putilich

A Quick Take On Qualtrics International

Qualtrics International (NASDAQ:XM) reported its Q2 2022 financial results on July 20, 2022, beating expected revenue while missing EPS estimates.

The company provides customer experience software to enterprises worldwide.

While XM is growing revenue and gross profit impressively, its continued loss-generating ways make it difficult to imagine an upward stock price catalyst, absent a pause in interest rate hikes.

Until management makes a meaningful turn toward operating breakeven or the cost of capital starts trending lower, I’m on Hold for XM.

Qualtrics Overview

Provo, Utah and Seattle, Washington-based Qualtrics was founded in 2002 to provide software-as-a-service that empowers organizations with the data they need to keep their customers satisfied through various stages of the customer journey.

Management is headed by Chief Executive Officer Zig Serafin, who was previously president at SAP and Corporate Vice President at Microsoft.

Qualtrics has developed its Experience Management, or XM, platform, which it says enables organizations to:

-

Gather and analyze a new class of data it calls Experience-Data, or X-Data, that is richer, more immediate, and potentially noteworthy to understand the quality of experience than traditional operational data.

-

Ensure a quality experience holistically, unifying information and insights from customers, employees, and partners and recognizing the operational linkages between these stakeholders.

-

Become more predictive and proactive, closing feedback loops, and turning insight into real-time action to prevent and close experience insufficiencies where necessary.

-

Decentralize the analysis and decision-making process across the organization by delivering capabilities in a simple, easy-to-use solution.

Qualtrics’ solutions include:

-

Customer Experience

-

Employee Experience

-

Brand Experience

-

Product Experience

-

Design

-

XM Services

The firm’s focus industries, throughout which the company’s solutions are utilized include, but are not limited to, B2B, automotive, government, travel & hospitality, financial services, media, airlines, and retail industries.

XM has invested in its Qualtrics Partner Network, which has more than 200 companies partnering with the firm to extend the platform for individual customization.

Qualtrics’ Market & Competition

According to a 2018 market research report by Research and Markets, the global customer experience management market is projected to grow to $21.3 billion by 2024, representing a very strong CAGR of 22% during the period between 2018 and 2024.

The main factor driving market growth is the increasing need for personalized customer experience.

Major competitors that provide or are developing customer experience management services include:

-

Adobe

-

Avaya

-

CA Technologies

-

IBM

-

Medallia

-

Sprinklr

-

Towers Watson

-

SVMK

-

HeartCore

-

Zenvia

-

WalkMe

-

FreshWorks

Qualtrics’ Recent Financial Performance

-

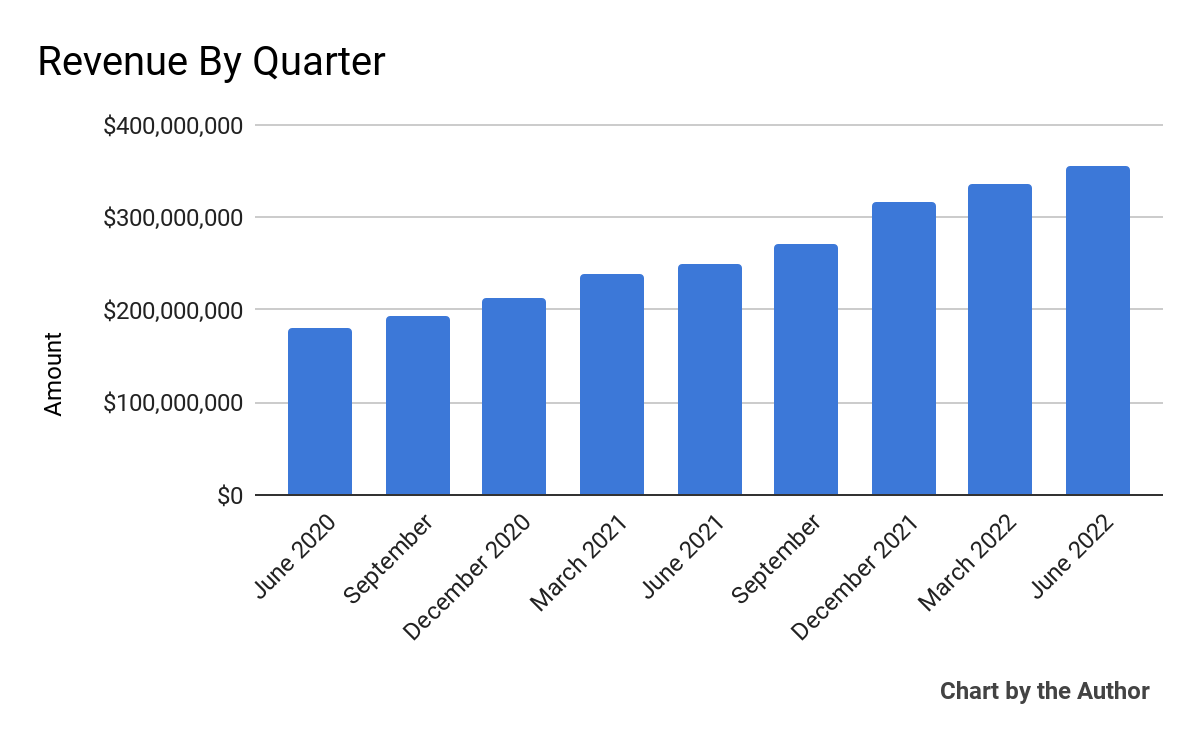

Total revenue by quarter has grown according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

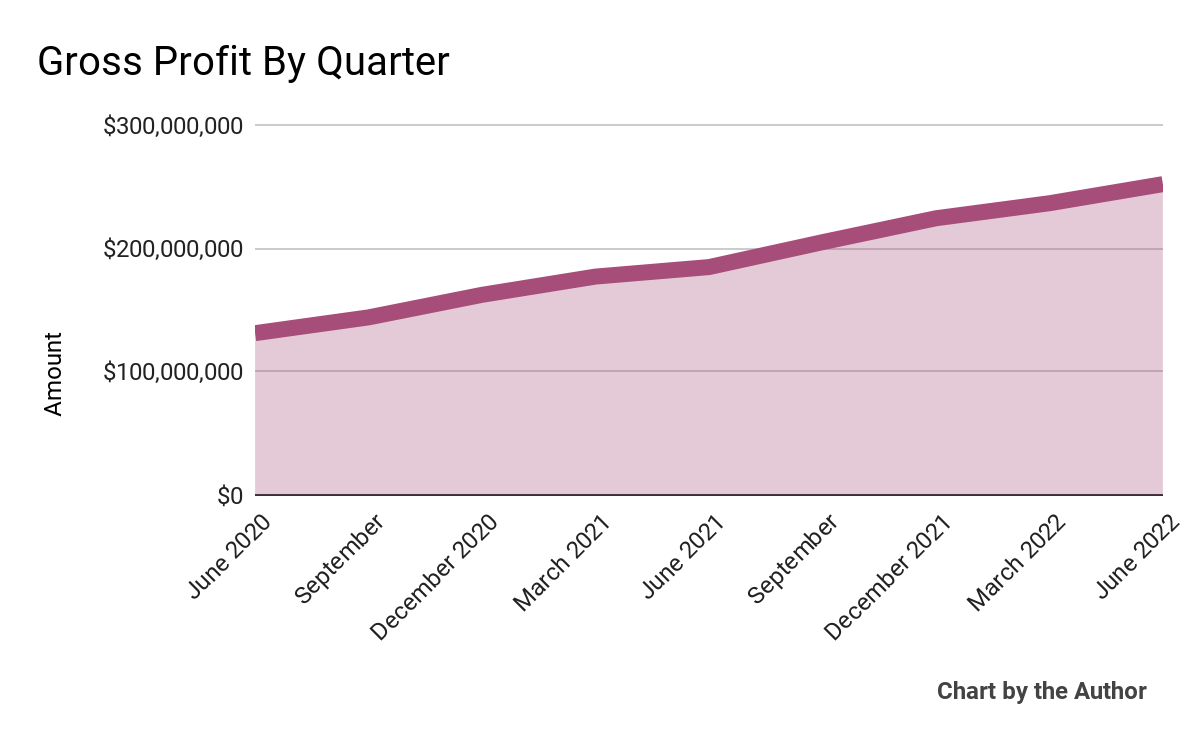

Gross profit by quarter has also increased, as the chart shows here:

9 Quarter Gross Profit (Seeking Alpha)

-

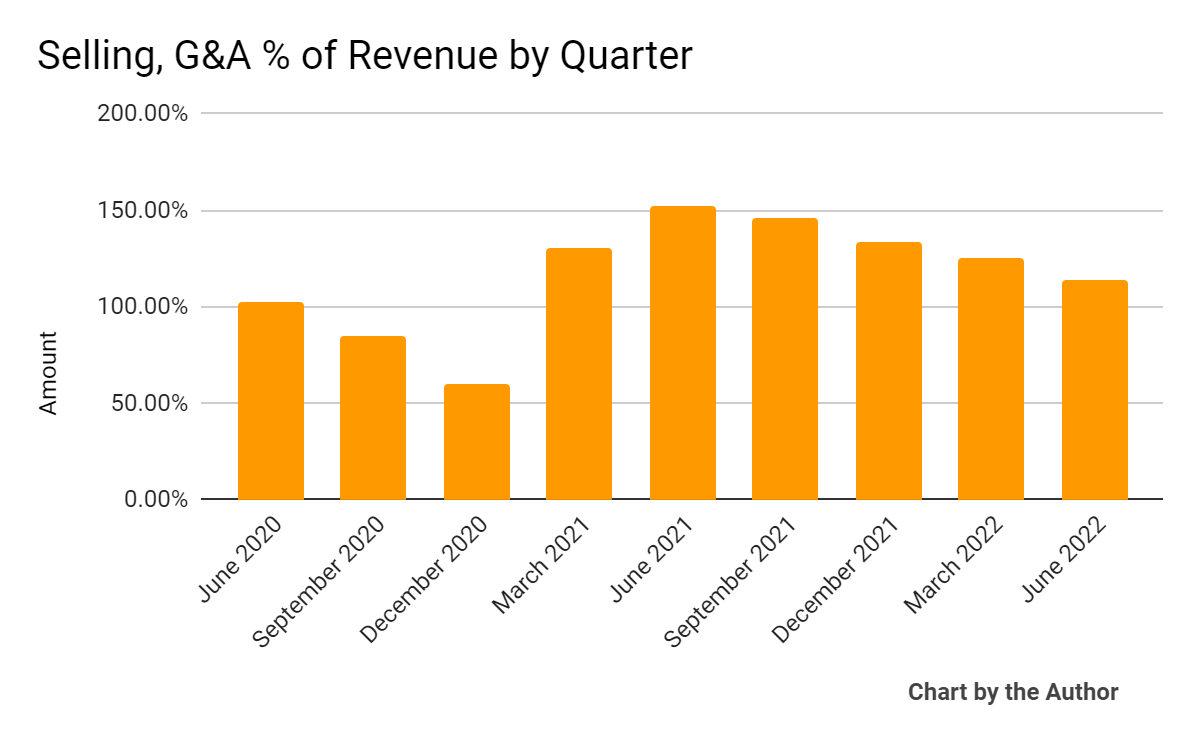

Selling, G&A expenses as a percentage of total revenue by quarter have risen and then more recently fallen:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

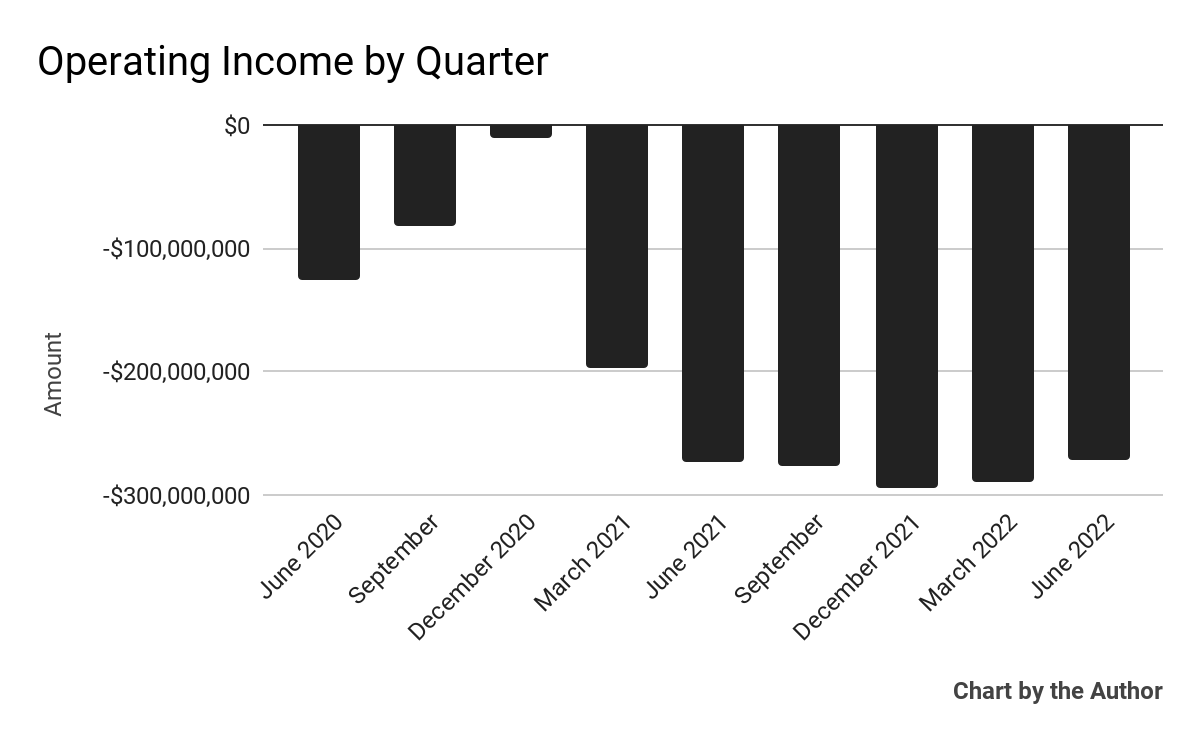

Operating losses by quarter have remained heavy:

9 Quarter Operating Income (Seeking Alpha)

-

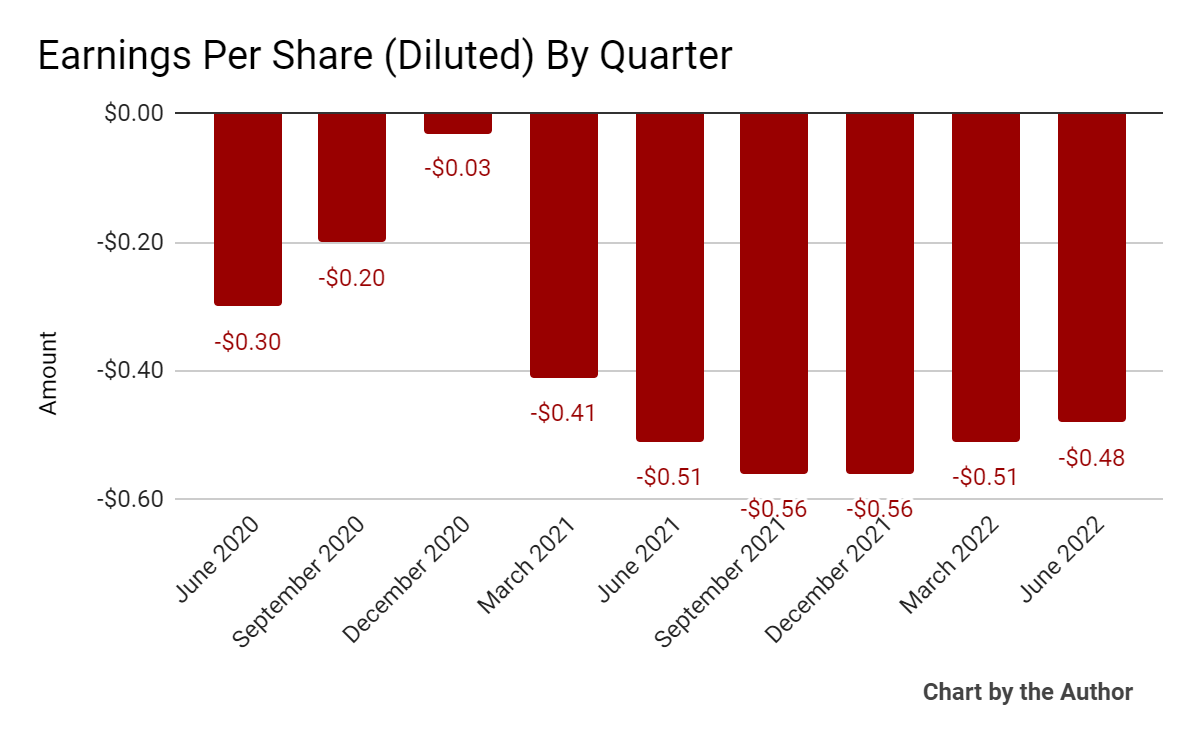

Earnings per share (Diluted) have also remained sharply negative:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

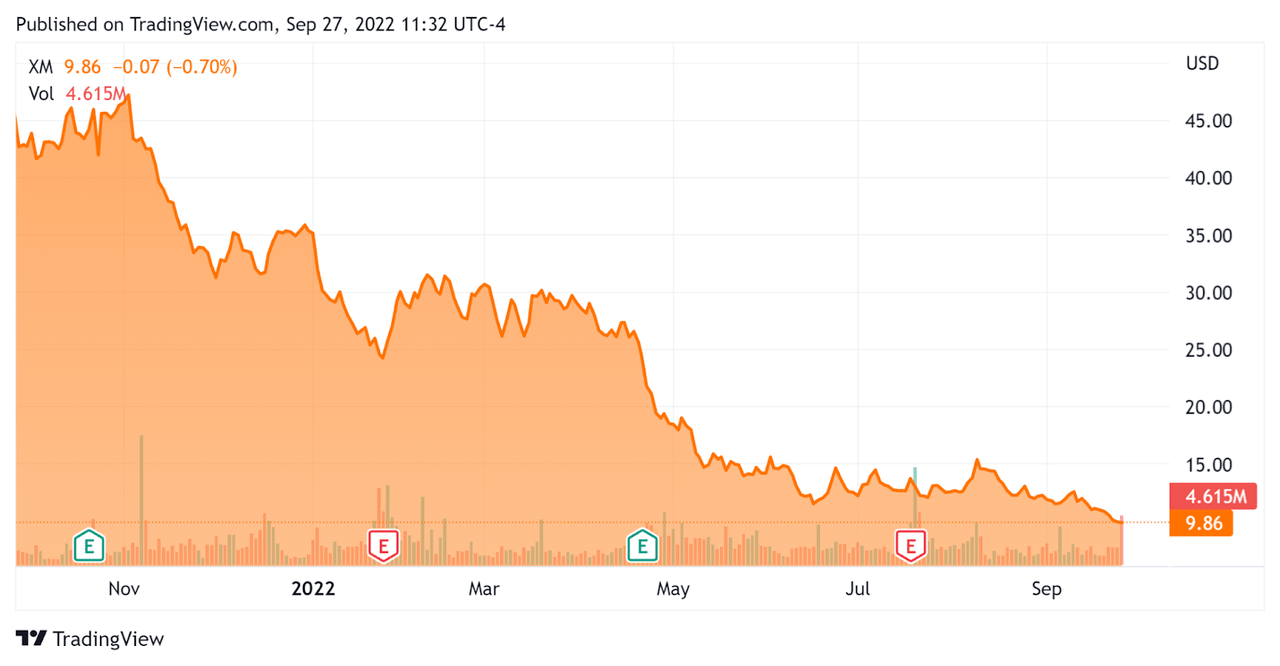

In the past 12 months, XM’s stock price has fallen 78.6% vs. the U.S. S&P 500 index’ fall of around 17.1%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Qualtrics

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

4.24 |

|

Revenue Growth Rate |

43.1% |

|

Net Income Margin |

-91.2% |

|

GAAP EBITDA % |

-82.5% |

|

Market Capitalization |

$5,930,000,000 |

|

Enterprise Value |

$5,430,000,000 |

|

Operating Cash Flow |

$37,240,000 |

|

Earnings Per Share (Fully Diluted) |

-$2.11 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Sprinklr (CXM); shown below is a comparison of their primary valuation metrics:

|

Metric |

Sprinklr |

Qualtrics Int’l |

Variance |

|

Enterprise Value / Sales |

3.41 |

4.24 |

24.3% |

|

Revenue Growth Rate |

29.8% |

43.1% |

44.5% |

|

Net Income Margin |

-20.4% |

-91.2% |

347.4% |

|

Operating Cash Flow |

-$13,090,000 |

$37,240,000 |

–% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

XM’s most recent GAAP Rule of 40 calculation was negative (39.4%) as of Q2 2022, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

43.1% |

|

GAAP EBITDA % |

-82.5% |

|

Total |

-39.4% |

(Source – Seeking Alpha)

Commentary On Qualtrics

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted some customer wins and expansions.

Also, it launched its Employee Journey Analytics, which enables organizations to improve their employee experience processes.

The firm announced its Discover product integration with major shareholder SAP’s Service Cloud to use its advanced machine learning system to analyze structured and unstructured data coming into the service cloud.

As to its financial results, total revenue rose 43% year-over-year, while subscription revenue increased 47%.

The company’s net dollar retention rate was 126%, indicating strong product/market fit and good sales & marketing efficiency.

XM’s Rule of 40 results have been extremely poor, with the company producing a sharply negative figure in this important metric as it makes high and continuing operating losses and negative earnings.

Of particular note, the company’s R&D expenditures have risen dramatically in recent quarters as it spends heavily to stay at the forefront of industry trends.

For the balance sheet, the firm finished the quarter with $786.6 million in cash and equivalents and no debt.

Over the trailing twelve months, free cash used was $76.7 million, with Qualtrics spending a hefty $113.9 million in capital expenditures.

Looking ahead, management reduced its fiscal 2022 revenue guidance to $1.424 billion due to ‘further macroeconomic uncertainty.’

Regarding valuation, the market is valuing XM at an EV/Sales multiple of around 4.2x.

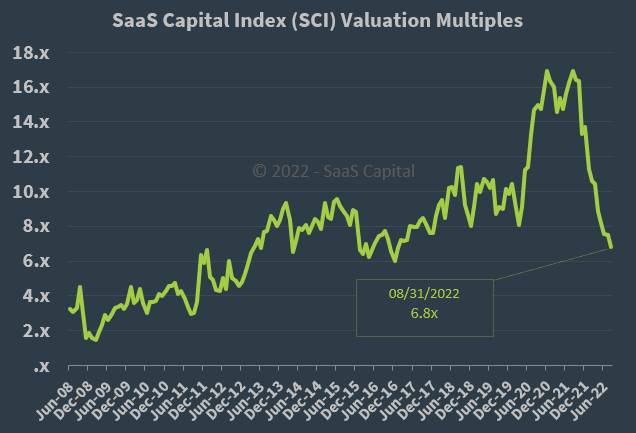

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x on August 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, XM is currently valued by the market at a discount to the broader SaaS Capital Index, at least as of August 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth trajectory.

The company stock continues to be decimated as it produces extremely high operating losses and cash usage, both of which have been heavily penalized in the current rising cost of capital environment due to interest rate hikes by the U.S. Federal Reserve.

While XM is growing revenue and gross profit impressively, its continued loss generating ways make it difficult to imagine an upward stock price catalyst, absent a pause in interest rate hikes.

Until management makes a meaningful turn toward operating breakeven or the cost of capital starts trending lower, I’m on Hold for XM.

Be the first to comment