jhorrocks/E+ via Getty Images

The S&P 500 just recorded its worst start to a year since 1970. The index, comprised of the 500 largest U.S. stocks, fell 21% in the first half. The tech-heavy NASDAQ Composite fell even more.

Investors believe the worst is yet to come. Sentiment, as indicated by the “Fear and Greed Index,” is near all-time lows. As of this writing, the index was at 23, indicating “extreme fear.” Worse still, the Federal Reserve has more interest rate hikes planned, and Michael Burry is on Twitter (TWTR) saying we’re only half way to the bottom.

In a situation like this, it’s natural to worry. Not only is this a bear market, it’s a historically unprecedented one. The exact combination of economic circumstances we’re seeing right now has never been seen before. The combination of negative GDP growth and high inflation is reminiscent of the 1970s, but the debt to GDP ratio was much lower then than it is now. High interest rates are a bigger deal when the borrowing is heavier. Assuming the Federal Government continues to borrow unprecedented amounts of money at these higher interest rates, we could be looking at a fiscal crisis.

There are real reasons to be concerned. A person could be forgiven for going all cash at a time like this–hell, they might even outperform by doing so.

But before you run out and sell everything, there is one key fact you must keep in mind:

It’s Only a Bear Market

It’s not the end of the world.

It’s not Nuclear Winter.

It’s not even the collapse of Civilization.

It’s only a historically unprecedented bear market brought on by hawkish monetary policy and a weakening economy.

When you view things in those terms, the situation becomes a lot more manageable. We’ve seen bear markets and recessions before, and we’ve always come out of them eventually. In this case, the “unprecedented” nature of the crash makes it difficult to gauge exactly when the recovery will be. Quite possibly, we will end the year in the red. Maybe we’ll even see a 2000-like scenario where it takes two years to see the bottom. But there likely will be a recovery eventually. And if you truly feel like this market crash is the real thing, the genuine article, the big one from which there’ll be no recovery, read on, because I’ll show shortly that even the worst market crashes can be overcome by purchasing at regular intervals.

Japan in 1989: When The End of the World Happened

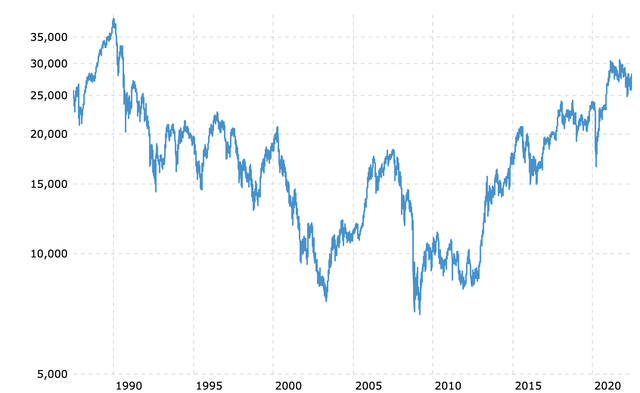

Japan in 1989 is every perma bear’s favorite case study. Japan’s Nikkei Index famously peaked at 38,915 in the late 80s. Today it is at 25,935, which gives us an astonishing -33% return over 33 years!

Certainly, if you went all in on the Nikkei at the top, you’d be hurting today.

But consider this:

With dollar-cost averaging, even this stock market “worst-case scenario” could have yielded modest profits.

Below, you can see a long-term chart of Japan’s Nikkei index.

As you can see, it looks pretty rough. Big 33% drop, with a peak in 1989 – ouch!

But would you have lost money if you had started making small purchases in 1989, rather than going all in?

We can test that theory by picking a few purchase dates at regular four year intervals ending in 2009. All of them will be on December 29 of the year in question (or the closest available date if the market was closed on December 29).

-

1989

-

1993

-

1997

-

2001

-

2005

-

2009

In the real world, you would purchase more frequently than this, but in the interest of not having a table with hundreds of rows, I’ll spread the buys out more than is normal. Here’s where each of these buys would have gotten you as of the July 1, 2022 close:

|

Date invested |

Amount invested |

July 1, 2022 |

Cumulative amount on July 1, 2022 |

|

1989 |

$1000 |

$670 |

$670 |

|

1993 |

$1000 |

$1490 |

$2160 |

|

1997 |

$1000 |

$1690 |

$3850 |

|

2001 |

$1000 |

$2500 |

$6350 |

|

2005 |

$1000 |

$1600 |

$7950 |

|

2009 |

$1000 |

$2550 |

$10500 |

TOTAL INVESTED: $6000

END AMOUNT: $10500

As you can see, with dollar-cost averaging, even the worst investor experience in history can be turned into a profit opportunity for longs. Which is a big part of why it pays to relax in the face of a bear market. There is always a chance that America will experience Japanification, in which case the November 2021 highs will never be seen again. If you got some buys in November last year, maybe those specific buys will never recover their value. But if you average down, you may still get a satisfactory result just by progressively buying the SPDR S&P 500 ETF Trust (SPY) over several decades.

Don’t Neglect Foreign Markets

As I showed above, you could easily make money by dollar-cost averaging into SPY over 20 years, even if Japanification comes to the United States. That’s not to say that you should necessarily PLAN for such a scenario. Ideally, you might want to diversify into other geographic regions–that would have been a better bet for Japanese people in 1989 than investing in Japan would have been.

And indeed, American investors have such an opportunity right now:

China

Chinese stocks, as measured by the Hang Seng Index, are outperforming the S&P 500 this year. Year-to-date, the Hang Seng is down only 6%, while the S&P 500 is down 20%. Amazingly, Chinese stocks are still cheaper than U.S. stocks. Today, the Hang Seng Index sports a mere 1.43 price-to-book ratio. The S&P 500 is all the way up at 3.8! When you consider that China usually has very high GDP growth, this seems to be a formula for high future returns.

Indeed, many investors believe that China is set to outperform. Charlie Munger and Ray Dalio are some famous individuals who are getting in on China. Likewise, the U.S. investing public seems to be warming to the country. Recently, the Financial Times reported that investors were getting back into Chinese stocks following the latest COVID scare. Indeed, BlackRock’s flagship China ETF recorded record inflows in the second quarter, and the investor appetite for Chinese stocks hasn’t cooled yet. Shortly before this article was written, Alibaba (BABA) closed up 2% on the New York Stock Exchange, outperforming the S&P 500. Notable was the fact that Hong Kong trading was closed the day before due to a holiday–the rally was due to organic interest from U.S. and global investors, not a boost from Hong Kong.

The Bottom Line

The bottom line about the situation in 2022 is this:

It’s only a bear market. A historically unprecedented bear market brought on by a hawkish Fed and a weakening economy, perhaps, but still just a bear market. We’ve been here before and we’ll be here again. Maybe this particular bear market really is the “big one” that perma-bears have been calling for since the Dawn of time – the dreaded Japan 1989 doomsday scenario. It’s not impossible that that’s the case. But with enough dollar-cost averaging and perhaps a little foreign exposure, you can succeed amid all this turmoil.

Be the first to comment