Feverpitched

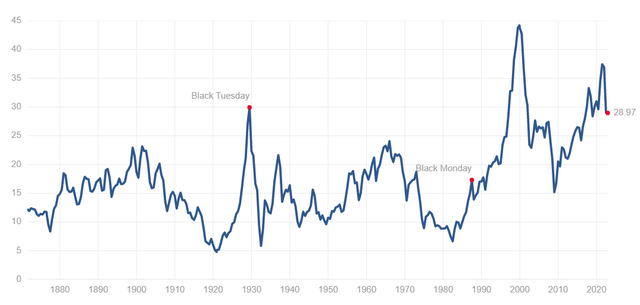

As I write, the S&P 500 Index (SP500) (NYSEARCA:SPY) stands at 3,956 and trades at a price to earnings multiple of 29 using the Case Shiller Cyclically Adjusted Price to Earnings multiple. This index compares the current stock price to prior decade average earnings adjusted for inflation, and “fair value” is derived from the average with wide divergences pointing to under or over valuation.

Cash Shiller CAPE index (www.multpl.com/shiller-pe)

The 10-year average is roughly an 18 multiple. That suggests stock are overvalued by about 60% and “fair value” for the S&P 500 lies in the 2,500 range.

S&P 500 earnings for the past 12 months (TTM) are about $195 and the nominal price to earnings ratio is about twenty times. In my opinion, that multiple is inconsistent with an inflation rate of just over 8% – I am old enough to remember the once popular rule-of-thumb that the price to earnings multiple of the broad based S&P 500 index should be 20 less the inflation rate or 12 times if 8% inflation was ingrained. That lines up pretty well with the Case Shiller view of the current valuation of the S&P.

For the past century, the average annual return on the S&P 500 was just over 10% including dividends. I don’t think the future will see a divergence from that historic pattern. High interest rates and high inflation see investors demand higher returns and in parallel, earnings multiples decline to compensate. That has yet to happen for the S&P 500 with a generation of analysts, brokers, fund managers and other intermediaries too young to have experiences inflation rates in the high teens or interest rates in the low twenty percent range, but I have lived through both. The conventional wisdom is that inflation has “all but peaked” and will reverse direction and government bond rates will fall as inflation falls. This is evident in the inverted term structure of Treasury bond rates right now, with 2-year rates higher than 10-year rates. In my opinion, the 10-year Treasury bond rate will rise to at least 7% in this cycle.

The factor that many seem to ignore is that inflation today has more than one cause – the liberal government spending during COVID is the proximate cause and shows no signs of abating. And, higher energy prices have resulted from a global shortage of fossil fuels with the industry directing is high cash flows to shareholders in dividends and stock repurchases with little expansion of oil & gas production. The result is that the global energy shortage is intractable and the appearance of a surplus will emerge during an economic slowdown only to revert to shortages in the next cyclical recovery, with inflation returning perhaps with a vengeance as I see it.

But the time frame for this article is year-end 2023 and hope springs eternal, so I am limiting my prognoses for “doom” to what happens next year. I see the picture unfolding like this:

- Triggered by rising overnight rates and quantitative tightening, the U.S. economy will slow materially in the first half of 2023.

- CEOs will protect income by laying off staff and cutting back on capital spending, and profit margins will remain more or less where they are today.

- Nominal revenues will increase despite real declines owing to the inflationary effect on selling prices, and corporations will book “inventory profits” as the carrying value of their inventories increases with the higher input costs.

- The S&P 500 index will fall to about 3,500 through the first half and then begin to rise as investors look ahead to the expected recovery and are lulled into complacency by the reasonably strong reported earnings, oblivious to the reality that inflation adjusted real income will have fallen.

- 2023 inflation will average about 6% in my opinion.

- By year end, I believe the S&P 500 will have risen to 4,500 reflecting reported earnings growth of 8% to $211 per share based on real economic growth of 2% and inflation of 6%. Expecting inflation to fall back to the target 2% range (an unlikely outcome but I expect it will be the popular belief) investors will capitalize that $211 per share of net income at a multiple of 21 times and the S&P 500 index will close at 4,500 as I project the market unfolding.

This article responds to a contest by SA to predict 2023 year-end.

For those interested in 2024 and beyond, the outcome is dire in my opinion. Predictions are difficult, but I foresee the following: sustained climate based pressure on fossil fuels which will exacerbate the global energy shortage and create an economic crisis in Europe and the United Kingdom; Americans will elect a new President and the election campaign will add to S&P 500 volatility since a lot depends on the outcome; energy prices will keep rising and inflation will return and reach double digit territory. I expect to see “windfall profit taxes” for oil companies (which will make a supply response even more unlikely); wage and price controls; high unemployment and political unrest.

Editor’s Note: This article was submitted as part of Seeking Alpha’s 2023 Market Prediction Contest, which runs through December 30. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment