allanswart/iStock via Getty Images

RCI Hospitality (NASDAQ:RICK) has a strong competitive advantage to roll up the nightclub industry due to its strong balance sheet, superior free cash flow generation and favorable capital structure over its peers. The management also has a scalable and replicable strategy to successfully run the highly profitable sports bar Bombshells, with an exceptional management team that understands capital allocation to drive long-term shareholders’ value.

Many consumer discretionary companies were punished by the market as investors fear that as recession creeps in, consumer demand may slow and earnings may decline. However, RICK is one of the few exceptions that have seen relatively strong consumer demand, and it has been executing well over the past few quarters since it emerged from the pandemic.

In its most recent 3Q22 result, the roll-up strategy remains well on track and the management has continued to impress me with its execution.

Let’s dive deeper into the quarter.

Nightclubs

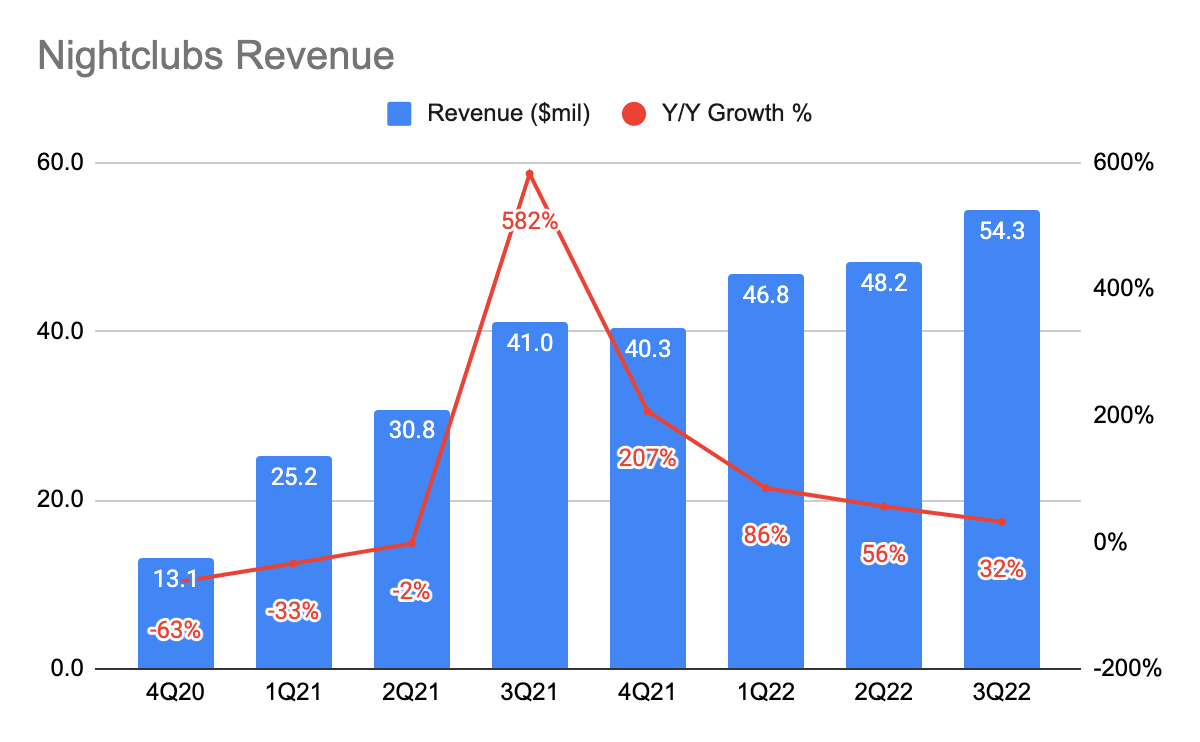

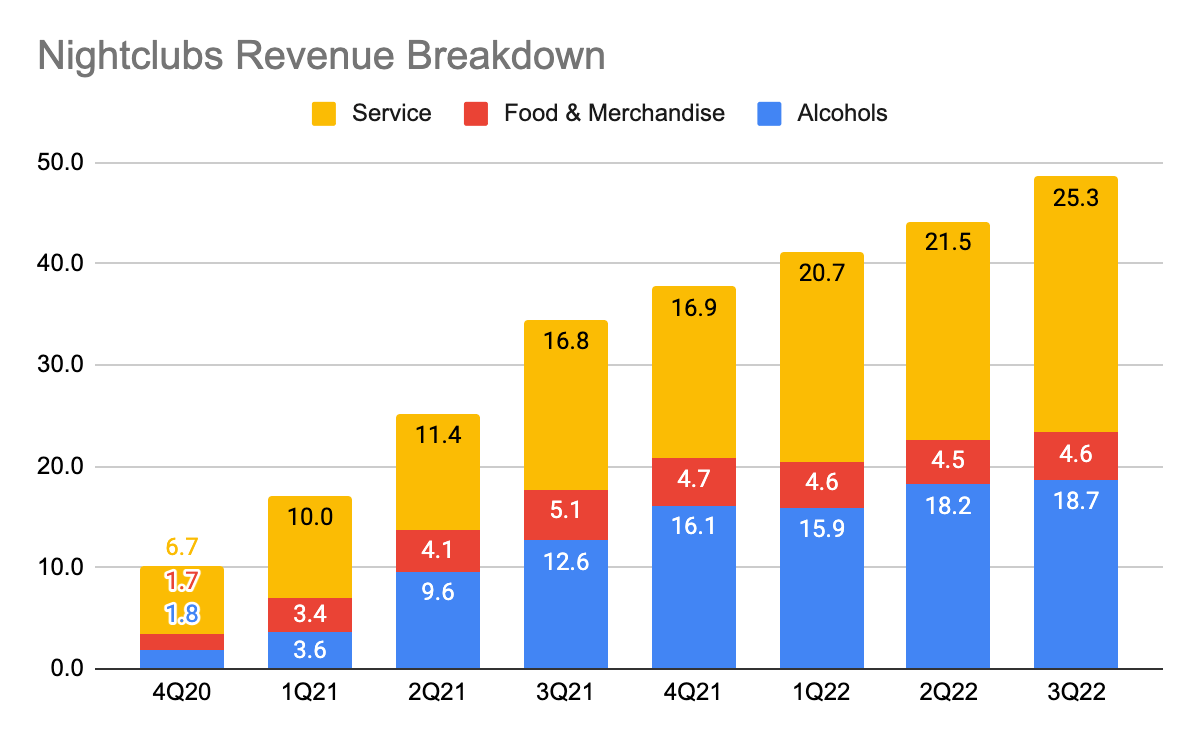

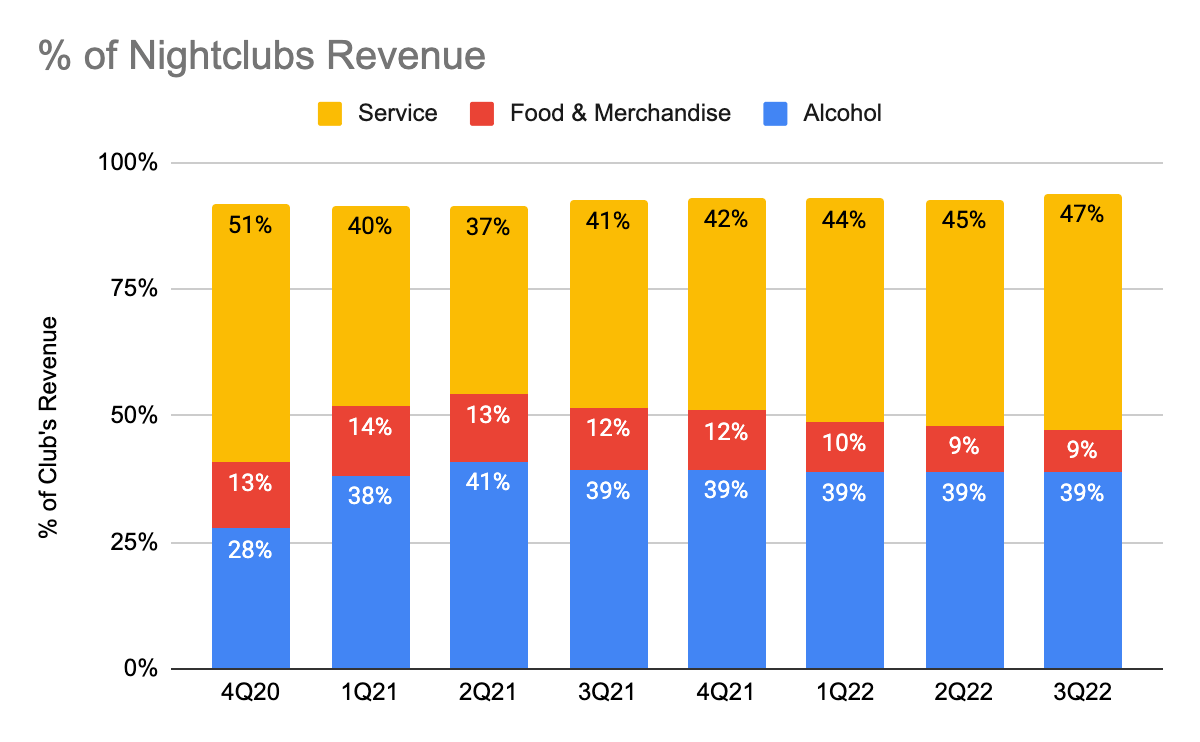

Image created by author with data from RICK IR Image created by author with data from RICK IR Image created by author with data from RICK IR

Nightclub revenue grew strongly at 32% Y/Y to $54.3 million.

FY20 and FY21 were unusual years for RICK as the business operations were affected by the pandemic and revenue declined massively. However, that didn’t hinder the management from executing as they quickly pivoted to Bombshells that thrived during those periods and they did not stop looking for acquisition opportunities (i.e. Lowrie and the Mansion Gentlemen Club).

As COVID headwinds wear off and traffic volume returned, high-margin service revenue rebounded strongly, same-store sales increased, and the management’s discipline to execute the roll-up strategy has resulted in the strong growth we see during the quarter.

One commentary from CEO Eric Langan caught my attention in the earnings call:

…our focus is about 95% on clubs and about 5% on Bombshells…the next three months that there’s going to be some great opportunities for us on the club side…We’re starting to pay four to five times right now for the big guys…a lot of guys talking to us right now…we’ve been saying $20 million increase for 2023. If the talks go well, and everything goes well…by December, when we do the K, we may have a much higher, larger target (>$20 million adj EBITDA?) based on deals on the pipeline…

I am highlighting this because it is important for various reasons:

-

Nightclub is the core business, making up 76% of total revenue, and thus making up the majority of its bottom line.

-

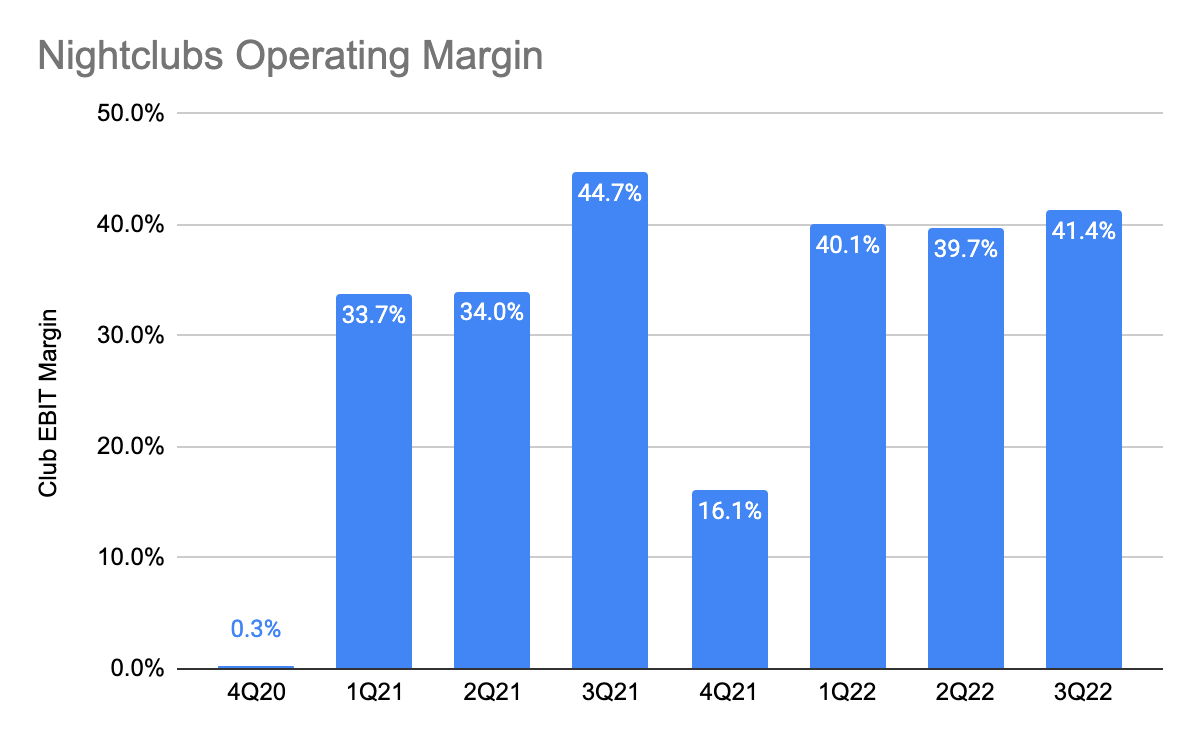

It has a substantially higher operating margin (41%) than Bombshells (19%), and they are extremely free cash flow (“FCF”) generative. This results in expanding cash flow over time.

-

They are the preferred acquirer in the industry with little to no competition and they have the perfect playbook to execute the M&A strategy

Therefore, this shift in focus was very well aligned with shareholders as the best use of the management’s time and resources should be spent on nightclubs rather than Bombshells.

During the quarter, they have already gone on to close 2 new acquisitions – Cheetah Gentlemen’s Club (40% EBITDA margin) and Oddessa Club (33% EBITDA margin), and they are in talks with a few more in the upcoming expo conference.

Keep in mind that the management plans to add $20 million of EBITDA in FY23, they have to do larger acquisitions or accelerate the number of deals. Given that they are the preferred acquirer, this market is up for grabs. As they acquire more clubs, free cash flow will grow larger over time, and that allows them to do larger acquisitions as club owners prefers cash payments.

