Dilok Klaisataporn

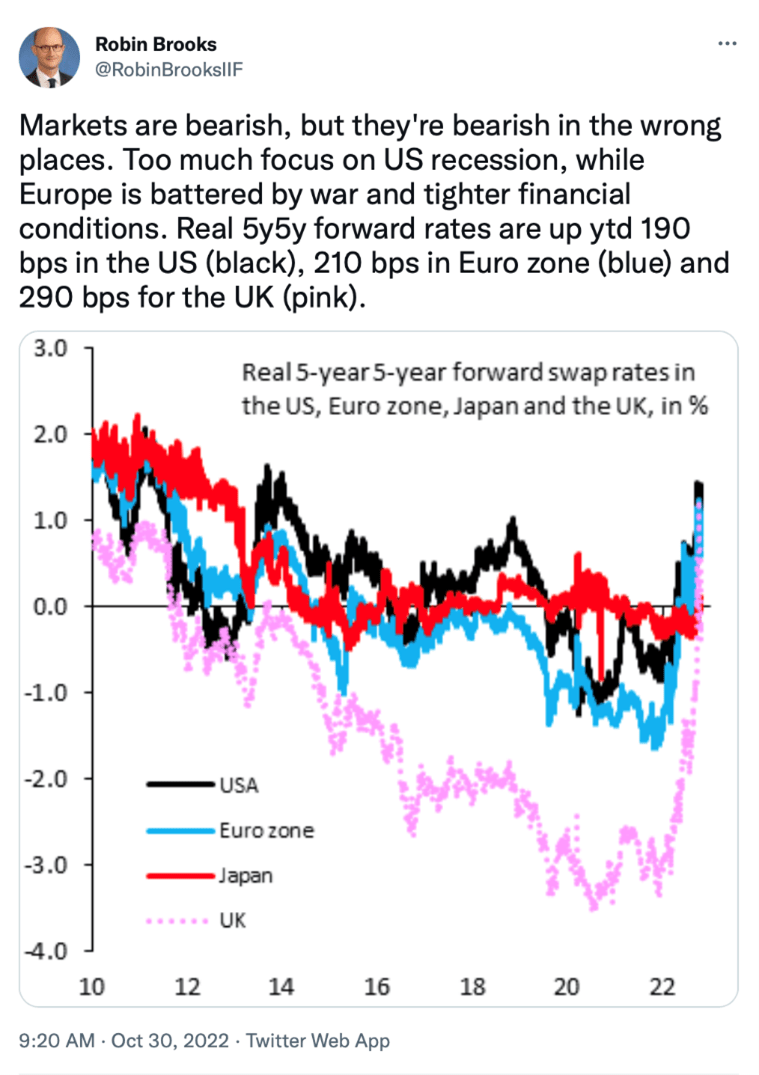

This tweet and chart from Robin Brooks is worthy of serious consideration. Brooks has impressive credentials: He is a chief economist at the Institute of International Finance, former chief FX strategist at Goldman Sachs, and former senior economist at the IMF.

(https://twitter.com/RobinBrooksIIF/status/1586709522558717955?s=20&t=0rbPyItg86vq1Y8669npzQ)

Here are two key “takeaway” points:

1. Forward rates are filled with information about how skilled market agents are pricing the future. For the first time in years, the “real” forward rates depicted are all positive. We have to go back to the exit from the Great Financial Crisis for a similar lineup. The interpretation is that all four central banks in control of these currencies are now pursuing a policy outcome that is restrictive in the medium term. Remember the basic concept: a zero real forward rate is a neutral market based price. If the real forward rate is negative, it implies that monetary policy in the medium term is stimulative. When the real forward rate is a positive number, it implies that the monetary policy in the medium term is restrictive. Note that the forward rate estimates are focused on medium term, which is the timing of capital market investments and transactions.

2. A nuanced takeaway indicator is that the Japanese real forward rate is now also a positive number, even though it is within the 10-year yield curve control period of the present BOJ program. Remember: the Bank of Japan is trying to control the interest rate by maintaining an unlimited bid to fix the yield on the 10-year government bond (JGB) thus controlling all interest rates between one day and 10 years maturity. This indicator suggests that skilled market agents are now betting with money that the Japanese policy of yield curve control will eventually fail. Why? Because the pressure of a weakening yen will cause Japan to change policy. Furthermore, because the 5-year, 5-year forward time period is within the clearly defined 10-year metric that has been repeatedly confirmed by the Bank of Japan over many years, the positive “real” yield suggests that market agents are now unrestrained when trading against the Bank of Japan. This serves to increase the pressure on the BOJ to change policy.

The lessons of central bank history show that a central bank can defend a currency (as long as it has reserves), or it can set a domestic interest rate at any level it wants, but it cannot do both things at the same time without incurring a high and rising cost while trying. Japan is now paying that increasing cost. Japan has now joined the club of restrictive monetary policy, in spite of its attempt not to do so.

At Cumberland, we follow forward rates closely. They are a complex indicator of future values. Many thanks to Robin Brooks for sharing this data in a public forum.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment