CHUNYIP WONG/E+ via Getty Images

It’s Climate Change, not just La Niña resulting in global heat waves

The last time I submitted an article on Seeking Alpha, natural gas (UNG) prices were under pressure from the shut-down of the FreePort, Texas LNG export facility. They were collapsing to below $6.00 a month or so ago. However, I disclosed an overall bullish summer outlook for natural gas prices based on what I expected would be one of the hottest summers on record. You can see the headlines of one of my latest newsletters.

CLIMATELLIGENCE NEWSLETTER (Jim Roemer www.bestweatherinc.com)

In addition, the severe western U.S. drought means the 2nd year in a row of limited hydropower supplies and a conversion to natural gas for millions of residents and commercial properties. Since then, the ETF NYSEARCA:BOIL has soared a whopping 70%.

Record U.S. heat (NY Times)

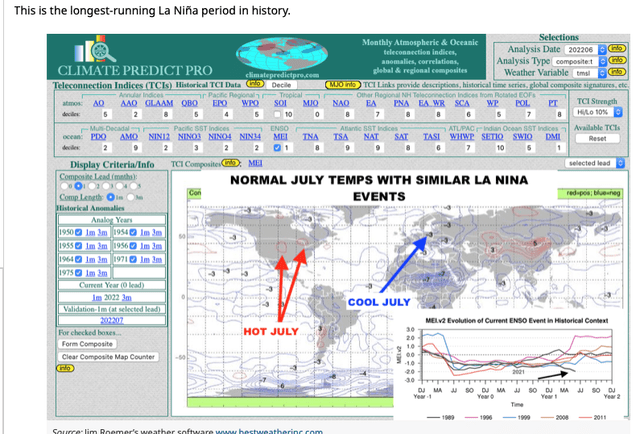

Not to be brash, but these pundits talking about low solar cycles and/or La Niña weakening would result in an overall cooling trend, months ago, have no clue what climate change, etc. is doing to the planet. It’s absolutely ridiculous. Case in point: This is the longest running La Niña event in history.

Every single La Niña event that is even closely similar to this years’ is shown below and not one had a hot European summer. Notice the blue arrow over Europe: It should be a cool summer but it is not. The reason? Climate Change.

Similar La Nina and normal historical summer temp patterns (Weather Wealth newsletter)

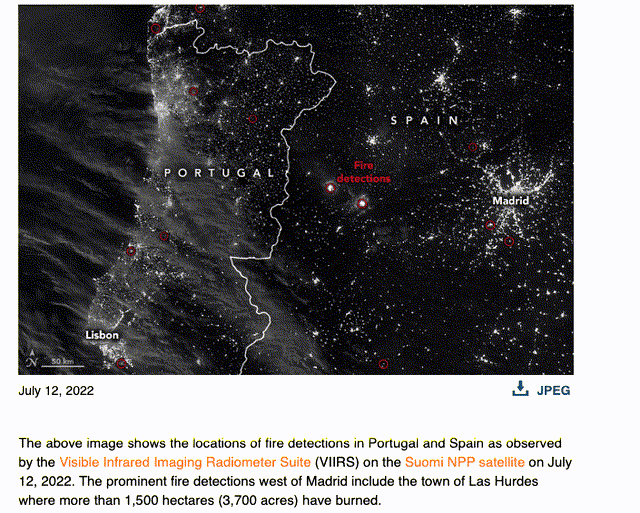

Not only has the extreme U.S. heat helped this historic summer rally in natural gas prices to continue, but in Western Europe, which was already experiencing severe drought, the heat wave fueled fires that raged across Portugal, Spain, and parts of France. Given the Russian gas export restrictions to Europe, because of the war, this has exacerbated an already tight gas situation.