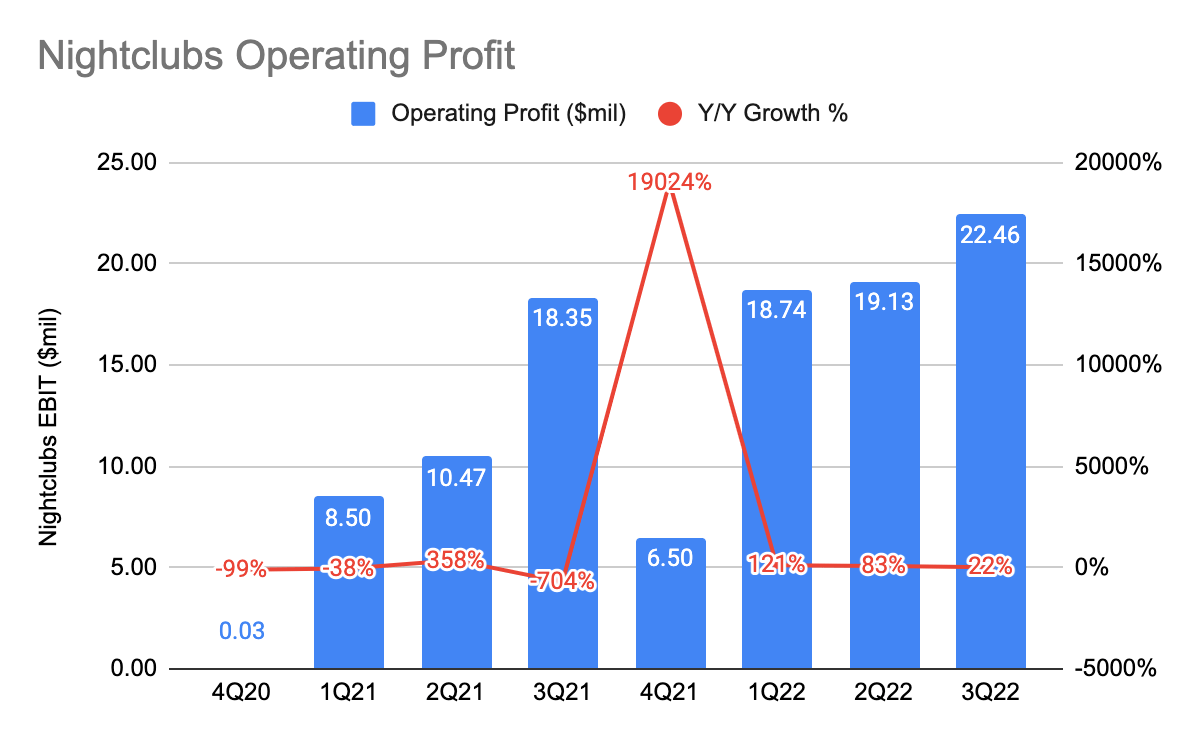

Image created by author with data from RICK IR Image created by author with data from RICK IR

Turning to profitability, its operating profit grew 22% Y/Y and attained a highly impressive operating margin of 44% – the 2nd highest quarter after 3Q21. Much of this was driven by the recovery in service revenue, in which COVID has previously musked the true profitability nature of the business.

As CEO Eric Langan put it, we are in the free cash flow business.

Some might be wondering, why are nightclubs immensely profitable? This boils down to a few reasons:

-

High margin (90%) service revenue. These are VIP spendings that incur little to zero costs to service their guests.

-

High margin alcohol (80%) with quick inventory turnover. When combined with economies of scale, they are able to get better pricing from suppliers to drive incremental savings.

-

Low maintenance capital expenditure. These include carpets, chairs, sound equipment, etc, which do not require much maintenance. Therefore, it is not expensive to keep a nightclub running.

-

Strong pricing power. They are able to pass on food price increases to customers during inflationary periods.

I like to call this a printing machine.

Enough said about this segment, so let’s turn to Bombshells.

Bombshells

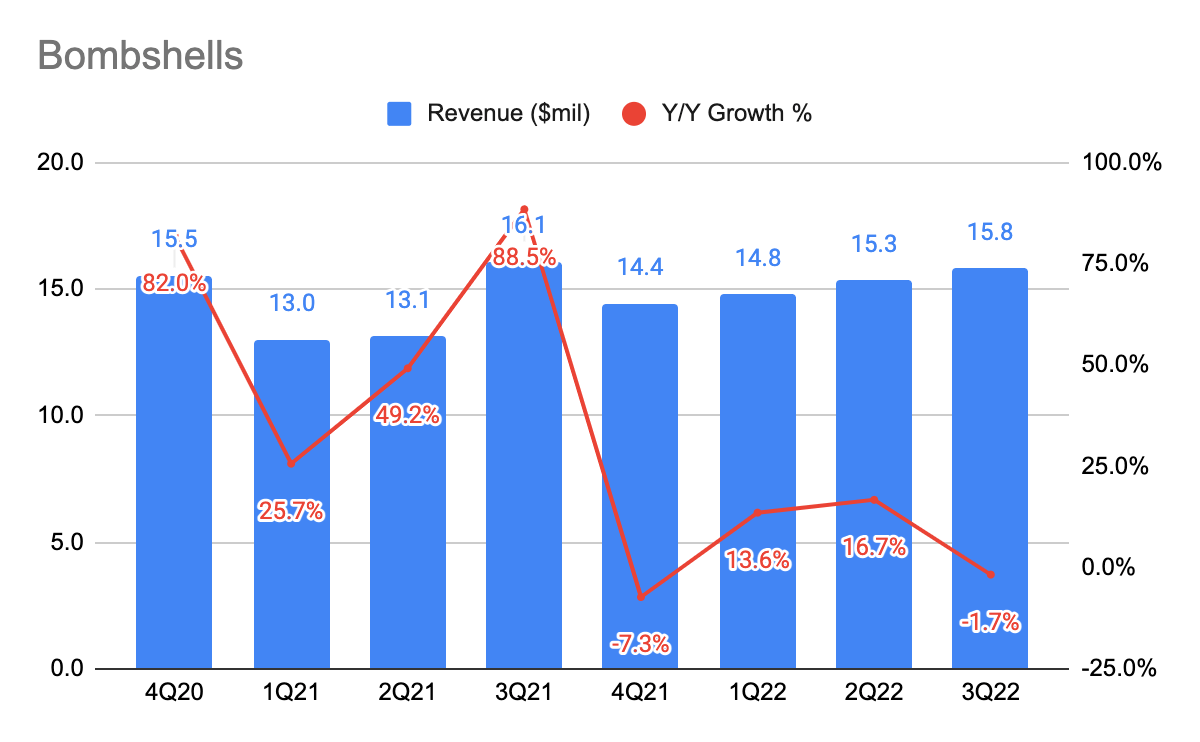

Image created by author with data from RICK IR Image created by author with data from RICK IR Image created by author with data from RICK IR

