Ben Gabbe

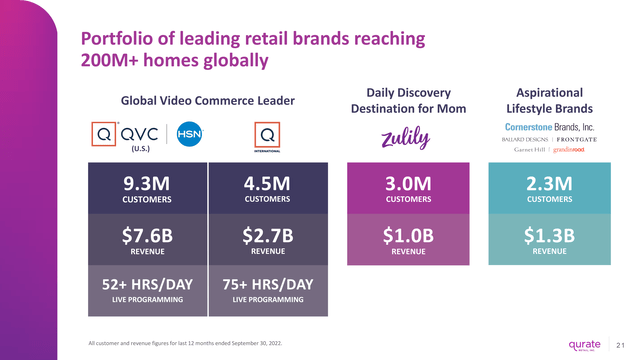

The new year 2023 is almost here, and we thought we would share our favorite pick to kick off 2023. This is a stock that we believe has one of the highest asymmetric risk-return profiles we have encountered. Qurate Retail, Inc. (NASDAQ:QRTEA) is an online retailer and leader in video commerce. The company consists of a few different brands, mainly consisting of QVC, HSN (Home Shopping Network), Zulily and others. In short, Qurate sells products primarily through cable TV, or as some call it, “home shopping.”

So what is our best choice for 2023? A video-commerce retailer that sells via linear TV, in a dying sector due to cable cutting, with a complicated corporate structure, heavily leveraged with $6.5BN in long-term debt while interest rates are rising at a record pace and the U.S. is already/probably on the brink of a prolonged recession. Plus, free cash flow just dipped negative.

Sound like a terrible idea? By all means, we get it. But the security analysts looking deep under the covers, assessing the company that no one else dares to assess, and put in the work, see a very different picture. One such security analyst is Michael Burry, who also bought the stock in the third quarter. In this article, we explain why Qurate retail is perhaps one of the most misunderstood companies out there, and why we think it is 508% undervalued.

Home Shopping Bonanza

So, if you were to buy the company Qurate retail for its $806 million market cap, what would you get with it? Surprisingly, a brand with a reach of over 200 million households and over 20 million customers, generating over $12 billion in sales annually. That’s a price-to-sales ratio of 0.06x! The last time we saw such a ratio was with GameStop (GME), which had a P/S ratio of 0.05x when value investors like Michael Burry bought into it (before the short squeeze).

It has many similarities to GameStop: it is in a sector in secular decline, has been completely written off by most investors and is priced as if it is about to go bankrupt, when there is no near-term bankruptcy risk if you understand its intricate debt structure.

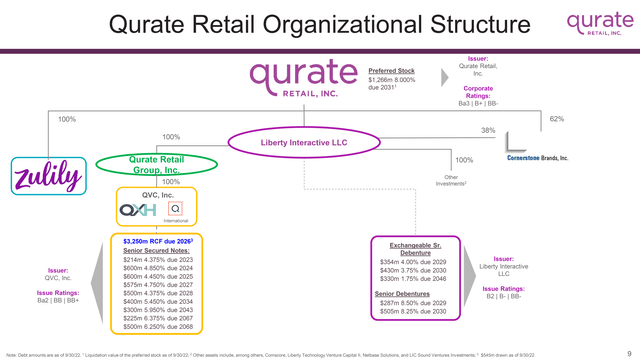

Qurate Retail was formerly known as Liberty Interactive, and was originally a division of Liberty Media. Liberty Media has a history of complicated corporate structures, endless spinoffs from certain of its subsidiaries, controlled by its company chairman John Malone.

To simplify the corporate structure, all you need to know is that it has 3 main divisions: QVC, QVC International and HSN, all of which are video retailers selling primarily through cable TV. These 3 units alone account for $10 billion in annual revenue. It also has other entities, such as Zulily and Cornerstone Brands, which make up a small portion of the company’s revenue.

In terms of shares, it has 3 entities: Series A (QRTEA), Series B (NASDAQ:QRTEB) and a preferred dividend share (QRTEP). The difference between Series A and Series B is that Series B are shares that have 10x voting rights, but are quite illiquid. The preferred dividend stock has a yield of 22.77%, but as mentioned, we predict that Series A has an IRR of 32% and thus remains the most attractive buy as a security analyst.

