IvelinRadkov

Introduction

I haven’t covered Rockwell Automation (NYSE:ROK) since 2021. Now, there’s a great reason to dive back in. One of the key themes I started discussing more in-depth this year is the re-shoring of supply chains. I recently wrote an article on this topic, highlighting the risks and opportunities of post-pandemic supply chain reconfirmations.

In this article, we’ll discuss a company that benefits from re-shoring as it addresses shortcomings like higher costs and challenges related to new technology trends like EV mobility. ROK is an outstanding dividend growth stock that offers companies innovative solutions for automation, AI, and everything related to optimizing production and service processes.

It’s a company that comes with a high likelihood of peer outperformance, a decent yield, solid dividend growth, and a business model that has never been more appropriate.

So, let’s dive into the details!

Re-Shoring Opportunities & Challenges

If you want all of my recent thoughts on re-shoring, feel free to read the article mentioned in the introduction. But no worries, I’m also covering the bigger picture in this article. After all, some context is needed before discussing the benefits that come with Rockwell Automation.

Essentially, re-shoring is a light version of de-globalization. Globalization accelerated after the second world war as technologies improved. New alliances were made, and companies saw opportunities in producing and selling products overseas. China was one of the biggest beneficiaries as it became a global hub for cheap manufacturing and materials.

However, globalization (supply chains) started to show some cracks in 2015/2016 when former President Trump highlighted the dependence on China and the need to fight back against unfair trade practices. This included trade tariffs and a tougher stance on companies looking to outsource production to overseas countries.

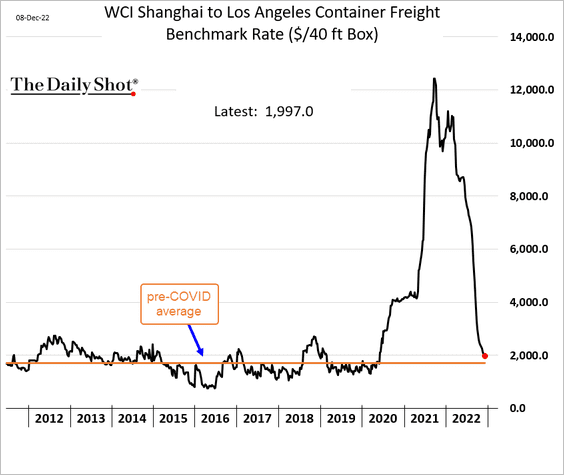

Then, the pandemic happened. Lockdowns, exploding shipping costs, and closed factories added a ton of uncertainty to global supply chains.

While shipping costs have normalized again, supply chains are not back to normal.

The Daily Shot

Supply chains were so stretched after the first wave of lockdowns (when the demand came back) that companies suffered greatly from supply chain issues and everything related to that. Or, as S&P Global put it:

“U.S. companies have taken multiple measures to address supply chain issues, including chartering freighters, rerouting shipping to smaller ports along the coasts, and relying more on air freight,” said Lillian Lin, portfolio manager at PIMCO. Companies with more diversified supply chains, less concentrated in China, have done better than others.

To make matters worse, Russia invaded Ukraine earlier this year, which added another layer of problems. Moreover, we didn’t even mention the increasing tensions caused by China pressuring Taiwan.

Because of these issues, the Biden administration has passed two bills aimed to improve domestic semiconductor production.

On top of that, companies in all sectors are starting to incorporate re-shoring strategies. For example, S&P Global highlighted comments from Martin Marietta Materials (MLM). The company said that re-shoring is expected to boost nonresidential construction investments in the US.

Moreover:

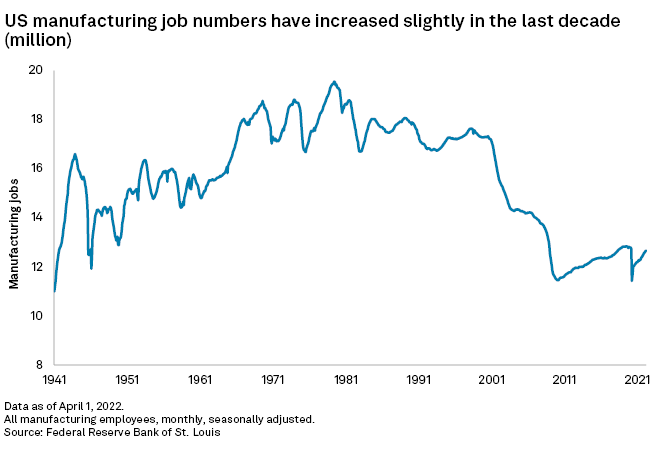

Reshoring and foreign direct investment contributed to nearly 262,000 jobs returning to the U.S. in 2021, up from nearly 179,000 a year earlier, according to data collected by Reshoring Initiative. A total of 1.3 million jobs have returned to the U.S. since 2010, with a further 3 million to 5 million jobs that could return if companies and governments embrace measures to support reshoring.

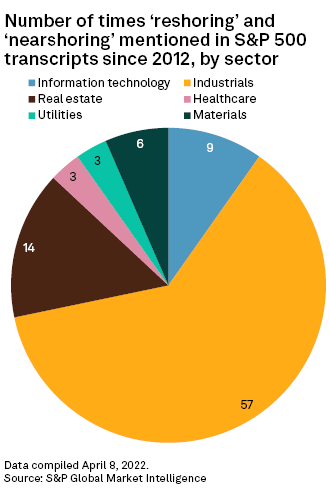

S&P Global

What’s interesting is that it’s not just industrial companies mentioning re-shoring. While these companies are the epicenter of re-shoring, we see a trickle-down effect. Real estate and information technologies are also increasingly focusing on these macro trends.

S&P Global

The importance of information technology cannot be underestimated. After all, re-shoring is extremely difficult. Remember, companies had a good reason to move production overseas. They were able to significantly reduce costs.

Bringing back supply chains is a good idea. However, it does not work in all segments. It also needs significant tech support to give the US another edge as it won’t be able to compete on labor costs – and that’s not a bad thing.

However, the US has other benefits. It has affordable energy (abundant natural gas, oil, and coal). It is investing in renewables. It has better demographics (also forward-looking) than most industrialized nations. It has excellent supply chains (water, road, rail, air), and a better rule of law than many emerging markets.

Now, the key is to incorporate technology to smoothen the re-shoring trend.

That’s where Rockwell Automation comes in.

Why Rockwell Automation Is A Re-Shoring Winner

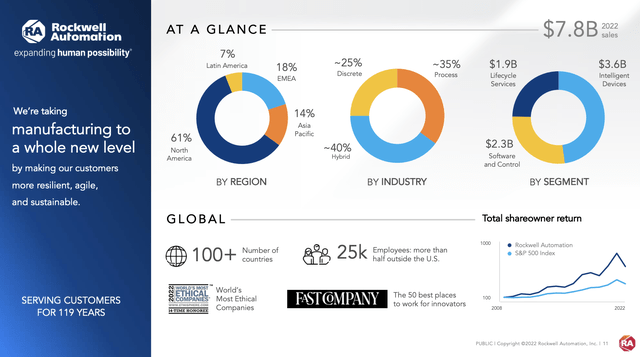

Rockwell Automation is an old and experienced company. Founded in 1903, the company provides industrial automation and digital transformation solutions in North America, Europe, and emerging markets.

The company operates through three segments, Intelligent Devices, Software & Control, and Lifecycle Services. Its solutions include hardware and software products and services.

The company’s segments offer products and services aimed to smoothen business processes.

Our operating segments share common sales, supply chain, and functional support organizations and conduct business globally. Major markets served by all segments consist of discrete end markets (e.g., Automotive, Semiconductor, and Warehousing & Logistics), hybrid end markets (e.g., Food & Beverage and Life Sciences), and process end markets (e.g., Oil & Gas, Metals, and Chemicals).

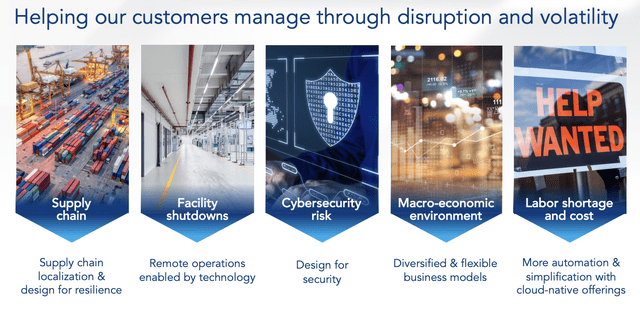

In an earlier report, the company highlighted challenges connected to post-pandemic developments. The company highlights one very important thing, which we highlighted in the theoretical part of this article as well:

A solid digital transformation strategy and technology deployments will allow manufacturers to meet commitments and even create a competitive advantage through their supply chain.

Needless to say, the company’s solutions are offering exactly what companies need to remain competitive – despite having a cost disadvantage versus emerging markets.

Here are some ways the company helps customers. Note that most of these solutions make sense even without re-shoring. I’m using some quotes from ROK’s latest investor presentation.

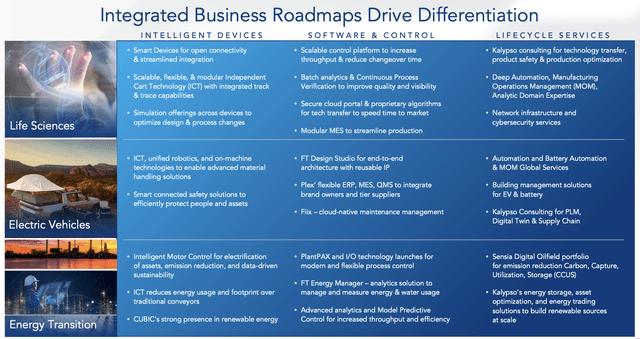

Healthcare

Problem: “Network orchestration to improve end-to-end drug development process & reduce integration cost”

Solution: “Technology that connects different parts of the value chain, from drug development to commercial manufacturing, while protecting everyone’s IP”

Electric Mobility

Problem: “Battery cost & supply”

Solution: “Independent Cart Technology, simulation software, core automation, and safety solutions reduce battery cell production cost while increasing production speed and quality”

In EV, the company is partnering with Ford and Hyundai to improve EV design and production.

Energy Transition

Problem: “Bring renewable energy sources to market at scale”

Solution: “Energy storage and management solutions through our Kalypso digital consulting, applied AI, and integrated control capabilities”

While ROK is officially categorized as an industrial company, its products and services are less tangible than people are used to in this sector. It doesn’t produce tractors, it doesn’t transport goods. It supports companies that do all of this.

With that said, allow me to use a few more quotes. In its third-quarter earnings call, analyst Andy Kaplowitz asked the following question:

[…] how much do you think reshoring is helping you at this point? And where do you think we are and let’s call it the reshowing cycle, if you may?

The answer was highly interesting. CEO Blake Moret made the case that the biggest impact on ROK is not the comeback of supply chains, but new supply chains being established in the United States.

I like talking about shoring rather than reshoring because it’s really more about the U.S. being an outsized beneficiary of new CapEx as opposed to shuttering plants in China and other parts of Asia and bringing it back to the U.S. It’s really about new lines of business, new capacity, filling out a little more of a local-for-local strategy, got a lot of manufacturers are providing, and I don’t see anything with the current economic headwinds that would cause people to say just kidding. Let’s go back to pushing manufacturing to other parts of the world and chase lower labor rates.

It seems that while re-shoring will be a longer-term benefit, ROK is generating value here and now by helping companies to adapt to a changing environment. In other words, moving closer to customers and de-risking supply chains. That’s on top of working on new supply chains like EVs, healthcare, and the energy transition.

Now, let’s talk numbers.

Rockwell Brings Value To The Table

Rockwell is not a fast-growing company.

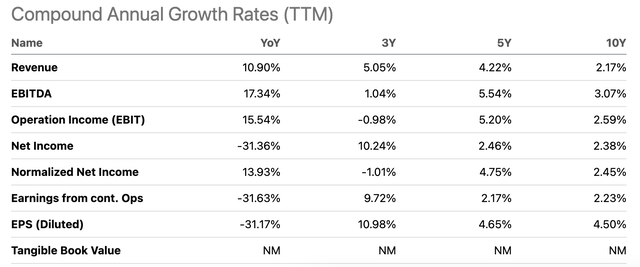

Using Seeking Alpha’s overview, the company’s financials are growing in the low-single-digit range.

