ThitareeSarmkasat/iStock via Getty Images

By Padhraic Garvey, CFA, Benjamin Schroeder, Antoine Bouvet

The US 10yr shoots back above 2.5%; more to come

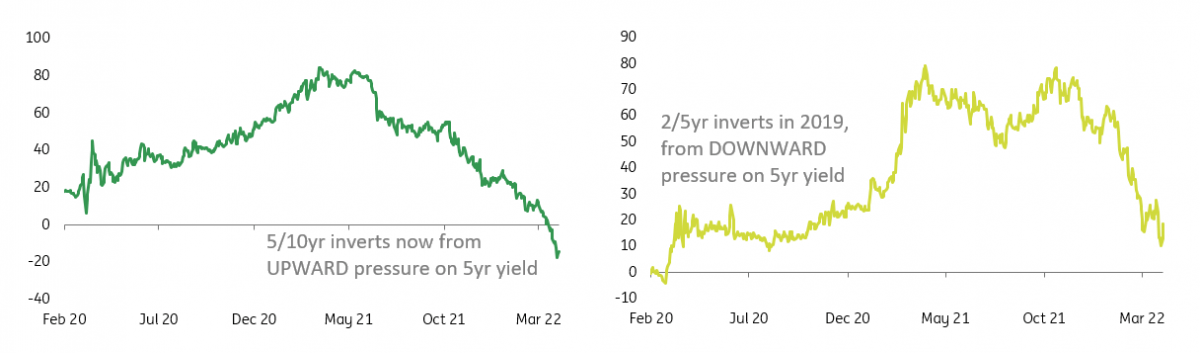

When the curve briefly inverted a week ago, it was the 10yr yield attempting to mark 2.5% as a peak. The question then was whether it was a local or a global peak. Well, it was clearly a local one, as the 10yr is now back above 2.5%. Also, the 2/5yr, which we are watching carefully, has re-steepened. The 2/5yr has not inverted so far. For us, it is the key recession and/or the end of the rate hike cycle precursor. As a recession predictor, the explanatory power from the 5/10yr segment is lower, and so far it is the 5/10yr that has dominated the inversion seen along the whole 2/10yr segment.

US 2/5yr and 5/10yr curves compared (bp) – they’re different… (Macrobond, ING estimates)

Another key point here is balance sheet roll-off. A reduction in liquidity in the system should increase its price, implying upward pressure on rates. The Fed’s Brainard has given this an extra boost by asserting that balance sheet roll-off is on the table from May. This places more upward pressure on longer-tenor rates, as these are less impacted, at least directly, by what the Fed is doing on the front end. This puts pressure on rates beyond 5yrs and out to 10yrs in particular. Hence the up-move there in rates.

Watch the US 2/5yr carefully. Steeper certainly means a bear market

The target for us is the 2.75% area for the entire curve. We could shoot to 3%, but the central view is that the curve tends to settle in the 2.5-2.75% area. From there, a spike to 3% could just as easily be followed by a subsequent capitulation lower in market rates, likely through a curve inversion from the back end. But we are not there yet.

Watch the 2/5yr going forward. The US curve will likely structurally invert. But when it does, watch the deepest dive to come from the 2/5yr. For now though, it’s not doing that – it’s steepening. That’s code for ongoing rising rates pressure.

Repo will be heavily impacted as balance sheet roll-off builds steam

It is also impactful for repo. The $1.6 trillion routinely going back to the Federal Reserve on its reverse repo facility is indicative of an excess of liquidity over available collateral in the system. This helps repo to clear at ultra-low rates, and often below the 30bp on offer at the Fed’s reverse repo window. As the Fed unwinds its balance sheet, some $2-3 trillion of securities will move from the Fed’s balance sheet back onto the open market, changing the liquidity/collateral balance, forcing repo higher, and reducing the need for liquidity to go back to the Fed.

There’s upward pressure on rates as a theme again out there as a consequence. We took a breather for a week or so, but the stars are aligning again for a further test higher. Friday’s payrolls set the scene, and balance sheet roll-off discussions are adding the required supply aspect to the conversation.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Be the first to comment