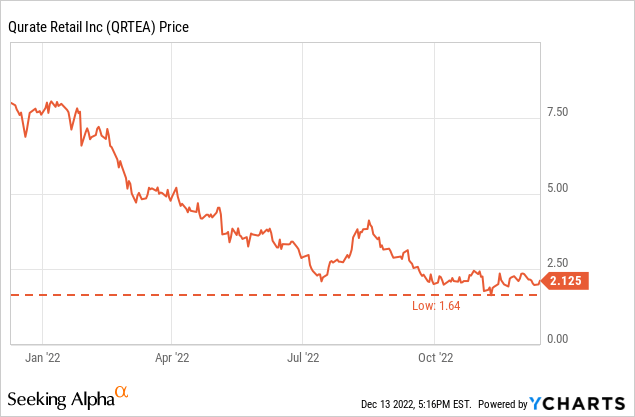

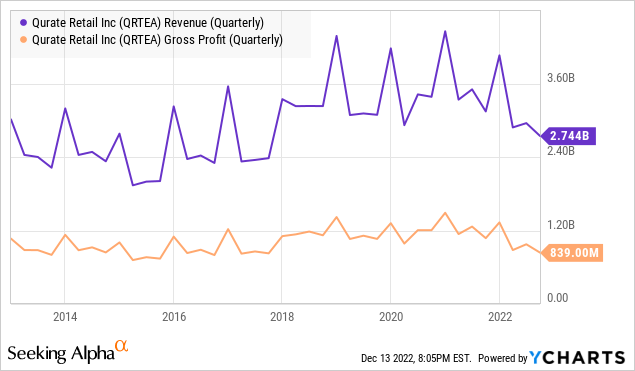

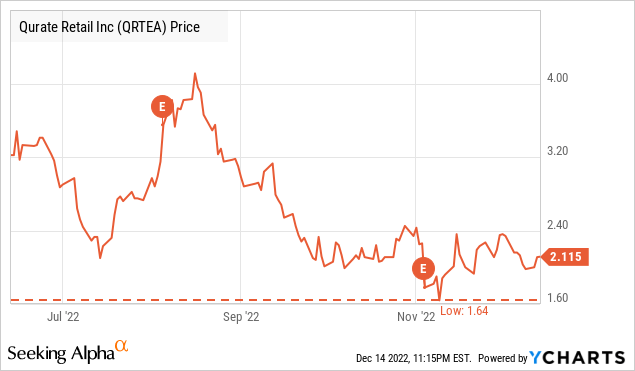

One of the reasons Qurate Retail plunged from more than $8 per share 12 months ago to about $2 has to do with its performance in the last 3 quarters. Sales have contracted somewhat, falling 12% year over year on a tough 2021 comparison. And like most retailers this year, Qurate Retail was not immune to severe margin pressure due to a handful of circumstances that we will discuss in more detail. Gross margin was also down 3.6% year-over-year.

Not A Qurate Problem?

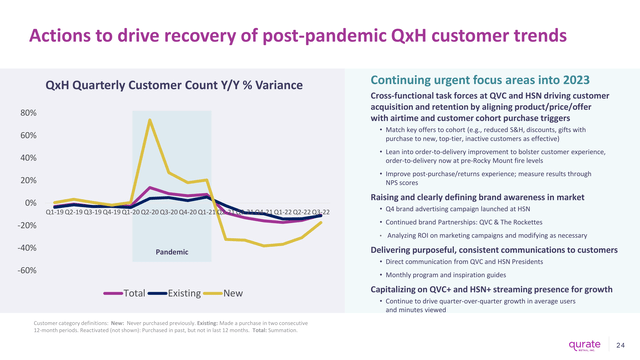

What had previously been a steady business for Qurate went into a wild ride in early 2020. While everyone stayed home, Qurate saw sales and profits boom as HSN and QVC benefited from people watching more home shopping TV during the pandemic. But later, when the economy picked up, management realized that these were only temporary, mostly bad customers who declined in the following months, rather than their usual loyal customer base.

2022 was a very difficult year for Qurate. To say that Murphy’s Law has been knocking on Qurate’s door for the past 12 months would be an understatement. It started in December 2021, when one of QVC’s warehouses in Rocky Mount burned to the ground. Not only was it QVC’s most efficient fulfillment center, it handled 25-30% of QVC US volume and was the primary return center.

While we do not know the exact number of sales specifically generated by QVC US, by our calculations we believe the distribution center drove more than $1BN in revenue annually. It was declared “the largest structure fire in history of North-Carolina.”

