Irina Starikova/iStock via Getty Images

Realty Income is the cheapest large-cap REIT

This article aims to present a new angle on analyzing the top real estate investment trusts (“REITs”) in the stock market. Realty Income Corporation (NYSE:O), is probably the most covered stock on Seeking Alpha, so there would not be much more I can add to the conversation in terms of investment narratives, future outlook, or profitability. The comparison I aim to convey in this article is to pit Realty Income Corporation against the top 4 REITs by market cap using the Benjamin Graham number formula from The Intelligent Investor. I will tweak the calculation by using adjusted funds from operations (“AFFO”) per share versus earnings per share, as the REIT industry operates and is evaluated almost exclusively on this non-GAAP metric.

My thesis is that Realty Income Corp. is a buy at these levels. It is hovering right around its intrinsic value using the Graham number, which is one of the more conservative metrics we can use to evaluate price.

The Graham number

Popularized by Benjamin Graham in The Intelligent Investor, the Graham number is unique in that it aims to incorporate both the asset value and the earnings into the fair price metric. Most financial analysis these days only focuses on future earnings or cash flow discounted to achieve a desired rate of return. These models incorporate a bit of clairvoyance, predicting cash flow growth and what the risk-free rate will be 5-10 years into the future to come up with a price target. The Graham number, on the other hand, draws a conclusion based on whether or not the stock is cheap in the present.

The formula can be represented by the square root of: 22.5 × (Earnings Per Share) × (Book Value Per Share). Depending on the industry we’re talking about, I like to modify this equation and substitute earnings per share for other non-GAAP metrics like EBITDA, EBIT, or free cash flow (“FCF”) per share. In the case of REITS, AFFO per share is certainly the most appropriate modification.

In Benjamin Graham’s day, assets were as important as earnings because IP had limited value. Most income was derived from tangible assets that could also be liquidated if necessary to bail a company out or create income. Today, the formula is less relevant due to massive advances in technology which have turned non-tangible assets into money printers for which investors are willing to pay many times book value. However, with real estate and real property-centric companies with a large portion of their assets being constituted by PPE, this formula remains very relevant in my opinion.

Top REITs by market cap

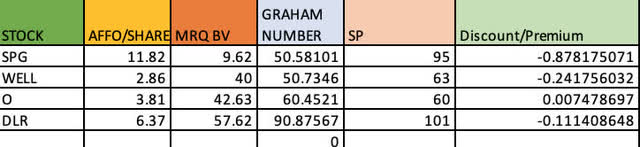

My selections for the comparisons are Simon Property Group (SPG), Welltower Inc. (WELL), Digital Realty Trust (DLR), and Realty Income Corporation. I used the most recent data related to book value and AFFO per share in the excel sheet.

For Realty Income Corp, I’m using $3.81 in adjusted FFO per share. Therefore we have SQRT (22.5)*(3.81)*(42.63)=$60.45 intrinsic value for Realty Income Corp. Here are the comps:

Excel sheet, data from Seeking Alpha

All the stocks are trading at a premium to their Graham numbers currently, but Realty Income is very close and has been in and out of the price target the past trading days at $60.45 a share. This is a rare metric for any REIT to fall into and should be noted for Realty Income Corp. Simon Property Group is showing the greatest overvaluation, but they are certainly able to get the most out of their assets in terms of AFFO per share, trading at only 8.25 X AFFO. Simon Property Group is heavily invested in mixed-use shopping malls and dining properties. Welltower is healthcare-centric.

I am aware that all of these REITS operate on different business models and will generate different returns on their assets depending on what the economy is doing. Digital Realty Trust is the second cheapest in this large-cap REIT list with only an 11% premium to its Graham Number. They have a completely different business model for generating income from data centers. All offer some degree of diversification across different asset classes.

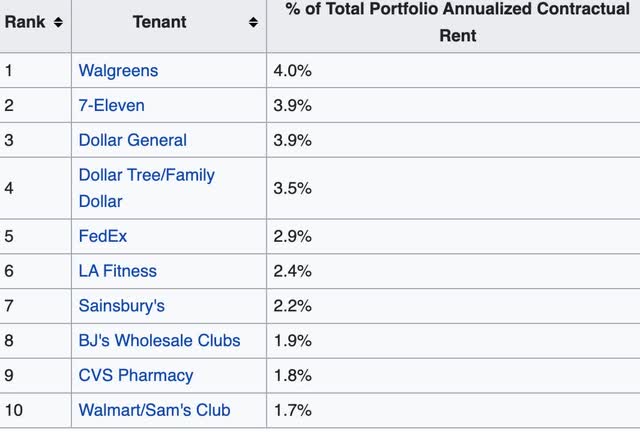

What I love about Realty Income Corp is its focus on long-term leases to respected anchor tenants, many of which are in consumer staples or consumer defensive. These are sectors that remain stable in good or bad economies. Not only do they provide stability, but we are buying the underlying assets for the fairest value amongst Realty Income’s peer group.

