ronniechua/iStock via Getty Images

Co-produced with Treading Softly

With inflation soaring and everyone collectively stressed about a recession, many are considering reducing their spending and focusing on the essentials. Do you really need a dozen different streaming channels? Maybe I’ll spare my leg and not pay for DoorDash (DASH); I’ll just exchange my arm at the grocery store.

When investing, it’s smart to ensure your income comes from essential sources. This way, it keeps flowing monthly and quarterly, even if the economy dives into recession.

What are two essentials you can invest in and receive large sums of income? Why not invest in two essentials on everyone’s mind lately – gasoline and natural gas.

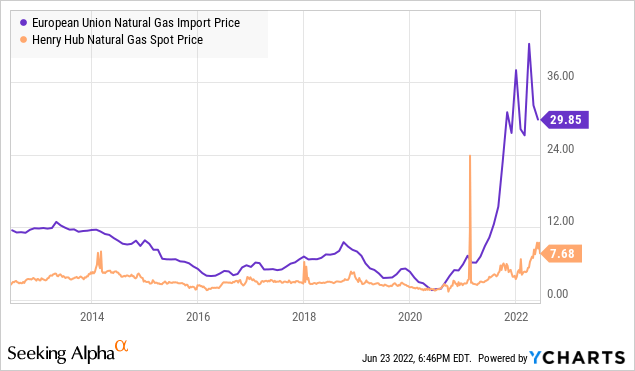

I have long owned the gas pump, getting high yields and solidly growing income. I have also long been bullish on American Natural Gas production and global natural gas demand – expecting it to rise. I did not predict a war in Ukraine, but even prior to Russian Natural Gas flows being reduced, global demand was outpacing production in its expected increases.

Today I view these two picks as essential holdings for an income investor’s portfolio. They’re essential in the daily lives of our friends, family, and countrymen. They’re essential to keeping your income flowing and paying for your retirement.

Let’s dive in.

Pick #1: AM – Yield 10%

Antero Midstream Corporation (AM) is an MLP that provides transportation and storage services for Antero Resources (AR). AM has only one customer, which is both a strength and a risk. The risk of having one customer is obvious. If something happens to that customer, there is no diversification. The benefit is that there is only one customer to keep an eye on, and AR is headed for some banner years.

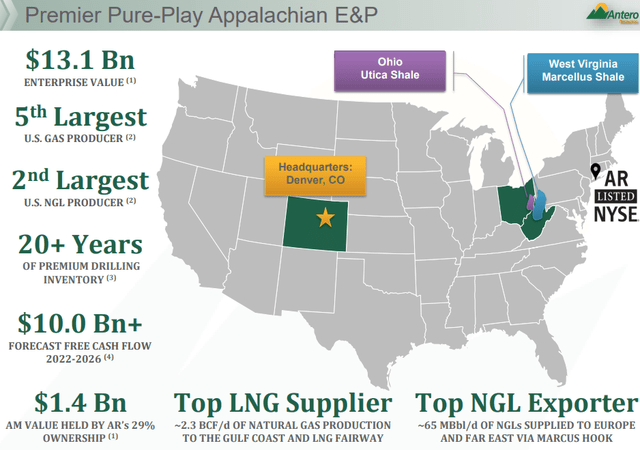

AR is the 5th largest U.S. gas producer, one of the largest NGL (natural gas liquids) producers in the country, and the largest exporter. (Source: AR Presentation May 2022)

It’s a great time to be exporting to Europe right now, with natural gas prices skyrocketing everywhere but much higher in Europe.

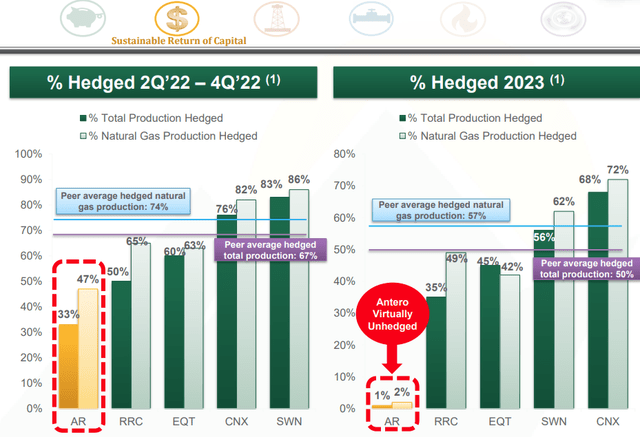

Europe is facing an energy crisis, and the solution will be neither easy nor quick. Demand and prices are likely to remain high for several years. AR is exceptionally well-positioned to take advantage of it with a very healthy balance sheet and operating with few hedges meaning AR will directly benefit from high prices.

With such strong fundamentals, AR itself is certainly worthy of consideration for investment. However, AR does not pay a dividend at all, so it does not meet the goals of HDO. Fortunately, AM does pay a dividend! As the provider of AR’s midstream needs, AM will grow with AR.

Additionally, AM expects to fully fund expansion through free cash flow, without having to issue any equity or debt. This growth will go straight to the bottom line. NG and NGL prices have extremely strong tailwinds and are likely to remain well above average for an extended period. This will benefit AR greatly, and in turn, the benefits will also extend to AM.