The market is presumably reckoning that Qurate’s performance over the last 12 months was due to poor operational performance as a company itself, but looking deeper into it, it does not appear to be a Qurate problem. More like an industry-wide phenomenon among retailers.

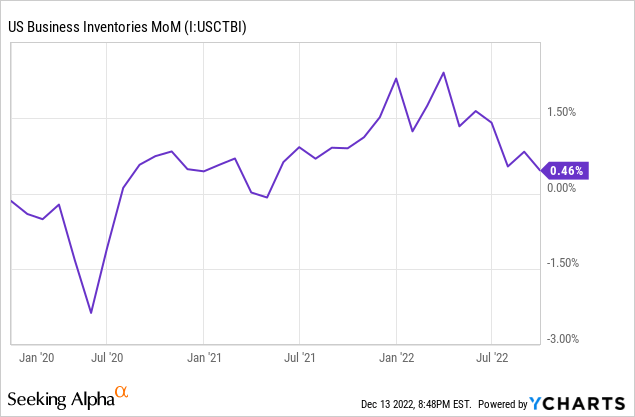

In 2021, retailers faced widespread inventory shortages due to supply chain constraints, which we are still seeing the adverse effects of today. Essentially, supply chains today still have a nonlinear complexity. When supply was scarce, retailers began producing more, anticipating a long-term higher demand. But when that demand recently declined, we saw a different phenomenon: an inventory pile-up/glut. Or as Michael Burry called it earlier this year; the Bullwhip Effect.

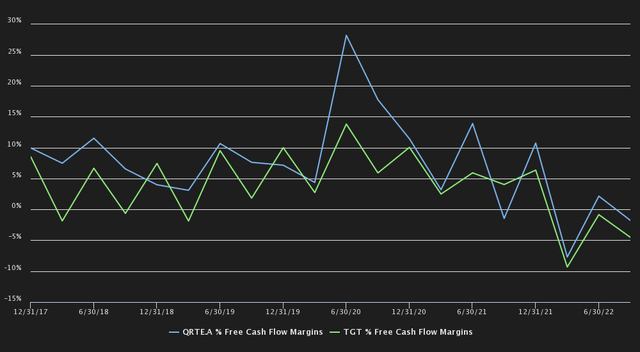

Other retailers such as Target (TGT) also suffered, resulting in declining free cash flow margins. The fulfillment side of Amazon (AMZN) saw the same effects, calling it a “unique inventory situation” during its latest earnings call.

This is an especially sour bean for Qurate, because their whole business model is to have the right product, at the right time, for the right people. You can’t sell Christmas decorations in February, so you have to go through that excess inventory in November, drastically reducing your margins. But to outsiders, who don’t look closely, it may look more like a business in decline or in hot water, whereas to us the problems seem very temporary.

The management team seems to be on the same page as us in this regard. This is a transcript of the investor day last month:

We started to execute aggressively. The fire at our most efficient facility in Rocky Mount was a major headwind in 2022, and recovery was a prerequisite for this turnaround. The team made rapid progress in cleaning up our inventory, improving our throughput and our network of fulfillment centers. You will see that the network of fulfillment centers and the challenges the entire retail industry faced this year were the biggest drag on profitability and is now the biggest opportunity going forward. (Qurate Retail CEO.)

F for “Force Majeure”

As if a massive inventory glut and burning down your most efficient distribution center weren’t enough: there’s more! What still seemed like a booming economy at the end of 2021, with “transitory inflation” and low interest rates on the horizon, has turned into a literal nightmare.

Earlier this year, the U.S. posted 2 consecutive quarters of negative GDP growth, technically pushing the U.S. into recession. Add to that a yield curve that is currently still inverted at -73 bp, the most since the early 1980s, and you get consumer confidence that is bearishly low. The record level at which the Fed raises its interest rates may seem equally dangerous to Qurate to some analysts because it is highly levered, but we’ll come back to those details in a moment.

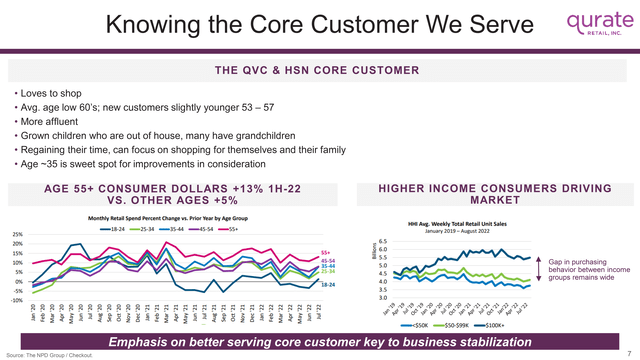

As with most other elements, an outside recession seems catastrophic when looking at Qurate Retail’s sales. But a closer look reveals that most customers are in their early 60s and women. Simply put, they are high-income individuals who tend to spend generously, though often ignored. They are the type of consumer the least affected by a consumer recession.

