Olivier Le Moal

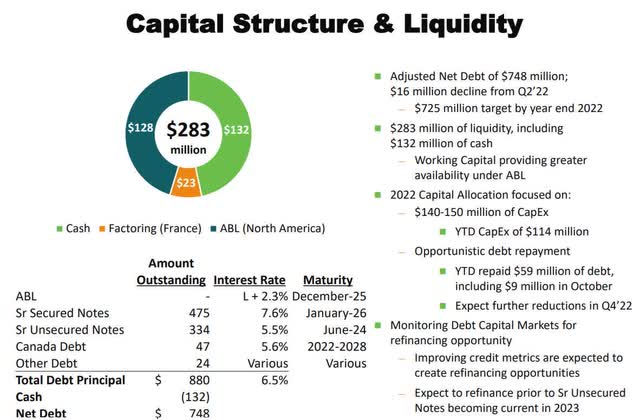

Rayonier Advanced Materials Inc. (NYSE:RYAM) is feverishly working to position itself to refinance its senior notes which are due in June 2024. To do so in a favorable way, the company must improve its credit metrics otherwise refinancing the debt at higher interest rates could be a major headwind.

The amount of senior unsecured notes due in June 2024 is $334 million, bearing an interest rate of 5.5 percent. In January 2026, its senior secured notes of $475 million are due and bear an interest rate of 7.6 percent.

In response to the need to boost EBITDA by reducing debt while raising prices in response to demand and supply chain constraints, the company was able to significantly increase EBITDA in its latest quarter.

In this article, we’ll look at some of the relevant numbers related to its current strategy, how the capital structure looks as refinancing its senior notes gets closer.

Related numbers

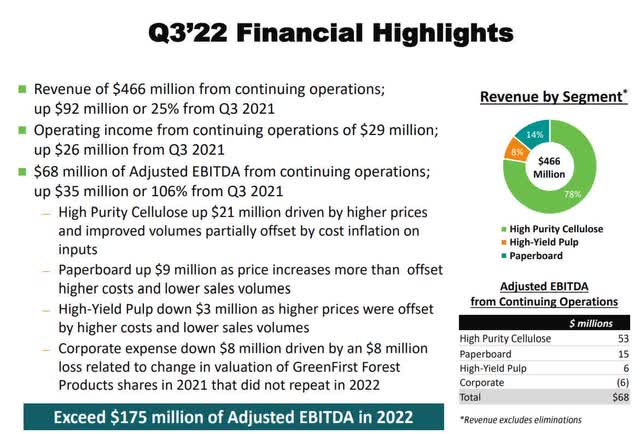

Revenue in the third quarter 2022 was $466 million, compared to revenue of $374 million in the third quarter of 2021.

Net income in the reporting period was $30 million, or $0.47 per common share, compared to net income of negative $(4.8) million, or negative $(0.07) per share in the same quarter of 2021.

Adjusted EBITDA in the quarter was $68 million, a gain of 106 percent year-over-year. The improvement was attributed to volume and price increases that “more than offset inflation.” Its High Purity Cellulose segment was the main catalyst, accounting for $53 million in adjusted EBITDA in the quarter.

Paperboard added $15 million to adjusted EBITDA, up 150 percent year-over-year, while High-yield Pulp added another $6 million in adjusted EBITDA to the total.

As a result of its strong adjusted EBITDA performance in the third quarter, RYAM upwardly revised its adjusted EBITDA guidance for full-year 2022 to over $175 million, up $15 million from its prior guidance.

Cash and cash equivalents at the end of the third quarter were $132 million, down from the $253 million at the end of calendar 2021. The company held long-term debt of $851 million as of the end of the third quarter. It lowered its debt by $16 million in the reporting period.

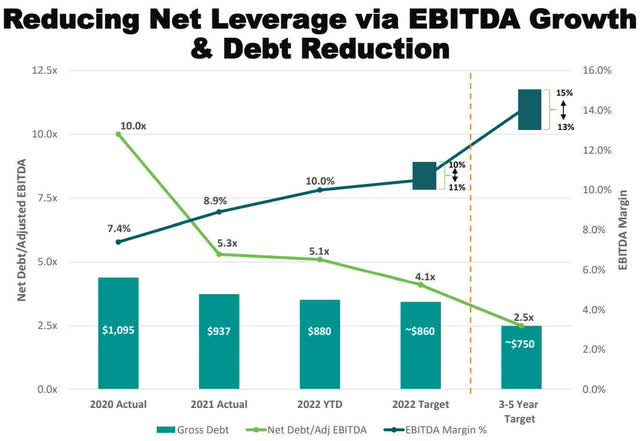

During the quarter, the company improved its net Debt to EBITDA ratio to 5.1x. That’s of course still high, but if it can continue with its improvement with adjusted EBITDA, it could bring it down to fairly reasonable levels by the time it’s ready to refinance the senior notes in June 2024.

Pricing power and cutting costs

With demand remaining strong for most of its products, RYAM was able to negotiate for higher volume and price increases in its cellulose specialty products, while also adding a $146 per metric ton surcharge in response to rising inflation.

In regard to specialty cellulose products, the company introduced a 20 percent increase in price related to small volume items. Management also stated that it had entered negotiations with its specialty cellulose products customers in order to “fully capture the fair value” of its products, i.e., raise prices.

On the cost reduction side of things, the company noted that it has been able to leverage its scale, cut back on material usage to lower costs, and focus on managing its discretionary spending.