Now, the good thing is that growth is improving. In the next few years, annual EBITDA growth is expected to remain in the low double-digit territory.

As the chart above shows, the company is using acquisitions to grow (higher net debt after 2020).

On a long-term basis, the company aims to grow its revenue based on three pillars.

- At least 1% from inorganic growth (meaning acquired growth)

- Double-digit growth in Information Solutions and Connected Services

- Core growth of at least 2x industrial production

These are eager targets, but not impossible as the company has indeed tools to benefit from the fastest-growing industrial segments.

Moreover, the company has a strong balance sheet to support acquisitions.

It’s one of our strengths, and the market access that we have to provide new value from M&A immediately into all of the industry segments of discrete and hybrid and process is second to none. So I’m happy with the way that we’re positioned with M&A. We’re going to keep doing it. We have a strong balance sheet, and we’ve got a great track record of turning these acquisitions into real value.

ROK is expected to end the 2023 fiscal year with $3.0 billion in net debt. That would imply a 1.7x net leverage ratio.

Moreover, the company is expected to do $1.3 billion in free cash flow in its 2024 fiscal year. That would imply a 4.3% free cash flow yield using its $29.8 billion market cap.

High free cash flow generation is beneficial for an aggressive M&A strategy.

Also, in light of all of these numbers, the company has an A-rated balance sheet.

So, what about the dividends?

The ROK Dividend & Outperformance

I think I speak for most of us when I say I want a dividend while betting on long-term business trends (like re-shoring).

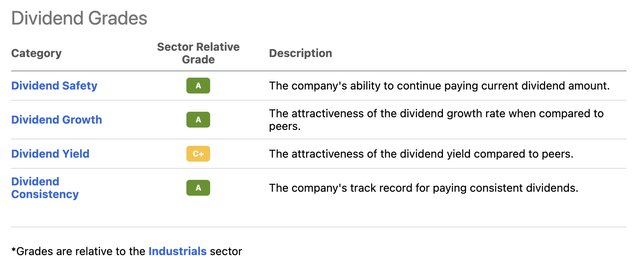

The company has a pretty good Seeking Alpha dividend scorecard. Rockwell scores high on safety, growth, and consistency. Unfortunately, its yield is somewhat low compared to the industrial sector.

How low is it, one might ask at this point.

Well, ROK pays a quarterly dividend of $1.18 per share. That’s $4.72 per year. This translates to a 1.8% yield.

In this case, I agree with a C+ rating. Especially after the market’s poor performance this year, there are plenty of stocks with better yields.

The good news is that ROK’s dividend isn’t bad. Over the past 10 years, the average annual dividend growth was 9.8%. The latest hikes average 5.0%. These are the latest hikes:

- October 2022: +5.4%

- October 2021: +5.0%

- October 2020: +4.9%

Again, that’s not perfect. Other shares have better yields and higher growth. These numbers don’t get me very excited.

But then again, ROK has other priorities. Despite its high age, the company isn’t a mature dinosaur just existing to distribute the cash it generates. As we discussed, ROK cares about growth and exploiting new business trends.

Hence, these are its capital priorities:

Our first priority is organic growth. After that, we focus capital deployment on inorganic activities. Then we focus on capital returns to shareowners, through our dividend, and then share repurchases.

