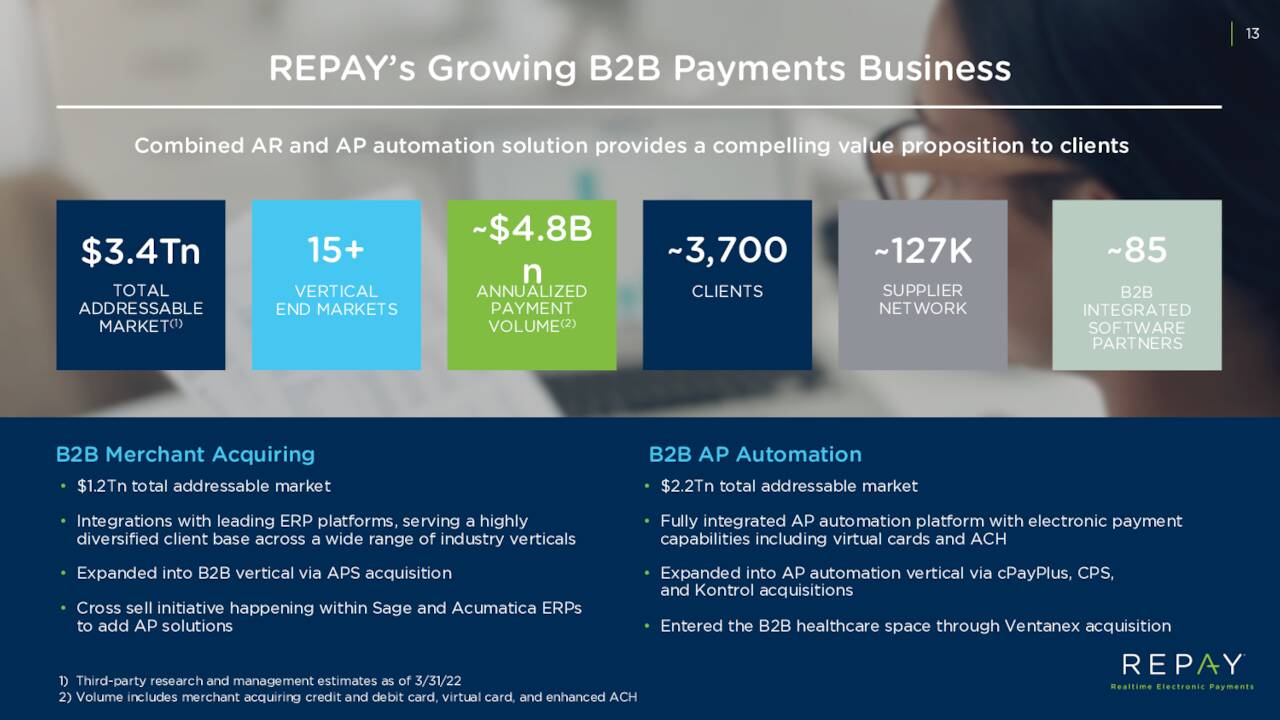

A significant portion of the company’s top line is generated from credit and debit card processing. Repay derives nearly half its revenue from consumer loan repayments – i.e., personal loans, automotive loans, and mortgage payments – ~20% from medium-to-enterprise level B2B; ~10% from healthcare payments; ~10% from accounts receivable management (ARM); and ~10% from other verticals. Even though the company does not disaggregate its revenue, personal loans comprise the majority of its consumer loan repayment business. In terms of annual payment volume, Repay’s addressable market is ~$5.3 trillion, the largest of which is the ~$3.4 trillion B2B market. In FY21, the company processed payment volume of $20.5 billion (or 0.39% of the opportunity), providing it a runway for significant expansion.

May Company Presentation

Market

For this business, Repay competes with large banks, credit card providers, and other payment processors, such as Global Payments’ (GPN) Total System Services, ACI Worldwide (ACIW), Paya (PAYA), FLEETCOR Technologies’ (FLT) Nvoicepay, Bank of America Merchant Services (BAC), Wells Fargo Merchant Services (WFC), U.S. Bancorp’s (USB) Elavon, and FIS’ (FIS) Worldpay, amongst many others.

Approach

To broaden its addressable market, increase penetration in existing verticals, as well as drive innovation and operational efficiencies, Repay has made 11 acquisitions since the onset of 2016. The company executed three acquisitions in FY21, the most significant of which was its purchase of BillingTree, a provider of omni-channel, integrated payments solutions to healthcare, credit union, ARM, and energy verticals, for $505.8 million ($277.5 million cash) in June 2021. For this consideration, Repay received 1,650+ clients, as well as expected FY21 card payment volume of $4.4 billion and Adj. EBITDA of $26 million.

May Company Presentation

Operational & Stock Price Performance

Between its acquisitions and organic expansion, the company has grown significantly, increasing FY21 revenue by 110% over FY19 to $219.3 million (45% CAGR) and Adj. EBITDA by 104% to $93.2 million during the same period, for a 42% CAGR. Add in an attractive gross margin (revenue minus commissions to software integration partners, third-party processing costs, and sponsor bank fees) of ~75% and it is easy to surmise why the market gave the profitable Repay – it earned $0.80 per share on a non-GAAP basis in FY21 – a premium valuation in a low interest rate environment.

