Imgorthand

Investment Thesis

In February this year I forecast that Regeneron’s (NASDAQ:NASDAQ:REGN) stock price could suffer in 2022, owing to the fact that its COVID antibody cocktail REGEN-COV was found to be ineffective against the Omicron strain of the virus, and its use correspondingly restricted by the FDA.

REGEN-COV earned Regeneron $5.83bn of revenues in the US last year, while partner Roche (OTCQX:RHHBY) – responsible for marketing and selling the therapy overseas – paid royalties of $362m to the Boston-based pharma.

Without these revenues in 2022, it seemed logical to assume Regeneron’s earnings and profits would shrink and its market cap valuation would decline. Initially, Regeneron stock continued to climb, hitting an all-time peak of $739 in April, but when the company confirmed that it did not expect to make any further sales REGEN-COV, the share began to slide, hitting a low of $548 by mid June – down 26% from its April high.

Since hitting that nadir however Regeneron stock has made a stirring comeback, and the company has two products to thank for that.

The first is Eylea, its eye disease therapy that was first approved in 2011 for “Wet” Advanced Macular Degeneration (“Wet AMD”), and has grown its sales in each year since, while expanding its label into Diabetic Macular Edema (“DME”), Diabetic Retinopathy and other related indications. Regeneron earned $5.8bn from sales of Eylea in the US last year, while partner Bayer (OTCPK:BAYRY) paid Regeneron $1.4bn – a share of profits earned marketing and selling the drug ex-US.

The second product is Dupixent – a monoclonal antibody that blocks the intracellular signaling of the cytokine IL-4 – which Regeneron co-developed with long-term partner Sanofi (SNY). Dupixent is approved to treat Atopic Dermatitis, Asthma, Chronic Rhinosinusitis, and Eosinophilic Esophagitis (“EoE”) – markets of respectively 2.2m, 975k, 90k and 50k patients – and will likely soon win approval to treat prurigo nodularis (“PN”), while Sanofi is looking to up to 10 more indications in which this mega-blockbuster drug may be approvable. Dupixent made sales of $6.2bn in 2021, with Sanofi paying Regeneron ~$1.9bn as a result of the 2 company’s revenue sharing arrangement.

The old stager Eylea and the new kid on the block Dupixent keep churning out positive news flow. Despite its age, nothing appears to be able to beat Eylea on safety or efficacy.

Last week, Regeneron revealed data from a trial of high-dose Eylea designed to last 16 weeks which showed that 77% of Wet AMD patients and 89% of DME patients were able to maintain their dosing regimes, while a larger proportion of patients receiving the high dose were without central subfield fluid – which can cause vision impairment – than this receiving the lower dose.

This is excellent news for Regeneron for two reasons. Firstly, it means that high dose Eylea is non-inferior too, perhaps even better than, Roche’s recently approved (in DME and wet AMD) VEGF-A protein inhibitor Vabysmo. Secondly, if Regeneron submits a Biologics License Application (“BLA”) to the FDA for HD Eylea as a new therapy, then it may receive a fresh round of patent protection lasting well into the next decade, preventing generic drug makers from flooding the market and steadily eroding the drug’s revenues at a rate of ~20% per annum.

On the back of this news – and analysts revising peak sales targets for Dupixent from $15bn, to $20bn, based on the opportunities in play – Regeneron has been surging, from $573 on Sept. 6, to $702 at the time of writing – a gain of >20%.

Regeneron’s market cap is presently $76.5bn, placing the company just outside what I like to term the “Big 8” US pharmaceutical giants – in order of size, Johnson & Johnson (JNJ), Eli Lilly (LLY), Pfizer (PFE), AbbVie (ABBV), Merck (MRK), Bristol Myers Squibb (BMY), Amgen (AMGN) and Gilead Sciences (GILD).

Unlike these companies, Regeneron does not pay a dividend – although it does have >$2bn remaining of a share buyback program – and it remains a long way shy of its nearest competitor in terms of revenue generation. Regeneron will likely earn top line revenues of ~$12bn this year, whilst Amgen will earn >$25bn.

Regeneron’s small share count – just over 100m, compared to e.g. Amgen’s >500m, Gilead Sciences >1.3bn, and Pfizer’s staggering >5.6bn share floats – explains the high price of its shares, and thanks to REGEN-COV revenues, EPS in FY21 was $76.4, up from $33 in 2020 and $19 in 2019 – and its price to earnings ratio <10x, which is superior to the average of the “Big 8,” which is ~23x.

Most of the above suggests that Regeneron’s share price can keep climbing – and for good measure the company reported a cash position of ~$14bn as of Q222 – but there are some risks to be aware of that I will highlight in the remainder of this post, whilst trying to map drug product sales out to 2030, and use discounted cash flow and EBITDA multiple analysis to try to establish a fair value price for the drug.

Analysts have been rapidly upgrading their price targets for Regeneron stock since the Eylea news – which range from $675 from Jefferies to $851 from Morgan Stanley (MS). Although I have been bearish on Regeneron’s prospects for 2022, and been vindicated to an extent by the drop <$575, it’s hard not to be impressed by the company’s ability to respond to adversity.

I do think there will be cheaper entry points to buy in at over the next 6-9 months as FY22 revenues will drop significantly year-on-year. It’s hard not to believe Regeneron will continue to reward shareholders and my objective analysis suggests there may be as much as 20% more upside to realize.

Taking The Long View – My Revenue Forecasts For Regeneron Products To 2030

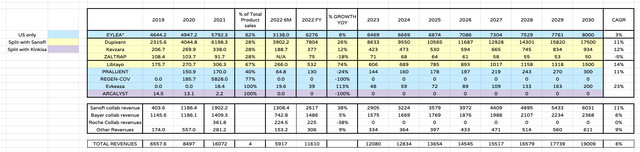

Regeneron product revenue forecasts (my table)

I have put together this relatively straightforward table to illustrate how Regeneron could grow its revenues between now and the end of the decade.

Beginning with Eylea, I’m – optimistic – assuming that the BLA for high dose Eylea is accepted by the FDA and the drug is approved, and patent protection conferred – likely until early next decade. In such a scenario I would anticipate Eylea sales growing and I have used a ballpark figure of $8bn sales in the US by 2030, which implies a CAGR of 3%. I calculate FY22 revenues simply by doubling 1H22 revenues quoted in Regeneron’s latest 10Q submission.

For the next three assets – Dupixent, Kevzara and ZALTRAP – I quote the sales figures as reported by Sanofi, however it’s important to note that Regeneron, by my calculation, only receives a ~28% share of these revenues by the terms of the deals agreed with Sanofi.

Although Dupixent has been an unqualified success for both companies, Zaltrap – indicated for colorectal cancer – has been an unqualified failure, while I may be being generous forecasting for peak sales of close to $1bn for Kevzara, approved to treat Rheumatoid Arthritis in 2017, given the competitiveness and innovation in the auto-immune markets.

Overall, however, I forecast a few rows further down that Sanofi collaboration revenues paid to Regeneron will increase at a CAGR of 11% – the same as the forecast CAGR for Dupixent sales should the drug achieve peak sales of $17.5 by 2030, which is the midpoint of management’s forecasts and analysts forecasts – and it’s these revenues I attribute to Regeneron, not those highlighted yellow, which are for illustrative purposes.

Moving on, Praluent also is marketed and sold by both Sanofi and Regeneron, with Regeneron having the US as its territory, and Sanofi paying Regeneron royalties on sales ex-US. Praluent is a cholesterol lowering drug that was approved at the same time as a rival PCSK9-targeting drug, Amgen’s Repatha. The companies have been at loggerheads ever since, waging battles in court and on price, but Amgen has emerged victorious, driving blockbuster sales for Repatha, while Praluent sales in the US have failed to break $200m. Hence my forecast for just $300m sales by 2030.

Libtayo was developed jointly by Sanofi and Regeneron but as I explained in my July note on Regeneron:

During Q2 2022 Regeneron opted to buy out Sanofi’s share of rights to market and sell Libtayo – an immune checkpoint inhibitor (“ICI”) approved to treat Advanced Cutaneous Squamous Cell Carcinoma, and Advanced Basal Cell Carcinoma – forms of skin cancer – as well as non-small cell lung cancer (“NSCLC”) where PD-L1 expression is >50% – in a deal worth $1.1bn, plus an 11% royalty on all sales.

Libtayo may have a bright future as a blockbuster (>$1bn per annum) selling asset, with trials in first line melanoma and prostate cancer underway, while Regeneron also is working with BioNTech, the messenger-RNA giant, on a melanoma vaccine.

Oncology – specifically skin and lung cancer – is increasingly becoming a central focus for Regeneron, which recently paid $250m to acquire Checkmate Pharmaceuticals and its melanoma targeting drug Vidutolimod – hence I have forecasted for peak sales of $1.5bn for Libtayo by 2030.

The only other approved assets are REGEN-COV – which seemingly has no future – ARCALYST – now being marketed and sold by Kinkisa, with Regeneron presumably earning a small royalty share – and Evkeeza, which is approved for homozygous familial hypercholesterolaemia (HoFH), a relatively small market. The rights to market and sell the drug ex-US have recently been awarded to Ultragenyx (RARE).

