gorodenkoff/iStock via Getty Images

Investment Thesis

I believe that if Rambus (NASDAQ:RMBS) can do good in the near term, it can do better in the long term, where I think it’s more profitable since there will be a constant need for IoT products, better PC technology, AI and machine learning, and products and solutions where Rambus produces. Additionally, its connection with its customers is crucial in determining the company’s future. I rate the stock as an attractive Buy since the company continues to find ways to be profitable by capitalizing on its end markets despite the macroeconomic challenges and difficulties in the semiconductor industry.

Where We Left Off

In my previous article, Rambus: Cheaper Than Fair Value And Growth In DDR5 Memory, I tackled the company’s broad segments and growth opportunities in DDR5 and AI. The company also exceeded my fair value calculation of $34.41 and is on its way to beating my high fair value estimate of $40.26 since it’s currently trading at $35.29 today. Although I highlighted the company’s potential growth in the DDR5 market, in this article, I’d like to highlight the company’s potential growth in its AI and Mobile markets. I’m still long on the idea of Rambus because they could potentially be generating more profits in the PC market, especially when the economy recovers and consumer spending returns to normal.

Discussing Its Growth In AI, Mobile, And PC Markets

In my previous article, I’ve constantly repeated that the company is on an excellent track for growth, which explains the company’s high valuation. Here are the growth drivers for its end markets:

Featuring PCIe 6.0 Interface Subsystems

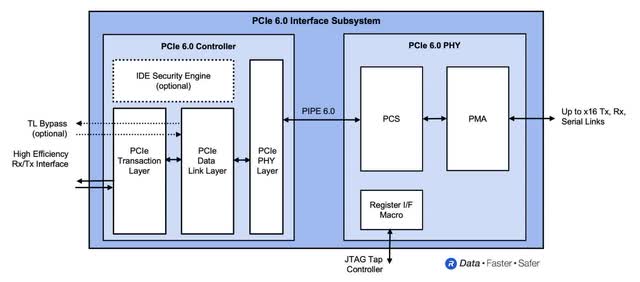

PCIe 6.0 Interface Subsystem (Graphic: Rambus Inc.)

On October 2022, Rambus announced the availability of its PCI Express [PCIe] 6.0 Interface Subsystem comprised of PHY and controller IP. It supports the latest version of Compute Express Link [CXL]. According to Scott Houghton, the company’s general manager of Interface IP at Rambus:

The rapid advancement of AI/ML and data-intensive workloads is driving the continued evolution of data center architectures requiring ever higher levels of performance…The Rambus PCIe 6.0 Interface Subsystem supports the performance requirements of next-generation data centers with premier latency, power, area and security.

– Rambus Delivers PCIe 6.0 Interface Subsystem

Compared to the PCIe Gen5’s transfer rate of 32 GT/s, the PCIe Gen6 features 64 GT/s, which means it is capable of high-performance workloads. It also means that it’ll operate faster with lesser data congestion issues since it’s running at a higher transfer rate. This improvement in speed could potentially attract more customers for Rambus.

Securing Its Mobile Customers

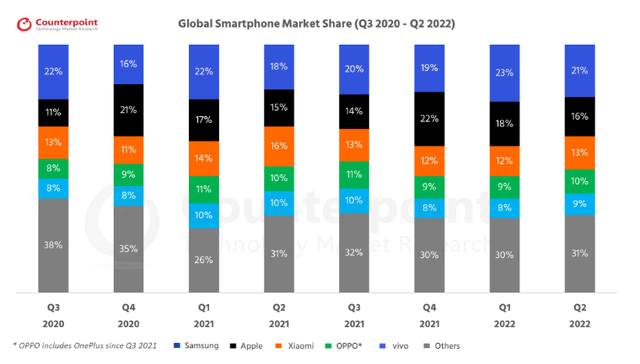

Global Smartphone Market Share – CounterpointResearch

Rambus also has been maintaining its connections with its mobile customers such as Samsung (OTCPK:SSNLF). On October 2022, Rambus and Samsung Electronics extended their comprehensive agreement. What does this mean? This means that Samsung has full access to the company’s patent portfolio, bringing more value to Rambus, as Samsung accounts for the second biggest global smartphone market size, contributing 21% of the global smartphone market share in the second quarter of 2022.

DDR5 Is The Future

As mentioned in my last article on Rambus, I’ve said that DDR5 is the future and can help the business perform better since people want to upgrade to the best technology available. From a business perspective, Rambus is already well-positioned to roll out its DDR5 memory with its current customers. Here’s what I said in my previous article on Rambus:

RMBS will play a significant role, especially in their different solutions that help the 5G/Edge innovation and further increase performance in Data Centers and IoTs. Still, I wanted to talk about DDR5 even more as data centers rely on memory for faster server performance and how DDR5 can affect the consumer industry through its partners in the PC market.

– Rambus: Cheaper Than Fair Value And Growth In DDR5 Memory

I’m still in line with my previous thesis on DDR5 memory. I think it will be the growth driver of Rambus’s customers in the PC market, increasing demand for the DDR5 memory that Rambus makes.

Taking A Look At Rambus Financials

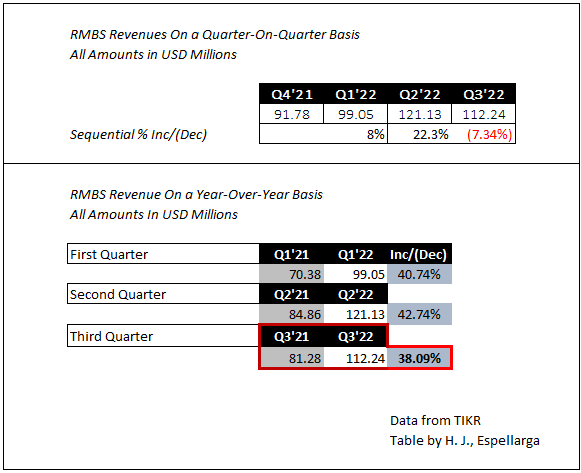

Rambus Revenue Growth – Data from TIKR – Table by Author

Rambus had $112.24 million in revenues on the company’s third-quarter results, or a 38.09% year-over-year increase compared to Q3’21 quarterly revenues of $81.28 million. On a sequential basis, the company’s revenue declined by 7.34%. However, it surpassed management’s expectations of revenues between $104 million and $110 million.

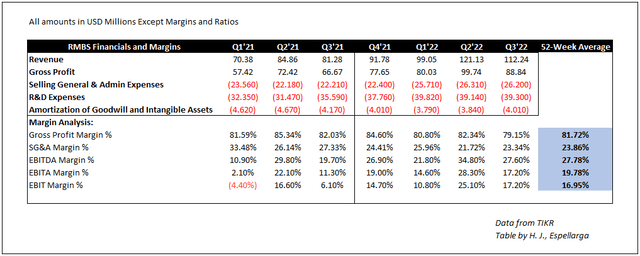

RMBS Margins – Data From TIKR – Table by Author

Rambus achieved a gross profit of $88.84 million, or a 79.15% gross profit margin. Despite a weaker top-line performance, Rambus keeps its margins more or less 200 basis points away from its 52-week average and a lot better than its sector median of 50%.

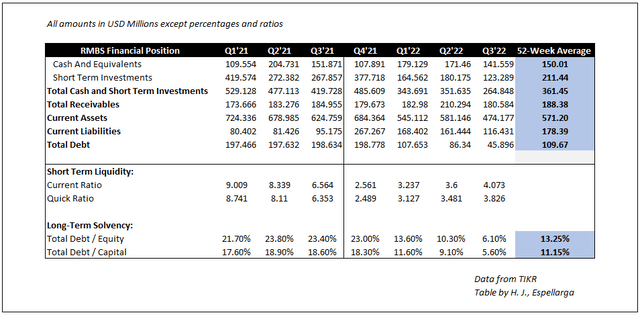

RMBS Financial Position – Data from TIKR – Table by Author

Rambus has less cash sequentially and on a year-over-year basis, driven by weaker revenues in the third quarter. However, the company doesn’t have any short-term liquidity problems as the company has $571 million in current assets and $178 million in current liabilities, which gives us a 4.0 current ratio. On the company’s Q4’21 results, the company had $198 million in debt, which has reduced significantly on the company’s Q1’22 results due to debt payment efforts.

Valuation Plus Short- And Long-Term Views

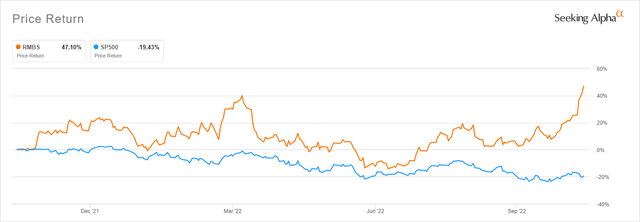

Rambus vs. S&P500 Price Returns – Seeking Alpha

I want to touch on my short- and long-term views on Rambus. Rambus’s EPS estimates have been a hit or miss lately. In the third quarter of 2022, the company missed its EPS GAAP estimates by $0.15. When talking about price return, Rambus outperformed the S&P 500, gathering a 47% price return compared to S&P 500’s -19%.

Rambus announced in September that the company would buy back $100 million of its stock. The program is expected to be completed in four months and is my near-term catalyst for the stock. The company pre-paid $100 million to Wells Fargo (WFC) for the purchase and received an initial delivery of 3.1 million shares of its common stock in the third quarter. Management expects the announced accelerated stock repurchase program to be complete during the fourth quarter of 2022. The announced stock repurchase program could boost the share price value in the coming months/quarters.

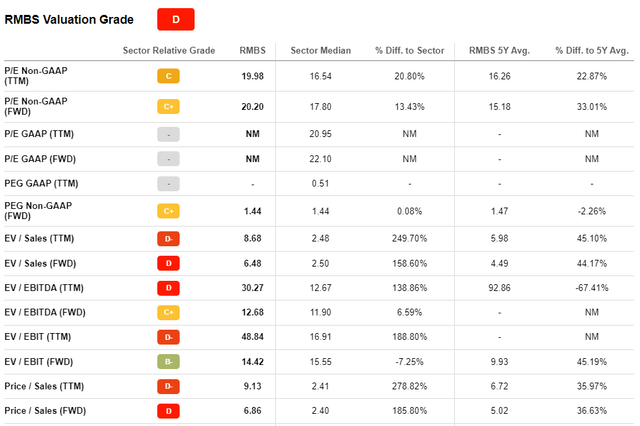

Seeking Alpha – Rambus Valuation Grade

The company will likely do great long-term because of the high demand for its products and solutions. Valuation metrics suggest that the company is overpriced. Its forward P/E ratio of 20.20 is higher than its sector median of 17.80; it trades at a TTM EV/EBITDA of 30.27 compared to the sector median of 12.67. We can interpret two things from this:

- The company is overvalued

- It’s expected to generate high returns

I’m leaning towards option 2 because the company is growing at a great pace and is profitable than its sector median.

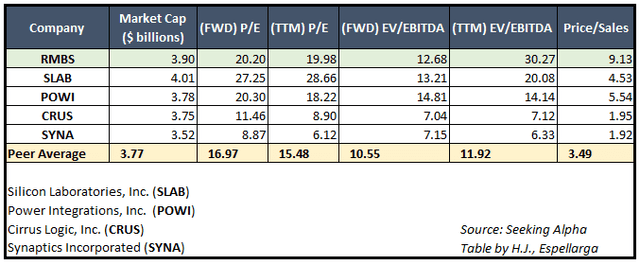

Data from Seeking Alpha – Table by Author

By comparing Rambus with companies like Silicon Laboratories, Inc. (SLAB), Power Integrations, Inc. (POWI), Cirrus Logic, Inc. (CRUS), and Synaptics Incorporated (SYNA) with similar market caps and industry, we can still see that Rambus is currently valued at a higher price, compared to its peers. Again, this means that Rambus is expected to generate higher returns in the future, not because the stock price isn’t reasonable.

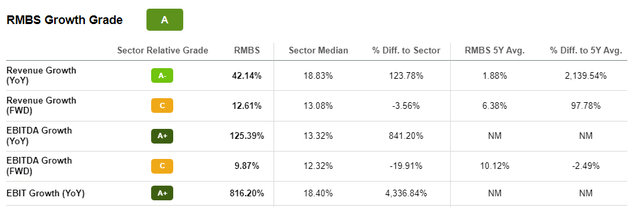

Seeking Alpha – Rambus Growth Grade

Rambus is a growth stock with relatively higher growth than its sector median. It currently holds a growth grade of “A” with Seeking Alpha’s quant ratings as Rambus has better revenue growth YoY (42.14% vs. sector median of 18.83%) and better EBITDA growth YoY (125.39% vs. sector median of 12.32%).

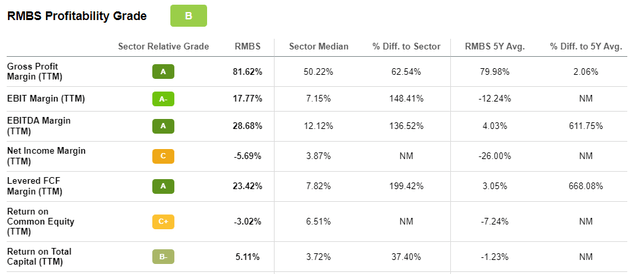

Seeking Alpha – Rambus Profitability Grade

Rambus is also profitable. In its financials, Rambus has higher margins than its sector median. Rambus currently holds an 81.62% margin compared to its sector median of 50%, which the company has been holding up to for several quarters. The company’s EBITDA margins are also 28.68%, double the sector median’s 12.12%. With high margins, we could say that if Rambus:

- Keeps its customers

- Provides faster and better tech

- Acquires new customers in Data Centers and AI/ML

- Returns some of its capital to its shareholders

Then I think the stock can maintain its high-profit margins while keeping its customers and shareholders happy. Customer relationship makes a company excel when operating in these markets. If Rambus can extend its partnership with Samsung, it can extend its partnership with other large-cap companies that’ll want its products and solutions.

So now that we’ve determined its growth drivers, this raises the question: Will the company continue to be profitable in the coming years? If so, how sustainable are they? Yes, the company will continue to be profitable because every piece of modern tech needs memory. Besides that, the current data center market spending increased by 37% or $178 billion in spending in 2021, which will continue to increase as data center expansion efforts continue in the coming years. If Rambus maintains good customer relationships, the company will remain sustainable since the demand for memory solutions wouldn’t run out.

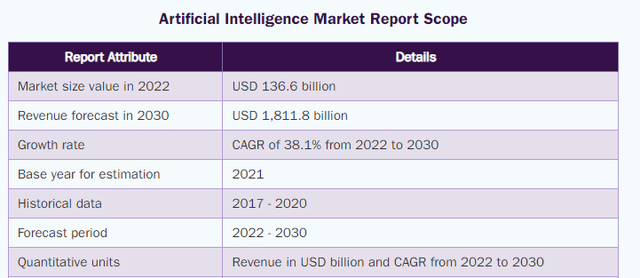

AI Market Report Scope – Grand View Research

The AI market (one of the potential markets that Rambus can enter and capitalize on) is expected to grow at a 38.1% CAGR from 2022 to 2030. This means that the company’s recent AI and machine learning expansion efforts would not go to waste since they’re investing in a market with a very high CAGR.

Risks Associated With Rambus

With the near-term risk, investors should know that the stock could be exposed to a slight pullback. If that doesn’t happen, we may see a new trend reversal that Rambus will be trading on in the near weeks/months.

Aside from that, most of Rambus’s long-term risks are related to customer relationships and innovation timings (innovation timings = how long they release a better product or something similar to the current best). These are the significant risks to think about when discussing Rambus.

If Rambus lags behind its competitors (slower speeds, outdated hardware, and incompatibility issues), this can significantly affect tech performance. When tech performance is affected, so do the customer relationships, and when customer relationships are affected, it means lesser revenues, margins, cash, growth, and profitability. On the bright side, if Rambus continues to perform better than its sector median while maintaining its high margins and customer relations, I believe the stock can excel in the long run.

Final Thoughts

I believe that Rambus is a profitable company that continues to soar through near-term macro challenges while making moves that will secure the company’s long-term future. I think Rambus is an outstanding stock because of the management’s ability to keep its customers and explore other end markets. This can be seen in the company’s recent press releases of the new PCIe Gen6, extending its partnership with Samsung and producing DDR5 memory. The stock repurchase program of $100 million can also boost the stock’s price in the near term, being a catalyst for a stock price increase in the next few weeks/months. I think the company is profitable and sustainable since the markets they’re expanding into constantly demand its products and solutions, and with that, I rate the stock as a Buy.

Thank you so much for reading, and have a great day.

Be the first to comment