Scott Olson/Getty Images News

Quidel Corporation (NASDAQ:QDEL) has been under my radar for a couple of months as a stock that I feel has significantly gained from the pandemic. It jumped more than 400% over the past five years, but has fallen 10% in the one-year timeframe. Since 2020, Covid-19 has been treated as a biosecurity threat, with many countries stockpiling vaccine supplies, therapeutics, and diagnostics for their citizens. Evidently, as a diagnostic healthcare product manufacturer, Quidel intends to expand its clinical diagnostics to not only double its market size in the U.S., but also give the company a higher global presence.

Thesis

I believe Quidel is a buy, especially due to its definitive agreement with Ortho Clinical Diagnostics Holdings (OCDX) alongside robust fourth-quarter earnings. This combination to form a diagnostics company will give shareholders value by increasing the commercial footprint of both entities. Quidel has also witnessed growth in rapid immunoassay that supported the company’s performance in 2021, further contributing to a solid end quarter. Quidel is confident that in Q1 2022 it will post the largest revenue in its history.

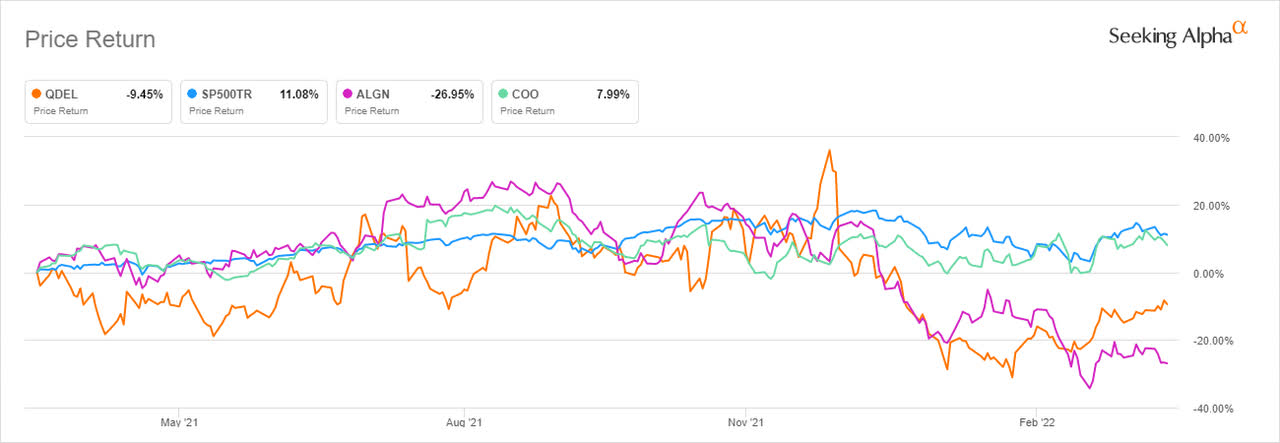

A look at price-return analysis shows that QDEL was unable to outperform the S&P 500 index over the past year, which grew 11.08%. It did, however, post better results than Align Technology (ALGN), which fell -26.95%.

Seeking Alpha

While Cooper Companies (COO) had a good year, scoring more than 7% in price returns, in the longer timeframe it could not beat both Align and Quidel, which gained over 260% and 400% in the past five years, respectively.

Strong Earnings

Q4 2021 saw Quidel report a 35% increase in its EPS at $6.98, against $636.9 million in revenue. The quarterly earnings had gained 24% after rising to $509.7 million in Q3 2021. Overall, Quidel recorded its best-ever revenue performance in 2021 at $1.699 billion despite its gross profit falling to $1.271 billion (YoY).

However, the company was unable to replicate its strong Q4 2020 revenue performance when it stood at a high of $809.2 million. This decline was attributed to a $249 million loss in the sale of Sofia 2 Flu and SARS antigen FIA. Customers seemed to have shifted to the lowly-priced QuickVue products, and for some time abandoned the Sofia analyzer, which is priced higher in the professional market.

Then again, Covid19-related products made revenue rise by $106.5 million, or 26.28%, to $511.8 million in Q4 2021, despite the slowing pandemic pains during the year. The company has embraced a post-pandemic reality. In 2021, Quidel took just nine months to open its largest immunoassay manufacturing plant. It boosted output tenfold, helping to meet the surging demand.

The fairly priced QuickVue At-Home OTC gave the company impetus to enter the retail and the home Covid19 testing markets. In its last earnings report, CEO Doug Bryant stated that the Covid19 assays helped Quidel create a strategic partnership with CVS, Walgreens, McKesson, the NIH, and others. It also struck a 12-month $500 million deal with the US government to deliver the OTC Covid19 test kits.

Companies such as Abbott Laboratories (ABT) were granted $1 billion in US Army contracts for the supply of Covid19 test kits. The supply is slated for completion on June 26, 2022, indicating the army’s satisfaction with the previous $306 million contract.

Early in January 2022, the Defense Department, in conjunction with the US Department of Health and Human Services (HHS), gave contracts to Abbott, iHealth Lab, and Roche Diagnostics. The Department purchased 380 million OTC Covid19 test kits in response to President Biden’s goal of delivering 500 million free at-home Covid19 test kits to arrest the Omicron variant.

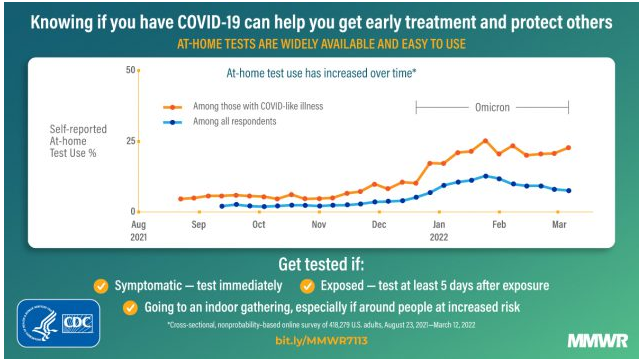

Even so, I believe that the rapid antigen tests, just like the pandemic, have an uncertain future. It is, therefore, imperative for the test companies to boost production and prioritize orders from the federal government to deliver on these lucrative contracts. From August 2021 to March 2022, self-reported use of at-home Covid19 test kits has increased by more than 50%.

CDC

According to the CDC, from August 2021 to March 2022, the use of at-home test kits increased by 5.7% in the Delta variant period. It later increased by 20.1% in the Omicron period, which coincided with the winter period. Nonetheless, the Covid19 prevalence has declined substantially since February 2022, affecting the at-home test use level. This decline was, however, not present among patients that had reported Covid19-like illnesses.

Ortho’s Acquisition

In its agreement with Ortho Clinical Diagnostics, Quidel expects to establish a high-end-to-end diagnostic solution covering high volume, complex hospital services, and laboratories. This portfolio will offer the point-of-care solution and help it maximize retail/ OTC channels.

From a financial standpoint, the $6 billion acquisition of Ortho is a strategic first for Quidel, since it will help contribute at least $100 million in revenue synergies by 2025. Quidel has a market capitalization of $4.85 billion, more than $1 billion less than the cost of Ortho’s acquisition. Even so, the company is set to close the deal in the first half of 2022. What we get from this back-breaking deal is that Quidel is determined to tap into the diagnostics business.

Quidel’s Savanna MDx platform is expected to contribute the largest portion of this revenue. In its Q4 earnings call, Quidel confirmed the launch of the Savanna MDx system in the various ex-US markets. Late 2021 also saw the launch of the CE Savanna multiples molecular analyzer and the RVP4 assay systems.

Investors should watch out for Quidel’s acquisition of its Emergency Use Authorization (EUA) of the RVP4- Respiratory Viral Panel in 2022- making this year, a very busy period for Quidel. The company is also working on the 510(k) submission for the RVP11. In the pipeline also are assays and panels to detect the herpes simplex virus, varicella-zoster (virus), STIs, and gastrointestinal pathogens.

The company stated that it had already received positive feedback on the Savanna system. Using PCR, the Savanna system can detect up to 12 pathogens in 20 minutes. To put this into perspective, using the Savanna MDx, Quidel will set up an in-vitro diagnostic (IVD) platform. This system is future-proof, flexible, scalable, and secure. We are looking at a diagnostics portfolio that embeds touch-screen features while using cybersecurity, cloud, and user management systems. Overall, Quidel expects annual revenues to reach $300 million in three years after Savanna’s launch in the US.

Speaking to investors on Ortho’s acquisition and the Diagnostics space, CEO Doug Bryant explained,

The planned Ortho acquisition is expected to more than double our global market opportunity, estimated to be worth over $50 billion between the point of care, clinical chemistry and transfusion medicine categories,” Bryant said. It also allows Quidel to maintain 9 percent to 11 percent top-line growth post-COVID.”

Risks

As a point-of-care pure-play diagnostics company, Quidel will rely on the payment of its products through reimbursements by third-party payers like private health insurance plans, Medicare (by the Federal system), and Medicaid (by the State). Primary users of Quidel’s products such as physicians and hospitals will want their purchases and costs of using these diagnostics systems reimbursed by their patients’ insurance policies. Timely payment will encourage usage of these facilities and thereby make a positive impact on Quidel’s revenue growth.

As previously stated, and despite the hype, Covid-19-related diagnostic systems are facing an uncertain future. At the moment, the sale of Covid-19 antigen tests and influenza have contributed largely to the company’s revenue structure. A drop in these sales will adversely affect Quidel’s profits. Nonetheless, the company is diversifying with the launch of the Savanna MDx, which will expand Quidel’s pathogen detecting system in the future.

Bottom Line

For the past five years, Quidel’s share price has been pushed higher by the tailwinds of a strong diagnostics portfolio. Since delivering a solid Q4 2021 performance, the company has lined up various product launches, including the Savanna MDx. QDEL is also set to close its deal with Ortho Diagnostics within the first half of 2022. The main headwinds faced by the company include third-party cost reimbursements (by insurers) and dependence on Covid-19 diagnostics tests which may be worn out with time.

However, Quidel has secured a 12-month $500 million deal with the US government, which the company is processing alongside other projects. It is still too early to time the ending of the pandemic due to the prevalence of Covid-19. For these reasons, we propose a buy rating for this stock.

Be the first to comment