REGN Stock – Guiding To A Target Price

To summarize the above, topline revenue growth at Regeneron is most likely to come from three sources between now and 2030. Eylea – astonishingly, given its longevity – Dupixent – a mid-to-late teen billion dollar per annum selling asset in waiting, it seems – and Libtayo, plus the wider oncology pipeline.

Normally, you would hope for more diversification in a big pharma portfolio – the dependence on two products is a little worrying, especially when we consider that Regeneron’s close relationship with Sanofi is under threat – the French pharma has other priorities and recently sold a 20% holding in Regeneron – but both assets are amongst the world’s best-selling drugs and the expectation is for continued growth.

By increasing Eylea’s US sales to $8bn, and Bayer’s overseas contribution to >$2.3bn I’m forecasting peak sales >$10bn, which may be slightly over-optimistic, but I can justify this since I have not included any new drug approvals in my forecasts, and Regeneron has an intriguing, if early stage pipeline.

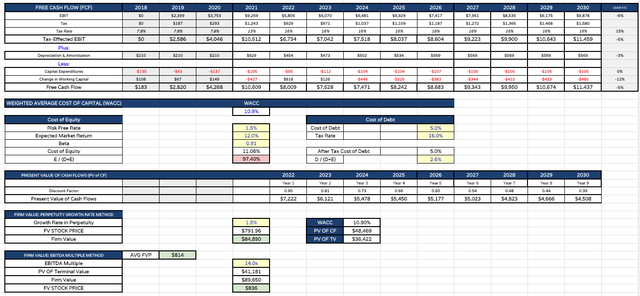

To get to my target share price I take the FY revenue figure and put them into an integrated financial statement. I forecast operating expenses as a percentage of total revenues to be 50%, which is higher than last year – 44% but lower than in 2020 – 58%. I suspect the drop in 2021 was due to high-margin REGEN-Cov revenues, so I raised the figure slightly in 2022, subsequently massaging it down to 48% by 2030.

Regeneron target price calculation (my table)

In the final reckoning I demonstrate my calculations in the above table. I forecast that it will take Regeneron until 2029 to better the free cash flow generated in 2021 thanks to REGEN-COV revenues, but cash generation in each year will nonetheless be very healthy, as revenues grow to nearly $20bn per annum by 2030.

I use a tax rate of 16%, and calculate a Weighted Average Cost of Capital of 10.9%. All of this is debatable, and by no means set in stone, however it’s useful for guidance and comparison purposes – typically, I use a WACC of 10% to evaluate target prices for the “Big 8” US pharmas, and it seems appropriate to use a slightly more demanding figure for a smaller, more aspirational company.

After applying discount factors I’m left with a suggested target price, based on discounted cash flow analysis, of $792 – a 15% premium to current price, and a target price using an EBITDA multiple of 14x, of $836 – a 22% premium. Averaging these 2 figures out I reach $814 – a premium opportunity of 19%.

Conclusion – Regeneron’s Resilience Ought To Support Share Price Growth Long Term

Regeneron has rewarded shareholders with a 50% increase in share price value over the past five years, but only a 7% increase over the past 12 months, although these are moments in time, and the Pharma’s share price is typically quite volatile.

Investors can use that to their advantage since Regeneron – by most measures – is a well run company that has benefited from an incredible product in Eylea, and a beneficial partnership with the French pharma Sanofi.

Both of these longstanding strengths are under threat to an extent – Eylea must win approval for a high dose version in order to ward off generics and keep growing – while the Sanofi relationship is deteriorating, although the Dupixent agreement does not seem to be under threat.

Ultimately however Regeneron has been characterized by strong growth in the past – growing revenues from $1.3bn in 2012 to >$15bn in 2021 – and although revenues will fall significantly in 2022 – management has not provided specific guidance but accepts this fact due to REGEN-Cov – the long term trajectory ought to be upward.

Regeneron has consistently been highly profitable – underlined by its small share count and high EPS – and if management can continue to find solutions to the problems of operating a major pharma – namely patent expiries, partnerships, pipeline and profitability – as it has proven so adept at doing in the past – there’s a good chance it will reward patient investors, even while there’s no dividend.

I have tried to show in this post one scenario that leads to growth and hope to update on the pipeline in more detail in future posts. I will give the company a HOLD recommendation at this time as its share price volatility seemingly guarantees there will be cheaper entry points available over the next 12-18 months. In general, however, fortune favors the brave, and it has traditionally favored Regeneron and its bold and innovative approach.

Be the first to comment