The extreme fires in Europe (Weather Wealth newsletter)

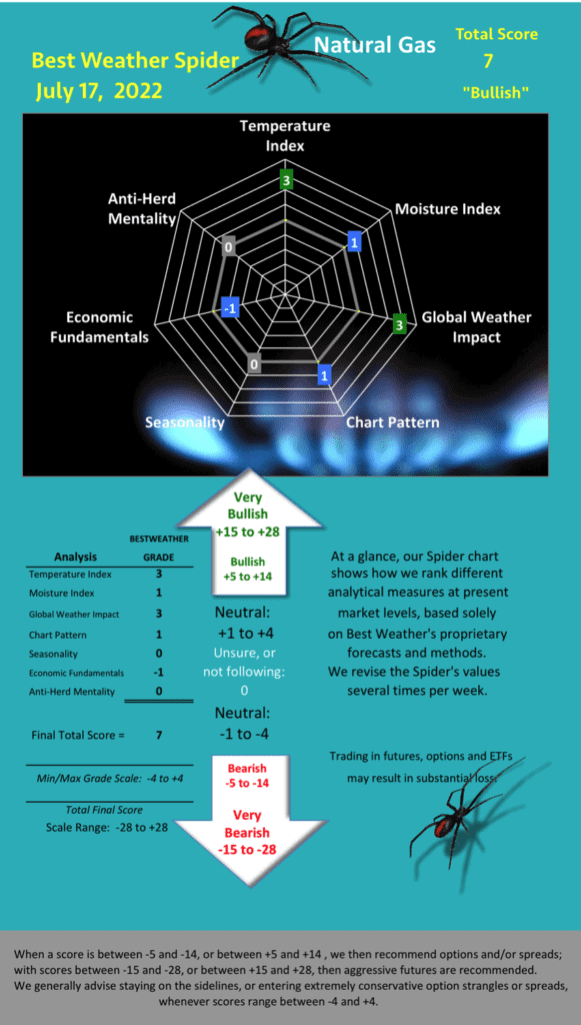

Natural gas prices have soared more than $6,000-$7,000 a contract since this spider was sent out on July 17th on global heat waves to my clients. You can take a look here at our track record and samples of what we do. Will we change our spider sentiment in the weeks to come? We may very well so come the fall and early winter based on my preliminary outlook, below.

Jim Roemer’s Best Weather Spider (Weather Wealth newsletter)

Clues for late fall and early winter

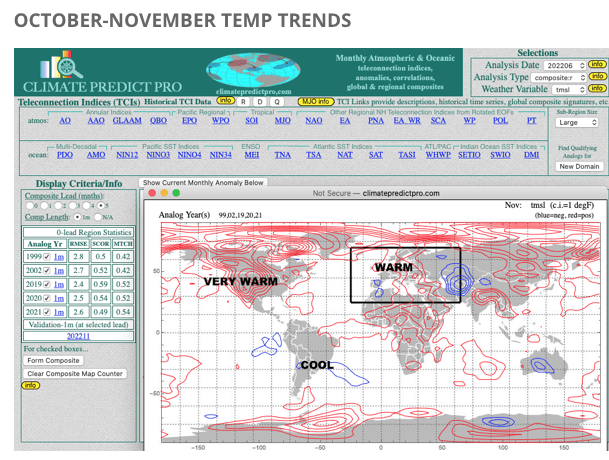

Warm to hot weather coming in October or November is often not a bullish factor for natural gas. The table below from my Climate Predict Lite program uses as variety of teleconnections (La Nina Sea Ice, etc.) and other studies to project out commodity trends for clients around the world. Just based on history, only, when looking at the warmest U.S. summers since 1950, notice how my preliminary forecast is one that is potential “not bullish” after we get through the peak heating demand months.

Potential late fall temp forecast (www.climatepredict.com)

Look at the potential hurricane season

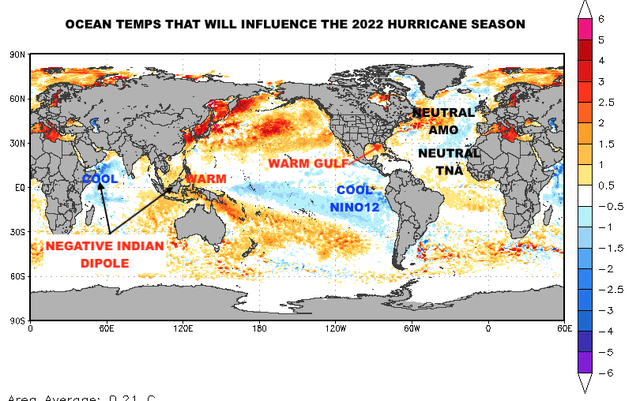

One other weather factor that could potentially be less bullish natural gas prices deeper in the fall is that this summer and fall has to do with hurricane season. This year may feature many more storms out in the Atlantic or along the east coast, rather than in the Gulf. I base the hurricane forecast on all of these different climatic variables.

Factors that will influence the hurricane season (Weather Wealth newsletter)

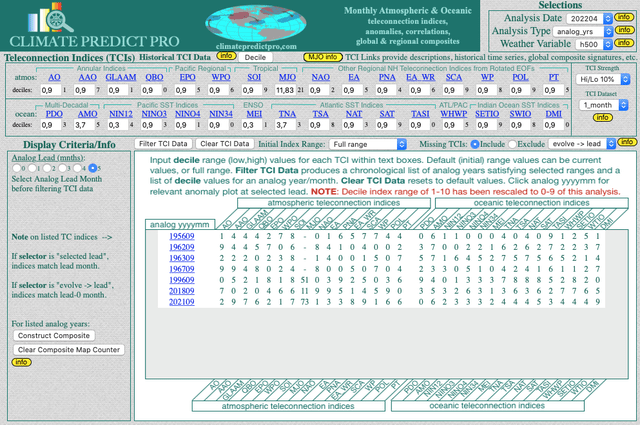

These are all the similar analog years since 1950 when looking at global ocean temperature features I show above. One caveat? The warming Gulf of Mexico due to Climate Change. For example, over the past 5 seasons, we have seen no less than 6 category 5 hurricanes explode within 24-48 hours due to the unprecedented warmth in the Gulf.

Analog years for the 2022 hurricane season (Weather Wealth Jim Roemer)

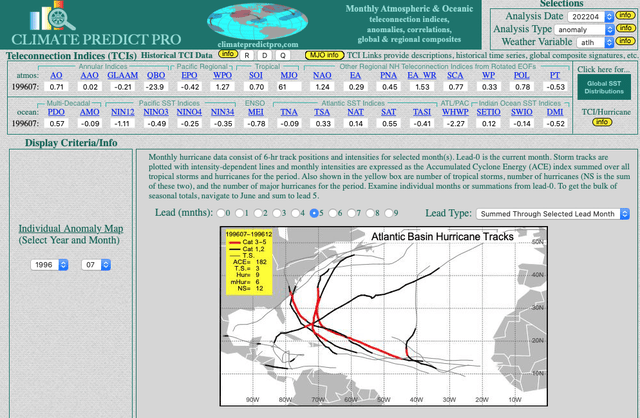

The majority of these analog years shown above had storm tracks similar to 1996 (shown below). I remember 1996 well, as I was living in Raleigh, North Carolina and hurricane Fran wiped out pretty much everything in its path.

If we end up having major Gulf hurricanes later this summer and fall, this would strengthen the argument even further that global warming is at play, because every other climatic study I have done would suggest otherwise: that the Gulf will be spared big storms this year.

1996 hurricane analog (www.climatepredict.com)

Conclusion

Most of the move long the natural gas ETF UNG and BOIL has already occurred on the record hot summer. If, however, we get into the fall and my forecast is correct about a weaker Gulf coast hurricane season and a potential warm fall or early winter, I will advice my clients to look at going short natural gas call options or the inverse ETF KOLD. However, there is still enough extreme late summer heat around that the weather remains mostly a bullish factor for at least part of the month of August.

Be the first to comment