It was not surprising to see Bombshells declining revenue growth considering that they are growing off really tough comps during the pandemic:

…revenues declined 1.8%…due to a tough year-over-year comparison against an unusually strong third quarter in fiscal 2021…was our record highest revenue quarter…That’s when Bombshells sells and margins experienced a huge benefit from being one of the few bars and restaurants open in Texas due to the state of COVID…

As COVID restrictions eased, competitors began to re-open, and that caused traffic volume, and sales to decline. We are now seeing normalizing growth as we enter post-COVID.

Image created by author with data from RICK IR

(The AUV is calculated by taking the last 12 months’ revenue divided by the total number of units)

While revenue has come down from its peak, the average unit volume (“AUV”) has held up relatively well ($5.48m) compared to a year ago ($5.77m). This means that on average, each unit is still seeing strong traffic and sales.

Years ago, the management has cracked the code on how to run Bombshells – by placing them in class A locations with high traffic volume, and since then, they have been extremely successful. Its newest and best-performing unit, Bombshell Arlington has a revenue run rate of $6.5m to $7m, and this is higher than its AUV.

To quote CEO Eric Langan from this quarter’s earnings call:

We’re super high traffic, high flow areas…we have certain operational advantages with our history of being in the business for so many years…we’ve fortunate and very strong that all of our locations are profitable…haven’t had any real competition…oldest location’s been there for over 10 years…Most of our locations are going on four to seven years old right now…we’ve proven the concept works for over 10 years now…

During the quarter, they have already secured the properties for the 2 more units and they are also in talks with other potential franchisees.

