Khanchit Khirisutchalual

In this article, we will examine the Real Estate Split Share Corporation (TSX:RS:CA). Middlefield Group, a company formed in 1979, creates and manages specialized investment products and created this fund. The Real Estate Split Share Corporation is one of their split share corporations besides their EFTs and other products, with a concentrated focus on real estate investments in Canada.

While RS:CA is a relatively new fund with less than two years of history, it has provided strong capital appreciation coming out of the COVID pandemic with an attractive yield. Given these attributes, we first look at what investments they hold in the fund and then uncover a little more about what split share corporations are and what this means for us, and how we might determine if this was a suitable investment for us. Despite the attractive yield, the distributions can be suspended if times are tough and so the product is dissimilar to other funds or stocks where we may have more assurance of continued income. Despite these drawbacks, the strengths of the fund and the attractive current dividend make me rate the Class A shares of the Real Estate Split Share Corporation a buy at the current prices.

What investments does the Real Estate Split Share Corporation hold?

The RS:CA is, not unsurprisingly, composed of REIT holdings. It is primarily Canadian-focused, with a broad exposure to different REIT types.

The Real Estate Split Corp. is focused on providing investors with an actively managed portfolio of primarily Canadian REITs with good sub-sector diversification, with a particular emphasis on e-commerce growth, data infrastructure, and a value-investing approach. The Class A shares, covered here, pay a higher yield at present than the preferred shares and they benefit from providing the opportunity for capital appreciation besides the cash distributions.

The fund is relatively concentrated in the Canadian real estate market (91.6%) and U.S. (8.4%). The top 10 holdings have a nearly 2/3 weighting at 63.7% of the fund (Table 1). At the end of the year for 2021, the annual management report of fund performance notes it is concentrated into only 16 holdings.

Table 1. Top 10 holdings (Source: Real Estate Split Corp. Fact Sheet 2022-06-30)

| REIT name | Sub-industry | % Weight |

| Granite REIT | Industrial |

9.1% |

| RioCan REIT | Retail | 8.0% |

| CT REIT | Retail | 6.3% |

| Killam Apartment REIT | Residential | 6.2% |

| First Capital REIT | Retail | 6.1% |

| Dream Industrial REIT | Industrial | 5.9% |

| Allied Properties REIT | Office | 5.8% |

| Chartwell Retirement Residences | Healthcare Facilities | 5.6% |

| Summit Industrial Income REIT | Industrial | 5.5% |

| Canadian Apartment Properties REIT | Residential | 5.2% |

| Fund Weight: | 63.7% |

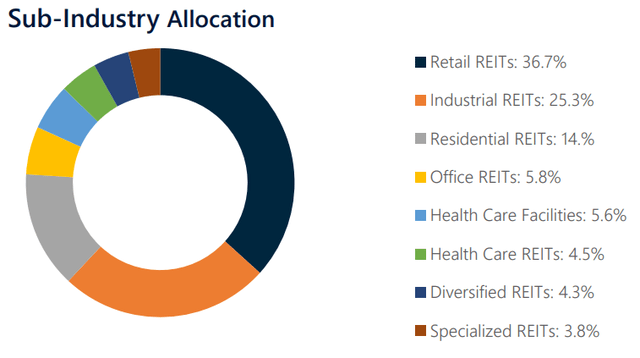

Within the narrow geographic focus of RS:CA, we can see (Figure 1) that there is ample sub-industry diversification. While there is a large retail focus, there is also a range of other, less correlated, sub-industry allocations that provide effective balance and reduce risk. If you are looking for instant REIT diversification in Canada, this fund would do the trick.

Figure 1. RS:CA Sub-industry allocation, showing reasonable diversification with a tilt towards retail (Real Estate Split Corp. Fact Sheet (2022-06-30))

What is a split share corporation?

The Canadian split share corporation is an investment type that has two distinct classes of shares (hence, the fund is ‘split’) that are invested in the portfolio of dividend-focused companies. Both shares trade separately. If we consider we might buy a stock with the hope of capital gains while receiving income as dividends, the split share corporation simply divides these two sources of returns into two distinct share classes that behave differently.

- Class A shares (RS:CA) will magnify the underlying stock movements more than if you owned the underlying shares directly, much like if you were leveraged by borrowing money to buy the underlying shares. They will derive the distribution payments (monthly) from the remaining dividend income from the portfolio (following payments made to preferred shareholders) and other sources, such as a return of capital, capital gains, and any income from covered call writing on the portfolio.

- The Preferred shares (RS.PRA:CA), in contrast, receive steady (quarterly) fixed payments. They do have a claim ahead of the Class A shares if they terminate the fund. But they do not gain any benefit if the stocks in the portfolio increase in price. Consequently, the market prices of a preferred share will be relatively stable. The income will primarily be driven by dividend income from the portfolio.

Distribution levels and growth

Split share corporations usually have a relatively stable distribution rate, and it is uncommon for them to raise their distribution level. RS:CA is unusual in this respect. Despite being relatively new, they increased the distribution from $0.10 monthly to $0.13 in August 2021. This represents a yield of 9.31% at the current fund price. In the 2021 tax year, 34.83% of the distribution was a return of capital allocation with the rest from capital gains (Source: 2021 Annual Report, Real Estate Split Share Corp., p. 27).

What types of investors will this Class A split share corporation investment make sense for?

At the current prices, the yield suggests that this will provide a good dividend income. The long-term appreciation of the underlying REIT assets should provide some effective capital appreciation.

As such, many investors looking for good income may find this useful.

There are funds with higher yields. But the fund structure provides a mechanism to generate a slightly higher yield from the underlying REIT holdings than we may find in other funds, with the ‘structural leverage’ of the split structure. In addition, the fund managers have a small loan facility (not exceeding 5% of the total value of the assets), which I believe they have not used yet and may add leverage in the future.

Long-term growth investors may need to look for other options for participation in the listed real estate space or may not be comfortable with the structural leverage from the fund structure.

Retired investors or those relying on investment income will need to consider this fund and other split share corps with caution or opt for the Preferred shares class of the split corporation. As noted earlier, the fund managers will suspend the distribution if the unit NAV drops below C$15. If you require this income and you are budgeting based on the income, then missing income in this way is not good.

Framed differently, if all is going well, you would get your income distributions. However, if there were a general market correction, recession, bear market, or a real estate correction (clearly relevant when discussing RS:CA), then the unit NAV for the fund may drop. If the unit NAV (the NAV of 1 Preferred and 1 Class A share combined) drops below C$15, the distributions will cease on RS:CA. Having your income drop during economically tumultuous times will not be fun. As such, if the security of investment income is required, the Preferred share option (RS.PRA:CA) may be ideal and may still provide a reasonable distribution yield.

What are the risks?

The heavy concentration in Canadian REITs represents a risk if anything were to change in either the wider stock market (such as an overall market correction that affects all sectors broadly) or the specific real estate market.

The “$15 rule” means that a slip below this level for the unit NAV (not just the value of the Class A shares) might see a substantial or rapid decline in value as the shares get dumped by investors, as the fund will no longer provide distributions for some time. Very generally, the Preferred shares in a split share corporation will tend to trade at C$10 (recall – they prioritize stability) and so a ‘quick and dirty’ check would be to that if the Class A shares are approaching C$5; if they are then there is a risk of the $15 rule being triggered.

The U.S. and international investors will invest in Canadian Dollars, opening them up to currency fluctuations and exchange rate risks.

Performance relative to alternative funds listed in the U.S.

If you are looking for a high yield from real estate, then there are several other holdings that might be considered. I have used a selection of comparable peers listed on the U.S. markets, with the group comprising index ETFs and income-focused funds:

- Aberdeen Global Premier Properties Fund (AWP)

- iShares FTSE EPRA/NAREIT Global Real Estate ex-U.S. Index ETF (IFGL)

- CBRE Global Real Estate Income Fund (IGR)

- SPDR DJ Wilshire Global Real Estate ETF (RWO)

- iShares Trust – iShares International Developed Property ETF (WPS)