That said, as late as early October 2021, Repay was trading at 10.8 times (what would become) FY21 revenue as anything with a ‘fintech’ label still garnered robust appraisals. Even when factoring in the relatively modest forward PE ratio of 30.1 (at that time), the commoditized nature of its business suggested Repay was priced for near perfection. Then, inflation concerns created multiple compression in high-growth names throughout 4Q21 and 1Q22. Shares of RPAY were not spared, falling 36% from $24.06 on October 1, 2021 to $15.40 when it announced its 4Q21 and FY21 financials five months later on March 1, 2022. That report included its FY22 outlook that included Adj. EBITDA of $131 million on revenue of $301 million (based on range midpoints), which was slightly higher than Street consensus of $292.2 million. Based on this forecast, Repay was trading at a forward price-to-sales of 5.0 and an EV/Adj. EBITDA of 14.6 – certainly not outrageous considering the 41% projected increase in Adj. EBITDA and the 37% anticipated rise in revenue (20% organic).

2Q22 Earnings & Revised Outlook

The fly in the ointment was management’s assumption of much stronger growth in 2H22 vs 1H22 baked into that forecast. With much higher interest rates impacting assumptions about economic growth causing lenders to tighten their lending standards, Repay reported 2Q22 disappointing earnings on August 9th, posting $0.17 per share (non-GAAP) and Adj. EBITDA of $27.6 million on revenue of $67.4 million versus $0.16 a share (non-GAAP) and Adj. EBITDA of $20.4 million on revenue of $48.4 million in the prior year period, representing 6%, 35%, and 39% improvements, respectively. These metrics were a function of card payment volume which, at $6.2 billion in the quarter, reflected a 34% rise over 2Q21. However, the bottom line missed Street consensus by $0.03 a share and the topline was $2.0 million short of expectations.

Furthermore, recognizing the impact that tighter lending standards would have on its personal loan business – from mid-teens growth by year’s end to ~10% – Repay was compelled to lower its outlook for FY22, dropping Adj. EBITDA by $9 million to $122 million – which assumes organic gross profit growth of 14% in 2H22 – and revenue by $25 million to $276 million as payment volume was revised from $27.5 billion to $25.7 billion, based on range midpoints.

Already lower since management’s initial forecast on March 1st, shares of RPAY sold off another 13% to $10.25 in the subsequent trading session.

Balance Sheet & Analyst Commentary:

With cash of $60 million and debt of $460 million – of which $440 million is convertible debt due 2026 – Repay is in good financial stead with current net leverage of 3.5, which should drop below 3.0 by YE22. Its board authorized a $50 million share repurchase program in May 2022, of which the CFO had only exhausted $1.15 million as of June 30, 2022.

With the economic outlook uncertain and financial institutions preparing for the worst, the Street’s nearly unanimous bullishness regarding Repay’s prospects ended in July and eroded further with the 2Q22 financial report and revised FY22 outlook. Morgan Stanley owned the only hold rating on the stock entering 2022. Credit Suisse then downgraded shares of RPAY in July, with both Citigroup and Keefe, Bruyette & Woods jumping ship after the earnings call. The opinion landscape for Repay now comprises three buys and one outperform against four holds with the median twelve-month price target falling from $17.50 to $13.00. On average, they now expect Repay to earn $0.81 a share (non-GAAP) on revenue of just under $280 million in FY22, followed by $0.95 a share (non-GAAP) on revenue of $320 million in FY23, representing 16% and 15% growth over FY22, respectively.

Board member Peter Kight did not jump ship. Instead, he used the weakness after the earnings news as a buying opportunity, purchasing 108,577 shares on August 18-19th at an average price of $9.75.

Verdict:

The revised outlook and subsequent selloff reset several forward-looking metrics for Repay. On a forward PE basis, it now trades at nine times FY22E EPS and under eight times FY23 EPS. On a price-to-sales evaluation, shares of RPAY trade at 2.6 times FY22E revenue and 2.3x FY23E revenue. Also, they trade at an EV/FY22E Adj. EBITDA of under nine. None of these metrics are excessively rich, but Repay is no longer expected to grow at 40+% CAGRs. If forecasts prove prescient, earnings will only grow 2% this year and 16% in FY23; revised FY22E Adj. EBITDA still reflects solid growth at 31% but down from the prior forecast of 41%; and revenue is now expected to rise 28% and 15% in FY22 and FY23, respectively.

It stands to reason that in the higher interest rate environment, automotive and mortgage loan volumes are at risk due to decreased consumer demand, while personal loan growth prospects are at still further jeopardy as banks tighten their belts. With these three verticals amounting to approximately half its business, Repay will be held hostage to perceptions, meaning dead money most likely for the near-to-intermediate term, unless there is a significant shift in the economic outlook. As such, the insider buying notwithstanding, one should adopt a wait-and-see approach with this payment processor.

Laughter is the shortest distance between two people.” – Victor Borge

Be the first to comment