AntonioSolano

One earnings report does not a trend make, yet it got me thinking.

My eyes were opened by PNC Financial Services’ (PNC) earnings report. PNC Financial Q3 earnings beat on robust operating leverage. “We grew loans and revenue, our net interest margin increased and expenses remained well controlled, resulting in substantial positive operating leverage,” said PNC Chairman, President, and CEO Bill Demchak. It struck me that the big banks have been stymied by their bigness, being involved with trading and investment banking and the like. A super-regional like PNC has credit cards, business lending, mortgages, and wealth management. While mortgages are at a standstill. It seems to me that old-fashioned banking – taking deposits and then making loans should be a very nice business indeed. I don’t feel sorry for the likes of Morgan Stanley (MS) et al., they will soon right their ships as the economy normalizes. The regional banks will be first in line. So you might have two questions (besides questioning my sanity of course) the first is why now, and the second is who are these banks going to lend to as we go into recession? Let’s take the first, why now? Well, one of the only good things about the Fed right now is that interest rates are going up. This will boost NIM, the Net Interest Margin, which is the difference between what the bank doles out to depositors (near zero), and the interest rate it can charge for lending which will be much, much higher.

Traditional banking is a larger part of regional banking than they are with the money center banks. Regional banks rely on their balance sheet more in terms of their revenue potential. A rising-rate environment will help regional banks more than those that are capital markets dependent. In reference to the “fintech world” that doesn’t take deposits and is raising funds via bonds in order to grow. Generating revenue will be that much more difficult than when interest rates were essentially zero. Less competition means bigger margins, resulting in higher Net Interest Income.

After the last rate rise Mike Mayo the best-known bank analyst spoke about the banks. The statement was regarding the bank sector in general but of course the regional banks as well, the Federal Reserve raised rates by $0.75 in September and a full 3 percentage points over the past six months. “What seems underappreciated is the degree to which industry NIMs should return closer to normal after having been suppressed for the past 14 years under mostly zero rates,” he said.

So what do I mean by Regional Banks are the next Oil?

In a sign of the times, banks may have a lower volume of loans due to an economic slowdown, but the margins will be much higher per loan. Doesn’t that sound familiar a little? Oil companies aren’t trying to raise production aggressively because they know they will make more per barrel with less expense if they ease off on pushing up production. Similar to the car industry, though in this case, the big 3 car companies couldn’t build more cars because of the chip shortage. Yet, they discovered by accident that they make much higher profits by making fewer cars. I think banks may have a similar opportunity. I also wonder if this isn’t some macro-trend, and this isn’t necessarily inflation. Banks could decide to compete with each other by raising deposit interest rates, and lower their lending rates, and spending more on advertising, but why would they do that? I guess some economists will put a name on this phenomenon and get a Nobel for their trouble. For our purposes, I think the rate rises are going to benefit regional banks first. So with less competition for loans and more profits from each additional loan, I see the financial sector start to show growth. As I often mention, I write to organize my thoughts and approach to the market, and I analyze the week that was. In this case, I am still working through the regional banking opportunity. I know I can get long the regional banking ETF (KRE), but I prefer to do research on individual names. The main reason I am not ready to jump in is that I think it’s a bit early. I would like to see how other regional banks perform and how the sector responds to the next rate rise. So I will let you know in a couple of weeks whether this truly makes sense.

Yes, we are still bottoming: Now for an update on the overall market

These wild swings increasing in frequency are the tell for the bottoming process. No one said that this turn in the market would be easy. The bears clearly had the upper hand for most of the year. Yet the economy hasn’t broken, much to the chagrin it seems to the Fed and the FOMC. They know if they break the economy, they have broken the back of inflation. The Fed should be careful what they wish for. Underneath this cyclical trend of fiscally irresponsible spending is the real secular trend of disinflation due to technological advancement. If the Fed pushes too hard, it could cause DEFLATION. Something that has been strangling the Japanese economy for decades.

