SolStock/E+ via Getty Images

To many investors, the packaging industry may not seem to offer that much in the way of opportunities. It may also not be the most exciting space to invest in. However, the fact of the matter is that there are a number of quality players in this space that have done well for themselves in recent years. One really solid but small operator that warrants the attention of investors is Ranpak Holdings (NYSE:PACK). Revenue with the company continues to expand and its bottom-line results have been generally positive. The company did hit a bit of a soft spot in the first quarter of this year, but management is guiding for revenue to continue climbing year over year. While it is entirely possible that the company could hit a soft spot in the event of a broader economic downturn, shares are cheap enough today, both on an absolute basis and relative to similar firms, to deserve upside in the long run.

Understanding Ranpak Holdings

First and foremost, Ranpak Holdings is positioned as a provider of packaging solutions. To best understand the company, however, we should discuss first its two main lines of products. At the top of the list is what management refers to as its Protective Packaging Solutions (or PPS) business. Through this, the company provides a variety of products aimed at fitting the needs of e-commerce companies and other shipping firms. These products fit into three different categories.

One of these is referred to as Void-Fill. And according to management, products under this category Can best be described as paper that is used to fill empty spaces in secondary packages for the purpose of protecting the objects within the packaging themselves. If you have ever ordered a set of glasses in the mail, you have likely received them with folded brown paper filling up the empty space within the box they came from so that the glasses themselves would not move around unnecessarily. That’s precisely what we are talking about here. During the company’s 2021 fiscal year, these products, sold under the FillPak brand name, accounted for 40.2% of the company’s revenue.

The second category is referred to as Cushioning, and the company’s systems, under this category, convert paper into cushioning pads by crimping paper to trap air between the layers in order to protect objects within boxes from external shocks and vibrations during the shipping process. These products are sold under the PadPak brand name and accounted for 42.4% of the company’s revenue in 2021. The company also has a category called Wrapping. Its systems here create pads or paper mesh in order to securely wrap and protect fragile items from shock and surface damage sustained during the shipping and handling process. The company also uses these products to line boxes and provide separation when shipping multiple objects. According to management, brand names that these are sold under include WrapPak, Geami, and ReadyRoll. During the company’s 2021 fiscal year, these products accounted for just 13.5% of the company’s revenue.

What’s interesting about this line of products is that the company sells actual systems dedicated to turning these packaging products from their base components into the final product in question. For instance, as of the end of its 2021 fiscal year, the company had 78,000 FillPak units installed globally. It also had 35,000 PadPak units and 21,000 WrapPak units. Instead of just selling these products, the company prioritizes the continued ownership over them. Instead, it focuses on leasing these out to its customers. Plus, naturally, it also generates revenue from the consumables used in the process.

There is another source of revenue for the company that warrants attention. And this is what management refers to as its Automation Products. These are automated systems That help customers to optimize their own shipping experience. For instance, one device called the Cut’it! EVO takes boxes and, using a sensor to detect the highest stacked item within the box, resize is the box so that customers can use uniform box sizes, receive customized box sizes ready for shipment, and ship more boxes on a single pallet as a result. The company also has other similar products focused on otherwise manipulating packaging. These devices are typically sold directly to its customers, while other devices that focus on helping users to automate the void filling and box closure processes are usually retained by the company and leased out. Unfortunately, this is a small part of the company, accounting for justice 3.9% of revenue last year. However, management has expressed interest in growing this part of the enterprise further and has made some major investments in that vein.

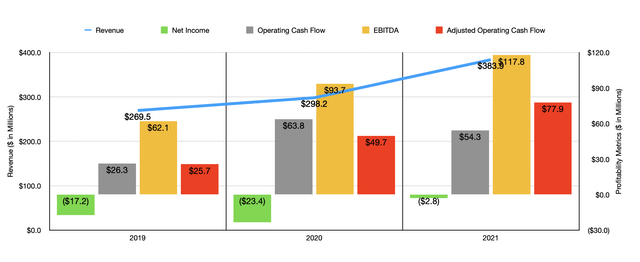

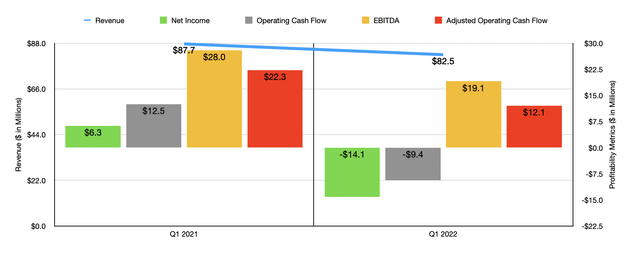

Although Ranpak Holdings has a long operating history, it’s best to view the company through the lens of its performance over the past three years. This is because, in 2018, the company agreed to combine with One Madison and such a combination does bring into question issues of comparability from year to year. What performance data we do have, however, has been quite impressive. Consider revenue. From 2019 through 2021, sales at the company increased from $269.5 million to $383.9 million. Unfortunately, the company has experienced a bit of pain so far this year. Management expressed their disappointment when revenue for the latest quarter came in at just $82.5 million. That’s actually down 5.9% compared to the $87.7 million generated the same time one year earlier. Despite this bump in the road, management did say that revenue for the entire 2022 fiscal year should be robust, with sales climbing by between 13% and 18% compared to what the company achieved last year.

On the bottom line, the picture has also been generally favorable for the company from a cash flow perspective. Even though net income has been consistently negative for the enterprise in recent years, it did see its operating cash flow rise from $26.3 million in 2019 to $54.3 million last year. If we adjust for changes in working capital, cash flow would have risen from $25.7 million to $77.9 million. Meanwhile, EBITDA nearly doubled, jumping from $62.1 million to $117.8 million. For the current fiscal year, the company, once again, has hit something of a roadblock. In the latest quarter, the business generated a net loss of $14.1 million. That compares to the $6.3 million net profit reported one year earlier. Operating cash flow went from $12.5 million to negative $9.4 million. If we adjust for changes in working capital even, this metric would have gone from $22.3 million to $12.1 million. During this time, EBITDA also suffered, going from $28 million to $19.1 million. Despite these concerns, management is cautiously optimistic about the current fiscal year. They think that EBITDA will range anywhere from 2.5% lower than it was last year to 6% higher than it was. At the midpoint, this would see the metric inching up to $120 million.

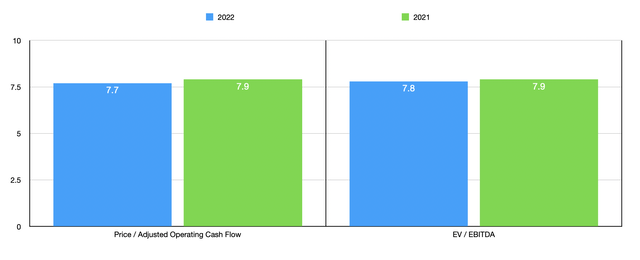

Using the data we have, it’s not too difficult to value the business. If we assume that operating cash flow will change at the same rate that EBITDA should, then we should anticipate an adjusted operating cash flow reading of $79.4 million. This would translate to a price to adjusted operating cash flow multiple of 7.7. That’s down from the 7.9 reading we get using 2021 results. Meanwhile, the EV to EBITDA multiple of the company would come in at 7.8. That compares favorably to last year’s 7.9. To put this in perspective, I compared the company to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 4.8 to a high of 35.1. Only one of the five companies was cheaper than Ranpak Holdings. Using the EV to EBITDA approach instead, we end up with a range of 8.2 to 41.6. In this case, Ranpak Holdings was the cheapest of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Ranpak Holdings | 7.9 | 7.9 |

| Pactiv Evergreen (PTVE) | 4.8 | 8.3 |

| Sonoco Products (SON) | 35.1 | 41.6 |

| Graphic Packaging Holding Company (GPK) | 10.9 | 12.0 |

| Sealed Air Corp. (SEE) | 12.9 | 10.7 |

| Packaging Corporation of America (PKG) | 10.6 | 8.2 |

Takeaway

Based on the data provided, I do believe that Ranpak Holdings is a unique company that will likely continue performing well in the long run. It will be interesting to see whether management’s expectations for the year turn out to be accurate. Even if the company does see its financial condition weaken moving forward, shares are priced at a low enough level that I have a difficult time believing that significant downside could be on the table for investors. Because of this, I have decided to rate the business a ‘buy’ at this time.

Be the first to comment