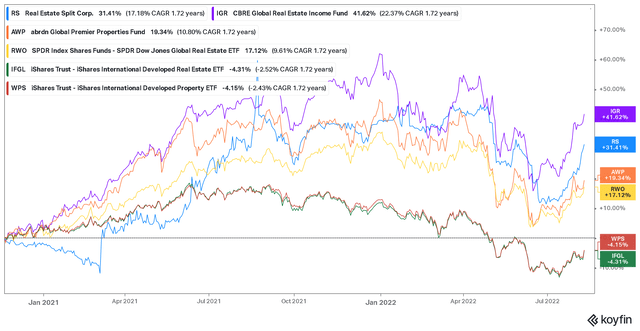

As we can see from Figure 3, there is a reasonable divergence from mid-2021, where WPS and IFGL both lag while the other funds had been in a more positive position. Both IGR and RS:CA are a reasonable way ahead of their peers over the seven quarters years and both are notably income-focused funds, suggesting the income generating ability of the funds has offset the price decline.

Figure 3. Relative total return between RS:CA and several comparable funds running for the seven quarter duration that RS:CA has been available. (Koyfin)

Considerations and deciding if Real Estate Split Corp is right for your portfolio

There are several issues here that I would consider if I wanted to add this fund to a portfolio. Here are some questions I would ask myself:

- Am I ‘over-paying’ for the fund? Is it trading at a discount or a premium?

- On 9 August it had a NAV of C$14.74 and was trading at close at C$16.75 and so it is trading at approximately a 15% premium to NAV. (We often see CEFs with strong distributions trade at significant premiums to NAV and so we should take this in the context of this type of fund.)

- Will I be ‘caught out’ with the $15 rule and forgo income? Recall that the NAV of both shares need to be above $15 for the Class A shares to pay out distributions. In this case, the NAV for the Preferred shares are always about $10 (remember – they are designed for stable prices and a set income) and on 9 August they came in with the NAV at C$10.06.

- This fund has a very healthy NAV of about C$25, well above the C$15 level.

- (Is this a real fear? Yes – several split share corporations do trade near the C$15 unit NAV level and are at risk of having the distributions suspended. If this were to happen, I would expect to see the fund then trade at a discount as investors sell out rapidly.)

- How does this fit within my wider portfolio composition? It is not simply a ‘stock’ but rather a fund. If I were a Canadian investor, buying RS:CA might over-expose me to the local REIT or real estate sector, particularly if there were overlaps with individual stock holdings or holdings in other funds.

- As an international investor, is it reasonable to have specific exposure to Canadian REITs? U.S. investors may find some comparability and similar market movements if they hold this fund and other U.S.-focused REIT funds. Will holding the fund provide geographic diversification? If the portfolio contains U.S. and International REIT funds, then buying this fund may over-expose a portfolio if it became an oversized component of the portfolio.

- Will this fit my income or growth objectives?

- If seeking consistent and reliable income, it is wise to keep in mind that the split share corps may skip distributions during tough times (which may be when an income-focused investor most needs the income from their investments!).

- If looking for long-term growth, will a fund focusing on REITs provide that capital appreciation? Many younger investors with a long horizon of decades may not want large income payments in the interim (think about the tax implications) and may instead be focused on capital appreciation and growth stocks.

- Do I want to deal with international holdings?

- If I am not a Canadian, do I want to hold this? I will deal with currency exchange rates and international taxation. It may be a little complicated!

Investment thesis

This is a relatively new fund. The Canadian focus may prove valuable for the U.S. or international investors seeking diversification benefits. The ‘natural leverage’ provided by the fund structure gives additional dividend yield and growth potential. We might not expect the distribution levels to grow significantly (based on experience with other split corps), but the yield of 9.3% is attractive and secure.

While we continue to have high inflation, REITs make sense as an investment class and this fund provides geographic exposure to Canada with diversification over different sub-sectors. The diversification over individual REIT holdings ensures less drag or risk from investments in specific sub-sectors.

The shares provide a steady distribution and good capital appreciation since their inception. The split structure’s natural leverage provides amplification of capital gains on top of the yield.

The RS:CA shares are a small part of my portfolio and I believe it is a solid buy at the current price.

However, the split corporation’s characteristics will mean that these Class A shares are not a great fit for every investor and portfolio – consider it carefully.

Be the first to comment