Pick #2: GLP – Yield 10.8%

Misery loves company. Remember when you were in high school and would bond with fellow students over your hatred of a strict teacher? Nothing quite binds people together like griping about someone who did them a perceived wrong. A few decades later, you might look back at that teacher with a fondness that can only develop through maturity, as you realize that “strictness” had a very positive impact on your life.

There are a few subjects you can gripe with perfect strangers about and immediately develop a sense of kinship-the weather, sports, and of course, gas prices. People love to complain about gas prices. Can you believe it is up to $X/gallon? I’ve known some people who will drive miles out of their way to save $0.10/gallon. Never mind how much the gas they burned along the way cost them.

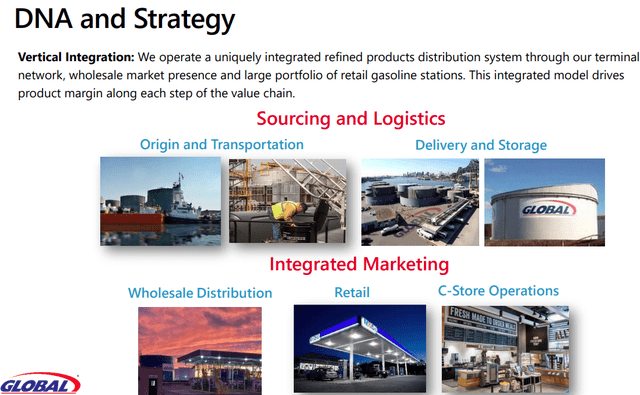

To be polite, I have to commiserate with them. Yet on the inside, I’m counting up my dividends from Global Partners LP (GLP). GLP is a vertically integrated supplier of gasoline. GLP is involved in every step, from origin to your gas tank.

First-Quarter 2022 Investor Presentation

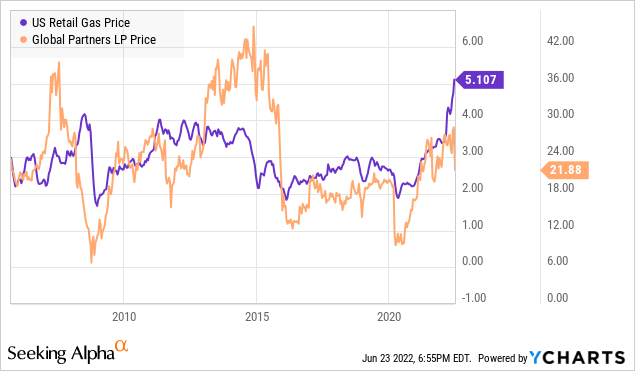

As a result, there is a fairly strong correlation between GLP’s share price and the price of gasoline.

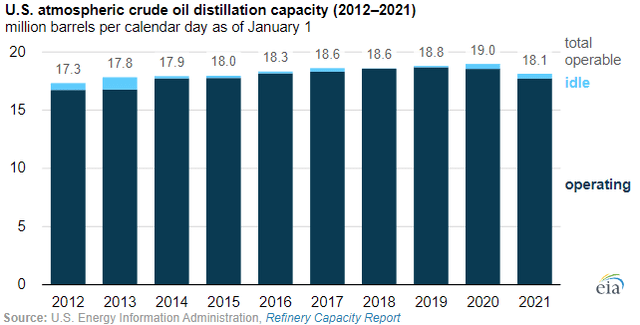

While gas prices are likely to moderate, the reality is that U.S. refining capacity is at its lowest level since 2015.

U.S. Energy Information Administration

Refining capacity doesn’t just magically appear overnight. It will take time for new capacity to come online, especially since most companies are hesitant to significantly invest in developing new capacity.

The bottom line is that gas prices are high and likely to stay that way for several years. It’s a reality that many will have to work into their daily budgets. Fortunately, we income investors can profit from this trend by investing in GLP. We’ll enjoy high dividends today and dividend growth, and if gasoline prices stay high, we could see the share price heading back over $40 again.

Note: GLP issues a K-1 at tax time.

Dreamstime

Conclusion

GLP and AM allow us to own essential services for the daily lives of countless others.

Natural Gas demand historically spikes in the colder months as more power generation leans on natural gas for production. This seasonality has given way to more of a secular demand curve. There is a real shortage that has been rocking Europe. Unfortunately, there is no overnight solution. This means that natural gas will continue to be in a bull market for years.

Gasoline is essential for travel and commuting. More businesses are bringing employees back to the office, causing more people to be forced to commute once more. In the U.S., there is a shortage of refining capacity – another problem that will take years to resolve. A recession might temporarily reduce demand for gasoline, but we’ve seen in the past that demand bounces back quickly.

As an income investor, I can help offset my living expenses by having them paid for by dividends. Retirees can entirely fund their retirement on the back of excellent dividend-paying investments. This allows you to float through any recession or bear market without a hiccup in your income stream. Go take a cruise or hit the golf course for a round. The market will still be here when you get back.

Natural Gas demand and Gasoline demand are not fading or disappearing. They are both still essential for our economy in good times or bad times. Supply-side pressures ensure that prices will remain above average. Thus, they will continue to provide the essential income you need for your retirement.

That’s a recipe for success.

Be the first to comment