Khanchit Khirisutchalual/iStock via Getty Images

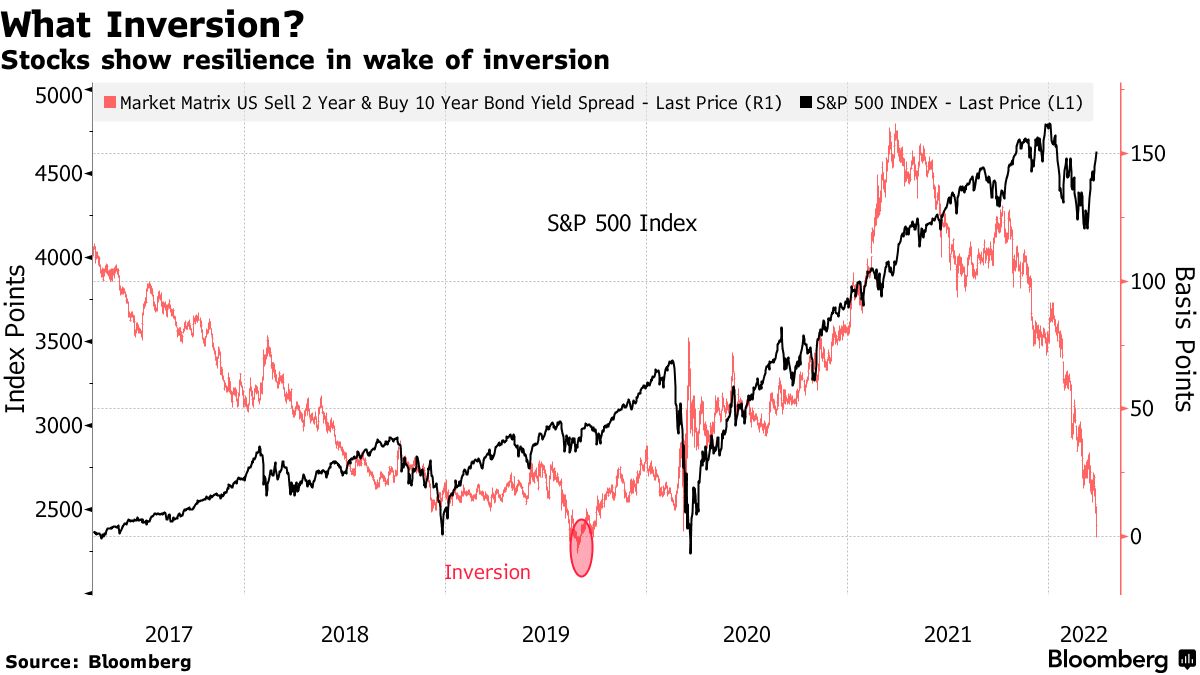

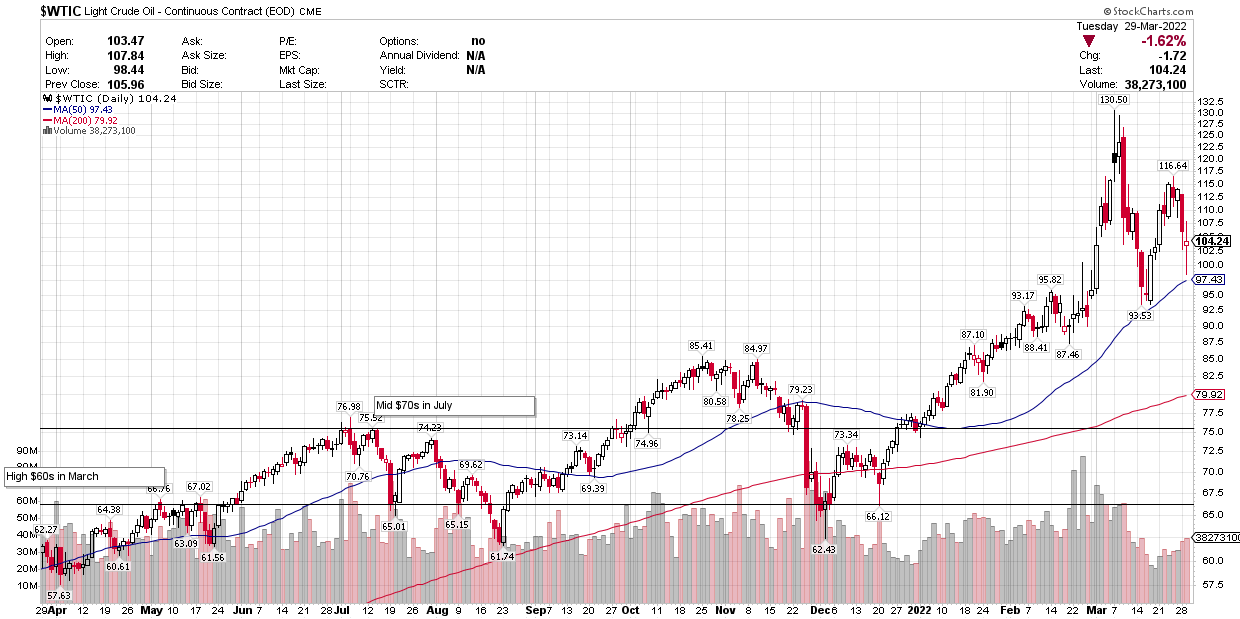

The major market averages continued to grind higher on hopes that cease-fire talks between Russia and Ukraine might lead to a de-escalation of the conflict, which was furthered by Russia’s chief negotiator stating Moscow was pulling back its military efforts near Kyiv and Chernihiv, but no formal agreements have been made. The spread between 2- and 10-year Treasuries turned negative yesterday for minutes before widening again to just 6 basis points, averting an inversion at the close, which also gave stocks a lift. WTI crude briefly fell below $100 a barrel before the open, resulting in energy being the only sector to suffer a loss yesterday.

finviz.com

The momentary inversion was entirely due to the 10-year Treasury yield declining, while the 2-year was unchanged, because cease-fire hopes led to a drop in oil prices, easing inflationary concerns. Hence, long-term rates declined for a good reason, which investors viewed positively. History has shown us that inversions need to last more than a day to have recessionary relevance. Yesterdays did not qualify. Now I am looking forward to a rate of change that results in a steepening of the curve in which long-term rates rising on the prospects of better-than-expected Q1 earnings and stronger economic growth moving forward. That should help propel the S&P 500 into positive territory for the year.

bloomberg.com

I focus on rates of change because they are far more important than absolute numbers. Is $100 crude oil a headwind or a tailwind for the economy? It depends on whether it has risen to $100 from $70 or it has fallen to $100 from $130. The former is clearly a headwind, while that latter is the opposite. As I wrote about on March 10, real-world supply and demand did not change to such an extent that it warranted a 40% increase in oil prices to $130, and when tensions inevitably ease on the geopolitical front, prices will fall as dramatically as they rose. We are well off what I asserted was the high in oil at $130, and I think the rate of change will continue to move in the right direction. That will be a tailwind for risk assets, as the S&P 500 bottomed within days of the peak in oil prices.

stockcharts.com

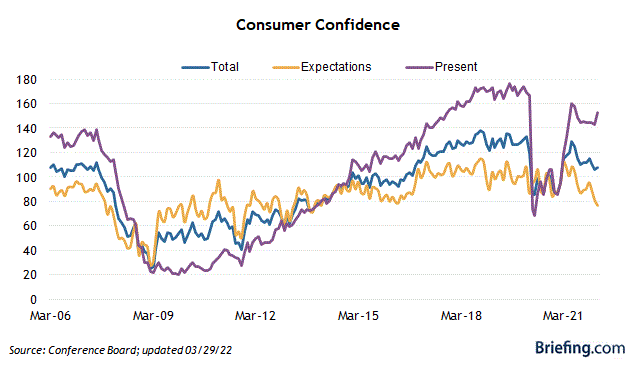

By the same token, I think we will see consumer confidence levels start to improve as oil and other conflict-related commodity exports fall in price. The Conference Board’s Consumer Confidence Index rose for the first time since last December, which was a result of the Present Situation sub-category increasing for the first time in several months to a 7-month high. That is the first step before seeing expectations improve.

briefing.com

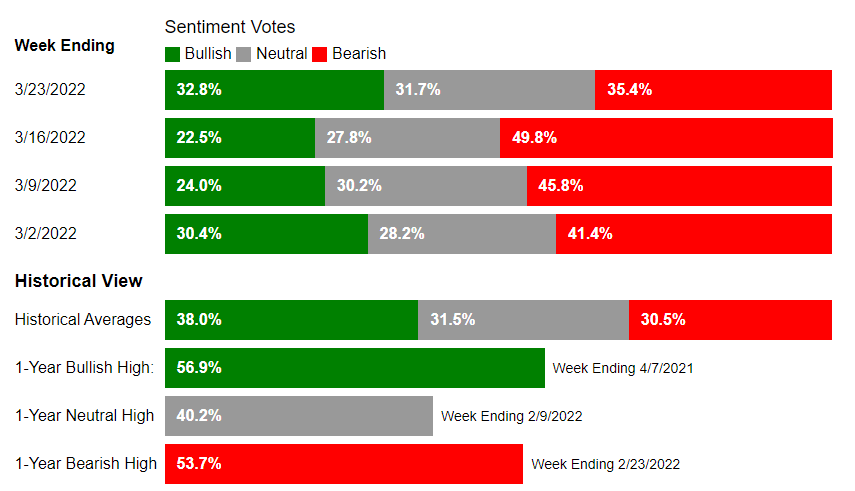

I noted in mid-March that investor sentiment was hitting multi-year bearish lows, which was a contrarian indicator. We are now seeing a positive rate of change on this front, with bulls increasing from 22.5% to 32.8%, which is still well below the historical average.

aaii.com

Yet the most important rate of change to look for will be in the bond market. I expect to see 2-year Treasury yields plateau at 2.35%, while 10-year yields gradually climb, resulting in a renewed steepening of the yield curve. That will be an indication that the rate of inflation is peaking, and the rate of economic growth is strengthening, validating the recovery in stocks from the correction and bear-market declines we have seen in 2022.

Technical Picture

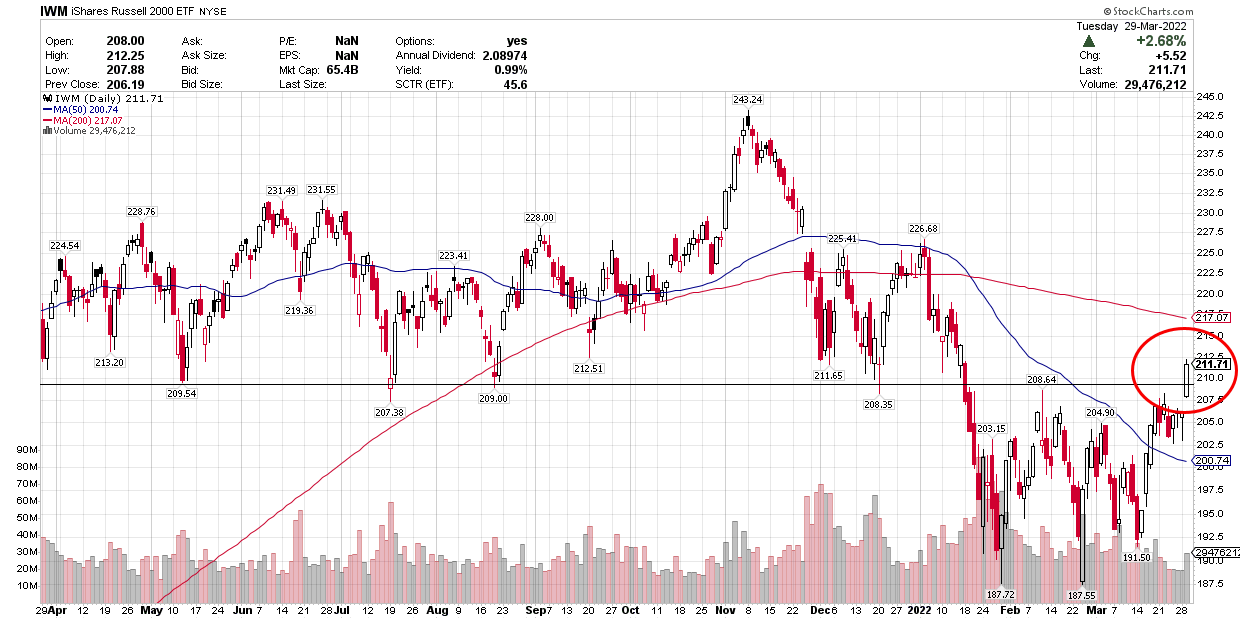

A breakout I have been looking for happened yesterday with the Russell 2000 climbing above a resistance level that had served as support for more than a year. This is a positive development.

stockcharts.com

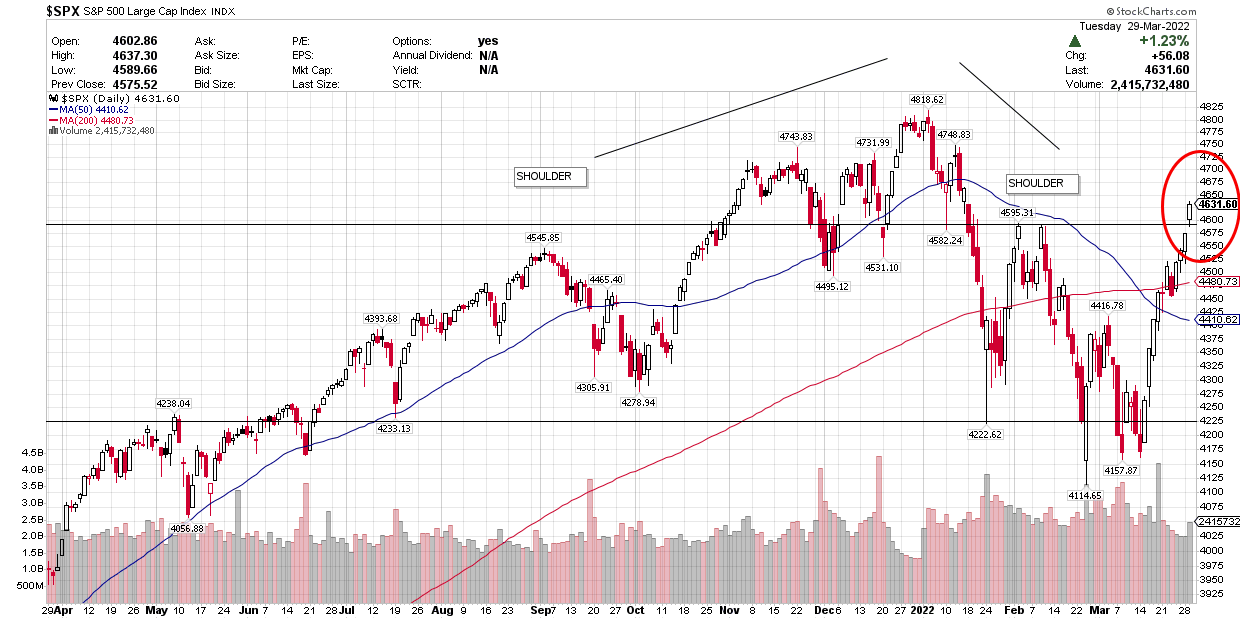

We also saw a positive breakout to the upside for the S&P 500 above the 4,600 level, which was the right shoulder in the head-and-shoulder pattern that had bulls on the defensive.

stockcharts.com

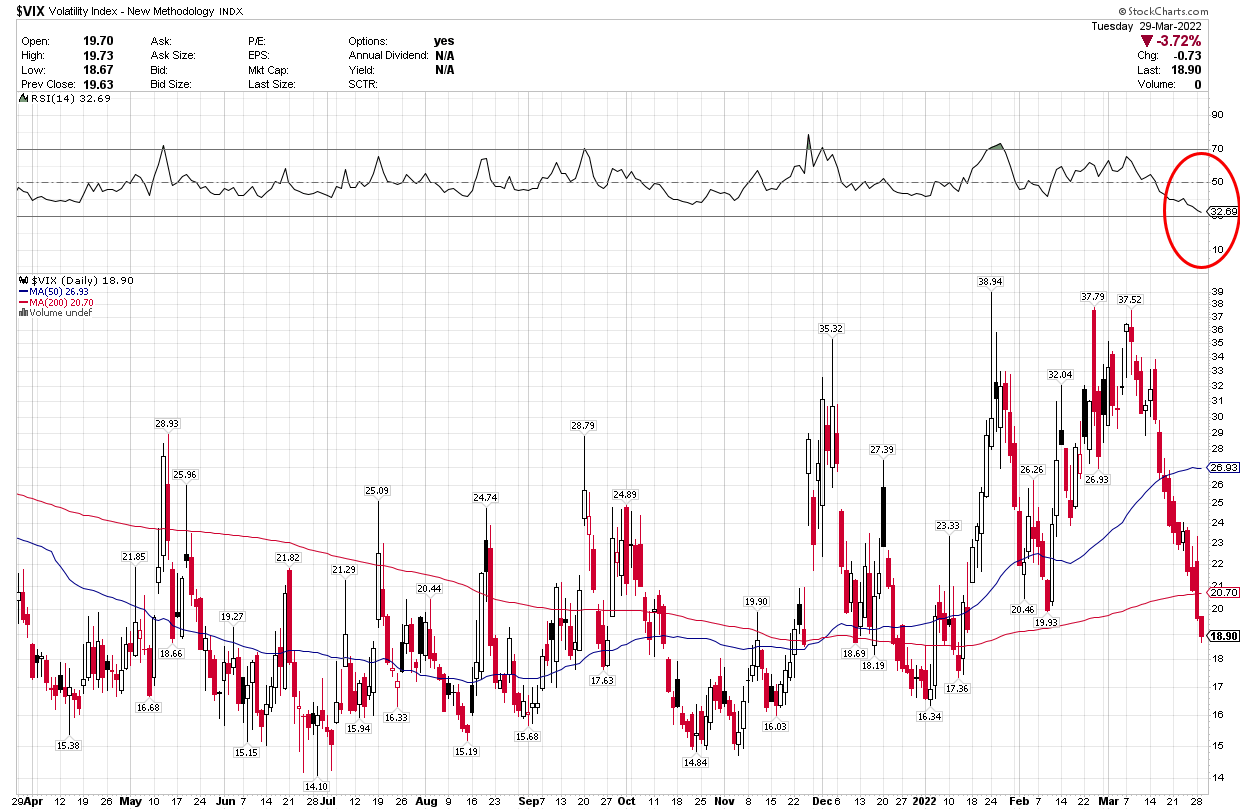

The only concern is I have is that volatility has plummeted and approaching levels where it is likely to bottom.

stockcharts.com

Be the first to comment