270770

Do you remember where you were when the Queen died? Much like recalling where we were when JFK was shot or MLK passed away, the death of the Queen has been a seminal event for many precious metals investors. And that is because so many modern coin designs have had the queen on them! Little did we all know; however, that the Queen’s passing would prompt a flurry of buying gold and silver coins with her likeness in the anticipation of those being the very last issuance of coins with her likeness on the market.

Canadian Maple Leaf (APMEX)

A Popular Figure

The gold and silver bullion markets have already been dealing with tighter supplies. And we have seen gold and silver inventories on the American COMEX industrial exchange shrinking dating back to the “silversqueeze” movement by American coin investors on three days in January and February of 2021. The interesting fact about the bullion markets is that investors never really stopped buying physical gold and silver after the pandemic restrictions were lifted. In fact, they kept buying more and more.

According to News.com.au in Australia, “Collectors are scrambling to get their hands on coins with Queen Elizabeth’s face as prices skyrocket after her death.” Demand for coins with the Queen’s likeness reached ‘insane’ levels at many dealers, who are now widely reporting strict supplies or pre-orders for new coins. Popular websites have been besieged by high traffic, and dealers have been scouring all known sources of gold and silver for these popular coins.

The Royal Mint, Perth Mint, and the Royal Canadian mint have said they will stop producing coins with the Queen’s likeness and replace them with King Charles III’s likeness. Being the first issuance with that likeness, many market experts predict a continued surge in collector demand for coins with royal likeness regardless of who is on the coin.

What’s Next For Bullion

The spike in demand not only for coins with the Queen imprinted on them but also for many other types of gold and silver, has not gone unnoticed. One conversation I had with a bullion dealer was that one of their main global wholesalers was out of 99% of silver inventory and premiums were rising fast. Another dealer told me that some coin issuance had premiums, the price paid above the market ‘spot’ price for metals, that had risen 2-3 times in some cases.

While surging premiums are never music to the ears of bullion buyers, the dynamics of the market are clear. Investors have been demanding more gold, and particularly silver since the beginning of 2021. And they are not stopping here. It appears any excuse for wanting more bullion is working with investors right now. It is a good time to be in the gold and silver industry, whether one works for the miner producing it, the wholesaler distributing it, the dealer selling it, or the buyer obtaining it while the prices are steadily rising as they are this week.

Market Outlook

Right at this moment, the market is rewarding patient investors of precious metals with temporary shortages and more robust prices. But what investors likely want a solution for is premiums over the derivative-market spot prices. What will cause those prices to change? We’ll examine quickly how that market really works.

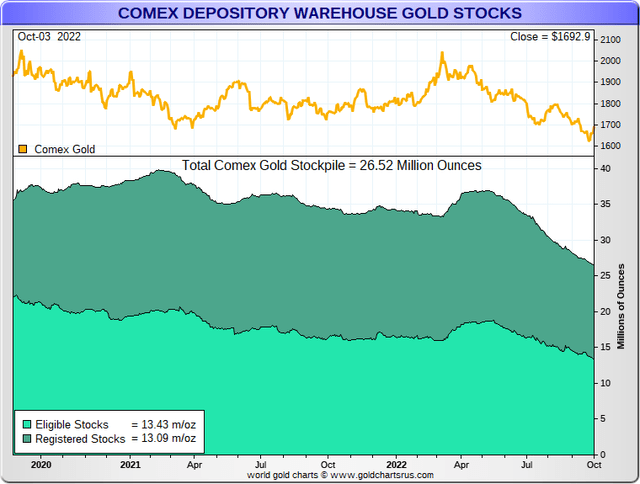

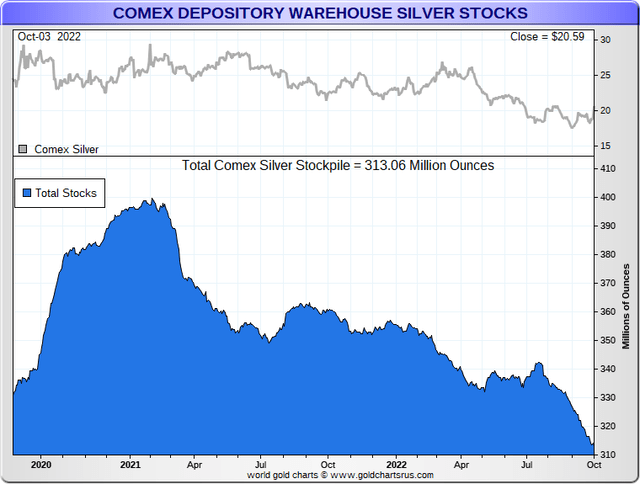

The COMEX, the commodity derivative market in the US, and the London OTC market, which essentially serves the same purpose in the UK, are both seeing declining inventories of silver in particular. The following charts highlight the direction of bullion inventories on the world’s two biggest industrial exchanges for gold and silver.

COMEX Gold Inventories (GoldChartsRUs.com)

As you can see from the chart, the past 18 months have seen gold supplies dwindle by approximately 28% while silver inventories have fallen about 23%.

COMEX Silver Inventories (GoldChartsRUs.com)

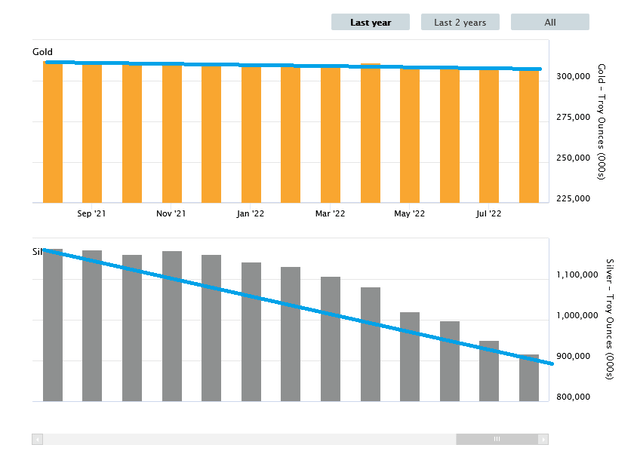

Not to be outdone, the London market has seen a precipitous decline in silver inventories due to increased participation in ETF investments such as SLV and others. While in London, the gold bullion inventory appears more steady.

London Metals Inventories (LBMA)

It appears as though physical bullion investors are interested in obtaining more metal from the two major Western bullion markets, and have been doing so in large part since the beginning of 2021. What is different about that is the demand has overwhelmed the mining supply, draining much of the above-ground known inventories of free silver and beginning to chip away at the mountain of above-ground gold in various storage.

It is unknown whether this will eventually negatively affect the US and UK bullion markets in terms of supply shortages. Certainly, if these now multi-year trends continue to hold up, physical bullion investors should expect to pay higher prices as a result of increased demand and back orders.

While those initially have resulted in higher coin and bar premiums at dealers, eventually one would expect the derivative markets, where spot pricing is determined, to catch up to the physical market and start to reflect higher spot prices for the metals. Time will tell whether this happens, and of course, we will continue to follow developments here.

Be the first to comment