DenisTangneyJr/iStock Unreleased via Getty Images

There aren’t many stocks out there that have a cult following. Recent examples like GameStop (GME), AMC (AMC), and Tesla (TSLA) come to mind. Even fewer earn that following by being extremely shareholder friendly, whether it’s through consistent dividend raises, market outperformance, or large buyback programs like Apple (AAPL) or Microsoft (MSFT). The company I’ll be writing up today is a favorite REIT of many investors and has even trademarked “The Monthly Dividend Company”. That’s right, I’m talking about Realty Income (NYSE:O).

Investment Thesis

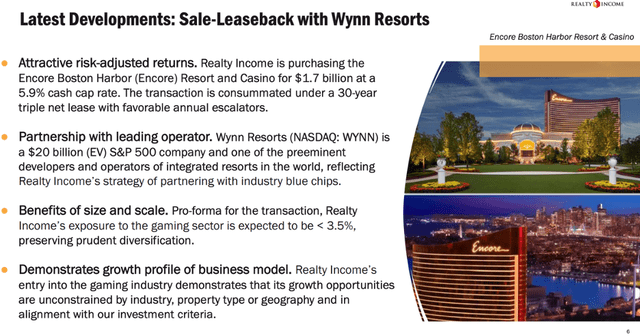

Realty Income is the largest net lease retail REIT on the market. The company has been looking for external growth opportunities in the last year, with the VEREIT merger and more recently, the acquisition of the Encore Boston Harbor from Wynn Resorts (WYNN). The company is trading at or near fair value in the low-$70s range, and I have no intention of selling my shares anytime soon unless the price runs up significantly. Realty Income is well known for its monthly dividend and Dividend Aristocrat status, and the monthly payout and quarterly raises has created a cult following for the company. Investors can add at these prices, but a margin of safety can be had if the price drops into the mid-$60s range.

The Business

The company has been active in the last year. They merged with VEREIT last November and spun off several of the properties they had no interest in keeping with Orion Office REIT (ONL). I liked the merger and the subsequent spinoff. Personally, I sold the ONL as soon it showed up in my Roth IRA and just viewed it as a special dividend of sorts. I didn’t have much interest in owning it since I figured they wouldn’t spinoff properties without a reason. Another recent transaction of note was the sale leaseback of the Encore Boston Harbor with Wynn Resorts.

Encore Boston Harbor (realtyincome.com)

This acquisition is a departure from Realty Income’s typical deal. Their real estate portfolio is heavily weighted to retail properties. Retail makes up approximately 77% of the portfolio, with industrial properties accounting for another 17%, and the last 6% classified as other (includes office, agriculture, and the recent Encore acquisition). Personally, I like the acquisition as it shows that the company is willing to diversify outside of their typical markets. The cap rate sits at 5.9%, with rent escalators of 1.75% for the first ten years. After that, the escalator will range from 1.75% to 2.5% depending on CPI.

The transaction is expected to close late in 2022. Realty Income also has a very diversified tenant roster, with their top 20 tenants only making up 43% of the portfolio rent. They have a history of operating with modest leverage, and their conservative management and consistent dividend increases is what makes Realty Income a must own for long term REIT investors. This all comes at a reasonable valuation, but I don’t think now is the time to be adding shares.

Valuation

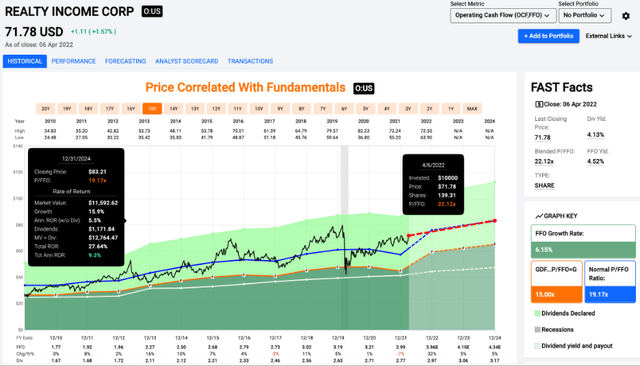

Shares currently trade at a price/FFO of 22.1x, which is a couple turns above its average multiple of 19.1x since coming out of the 2008 Financial Crisis. I think shares are close to fair value right now, but the projections show that FFO/share growth is primed to accelerate in the next couple years. While it might not be cheap, Realty Income is a company that only gets cheap very rarely and has earned the higher valuation with its consistent performance.

I think that we could see decent forward returns from the low-$70s, but I’m not looking to add to my position right now. I bought shares just under $60 in late 2020 and have been reinvesting dividends ever since. This brings me to a main piece of the bull case for Realty Income investors, and that is the dividend.

The Dividend

Like I mentioned earlier, Realty Income has become known as the Monthly Dividend Company. They are also a dividend aristocrat, with more than 25 years of consecutive dividend increases. The dividend yield currently sits at 4.1%. They aren’t going to light the world on fire with their dividend growth as a larger REIT, but the company has increased the dividend for 98 consecutive quarters. That steady, consistent growth is what has created a cult following, especially among income investors. When you combine the above average yield with the monthly payout, Realty Income is one of my favorite options for reinvestment.

Conclusion

Investors have had to deal with volatile markets to start 2022. Realty Income is a REIT with a fantastic track record of dividend growth, and investors have relied on the monthly payout for years. Shares are currently near fair value, but I wouldn’t be looking to start a position or add to one above $70 a share. If shares dropped into the mid-$60s, I would start to get more interested. If shares dropped below $60, I would start adding aggressively. However, I think that is probably unlikely given the quality of the company and an investor base that would start scooping up shares in a major sell off.

The company has been active in the last year, with the VEREIT merger expected to provide continued growth. They also made a big sale leaseback deal with Wynn Resorts in the last couple months, which could be just the beginning for Realty Income and the gaming sector. I won’t make any bold predictions, but I think it’s possible that we see the company make similar acquisitions in the coming years. I’m excited to be a shareholder and I plan to hang on to my shares for a long time to come.

Be the first to comment