Trio Images/DigitalVision via Getty Images

RCI Hospitality Holdings Inc. (NASDAQ:RICK) is a company that operates two business segments, Nightclubs and a sports bar and restaurant chain called Bombshells. Both businesses are well-oiled machines that generate lots of free cash flow for the business.

In this article, we will be accessing RICK’s recent Q1’22 quarterly results, and before we do, do head over to our previous article for a deep dive.

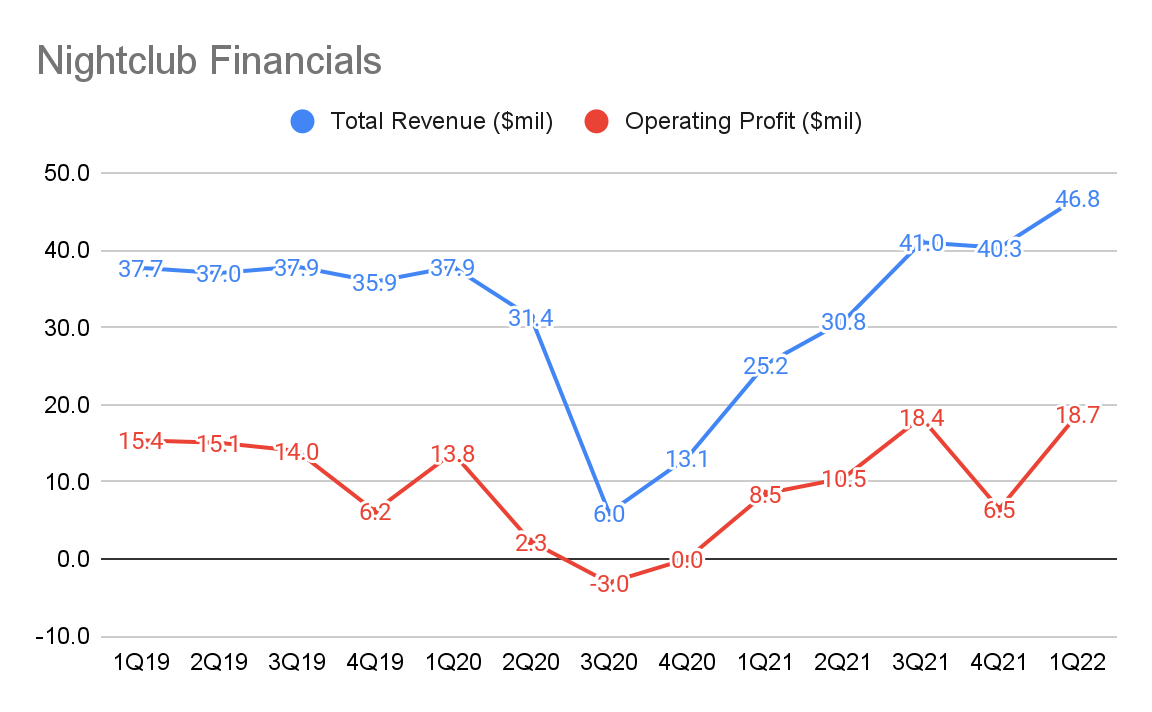

Nightclubs

RCI Hospitality

Since the segment of Nightclubs contributes roughly 75.7% of the entire business, shall we look at the latest results?

During the quarter, the Nightclub’s revenue grew 86% annually to $46 million. This was assisted with the recent addition of clubs and the gradual resumption of existing clubs. The new clubs contributed $6.3 million in revenue and $1.7 million in operating profit.

According to CEO Eric Langan in his recent earnings call, he mentioned some clubs are still not operating at full capacity. Without the recent clubs, nightclubs were doing a combined revenue of $40 million and adjusted EBITDA of $14 million in pre-pandemic levels, and they are expected to resume or exceed these numbers in Q2’22 to Q3’22.

This means that it is highly likely that we will see higher revenue and profits in the upcoming quarters.

The same-store sales were up 31% for the nightclubs.

In some companies, we observed that acquisitions are often used to mask slowing growth in existing businesses. Over here, we have a rare case where we have a disciplined capital allocator who is able to acquire sensibly, improve on acquired assets and grow existing nightclubs. We do not want a company to be overly reliant on acquisitions to grow.

RCI Hospitality is meeting our expectations.

RCI Hospitality

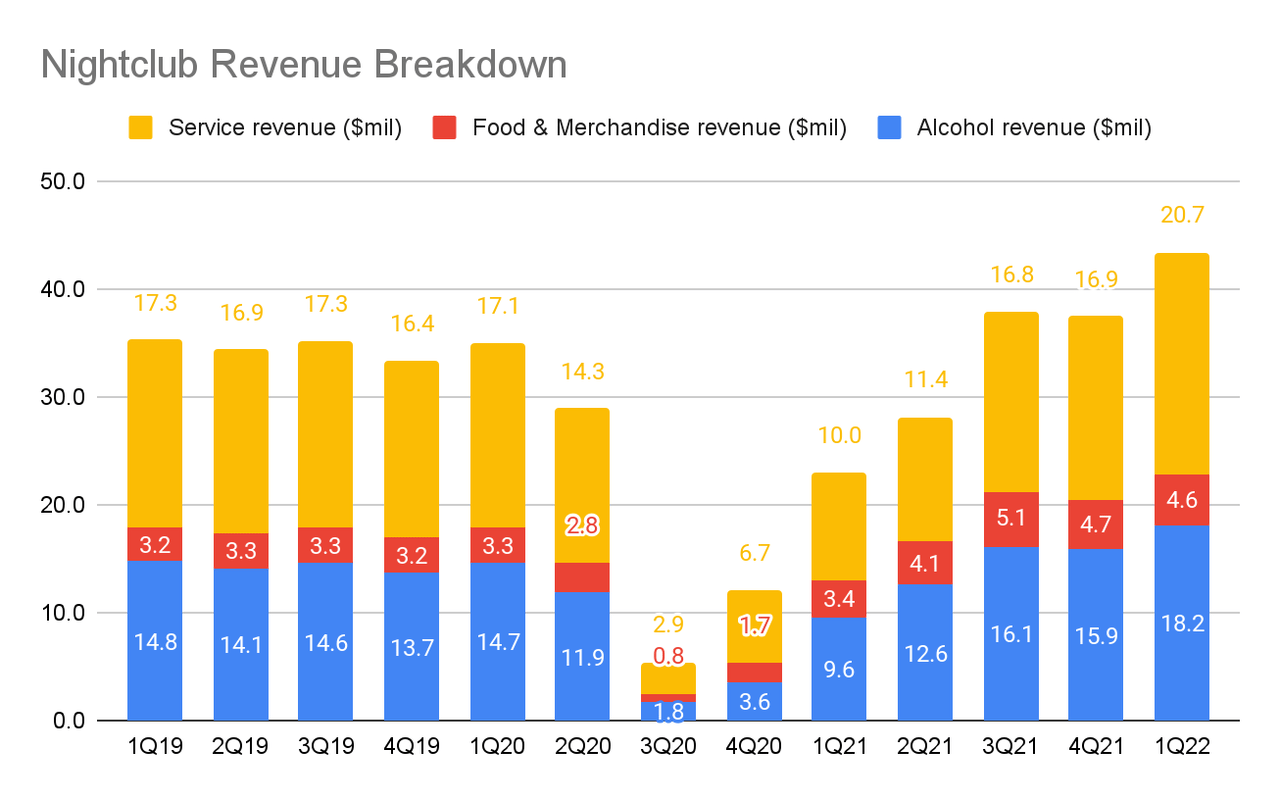

Diving deeper, the overall revenue was mainly driven by the increase in alcohol sales, and the service revenue as the high-margin VIP spending rebounded strongly in the quarter.

As a result of the increased sales volume and rebound in service revenue, operating leverage also kicked in as the Operating Profit (“EBIT”) grew at a faster rate of 121% compared to its revenue growth of 86%. This lifted the operating margin to 40% since the pandemic struck in FY20.

It’s very rare to see a hospitality business commanding a 40% operating profit margin. This definitely speaks of the operational efficiency each nightclub has. In any case, there could be a transfer of management knowledge to help acquired clubs to improve their margins too.

Lastly, its service revenues are expected to perform strongly during the same timeframe – driving even higher margins for the business.

Soft Launch of AdmireMe

AdmireMe had also announced its soft launch in which they are expected to onboard 1,000 girls out of the 10,000 girls available. According to CEO Langan, AdmireMe is going to be a highly synergistic business to its nightclubs:

I want to get 1,000 girls or creators on the site that, that is our initial goal. To put 1,000 creators – new creators on the site from our clubs and our partners’ clubs. I think that’s – it’s going to be a very, very powerful and significant try for us, plus it’s going to increase our brick-and-mortar, I think frequency because a lot of guys are – we have a lot of really pretty girls that work for us and guys get intimidated. But they can find them on the Internet, they can chat with them, message back and forth, maybe get a little more comfortable and then be able to come into the club.

This shows that not only does AdmireMe help to drive more traffic to the nightclubs, it also enhances the customers’ stickiness as customers go wherever the girls are. We should expect more repeated visits, more regular customers or more VIP customers. We think AdmireMe is an excellent business idea that allows customers to continue their club experience when they are back home or attract customers to the clubs. The company is likely to incentivize its creators by giving a reasonable commission for every transaction on the site – helping their girls earn more money.

We believe this will help Nightclubs attract more girls to work for them as opposed to other clubs that do not have this extensible model.

Maybe one of us should scuttlebutt and sign up for an account to see if it entices us to spend money. Any volunteers?

Club Acquisitions

The management also states that they are looking to do similar-size acquisitions like the multi-club acquisitions that they did recently, which are proven cash generators.

Last quarter, CEO Langan said that this multi-club deal they secured had generated a lot of interest for them:

The current acquisition that we just did was a 5x EBITDA acquisition for some great locations, like you said, four new markets and we dominate in those markets with those locations. And basically some of them, they are the only locations in those markets. So we’re very excited about that. It’s woken up some other owners that have some quality clubs…there are certain clubs that in certain markets where I’m going to pay 3x to 4x. And then there’s some, what I call supermarkets, that I would pay a higher multiple for and certain clubs. And so I’m getting calls from some of those owners now.

In any event, any club owners want to sell their clubs, we believe RCI Hospitality will be among the top few they will reach out to. RCI is a reputable, well-respected, and cash-rich company in the industry. This puts RCI in an advantageous position to consolidate the industry.

Some websites like Ibis World are putting the number of bars and nightclubs to approximately 60,000, we believe there is an extremely long runway to grow via acquisitions.

By the way, here is a fun fact. CEO Langan has his own Twitter account and you can see what interests him.

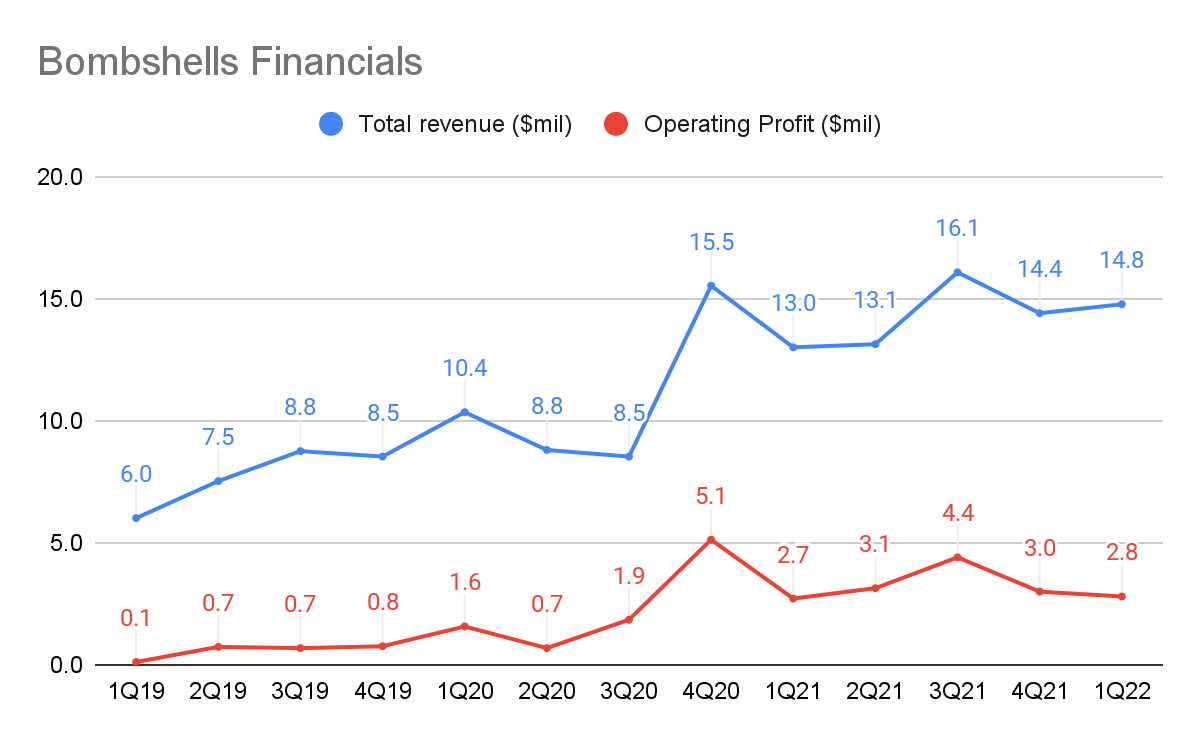

Bombshells

RCI Hospitality

During the quarter, Bombshell’s revenue grew 14% annually to $14.8 million, driven by the sales from existing units as well as the addition of the new Arlington location, which contributed $794,000 (or 45%) of revenue in the quarter since its opening in early December.

According to CEO Langan, the Operating Profit and Operating Margins were affected by more than 2 months of pre-opening costs with no sales at all. So, we should expect to see higher revenues in the next quarter as it includes the full quarter sales from Bombshell Arlington.