Other factors also played a role: inflation, a rout in the debt market and a strong dollar. Inflation also played a big role at the company, as it chose not to raise prices this year to eliminate excess inventory and get back to a clean sled. Qurate also suffered greatly from inflation, as oil prices drove up transportation and freight costs significantly, combined with labor shortages and higher wages. This was also one of the factors that reduced Qurate’s margins.

The debt market was also extremely volatile. The combination of the Fed starting QT and the Treasury Department issuing twice as many bonds as before the pandemic led to a seemingly illiquid government bond market. Credit spreads between treasuries and high yield bonds have also inflated as the Fed raises its interest rate to an expected terminal rate of about 5%. Since Qurate has a lot of debt (more than 6.5 billion long-term debt), this technically makes it more difficult at the moment to take on more new debt at favorable rates.

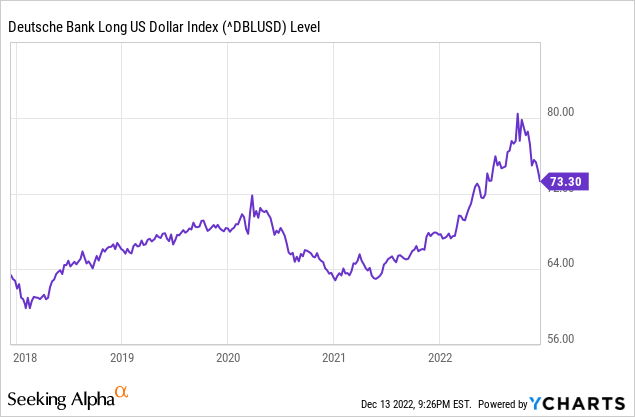

Not to mention that because of this inflation, and the difference in speed of rising interest rates from the U.S. versus other places like Europe, the U.S. dollar reached parity again for the first time in 20 years, and went above parity against the Euro. Since QVC International generates $2.7 billion in revenue, the company was also hit hard by this. According to their latest SEC filing, they lose about $4 million on an annual basis for every 1% change in exchange rates against the U.S. dollar. Now imagine the extreme 20% Forex swing we had this year. In constant currency, everything seems fine.

But fortunately, there is light at the end of the tunnel. Container costs are falling, inflation is finally dropping, oil prices are dropping significantly, and the U.S. dollar is also falling. But none of this is reflected in the stock price.

The fact that certain risks showed up that were completely out of the blue is uncanny. For example, in the third quarter due to the death of Queen Elizabeth II, the company lost an estimated $10 million in revenue by pausing programming. In the U.S., Hurricane Ian also cost the retailer about $3M-$5M in sales.

The Debt Structure

Who would want to invest in a company with more than $6.5 billion in long-term debt in a market where interest rates are so high? We think not many people.

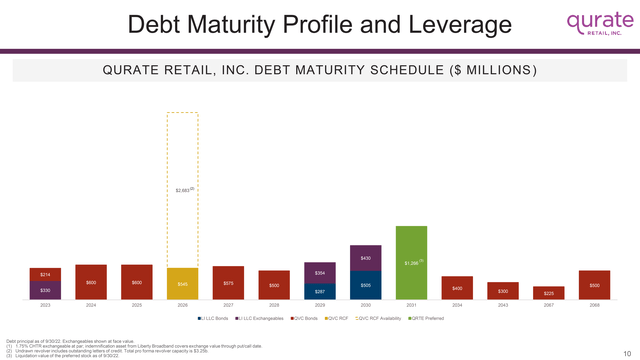

Fortunately, we are not “many people.” Interestingly, looking at Qurate’s debt structure, we can note 2 things: their debt is fixed maturity debt, and almost all of their issued debt is at a fixed interest rate. Their fixed-rate debt has an average interest rate of 5.1%-5.4%, while their small portion of variable-rate debt averages 4.5%.

As you can see from the image below, much of Qurate’s debt actually does not mature until after 2030. For the next 3 years to 2026, their maturities average about $600M, which is very doable. We don’t think many investors are also highlighting their huge revolving line of credit they have until 2026. They can still draw over $2.6BN from this revolving line of credit, and can even use that revolver to pay off maturities before 2026.

This revolver, by contrast, is subject to some covenants based primarily on debt, cash and adjusted EBITDA of QVC, Cornerstone and Zulily. Currently, their leverage is 2.0x, compared to the maximum leverage of 4.5x they are allowed to borrow. This is despite the fact that EBITDA margins are under severe pressure due to all the temporary problems mentioned earlier.

Needless to say, the market seems to be pricing in bankruptcy, but if you look deeply enough at their credit agreements, it is highly unlikely that they will go under anytime soon. Plus, they technically could buy back their own debt cheaper if it’s trading at a discount.

Athens To The Rescue

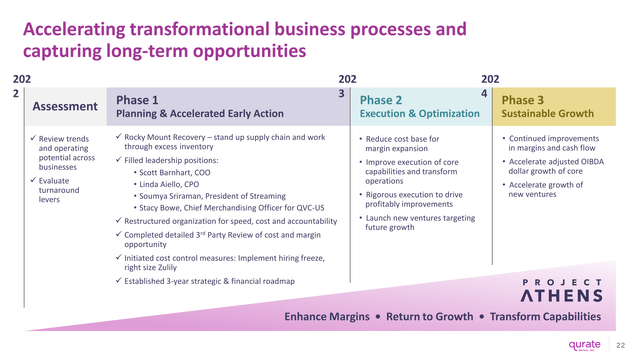

Another factor that we think is not reflected in the share price at all is Qurate Retail’s “Project Athens.” This is a project announced in June this year by new management to return to their base of strong free cash flow and EBITDA growth.

Their plan runs through the end of 2024 and is currently already underway. They have finished defining the actions they will take, and have begun implementation this quarter. Most of the progress should be visible in 2023, through 2024. This program, combined with the aforementioned problems being solved, means that there will be many vectors pointing to the upside next year.

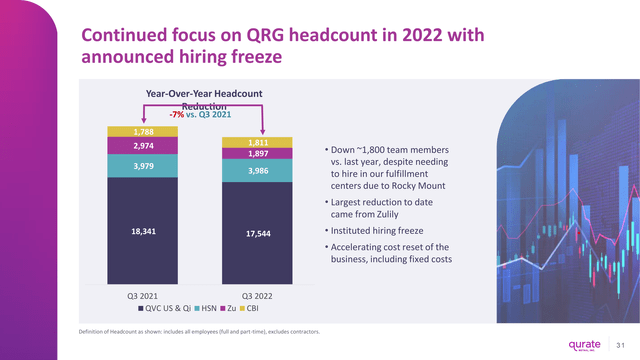

For example, they have already implemented a hiring freeze at Zulily, which was a drag on profitability in previous quarters because it is primarily a money-losing operation. As mentioned earlier, they have started reducing inventory earlier than the other retailers, and are already ahead of schedule.

But since we are security analysts, we are usually more enticed by knowing what the financial gain from this program will be, and fortunately management gave us a rough indication of what to expect.

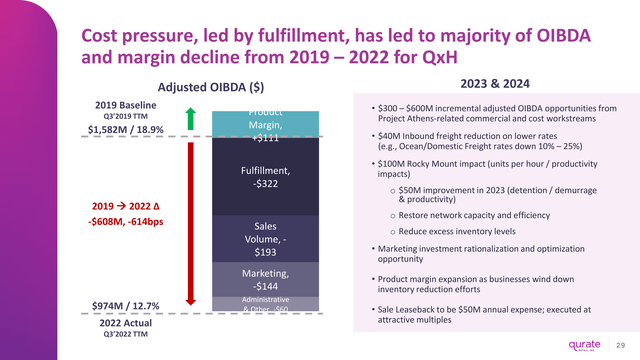

In terms of OIBDA, we saw a decrease of $608 million between 2019 and 2022 (TTM), mainly due to previously mentioned issues such as supply chain disruptions and excess inventory combined with force majeure such as the Rocky Mount fire and others. Nonetheless, they expect to realize $300 million to $600 million in OIBDA cost improvements in 2023 and 2024 through Project Athens alone. Combined with alleviation of supply chain constraints, such as post-Rocky Mount supply chain stabilization and reductions in freight and fuel costs, this will likely result in profitability returning close to pre-pandemic levels.