The assets

Realty Income Tennants (Wikipedia)

With Realty Income Corporation, not only am I buying into the assets at a fair price, but the tenants above are very recession-resistant. Some would argue that these asset values will fluctuate and drop in a downward real estate market, but I would digress that a custom-built property for Walmart (WMT), Walgreens (WBA), or Dollar General (DG) will always command a market premium.

Realty Income Anchors (Realty Income 2021 Investor Presentation)

Not only that but there would be very little reason for any of these companies to want to exit a lease regardless of the economy. Many of these tenants might experience higher revenue and profit in a prolonged recession, as a matter of fact.

REIT dilution

One area in which I come to loggerheads with other value investors is share dilution. The share count for all REITS climbs YOY with consistency. This is usually from drip reinvestment and equity creation used to buy more properties and create more income. Since the payout ratio for REITS is around 90%, this is logical. If income increases keep up with the share dilution or exceed it in investor returns, then this is not an issue. Real estate acquisition is certainly different than any other type of share dilutions used for working capital or future investments that will take time to generate a return. Real estate is unique in the ability to buy capacity in October and immediately start generating revenue and profit in November. There are not many assets out there like it.

The monthly dividend begets monthly compounding begets more acquisition opportunities

For many of us, we reinvest our dividends. Others, especially retirees, like to take the income to fund their lifestyle. With quality REITS, the reinvestment of dividends gives a company like Realty Income Corporation more opportunities to make property acquisitions and compound their portfolio of properties to in turn create more income for us the investors. They will buy some properties high, some properties low. If they have demonstrated exemplary judiciousness in their investment decisions over a long period, and you support their asset target mandate, this is a virtuous cycle that will create more value for everybody.

The monthly versus quarterly compounding system gets DRIP investors the best blend of share price average. It also keeps the company with adequate funding on a month-to-month basis to catch better deals for acquisition on a more frequent basis.

The debt and the dividend

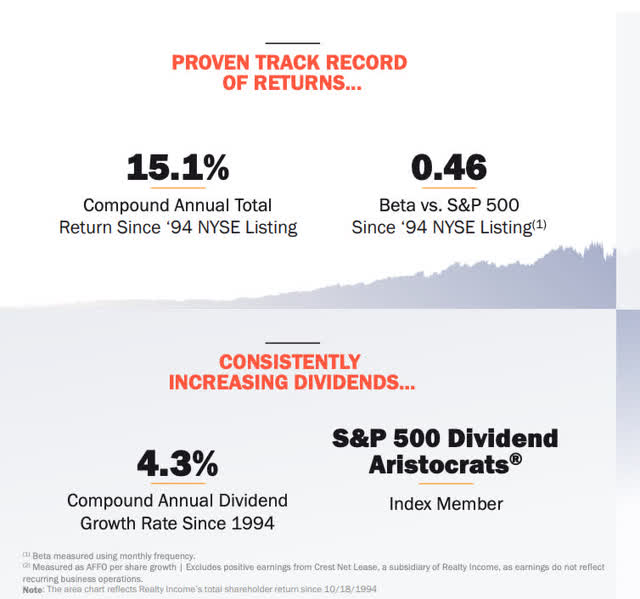

Realty Income Performance (Realty Income 2021 Investor Presentation)

The company maintains about $16 Billion in debt mrq with a debt to equity ratio of 62%. This is mainly leveraged against real property representing the equity in the equation. Regardless of what the share price of a REIT does, the true market value of their real property will dictate a lot of their access to debt. Conversely, companies with a lot of non-tangible assets will have their access to debt adversely affected by share price retracements.

The current dividend yield of 5.02% is covered by FFO with a TTM payout ratio of 82%. The company is operating in line with other REITs, high payout of FFO, growing the portfolio and FFO through equity and debt in forward quarters versus cash flow. As long as the company continues to issue equity and take on debt wisely, the increase in shareholder value through premium property acquisition will ultimately create rather than destroy value.

Summary

With Realty Income Corporation being a thoroughly covered stock on Seeking Alpha, I just wanted to add my two cents in evaluating the company on both its assets and its earnings. I also have to commend Seeking Alpha for their supplemental non-GAAP items on the income statement as it pertains to REITS, having easy access to all the FFO and AFFO information is invaluable for REIT investors. I reiterate a buy rating on Realty Income Corporation with a price target of $60-$65 (I’m willing to pay a bit of a premium) a share based on a modified Graham number substituting EPS with AFFO per share.

This is a company trading close enough to book value to make me sleep well at night. Walmart, Walgreens, Dollar General, and FedEx (FDX) are all consumer defensive/staple and Industrial names that will be resilient in a down economy. Quality names I own or would consider owning. Now with Realty Income Corporation, I can be their landlord, too!

Be the first to comment