RCI Hospitality

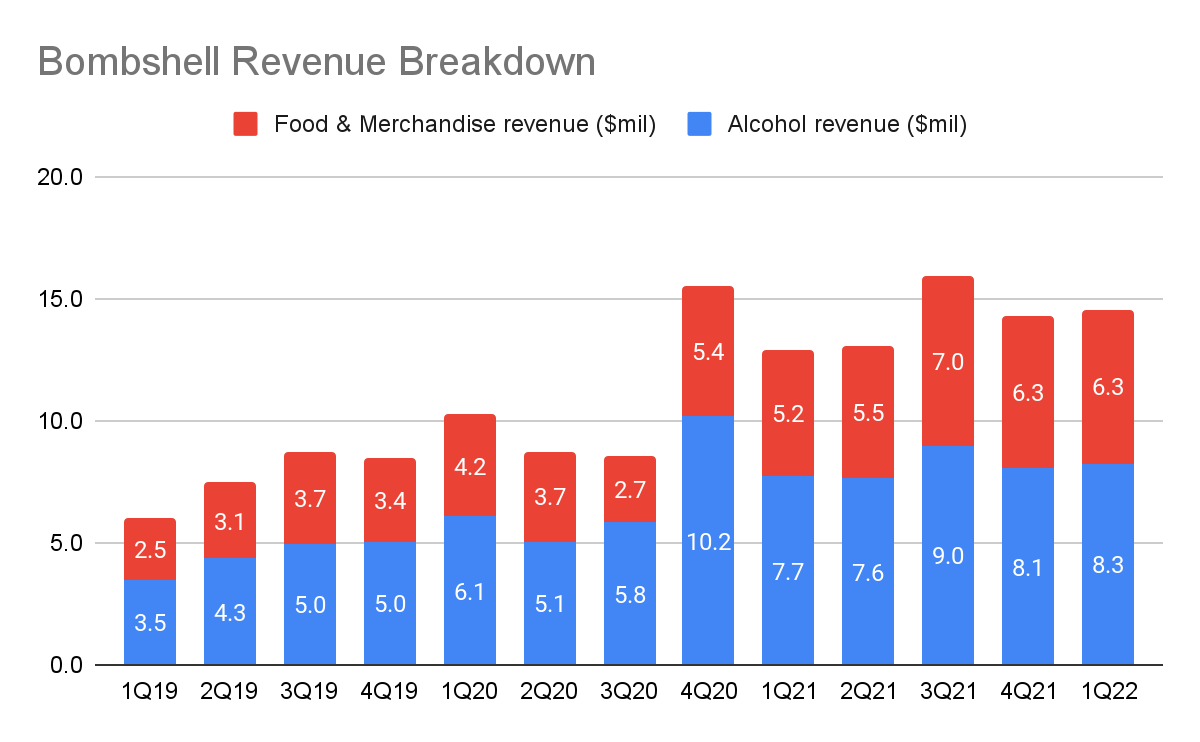

Diving deeper into the breakdown, the overall revenue was mainly driven by the increase in alcohol and food & merchandise sales from existing units.

In addition, the management was also able to pass on the rising food costs to its customers.

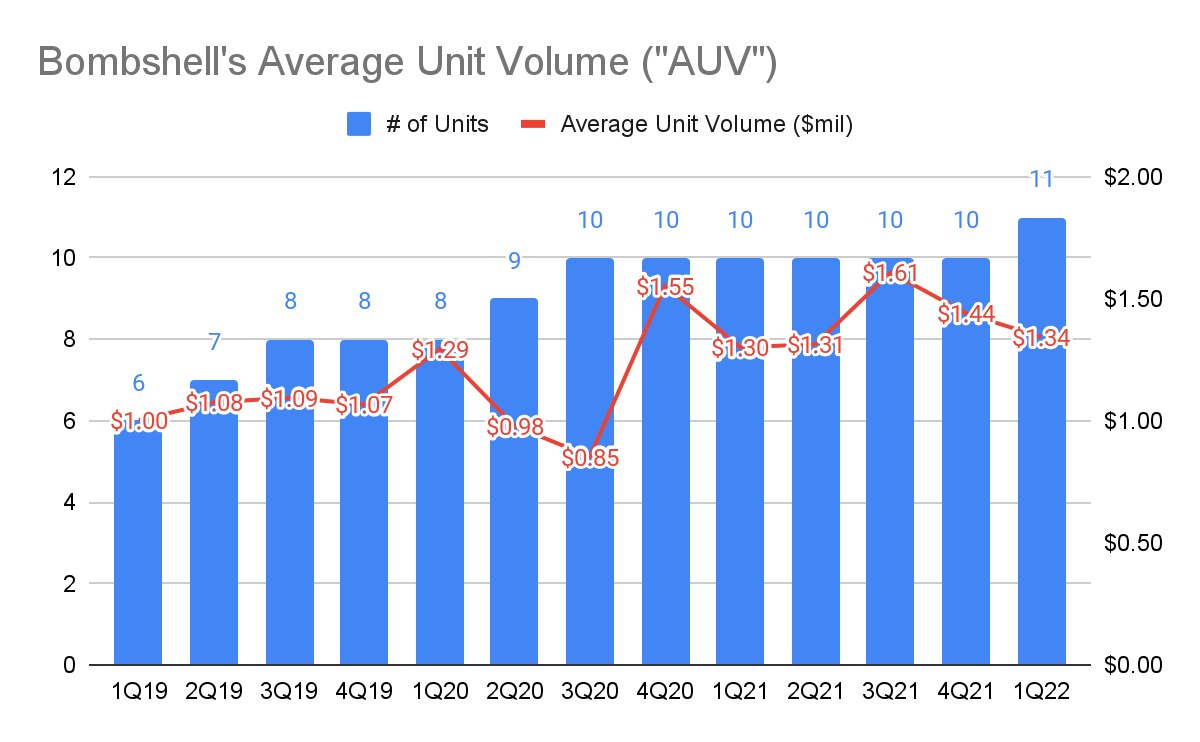

Average Unit Volume (“AUV”)

RCI Hospitality

Despite not including the full quarter sales from Bombshell Arlington, we can see that Bombshell’s Average Unit Volume (“AUV”) remains stable at $1.34 million versus a year ago.