They have also executed a number of sale leasebacks to pay off their debt early and obtain attractive financing in these times of a volatile debt market. Since this event for investors, sea and domestic freight rates have also dropped significantly and are moving in the right direction. China also seems to be opening up again, which hopefully will finally stabilize international supply chain logistics.

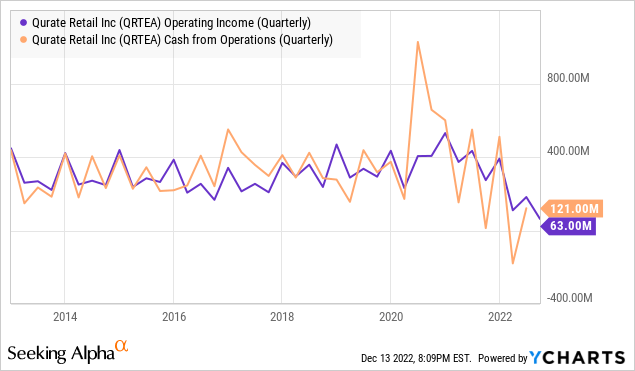

As noted earlier, a good idea might be to look at free cash flow earlier, though, since Qurate has a lot of interest expense not included in EBITDA/ OIBDA.

As for free cash flow, it takes a bit more digging to come up with a good estimate, since management is using 2022 as the base year, and we don’t know Q4 free cash flow yet. Although, we do know what the free cash flow was for the last 9 months. Management estimated this figure in Q3 at -$105M for the last 9 months, although that does include insurance proceeds from their fixed assets, which management mentions in their guidance. That means we end up with an estimate of -$289M for the past 9 months excluding insurance proceeds.

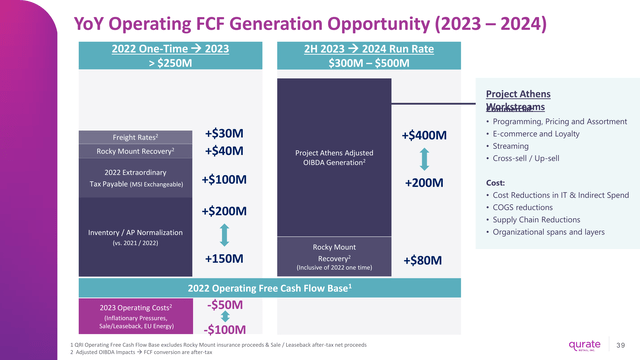

This figure may be a bit misleading, however, since Qurate’s business is heavily focused on the fourth quarter and Q4 revenues and cash flows have always been stronger. Since management is still in the process of liquidating stock, we assume a base of -200M in FCF for FY2022, although in the long run even a lower base would still generate a lot of free cash flow and provide a wide margin of safety. Management’s expectations are shown in the figure below:

If we go from our estimates and add $250 million of FCF to our base of $200 million, that would already provide $50 million of free cash flow and represent a rapid return to positive cash flow. Add another $300 million to $500 million of FCF from Project Athens and the Rocky Mount recovery from 2H 2023 to 2024, and we would arrive at an annual free cash flow of $350 million to $550 million.

Even if the outcome of the project falls well below estimates, it still provides investors with a wide margin of safety. Especially since the market capitalization is currently only $806 million. If management can execute as planned, we would currently only be trading at 1.5x-2.3x, 2024 Free Cash Flow. Even assuming a lower base, if execution were to go wrong, at an FCF multiple of 10x, management should generate only $80.6 million in free cash flow annually.

Looking Ahead

Since we are also long-term investors, we want to point out a few factors, as the company is positioned in a sector that is technically in secular decline.

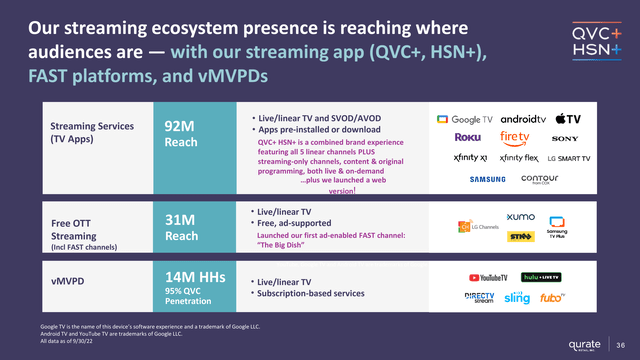

From a long-term perspective, the company is fighting phenomena such as cord cutting and innovation in several ways. First, the new management, like the CEO, is somewhat younger and has a history at market researcher NielsenIQ and seems well-prepared for innovation. As for cutting cable, they are fighting that by also slowly moving to streaming platforms such as YouTube TV, Fubo TV, Hulu Live TV, Apple TV, Google TV, and they also launched on Roku last month.

