Joey Ingelhart/E+ via Getty Images

Range Resources Corporation (NYSE:RRC) is one of the largest independent producers of natural gas in the world, boasting a commanding position in the extremely wealthy Marcellus Basin. The energy sector has been the focus of a great deal of attention lately as both crude oil and natural gas have surged dramatically in price over the past 18 months. This price surge became even more severe following the start of the crisis in Ukraine and the Western powers placing stronger sanctions on Russia. Although the surge in crude oil prices is the thing that has gotten everyone’s attention, there are a lot of reasons to like a pure-play natural gas company like Range Resources as well. This is because natural gas has a much stronger and more promising future ahead of it than crude oil, which is largely due to international concerns surrounding climate change. When we combine this with Range Resources’ incredibly attractive valuation, we can see the makings of a very appealing investment. I last discussed the company back in December and since then the investment thesis has only strengthened for the company. This is mostly due to its latest results showing positive reserve development and the company’s increasing focus on rewarding the shareholders through its strong free cash flow generation. The market has not recognized this however as the company’s valuation continues to be as attractive as it ever was.

About Range Resources Corporation

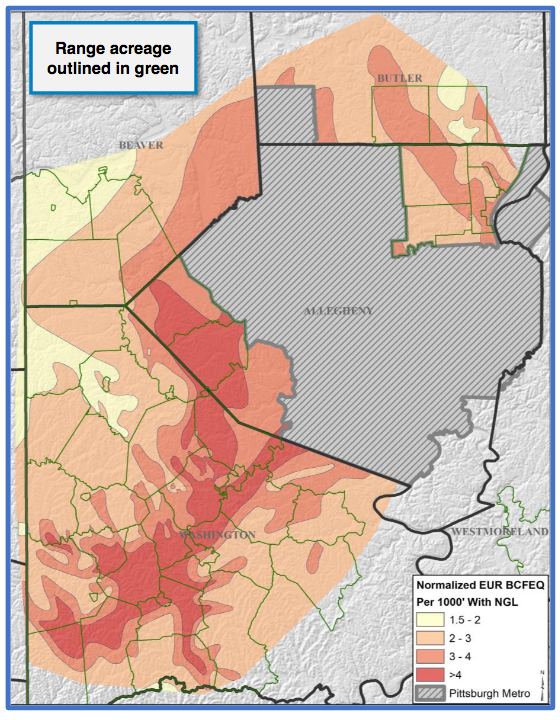

As stated in the introduction, Range Resources is one of the largest independent producers of natural gas in the United States. The company has achieved this position through extensive leasing and acquisition of natural gas-rich properties throughout the southwestern portion of the Marcellus shale. Range Resources overall controls 460,000 net acres in Southwest Pennsylvania, primarily in Butler, Beaver, and Washington Counties surrounding Pittsburgh:

Range Resources Investor Presentation

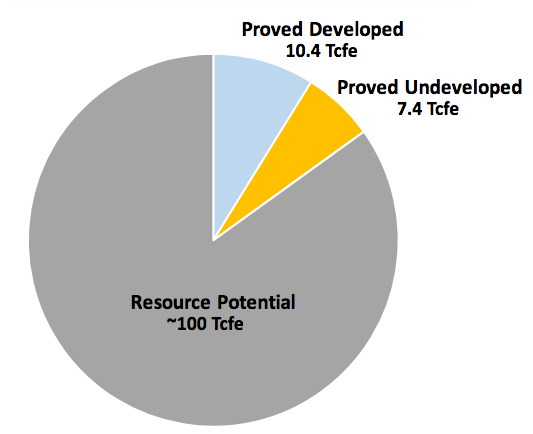

The Marcellus shale is one of the richest areas of the world in terms of natural gas resources. Back in 2015, the U.S. Energy Information Administration stated that the basin had 148.7 trillion cubic feet of economically recoverable natural gas in place. When we consider that natural gas prices are higher now than they were in 2015, it’s quite possible that the recoverable reserves in the basin are higher now. Fortunately for Range Resources, the area in which its acreage is located is among the richest in the basin. We can see this by looking at the company’s reserves. At the end of 2021, Range Resources had proven reserves of 17.8 trillion cubic feet of natural gas equivalents with a significantly larger amount of potential resources located on the acreage that it already controls:

Range Resources Investor Presentation

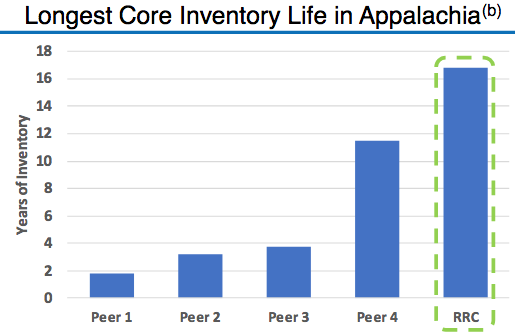

Investors in energy companies often overlook their reserves but they’re critically important. This is because the oil and gas industry is by its very nature an extractive one. After all, these companies literally obtain the products that they sell by pulling them out of reservoirs in the ground. As each of these reservoirs only contains a finite quantity of resources, the company must continually discover new sources or it will eventually run out of products to sell. As the success of this is not always guaranteed, the company needs to have reserves that it can exploit to continue producing until it discovers or otherwise obtains new sources of oil and gas. Ultimately then, the company’s reserves determine how long it can continue to operate in a worst-case scenario. In the case of Range Resources, this is about 18 years. This is longer than any other operator in Appalachia, and is in fact longer than many of the major integrated companies like Exxon Mobil (XOM):

Range Resources Investor Presentation

This is also a longer reserve life than the company had as of the end of 2020, which is the last time that it released information about its reserves. Thus, this reinforces my earlier statement that rising natural gas prices will be beneficial for it in terms of reserves because it makes more of them economically viable to produce. This is something that should overall be comforting to investors in Range Resources. This is because the company is not desperate to obtain new resources. As such, it can wait for an appropriate time to acquire new acreage. As the price of obtaining new resource-rich properties tends to fluctuate, Range Resources can wait until the price is low before making an agreement instead of possibly needing to pay a high price due to desperately needing to replace production.

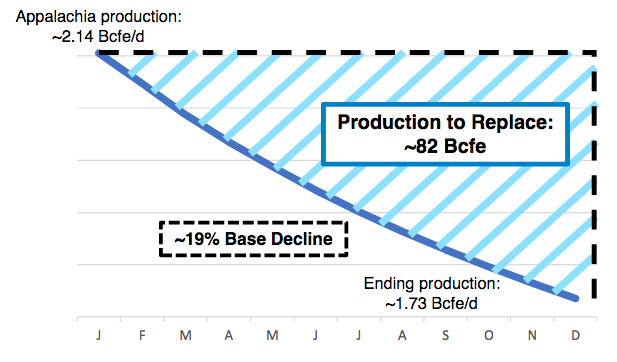

One of the biggest problems with shale production is that the wells tend to have an incredibly high decline rate. This is something that conventional deposits suffer from as well but the problem is especially bad with shale wells. It refers to the fact that the production of a given well tends to go down over time compared to the level that it had when the well was first drilled. In the case of many shale wells, the production level may only be 10% of its original level at the end of its second year of production. This forces shale producers to keep constantly drilling new wells if they wish to maintain, let alone grow, their production. This can be an expensive proposition and it’s one of the reasons why the shale industry has been one of the largest issuers of junk debt over the past decade. Fortunately, the very high quality of Range Resources’ acreage allows it to not have this problem to the same degree. Indeed, Range Resources’ decline rate is only about 19% on average for a newly drilled well:

Range Resources Investor Presentation

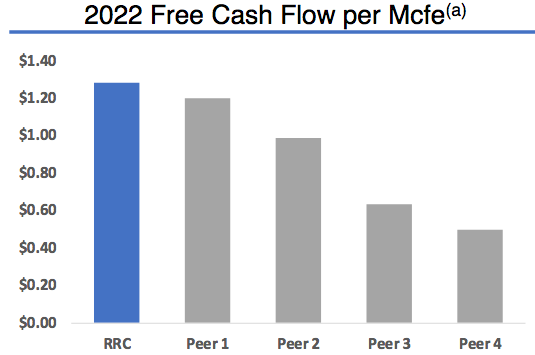

This has the advantage of helping to keep Range Resources’ capital expenditures down compared to many of its peers. It only costs the company an average of about $390 million per year to hold its production at a steady pace, which is far less than it brings in from the approximately 51 new wells that it has to drill to hold its production steady. This obviously results in fairly high margins and is the primary reason why Range Resources has been one of the only American energy companies that have been free cash flow positive on an annual basis since 2019:

|

2021 |

2020 |

2019 |

2018 |

2017 |

2016 |

|

|

Levered Free Cash Flow |

379.7 |

158.8 |

759.1 |

(68.7) |

(272.4) |

200.4 |

|

Unlevered Free Cash Flow |

513.4 |

272.3 |

874.1 |

60.2 |

(155.5) |

298.3 |

(all figures in millions of U.S. dollars)