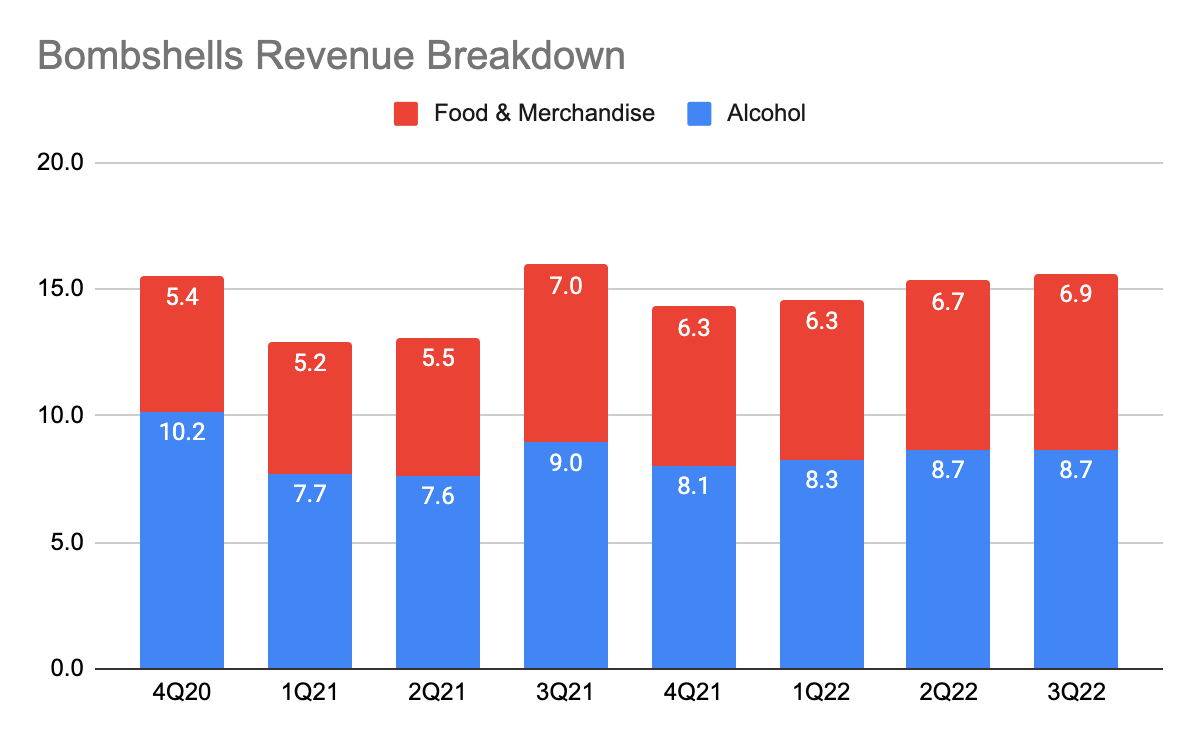

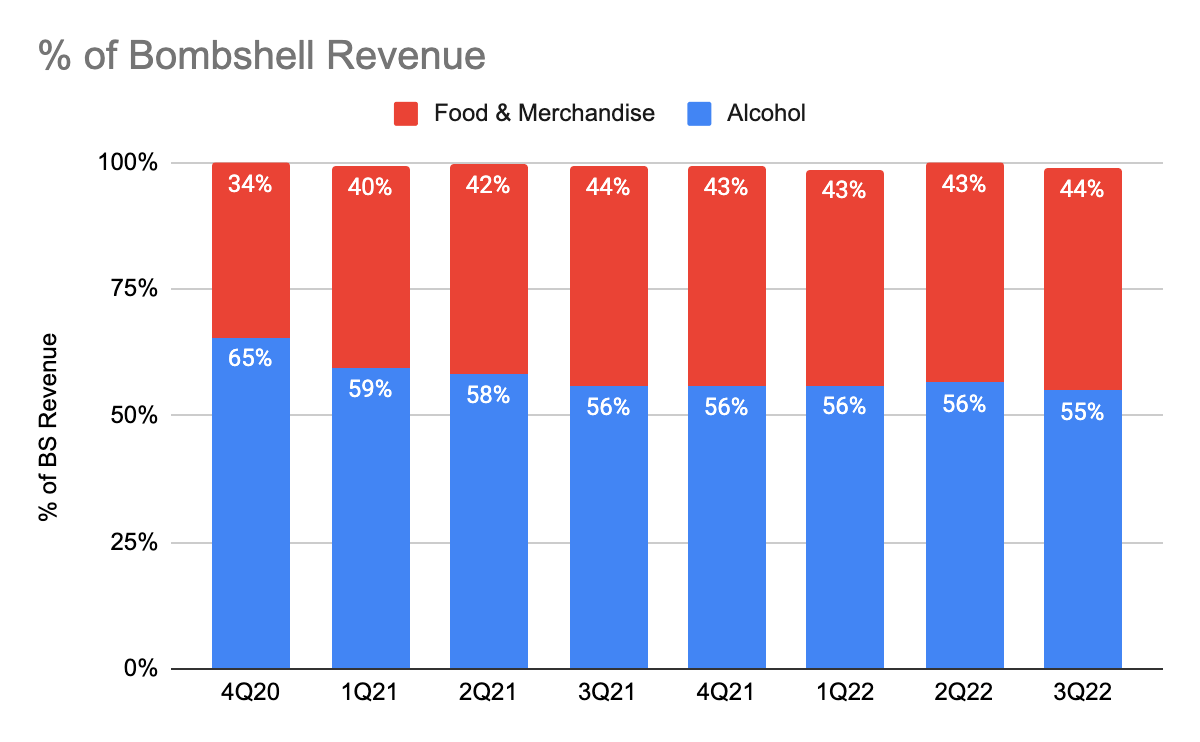

Image created by author with data from RICK IR Image created by author with data from RICK IR

Bombshells’ operating profit and margins have also obviously declined given the declining revenue.

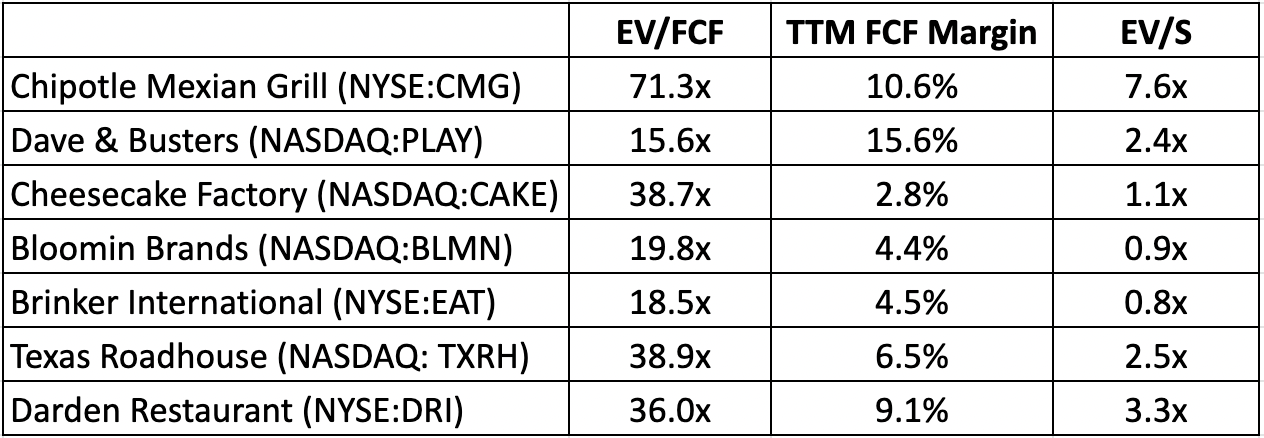

Its current operating margin of 19% is a better reflection of its normalized margins, which is still higher than its restaurant peers like Chipotle Mexican Grill (CMG) and Dave & Buster’s (PLAY). This is mainly because they sell high-margin alcohol sales, with the ratio of alcohol to food & merchandise revenue being 55%-44%.

Overall, this was a great quarter for Bombshells.

Free Cash Flow

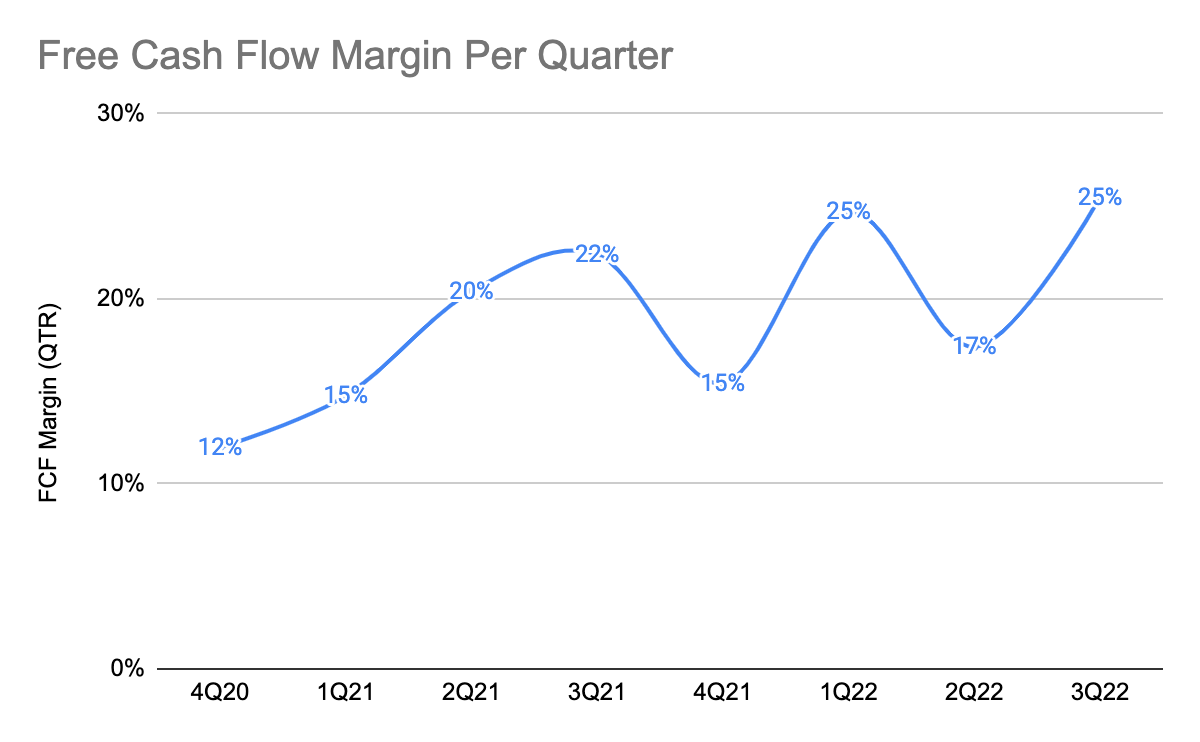

Image created by author with data from RICK IR Image created by author with data from RICK IR

Given the strong rebound in nightclub’s service revenue and a one-off $2 million tax refund, they brought in $18 million worth of FCF (+39% Y/Y), making this the highest FCF quarter. This brings its year-to-date (“YTD”) FCF to $44.4 million (+61% Y/Y). As of 3Q22, its FCF margin is 25% and its YTD FCF margin is 23%.

They have also been consistently surpassing their internal goal:

I’ll tell you, I pushed my personal goal. I know we’re 10% to 15%, we’ve been doing about 20%. I think 2022 will end it over 30% free cash flow growth. And I think that, right now, 2023 is headed to be another 30%-plus year…So, it’s very exciting right now.

These past few quarters’ results are becoming a better representation of how cash-generative the business is in a post-COVID era. By acquiring more clubs and building out more Bombshells, its FCF will expand larger over time, enabling them to larger acquisitions like Lowrie, which is their biggest club acquisition to date.

Let’s now head into the valuation portion.

Valuation

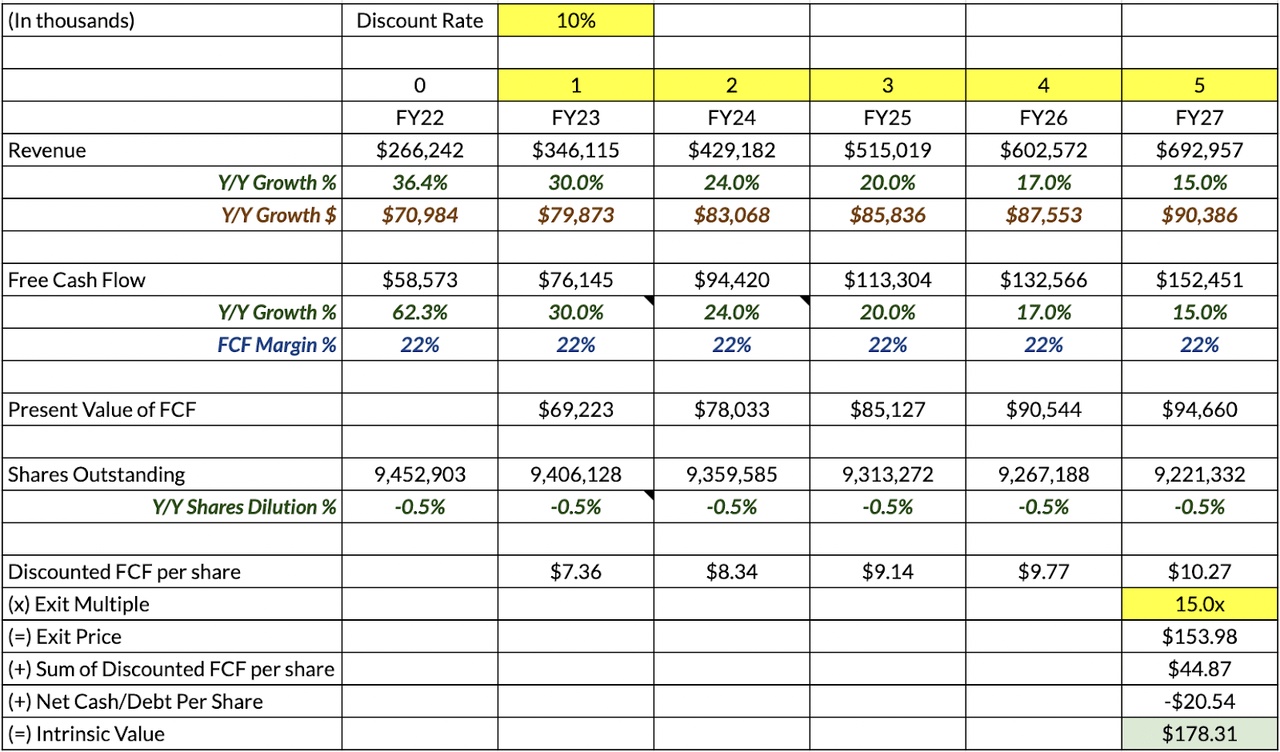

Author Estimates

Let me walk you through the certain assumptions I’m making and how I derived the numbers in my discounted FCF valuation model.

1) I’m expecting a minimum expected return (discount rate) of 10% as I am benchmarking against the S&P 500.

2) 3Q22 revenue came in at $70 million, and since the second half of every year is seasonally weaker quarters, I’m also expecting $70 million for 4Q22 too. This brings us to total revenue of $266 million by the end of FY22.

3) CEO Eric Langan guided for a 30% Y/Y FCF growth for FY23. Using the same YTD FY22 FCF margin of 22%, this gives us a total revenue of $346 million by FY23.

4) Assuming that they continue to add $20 million in EBITDA every year, this means that they have to add similar amounts of revenue to maintain their target.

Since the difference between FY23 and FY22 revenue is $79 million, I am expecting the same amount of revenue to be added from FY24 to FY27. My assumption of 22% FCF margin remains unchanged.

With a 10% discount rate, this gives me the revenue and discounted FCF for each fiscal year.

5) I will be using the average growth of shares outstanding from FY17 to FY21 as a proxy for shares dilution, which is negative 0.5%.

RICK’s management is careful not to dilute shareholders (rarely issue equities), and along with share buybacks, I believe this is reasonable. Using this, I can find out the discounted FCF per share.

6) When comparing RICK against its restaurant peers with lower FCF margins, I believe a 15x multiple is reasonable. This gives us an exit price or terminal value of $153.98 by FY27.

TIKR

7) Finally, after adding in the sum of discounted FCF per share and net debt per share into the exit price, this gives me an intrinsic value of $178.31 by FY27.

Do note that as valuation is dynamic, there can be multiple nuances that could affect the overall intrinsic value, such as increasing recessionary concern and management’s inability to execute the roll-up strategy could slow down revenue and FCF growth. Do conduct your own due diligence to see if my assumptions make sense.

Risks

Recessionary Concerns

A recession can lower consumer confidence, and that in turn can slow down consumers spendings. As a result, revenue and profitability will decline. While they have yet to experience any slowdown in spending, I will not rule out the possibility that it may impact RICK. This is an external factor that is not within the management’s control.

Low Multiples Capped As A Sin Stock

I’ve seen many investors screaming for a higher multiple as RICK with a higher FCF margin is trading at a multiple lower than its restaurant peers. However, it is a sin stock, so it continues to trade at low multiples.

If you recall, Adam Wyden previously raised a good point on how the management was able to execute the Lowrie deal because the stock was trading at a higher multiple. Share prices are important for companies because lower share prices create more dilution, and we all know that the management is extremely careful not to dilute shareholders.

With equities, CEO Eric Langan believes they could grow faster:

“If our equity becomes our cheapest cost of capital…we’re able to grow at a much higher rate. We keep these top ROIs, that we’re doing at 25%, 30%, cash on cash. The differences they’ll go up even higher because we won’t be having those huge interest expense payments if we’re able to use the equity.”

This isn’t necessarily a risk, but something to take note of when investing in RICK.

Execution Risk

As RICK grows larger, they either have to accelerate the number of deals they are doing or do larger acquisitions to maintain its revenue and FCF growth. Both of these represent huge execution risk.

Concluding Thoughts

Here’s a recap of what I have covered so far:

Nightclubs service revenue rebounded strongly as they attain an impressive operating margin of 44% during the quarter. As to the roll-up strategy, it has been executed brilliantly. While bombshell’s revenue has declined drastically primarily due to tough comparisons, it’s still an impressive quarter as AUV has remained relatively unchanged and margins are still significantly higher than its restaurant peers.

Yet again, the management has continued to impress me with their execution by gobbling up market share in the nightclub industry and consistently building out highly profitable Bombshells. Their ability to execute, not just once, but over multiple quarters has given me ample confidence that they can continue to replicate the same success playbook to build an even more profitable business (with expanding FCF) over time.

However, like all businesses, RICK is not without risk. It is incredibly important for you to consider the risks mentioned, and possibly others that are not talked about here.

Finally, I like to also hear your thoughts on the quarter in the comments section below, and I’d appreciate any feedback as well.

Be the first to comment