8vFanI/iStock via Getty Images

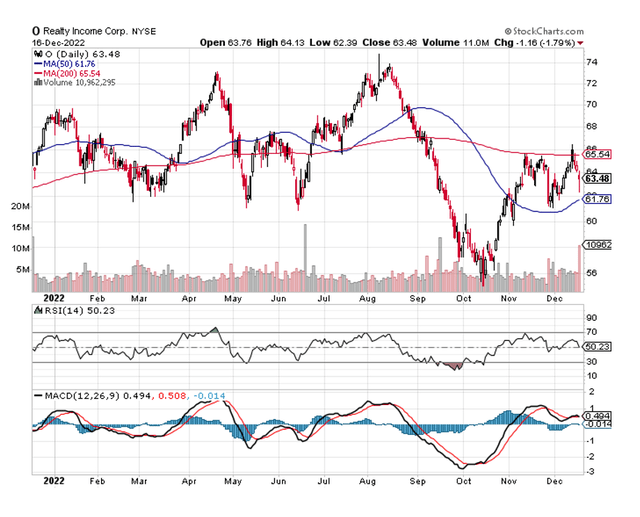

Realty Income Corporation (NYSE:O) is expected to return to a downtrend after failing to stay above the 200-day moving average line last week.

In December, the central bank raised interest rates by 50 basis points, which likely explains the reemergence of weakness in Realty Income’s stock price.

Passive income investors are irrationally concerned about rising interest rates, which are frequently mentioned as a potential source of FFO pressure for real estate investment trusts. Higher interest rates do not affect Realty Income, and higher rates have not been shown to harm Realty Income’s rental business.

A retracement to $55 would make Realty Income a very appealing passive income investment.

Doing Away With Investors’ Irrational Fears About Interest Rates

Investors are concerned about rising inflation and interest rates. Higher interest rates, implemented by the central bank to reduce inflation, are frequently viewed as a potential headwind for a trust’s funds from operations prospects.

In December, the central bank raised interest rates by another 50 basis points, bringing them to a new range of 4.25 to 4.50%. The central bank hopes to reduce inflation by doing so, but it risks increasing funding costs for businesses that rely heavily on debt to finance their operations.

However, the impact of higher interest rates on Realty Income is likely to be minimal because there is no hard evidence that suggests Realty Income (or any other real estate investment trust) is fundamentally disadvantaged by higher interest rates.

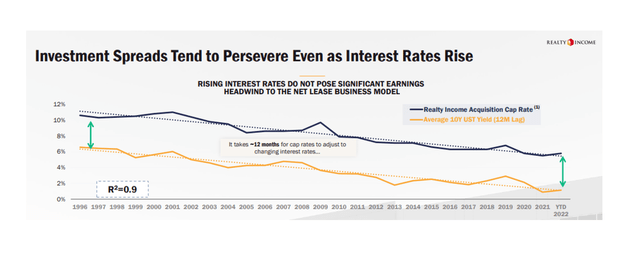

Investment spreads in the real estate market have very little variability over time (see below), implying that trusts face no significant headwinds in terms of cap rates or FFO potential.

Acquisition Cap Rate (Realty Income Corp)

Actually, periods of higher interest rates, such as the one we are currently experiencing, may end up being very beneficial to Realty Income because they tend to lead to a larger pipeline of acquisition opportunities during a recession, and recessions typically follow periods of high interest rates.

Recessionary periods, for example, were the most appealing times to buy large real estate portfolios. Realty Income is one of only a few large-cap REITs that can afford to make aggressive real estate acquisitions thanks to its strong balance sheet.

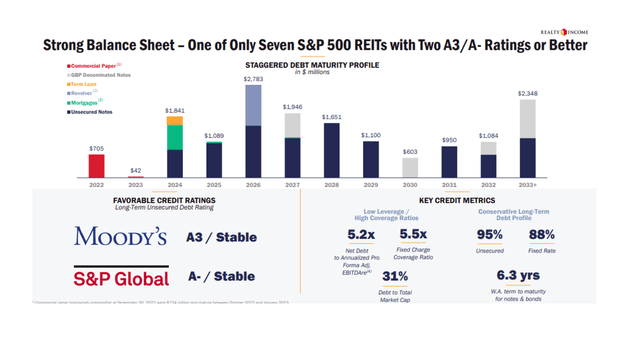

Realty Income has a debt-to-equity ratio of only 31%, allowing the trust to raise debt to fund new acquisitions. The trust also has an investment-grade credit rating and $2.5 billion in available liquidity at the end of the third quarter.

Strong Balance Sheet (Realty Income Corp)

Technical Evaluation

Realty Income’s stock price decline, in my opinion, is related to concerns about rising interest rates, which the Fed rekindled in December. The 50-basis-point increase in December alone is not significant, but the central bank prepared the market for more rate hikes in 2023, which (incorrectly, I believe) added to investors’ perceptions that REITs suffer from higher interest rates.

Importantly, Realty Income’s stock price fell through the 200-day moving average line last week, which is widely regarded as a bearish chart signal. The 50-day moving average line is currently at $61.76, so a break of this line would immediately expose Realty Income to a retracement back to the previous low at $55.50, a level that I would aggressively try to exploit.

Moving Average (Stockcharts.com)

FFO Multiple

Realty Income reduced its third-quarter FFO guidance and now expects to earn $3.87 to $3.94 per share in funds from operations. Realty Income’s valuation at the current price of $63.48 reflects a P/FFO-ratio of 16.3x, which I consider to be a moderate margin of safety. The margin of safety would be much higher at a $55 buy point (P/FFO-ratio of 14.1x).

Why Realty Income Could See A Lower/Higher Valuation (Risks)

Realty Income’s operational performance (occupancy, portfolio performance, dividend coverage) is strong, and the trust has built a reputation for competent execution and skillful market navigation, particularly during the 2001 and 2008 recessions, when the trust became an aggressive buyer of real estate.

With that said, the market’s perception of trust in the short term is likely to be determined by the interest rate cycle, as irrational as I believe this is. A deep real estate recession that causes occupancy to rise and FFO growth to slow are risks to Realty Income’s operational execution.

My Conclusion

Realty Income is a well-managed REIT with strong operational metrics. However, downside pressure on the trust’s valuation has returned after the central bank raised interest rates again in December. In fact, there is no compelling evidence that higher interest rates reduce Realty Income’s FFO or harm the trust’s prospects in any meaningful way.

Given what looks to me to be a downward retracement in the stock price, I think the $55 level might get revisited, at which point I am going to give myself a Christmas present and be an aggressive buyer of the trust’s stock.

Be the first to comment