Needless to say, the medium of broadcasting may have changed, but management is not blind to it and is cleverly rolling out on streaming platforms for more advanced users as well. And even if they cut the cord and don’t have a streaming service, they can still watch live on QVC & HSN’s website.

Furthermore, video commerce has yet to really gain a foothold in the United States, at least compared to China. In China, video commerce has become a huge industry, growing at a tremendous rate. The market grew from 120BN yuan in 2018 to an estimated 3.4T yuan, or nearly a 30x increase in 4 years.

It is estimated that this growth will continue at 30% CAGR until 2030. Some of the drivers of success are Taobao and Alibaba Live Shopping, owned by Alibaba (BABA). Some platforms are also trying to bring this type of shopping to the U.S., with TikTok recently launching live shopping in October.

We think Qurate is also poised to take advantage of this secular shift in e-commerce, if it takes off in the United States. Qurate has the right assets, distribution centers, TV studios and network to successfully launch such platforms.

The Valuation

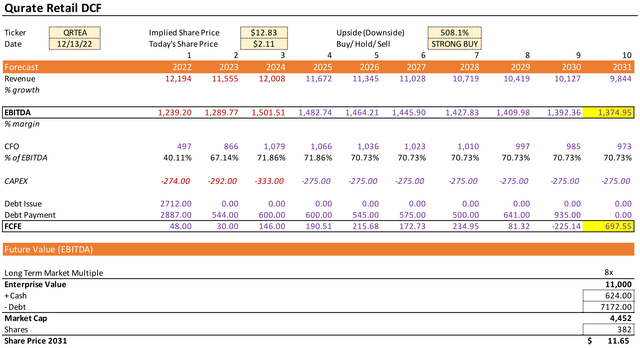

Finally, our valuation. Our assumptions are based entirely on the information mentioned earlier and what we consider to be very conservative estimates. For revenues, we have taken FY 2022 revenues and anticipated a further decline due to secular declines as mentioned earlier.

EBITDA estimates are based on a combination of historical data and should be consistent with Project Athens improvements and stabilization of operations between now and 2024. By comparison, our highest EBITDA estimate for 2024 is considered very conservative compared to the $2.13BN EBITDA the company achieved just 2 years ago in 2020. It is also far less than the 10-year average historical EBITDA generated by the company, which averaged $1.86BN.

We have also factored in a decline in this EBITDA as sales shrink. It is quite possible that the company will continue to expand margins and find new efficiencies on a smaller scale, which we have not taken into account. Thus, our estimates are skewed towards the downside. Our estimates are based on a margin of safety.

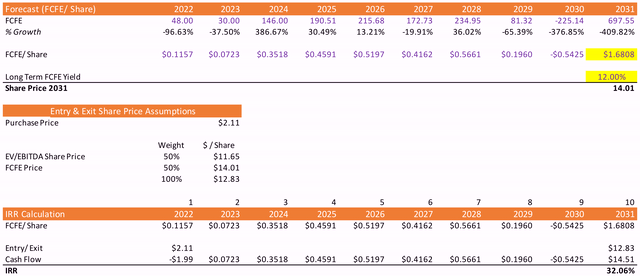

As a multiple, we used only 8x EV/EBITDA, well below the industry average of 26.22x EV/EBITDA used for other online retailers, or even the 11.84x EV/EBITDA for general retailers. We used this estimate because we believe investors will continue to take a pessimistic view of the sector and because the company’s sales are likely to shrink. Taking into account debt and cash, that brings us to a conservative price target of $11.65.

For our FCFE estimate, we may have taken an even more radical stance, factoring in that Qurate cannot issue more debt, as it used to when interest rates were low. Since the Fed is likely to start cutting interest rates sometime in 2024, it seems more likely to us that the company will be able to continue issuing debt from 2025 and beyond. For example, the dot plot released by the Fed yesterday shows that interest rates are already at 3.1% in 2025. By the time their revolving line of credit expires in 2026, there should be plenty of financing available at attractive rates.