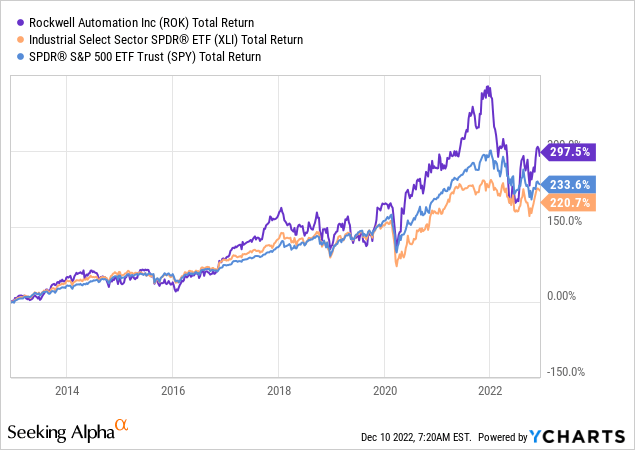

Also, ROK shares have outperformed both the S&P 500 and the Industrials ETF (XLI) over the past ten years, by a considerable margin. That’s important. After all, the company is focused on accelerating growth, not distributing a high yield. I expect outperformance to continue. However, it won’t be without some major drawdowns. The company has a longer-term standard deviation of 30%. That’s not extremely high, but it is high compared to most mature industrial stocks with high-tech exposure.

This brings me to the valuation.

Valuation

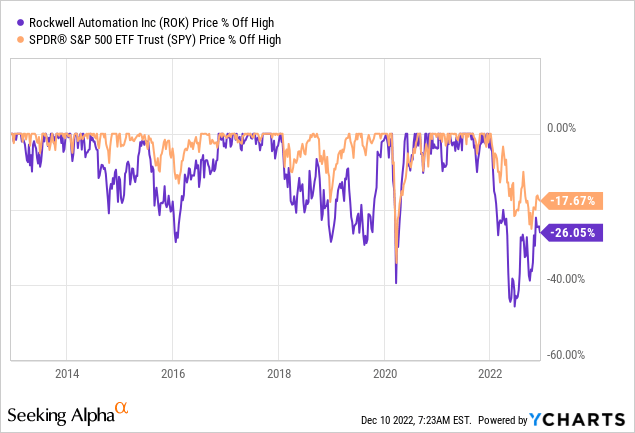

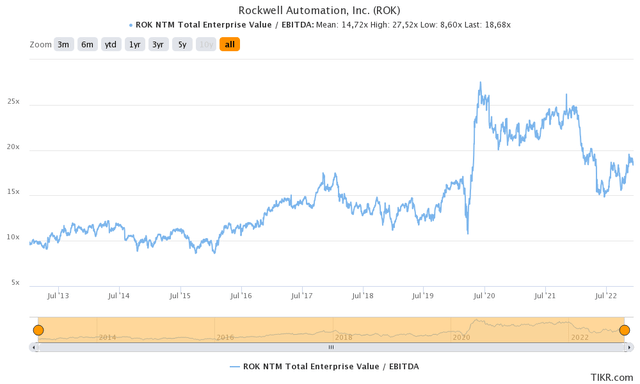

Speaking of high volatility, ROK shares were down more than 40% earlier this year. Now, ROK is trading 26% below its all-time high. This excludes dividends. It’s roughly 9 points worse than the S&P 500 performance.

Unfortunately, ROK still isn’t cheap. The company has an implied enterprise value of $33.6 billion. That’s based on its $29.8 billion market cap, $3.0 billion in expected FY23 net debt, $500 million in pension liabilities, and $300 million in minority interest.

That enterprise value is 18.7x FY23E EBITDA of $1.8 billion. That is a lofty valuation, even after a 26% drop.

I would make an exception if free cash flow were higher, but an implied FY24 free cash flow yield barely above 4% does not justify this valuation.

While the company is accelerating EBITDA growth, I would be more comfortable with a valuation close to 15-16x forward EBITDA.

Takeaway

In this article, we did two things. We started by discussing re-shoring opportunities and threats. While it needs to be seen what the future of re-shoring looks like, there is no denying that American manufacturing is going to play a bigger role. Given that new solutions need to pave the way for higher margins (re-shoring is expensive), we need to look for opportunities in that space as well.

Hence, the second thing we did is discussing Rockwell Automation. This company is in a tremendous position to benefit from an increasing need to optimize supply chains. This includes the EV transition, renewable energy, process automation, and everything related to that.

Moreover, the company has a decent dividend yield, a low payout ratio, and the ability to outperform the market on a long-term basis, thanks to accelerating EBITDA growth.

Unfortunately, the valuation isn’t that attractive. Investors looking to buy exposure might benefit from waiting for a better opportunity. Given the state of the economy, I believe another opportunity will present itself.

(Dis)agree? Let me know in the comments!

Be the first to comment