If we assume that Bombshell Arlington continues to generate $794,000 a month, this means that its next quarter AUV should be roughly $2 million, which is substantially higher than its current AUV.

During the Sidoti Conference, CEO Langan states that Arlington is their top location which is running at $10 annual revenue. Hence, we will likely see a higher AUV in the next quarter.

For investors, it is important to measure the AUV as it tells us whether existing and new units are performing well. When the AUV increases, it shows that the management is getting better at executing Bombshell’s concept, and at identifying great locations.

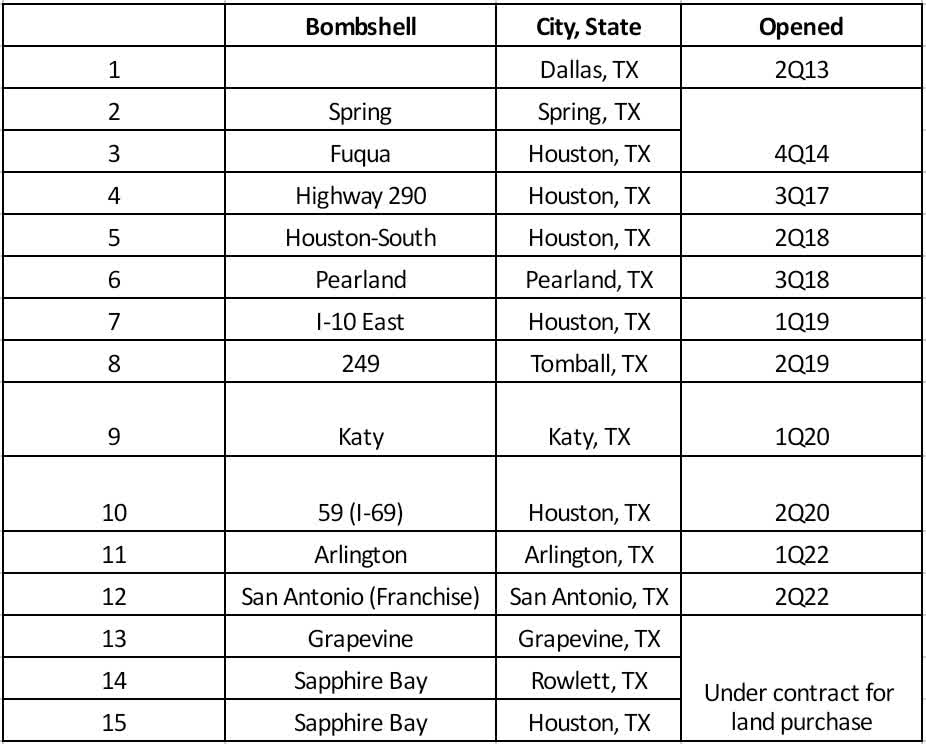

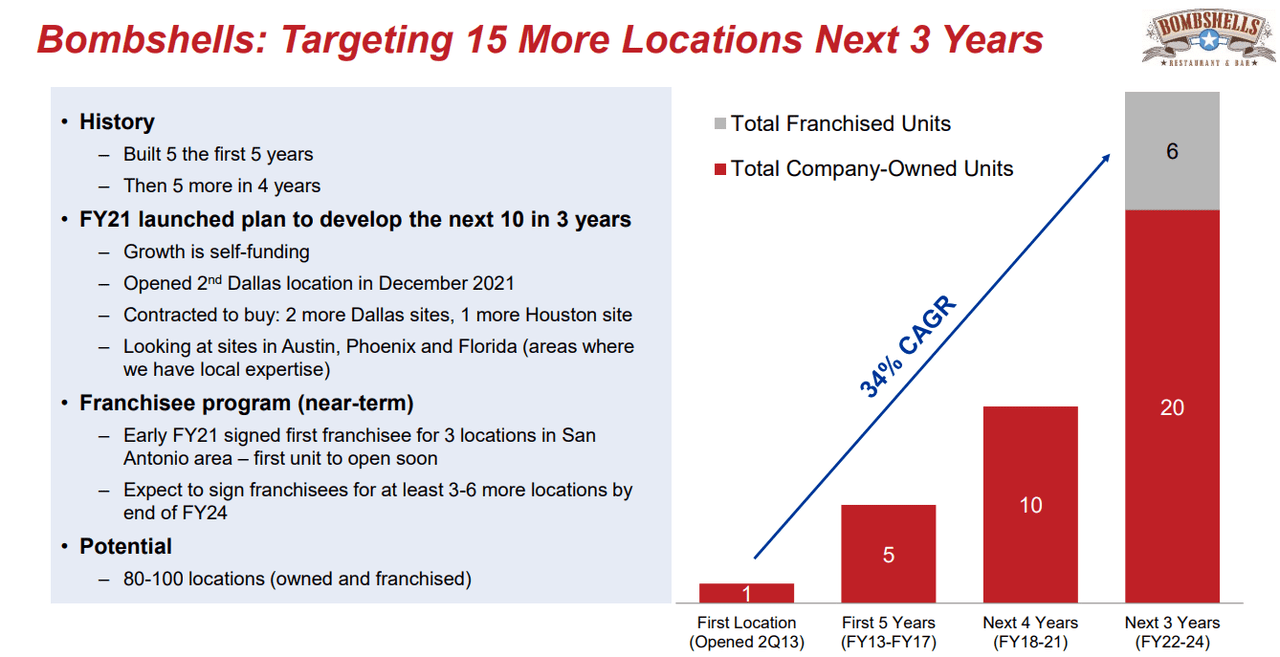

Opening More Locations

RCI Hospitality

As of this quarter, this brings Bombshell to a total of 11 units, with the first franchisee San Antonio location coming in Q2’22.

ICR Conference 2022

Previously at the ICR Conference, RICK management mentioned that they are looking to reach a total of 20 company-owned and 6 franchised units at the end of 2024.

And during this quarter’s earnings call, CEO Langan stated that they are looking to add 12 to 15 locations in 2025, assuming that 2026 follows the same growth trajectory.

This means that at the end of 5 years (2026), we should expect a minimum of 50 units, with a mix of both company-owned and franchise.