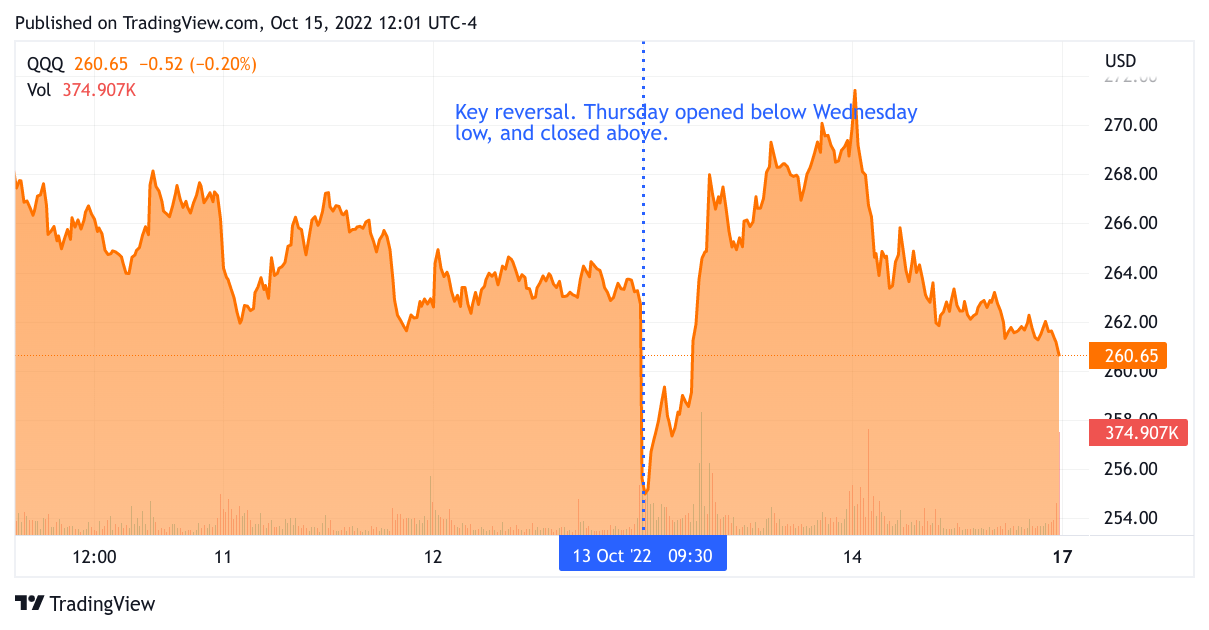

Tradingview

The chart above is a 5-day chart of the S&P 500 ETF (SPY). The dotted vertical line shows that the index fell below the recent low, and also below the previous day’s low, then the SPY spiked above the previous day’s high, and then soared way higher. It was a massive turnaround. The S&P 500 fell 2.4% before finishing up 2.6%, a five-point swing. You see this kind of price action toward the lows. So have a little more patience

My Trades

This week we organized a trading plan focused on the CPI report on Thursday. We generated cash to prepare and hedge. Our premise was that the market would sell off going into the CPI report. As the week wore on, we (Dual Mind Research Community) topped up our hedges – primarily the inverse 3X ETFs SQQQ. The morning of the report going into the report at 830 am we closed out that position (in the pre-market). Our assumption was that the market would rally after the CPI, whether or not the news would be bad. Though honestly, we expected the CPI report would at least be as expected or lower. Still, the market has been so oversold we were confident that the rally would reassert itself, and so we started going long. A number of community members swapped into the bullish 3X ETF TQQQ for a faster trade. I preferred adding to my “go to” tech names – Amazon (AMZN), Alphabet (GOOGL), and Microsoft (MSFT), Also added to my Boeing (BA) position. The fast traders in the group sold into the peak Thursday at the close. Friday morning, it was time to rebuild the inverse 3X ETF again – SQQQ. Unfortunately, I was too slow to really catch enough SQQQ to any appreciable level, but several other community members closed out half their positions for more alpha. I don’t mind if my members do better than me, in fact, I would rather it would be this way than the opposite.

As far as what we do next, our assumption is that we are running out of sellers. Most of the selling pressure is coming from short sellers and a thin veneer of market participants that can still be stampeded out of positions. The volume on Thursday was way higher than Friday. To me, that means there are way too many traders leaning on one side of the boat (being short). Any little piece of positive news, like a string of positive earnings reports, and wham o, another huge rip higher. So I am going to be tactically bullish.

Be the first to comment