The generation of free cash flow is very important because this is the money that’s available to benefit shareholders. After all, this is the money that’s produced by the company’s ordinary operations that’s left over after the company pays all of its bills and makes all of its capital expenditures. This is the money that can be used for things such as reducing debt, buying back stock, or paying a dividend. Thus, free cash flow is the money that can be used to provide a reward for shareholders. The ability of free cash flow to reward shareholders is the reason why so many shale companies recently changed their business models to focus on the generation of free cash flow instead of growth at all costs. The change in business model was due to shareholders’ desires for higher returns but Range Resources did not have to make any changes to its model as it has been doing this all along. This could be a very positive sign for the company’s future relative to its peers.

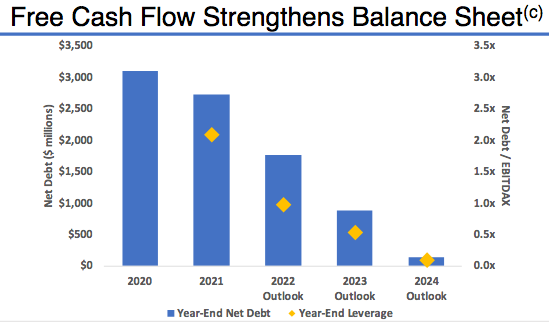

One of the things that Range Resources has been doing with its free cash flow is reducing its debt. This is certainly nice considering that high debt loads are one of the biggest problems plaguing the American energy industry, as already. While high debt can be a risk for any company in any industry, it can be a significantly larger risk for an energy company because of the volatility of crude oil and natural gas prices. Range Resources appears to recognize this as it has implemented a plan to get its net debt down to essentially nothing by 2024 compared to more than $3 billion at the end of 2020. The company made some very real progress on this plan in 2021 as its net debt stood at $2.755 billion on Dec. 31, 2021, which was almost a $400 million decrease over the course of the year:

Range Resources Investor Presentation

In addition to reducing the company’s risk, this reduction of debt has other advantages for shareholders. As we can see in the chart above, the company’s ability to carry its debt is improving over time as the company executes this plan. The less of its cash flow that Range Resources has to spend on interest and debt support, the more money that it will have available for other purposes. Thus, we might see the company begin to raise its dividend or aggressively buy back stock as its debt goes down (it has already initiated a $500 million buyback but it could get more aggressive about this). Either of these things would likely be good for the share price.

Macroeconomic Outlook for Range Resources

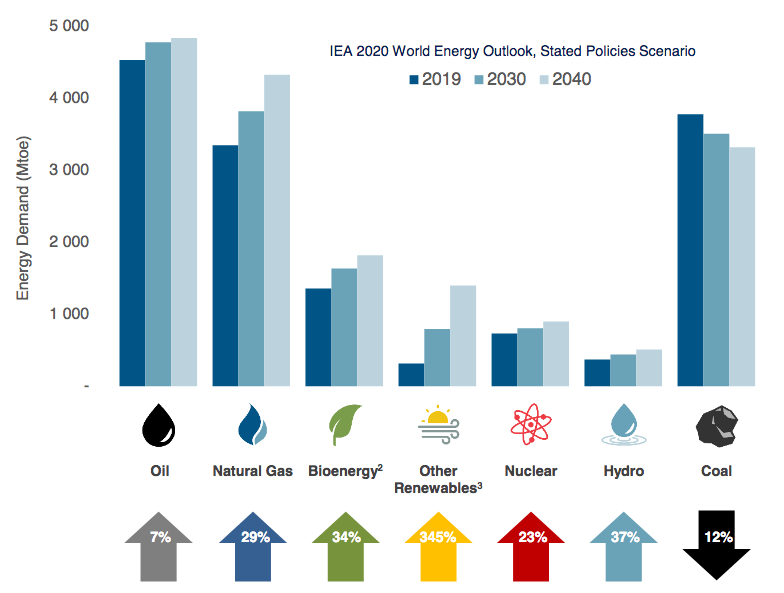

The fossil fuel industry in general has been getting a lot of negative attention by politicians and the media lately so one might believe that the overall fundamentals for it are quite poor. However, nothing could be further from the truth. In fact, the fundamentals for natural gas are quite strong and this strength is being caused by international concerns about climate change. As everyone reading this is likely well aware, these concerns have induced governments all over the world to impose a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective nations. One of the most common strategies that are being used to accomplish this is to encourage the retirement of old coal-fired power plants because coal is the most heavily polluting of all the forms of power generation. These power plants are replaced with renewables and natural gas turbines. The reason for the natural gas turbines is that renewables are not reliable enough to support a modern electric grid. Natural gas solves this reliability problem and burns much cleaner than other fossil fuels. This is why natural gas is often called a “transitional fuel,” since it provides a way to reduce carbon emissions while still ensuring the reliability of the grid until renewable technology has advanced enough to carry the grid on its own.

The International Energy Agency expects that this process will continue and increase the global demand for natural gas. According to the agency, the global demand for natural gas will increase by 2.9% over the next 20 years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

We have in fact been seeing this in the United States as well. Back in 2008, natural gas only produced 21% of the electricity consumed in the United States. That figure is 40% today. This is expected to increase further going forward. The nation’s utilities have already announced that they will be retiring at least 29 gigawatts of coal-fired capacity over the 2022 to 2026 period. Admittedly, it has not been explicitly stated what will replace this retired capacity but it will likely be some combination of renewables and natural gas just like we have seen in other countries. This will thus ultimately increase the demand for natural gas domestically.

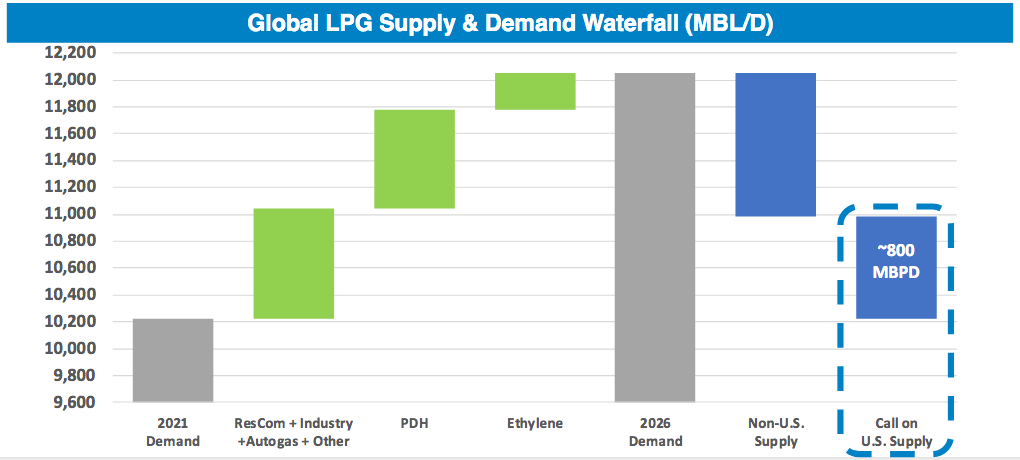

We’re seeing similar trends in the market for propane and other natural gas liquids, such as ethane. This is particularly true in rural areas of the world where there’s an insufficient natural gas distribution network. As such, people are essentially forced to use propane to heat their homes and cooked their food instead of substances like coal or wood. This is very prevalent in nations such as China, India, and Indonesia that do not even have electricity in many poor rural areas. According to the Energy Information Administration and Wood Mackenzie, the demand for liquefied petroleum gas will grow at a 3.4% compound annual growth rate over the next five years:

Range Resources/Data from IEA, Wood Mackenzie, EIA

About 800,000 barrels of demand per day is expected to be satisfied by the United States as it’s one of the only areas in which production can be sufficiently increased to meet this demand.

Range Resources Positioned To Benefit

Range Resources is quite well positioned to benefit from this projected international demand growth. The company is already the largest exporter of natural gas liquids of all the independent exploration and production companies in the United States. The overall high quality of the company’s acreage and its low decline rates likewise allow it to earn higher margins than any of its peers in the Appalachian region:

Range Resources

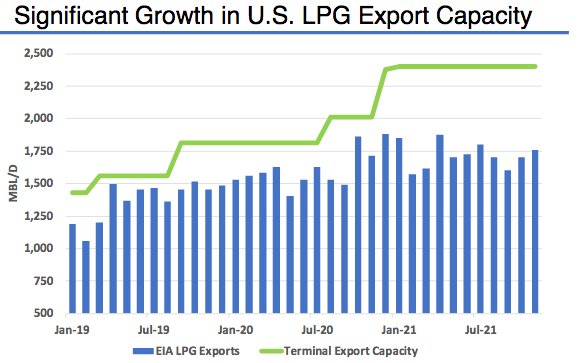

Naturally, though, the company cannot grow its production without sufficient midstream takeaway capacity to get it to market. As many of the midstream projects that were expected to add to the nation’s fossil fuel export capacity were canceled or delayed in 2020, this might prove to be a very real concern. However, most of those projects that were canceled or deferred were intended to serve the Permian Basin and not Appalachia. They also were frequently crude oil-related projects. In fact, the nation’s ability to export liquefied petroleum gas has increased dramatically since 2019, although it has largely been stagnant since early 2021. However, the industry as a whole has more capacity than it needs. As we can see here, the nation’s actual exports of the resources are substantially lower than what its terminals are capable of:

Range Resources/Data from EIA

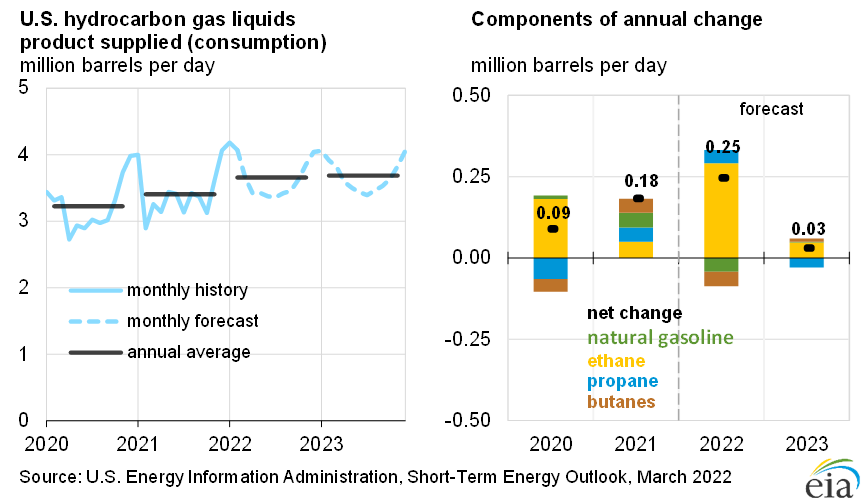

The company’s combination of very low costs, huge reserves, and low decline rate could position it well to take advantage of this demand growth. However, the company has not currently stated that it intends to do this. It has guided for a production level of 2.12 to 2.16 billion cubic feet of natural gas equivalent per day in 2022, which is relatively in line with the 2021 average production level of 2.13 billion cubic feet of natural gas equivalent that it had over the full-year period. However, this could still put the company in a position to benefit from rising prices. The Energy Information Administration projects that American natural gas liquids production will be relatively flat over the next two years:

U.S. Energy Information Short-Term Energy Outlook March 2022

However, we have already seen that the global demand for the substance is expected to grow over the same period. This should result in rising prices and demand begins to outstrip supply. As Range Resources is the largest exporter of natural gas liquids among all independent energy companies in the United States, it should naturally see significant benefits from these rising prices.

Valuation

As mentioned in the introduction, Range Resources appears to have a very attractive valuation despite the potential that it currently has. We can see this by looking at the company’s price-to-earnings growth ratio. According to Zacks Investment Research, the company has a price-to-earnings growth ratio of 0.30 based on an expected three to five-year forward earnings per share growth rate of 28.40%. This could indicate that the stock is undervalued relative to its earnings growth. Here is how that compares to some of the company’s peers:

|

Company |

PEG Ratio |

|

Range Resources |

0.30 |

|

EQT Corporation (EQT) |

0.55 |

|

Antero Resources (AR) |

NA |

|

Chesapeake Energy (CHK) |

1.29 |

As we can see here, Range Resources appears to have one of the most attractive ratios of numerous companies that are focusing primarily on producing natural gas and natural gas liquids. Zacks’ analysts also give it a forward price-to-earnings ratio of 8.41, which is almost unheard of in today’s richly-valued market. Overall, Range Resources certainly has an overall attractive valuation.

Conclusion

In conclusion, Range Resources has a lot to offer any energy investor right now. The company’s commanding presence in the richest part of the Marcellus shale positions it very well to take advantage of the growing demand for both natural gas and natural gas liquids, although it is not increasing production. This should still allow it to boost its free cash flow however since we could very easily see the prices of these resources continue to climb. When we combine this with the fact that the market does not appear to be seeing this, we can definitely see a winner.

Be the first to comment