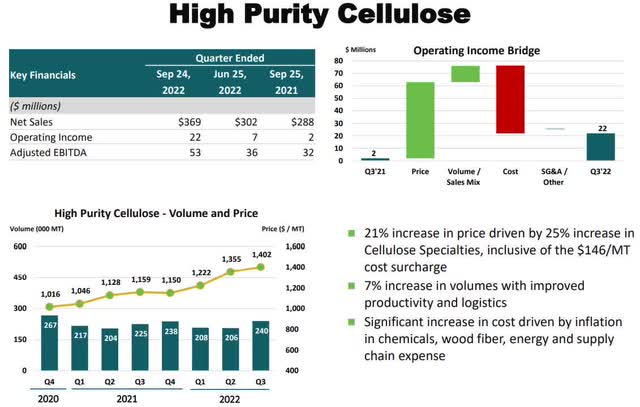

High Purity Cellulose

High Purity Cellulose is by far the largest segment RAYM competes in, and revenue in the third quarter came in at $369 million, with adjusted EBITDA of $53 million, compared to revenue of $288 million, or adjusted EBITDA of $32 million in the third quarter of 2021.

With the fourth quarter delivering the best performance in the segment over the last three years, it’s highly probable the company could get another boost in its share price, depending upon how its performance compares with Q4 of 2021.

And with Q1 and Q2 being the recent historically low producing periods for the High Purity Cellulose segment, it’s likely the share price momentum of the company will be under some pressure after the Q4 numbers come out, based upon probable taking of profits and the next couple of slow quarters.

Volume in the third quarter was up 7 percent, with a 21 percent increase in price, led by a 25 percent increase in Cellulose Specialties, which included the $146/MT cost surcharge.

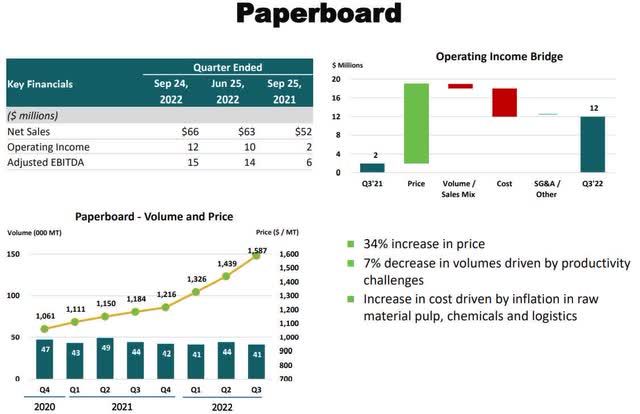

Paperboard

Its Paperboard segment generated $66 million in revenue in the third quarter, up $14 million from the $52 million in revenue generated in the third quarter of 2021.

Adjusted EBITDA in the segment was $15 million, up $9 million year-over-year.

There was also a 7 percent drop in volumes in the Paperboard segment, although the company was able to boost prices by 34 percent.

Over the last couple of years volume has remained somewhat flat, while its price has continued to climb by significant levels.

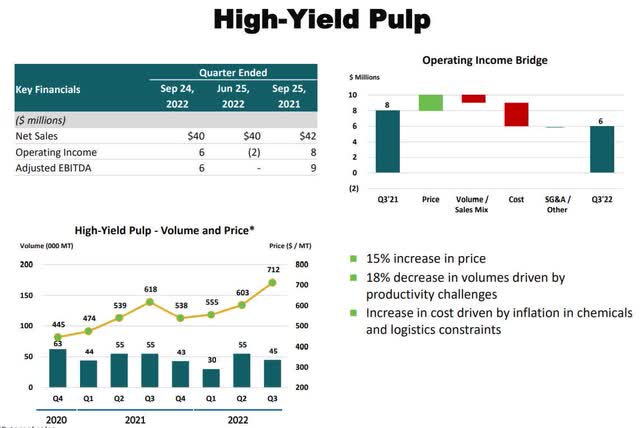

High-Yield Pulp

In its High-Yield Pulp segment, the company generated revenue of $40 million, down by $2 million from the $42 million in revenue generated in the third quarter of 2021.

Adjusted EBITDA in the segment was $6 million in the third quarter of 2022, down $3 million from the adjusted EBITDA in the third quarter of 2021. While the company was able to boost prices by 15 percent in the third quarter, volumes plunged 18 percent based upon “productivity challenges.”

Other factors were supply chain constraints and higher costs associated with chemicals.

Conclusion

The share price of RYAM has taken off since October 10, 2022, jumping from approximately $2.80 per share to its 52-week high of $9.06 per share on December 12, 2022. I has since pulled back to $8.15 per share as I write, and I tend to think it could go lower before rebounding.

The reason I think it’ll rebound, at least in the near term, is because of the aforementioned strong fourth quarters the company typically has. That said, the first two quarters of calendar 2023, based upon prior performance in the first half, are likely to put downward pressure on the share price of RAYM after the strong probability of it jumping higher as its next earnings report approaches.

Further out, I think under the current economic conditions, even with the recent pricing power of the company, it is going to struggle to regain momentum after the second quarter if we enter into a deeper and longer recession.

And with the Federal Reserve poised to raise interest rates at least a couple of more times before pausing, in my opinion, money is going to get more expensive, and it’s probably not going to come down a lot by 2024, once interest rates find a ceiling in the current cycle.

One big question in the quarters ahead is how much pricing power RAYM still has available if inflation remains high for longer than expected, and companies start to resist higher costs. If it’s able to retain pricing power while reducing costs, it may achieve its net leverage via EBITDA goal.

On the other hand, if EBITDA fails to meet expectations, it’s going to have a hard time when refinancing time arrives.

Be the first to comment