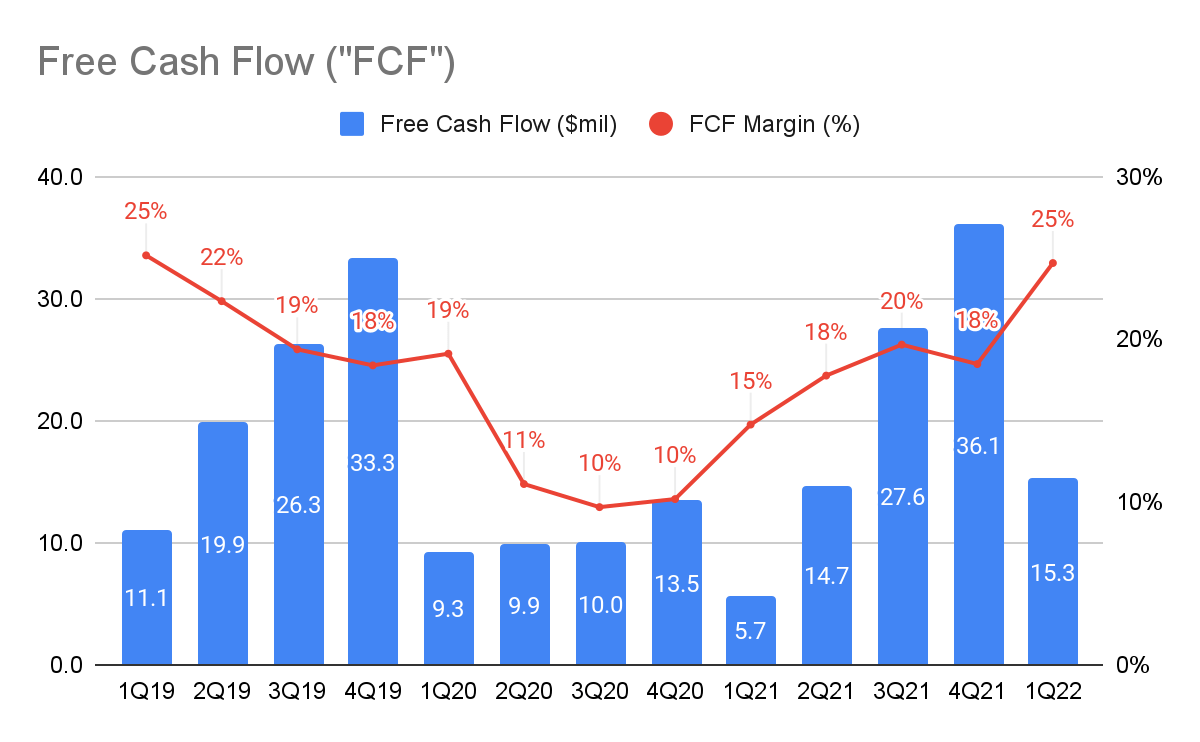

Free Cash Flow

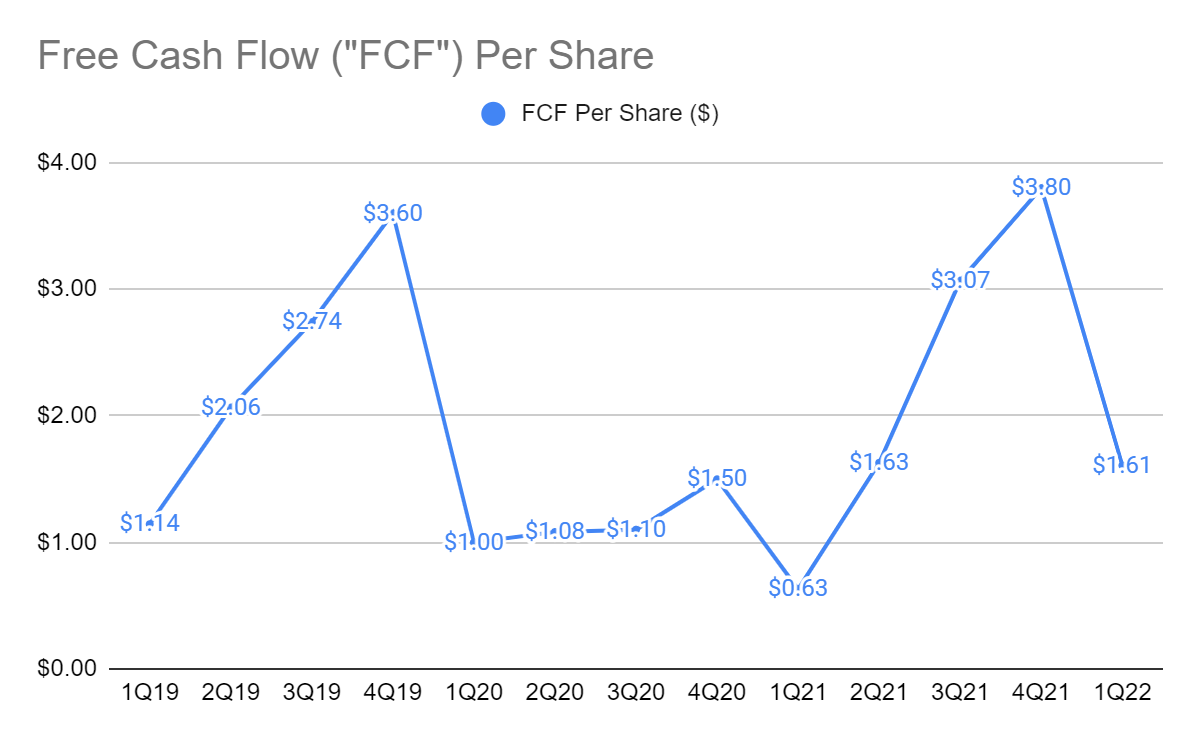

SEC Filings by RCI Hospitality

We are using the non-GAAP free cash flow which refers to net cash provided by operating activities less maintenance capital expenditures. We believe this captures the true cash flow ability without having distortion from growth capital expenditures.

Due to the increased sales volume from nightclubs and the new club acquisitions, the FCF grew 155% annually to $15.3 million. This also led to the drastic improvement in FCF margin as it reached 25% in the quarter as nightclubs sales recovered.

SEC Filings by RCI Hospitality

As a result, FCF per share reached $1.61 in the quarter, which is a 155% growth from a year ago.

Considering that vaccination rates continue to rise and as nightclubs resume normal operations, we believe FCF will continue to improve in the upcoming quarters, and FY22 FCF per share may even exceed that of FY21.

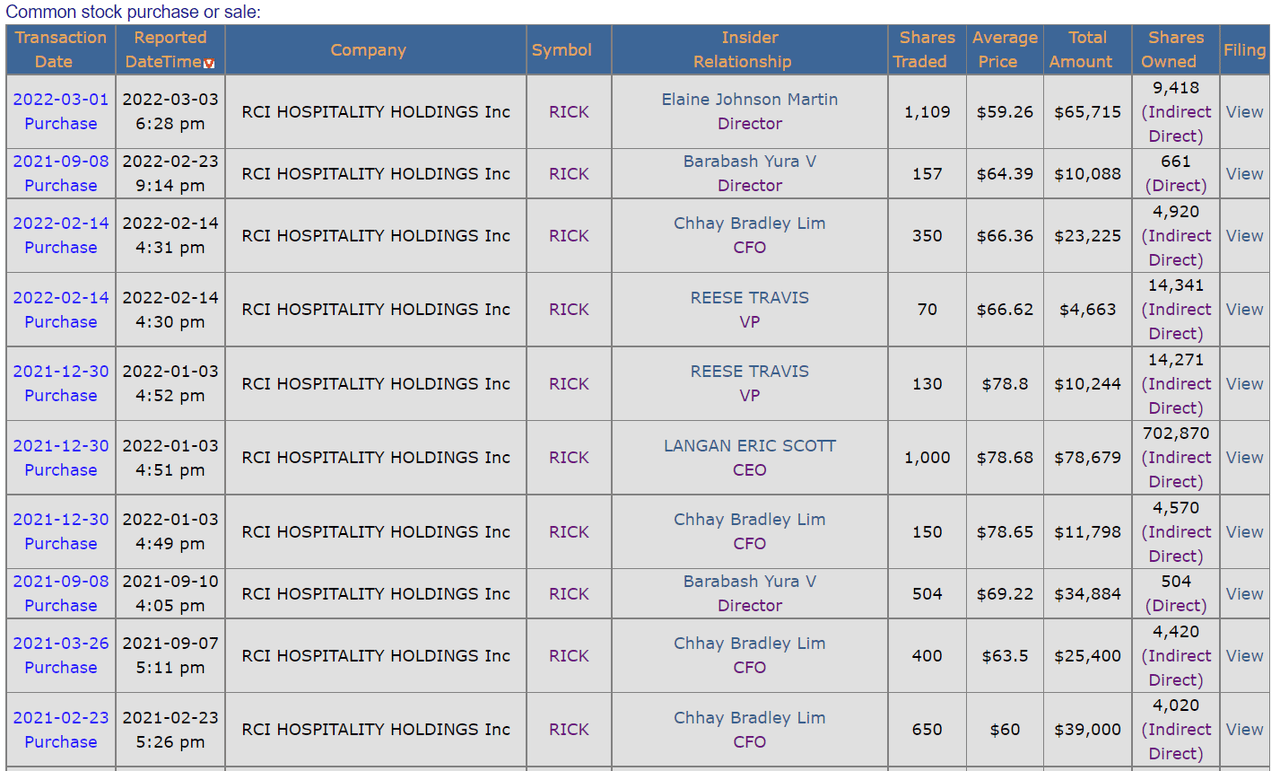

Insider Purchases

According to SEC4form.com, a number of insiders bought shares between prices of $78.8 to $59.26. Usually, in some companies, it could be seen as propping up the share price or project confidence.

We think the purchases made by their CEO, CFO and Director were somewhat substantial.

SecForm4

Valuation

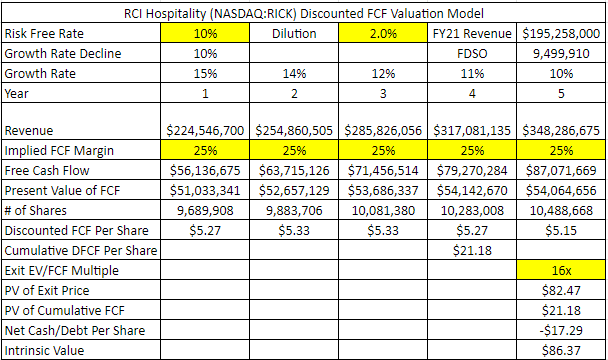

Author’s Own Estimates

Using the Discounted Free Cash Flow model, we are assuming a 15% growth rate for the next year, followed by a 10% growth decline till the end of year 5, which is equivalent to a revenue CAGR of 12%. This is factoring that nightclub operations will gradually resume to full operations as vaccination rates in the U.S. continue to increase despite the Omicron virus, and the addition of new clubs and Bombshells.

We believe there is a possibility where RCI Hospitality could outperform our growth estimates thus we deem our valuations to be a conservative one.

Risks

Rise of Omicron Virus

-

Depending on the severity of the Omicron Virus, RICK businesses may be impacted. For instance, employees that got tested for COVID positive may render RICK unable to operate at full capacity. However, CEO Langan mentioned during the quarter that the nightclub’s sales in Feb and March did not get impacted by the Omicron. Moving forward, it still remains uncertain how it may impact its operation.

High Food and Labor Costs

-

The management did indicate that they were able to pass on the food costs to the customers, but if food prices are too expensive, they may have to absorb the costs which may affect the short-term profitability of the business. And by opening more units, the company needs to hire more talents to run their units, such as chefs, managers, waitresses, etc., and the shortages of manpower and the rise in wages may restrict the company from operating and expanding. This is our key risk entering into 2022 because inflation is driving wage costs.

Ability To Raise Capital At Low Cost

-

As RCI is dependent on bank financing to make club acquisitions, typically in a higher interest rates environment, banks may raise interest rates which can affect the RCI’s ability to get financing at attractive interest rates.

Conclusion

During the quarter, nightclubs showed a strong rebound as sales volume increased and gradually returned to pre-pandemic levels. This had led to the improvement in Operating Profit Margin as well as the Free Cash Flow margin.

On the other hand, Bombshell continued to show resilient growth as sales from existing units continued to grow.

Going forward, the management will continue to do multi-clubs acquisition and open more Bombshell locations, which are expected to contribute to its Free Cash Flow over time.

Lastly, based on our estimates, we believe that the intrinsic value of the business is $86.37, which continues to be undervalued.

Be the first to comment