But again, we rely more on a worst-case scenario, and include as much as $4.94BN of debt to be repaid by 2030, in line with the year their maturity dates are. Free cash flow is again based on Project Athens provisions and conservative historical data. We’re basically pricing in an almost complete deleveraging of the company.

In contrast, Fitch, in issuing its ratings in late September for Qurate’s bonds, estimated that free cash flow would grow from $212 million in 2021 to $952 in 2025. Our estimate is even more conservative than the rating agency’s, coming in at $790.5 million in 2025 (CFO-CapEx).

We put a 12% FCFE Yield on our estimate, again very conservative compared to industry peers, from which we derive a price per share of $14.01. If we take both valuations at a 50% weighting, we arrive at a price per share of $12.83 or an IRR of 32.06% when cash flows are taken into account.

When it comes to debt, we often see the question of why the company has so much debt. We think it is a combination of tax benefits from interest expenses, along with the fact that most Liberty companies are leveraged and have a long history of spin-offs and acquisitions.

The Downside Risks

No matter how calculated and rational one’s proposal is, the worst can still happen. Just look at the force majeure that hit Qurate Retail in 2022, which perhaps should be seen as a condition of the future. So here are some of the risks to watch out for in the future that may change our thesis:

- An overly bearish Federal Reserve, with inflation falling slower than expected/ firmer. This would lead to higher rates for a longer period, making it harder to issue debt at attractive rates.

- Persistent supply chain disruptions, with China locking up again or continued labor shortages leading to higher wages/ smaller margins.

- Inability of management to realize Project Athens, or too drastic changes in the business model, leading to a faster-than-expected decline in customer base.

- Persistent problems that put pressure on margins between now and 2025, causing most maturities to be paid off with their revolving line of credit, so they are taking on more debt.

- Other instances of force majeure leading to a weakened business model, making it more difficult to repay/refinance their debt in the short to medium term.

- An extraordinary recession, affecting even the top earners, leading to lower spending and consequently inefficiencies.

- Lack of insider purchases, even at these prices. Although management hasn’t been selling, and is currently holding on to their shares firmly.

While anything is possible, the downside seems rather protected to us. Once the company is stabilized, and recovery is visible, the share price should get a significant boost. (Perhaps management can throw in a set of Ginsu knives to entice shareholders to start buying more at these prices.)

On the other hand, the fixed income market seems to have a better view of Qurate’s future and correctly values the company compared to the equity market, which seems to be extremely pessimistic. We strongly recommend monitoring Qurate’s bonds, as we have done, as the bond market typically gets it right.

The Bottom Line

There are a few catalysts to watch out for in 2023:

- An insider purchase can dramatically bolster shareholder confidence

- Q4 has historically been a great quarter

- Slowdown/reversal of QT and stabilization of bond market

- Interest rates/ yields peaking

- A further decline in dollar strength

- Improving labor shortages/ inventories/ supply chain

- Results of Project Athens becoming visible

Beyond these factors, there is also a small possibility that Qurate may be paying a dividend or buying back shares in the meantime. Last year around the same time, Qurate issued a special dividend of $1.25, which currently amounts to more than half the share price.

In August 2021, they also authorized a $500M share buyback, of which there is plenty of capacity left, and could technically buy back more than half the float at this price with $500M. Management has traditionally been very shareholder-friendly and usually uses its money to buy back shares and pay dividends. Management is also heavily compensated in RSUs, stock options and shares, so most of their compensation is tied to shareholders.

Ultimately, Michael Burry likes to invest in companies that have “sheer outrageous value,” are mostly misunderstood and have a wide margin of safety. He buys companies when they look like roadkill, and sells them when they are somewhat polished. Qurate Retail meets all these conditions. He also likes to buy within 10-15% of the bottom, and sell at new lows. The stock is currently finding tremendous technical support at $2.

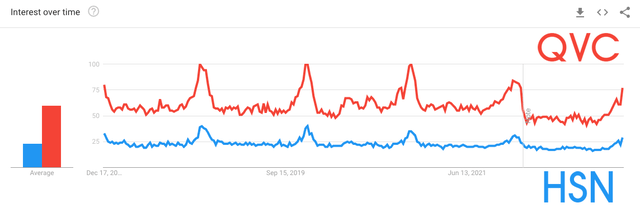

P.S.: We’ve also been monitoring search traffic for QVC and HSN over the holidays, and it looks like business is carrying on as usual as it did last year.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment