baona/iStock via Getty Images

By Oliver H. Wong, CFA, Portfolio Manager, Research Analyst, Franklin Mutual Series

Mutual Series’ Oliver Wong believes high-quality microcaps house hidden benefits, despite the extreme market declines seen in the first half of the year.

This year’s volatile equity markets have punished microcap stocks. The group, as measured by the Russell Microcap Index, has lost a quarter of its value over the first six months of 2022, falling more than the broad-market Russell 3000 Index, which dropped by about a fifth.1 The Russell Microcap Index is comprised of the smallest stocks, with market capitalizations ranging from approximately $30 million to just over $1 billion.2 Despite recent declines, we expect quality microcap stocks with strong balance sheets and seasoned management teams will likely outperform over the longer term, and believe there may be benefits to investing now.

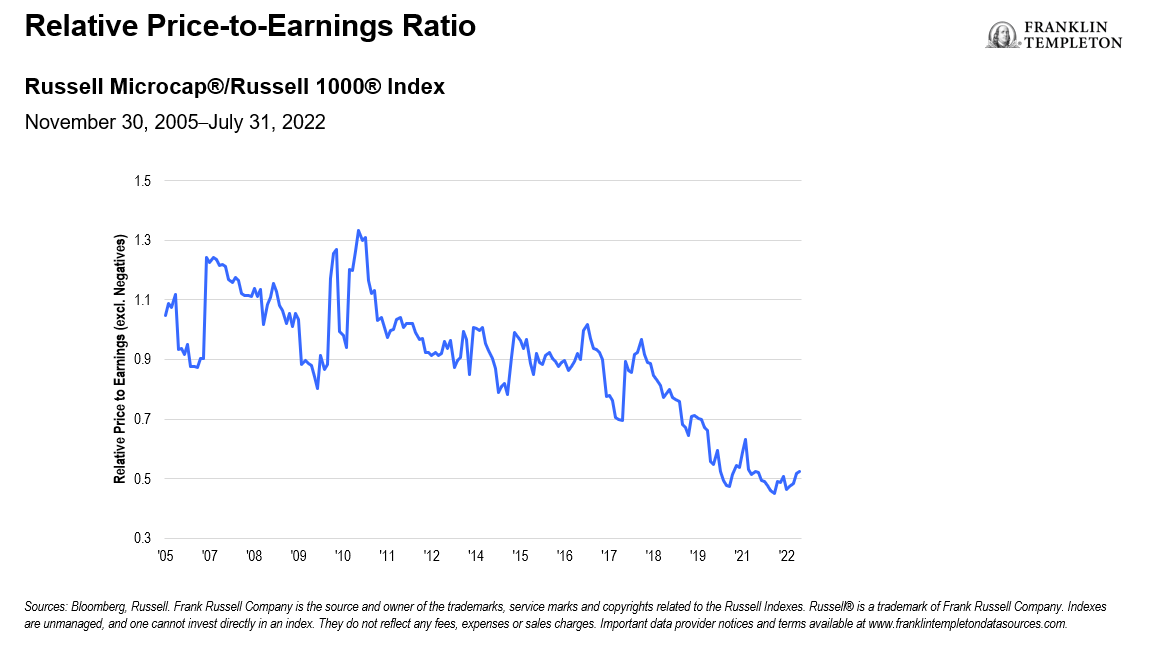

Chart 1

Risk and resilience

Microcap stock valuations have fallen significantly, both on an absolute basis and when compared to their large-cap counterparts, as seen in Chart 1. Moreover, microcap stock price-earnings (P/E) multiples have reached levels not seen since the global financial crisis. As of June 2022, the P/E on the Russell Microcap Index stood at 10.5 times, according to data from Russell. However, we believe the long-term outlook for profitable microcap companies remains bright as earnings continue to grow quickly, suggesting that valuation multiples might revert to the mean in the future.

Furthermore, microcap companies primarily operate US-centric businesses and can offer a degree of protection against heightened international and geopolitical risks that large-cap companies are typically more exposed to. This US centrism could further close the valuation gap between microcap and large-cap stocks over time.

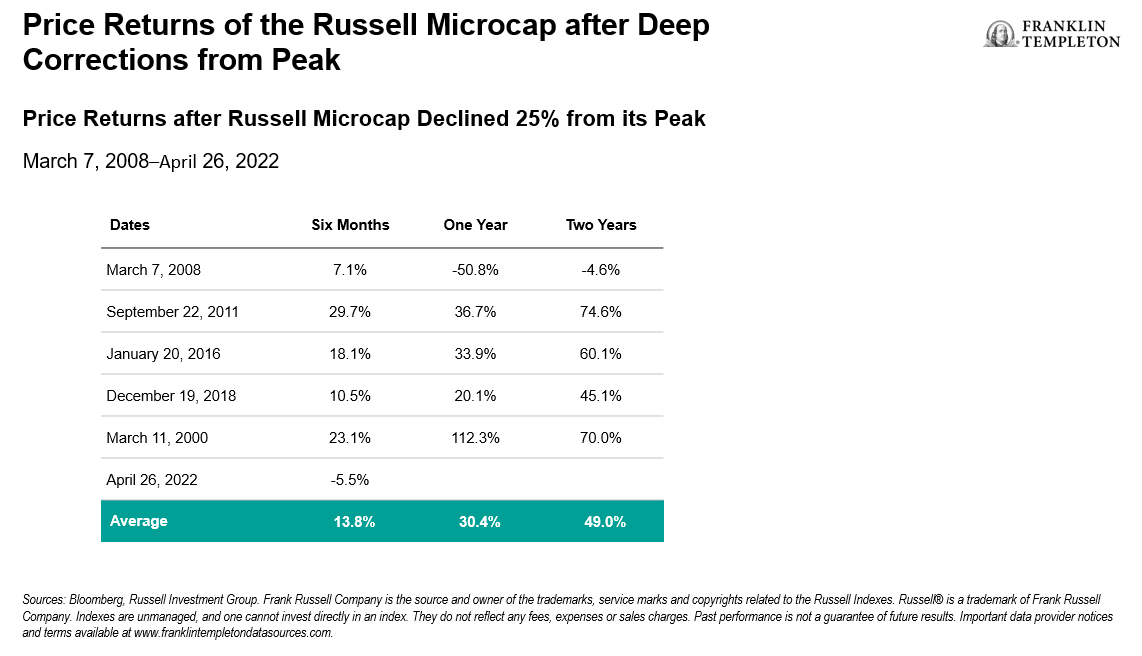

In addition to what we believe to be inexpensive, the Russell Microcap Index has often bounced back strongly after periods of sharp declines like the one the group is currently facing. Microcap stock prices may continue to fall further, as they did during the global financial crisis, but on average after a 25% decline, the Russell Microcap Index returned 30% over the following year, while gaining 49% over a two-year period.3 (See Table 1 below.)

Table 1

Although we may continue to see near-term declines, we believe the pullback in microcaps so far this year has given investors a compelling opportunity to invest in an asset class that we think offers strong future earnings growth at attractive valuations.

A quality cushion

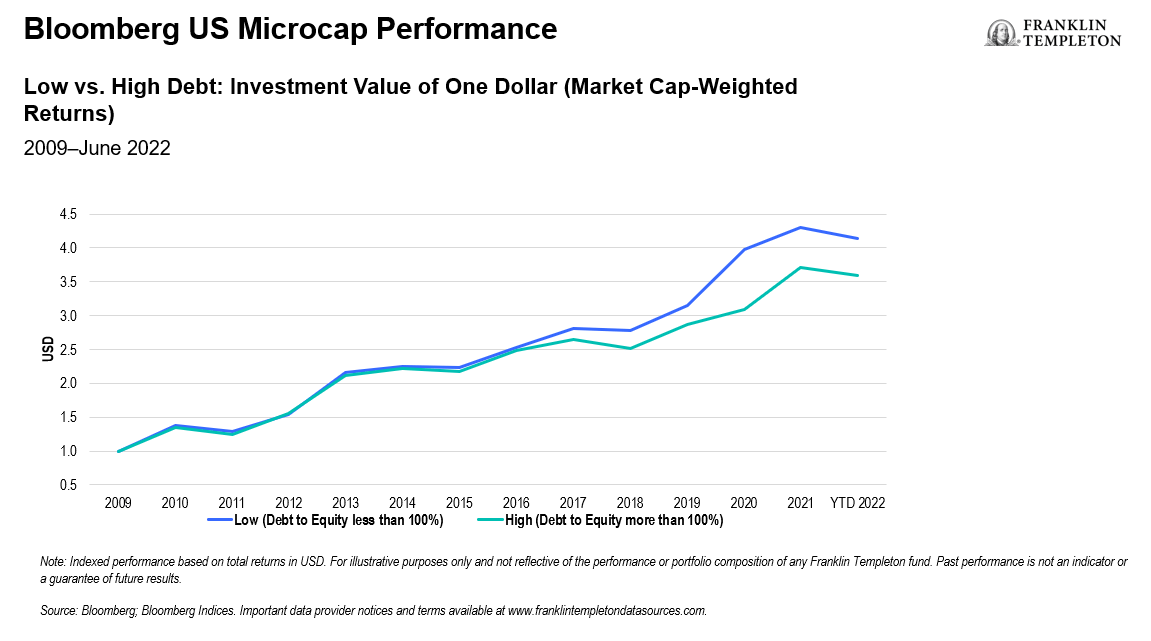

We believe there are several reasons why stocks may look cheap. They may be in a business cycle downturn, operating in an out-of-favor industry, or facing company-specific issues. Whatever the reason, we believe our odds of investment success are drastically improved by focusing on higher-quality companies. We like those companies with manageable or no debt on the balance sheet, as high financial leverage can push companies into distress during economic downturns.

As Chart 2 suggests, those companies with lower debt levels have tended to outperform. Investor concerns about what impact higher interest rates will have on those companies with significant debt levels, and the potential for an eventual recession, have taken their toll so far this year. We believe high-quality microcap value stocks should continue to fare better than indebted companies through both the downturn and subsequent recovery.

Chart 2

Similarly, we also prefer companies with management teams that have successfully navigated their companies through both good and bad times and can generate consistent cash flow to weather any near-term challenges. Regardless of the economic environment, we tend to look for companies we can hold over the next three to five years that are managed well and possess the potential for good long-term earnings growth.

Finally, we typically avoid companies with protracted difficulties, instead focusing on those whose issues we believe are either fixable or temporary. By focusing on quality companies, we believe an investor can avoid some of the hazards that come with investing in microcap stocks. The higher quality a potential investment, the more opportunities there are for the stock to overcome any short-term challenges to its price, in our view.

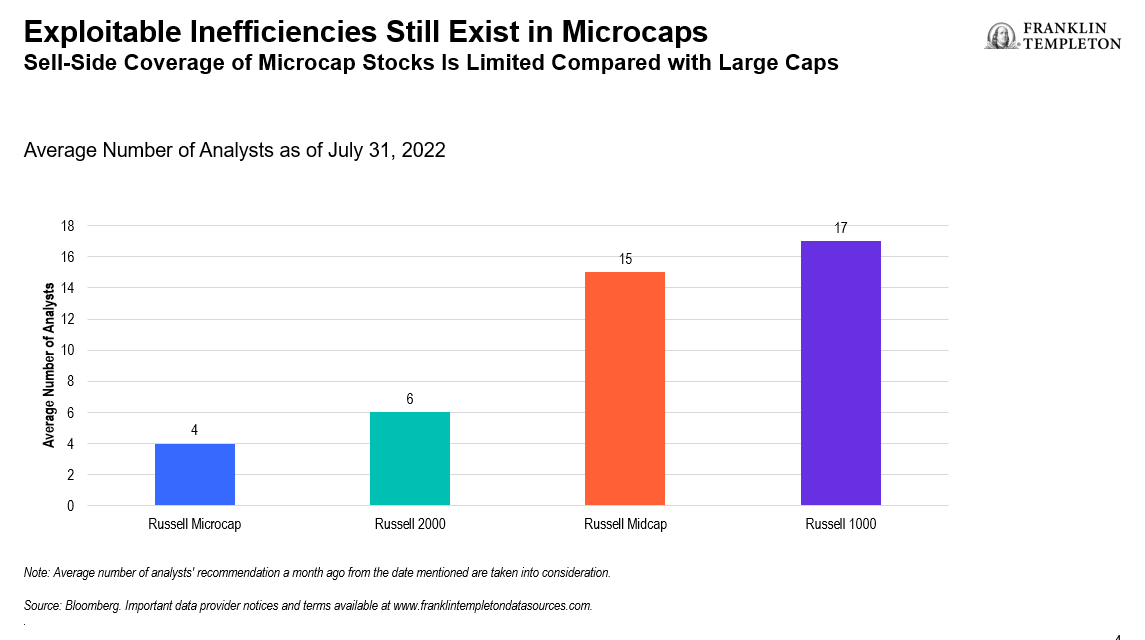

An active following

We believe active management is crucial when looking for microcap companies. Big institutional investors have tended to ignore the market’s smallest companies—those that have less than a $1 billion market capitalization. As a result, there are plenty of microcap stocks that have little, if any, coverage on Wall Street and that may be trading at a sharp discount to their fundamental value. This inefficiency leads to more opportunities for investors who can separate out the poorly run companies from those that offer real promise.

If we look at the Russell Microcap Index, there are 1,756 stocks that fall into the microcap space, as of June 2022, with an average market capitalization of $558 million and a median of $214 million. Of those, there are only about four analysts covering each stock on average compared with 17 for the Russell 1000 Index (according to data from Bloomberg illustrated in Chart 3), providing many opportunities for dedicated buy-side fund managers to add value through an extensive review of their underlying businesses, the cash flow they generate, and the strength of their balance sheet.

Chart 3

When looking through microcaps, one stock could be a high-growth company blazing new trails in its industry, or it could be a former large-cap stock heading for extinction. These companies, which may look the same on the surface, may produce wildly different results for investors. That makes active stock selection crucial in finding the best ideas and avoiding potential pitfalls.

With microcaps having already fallen sharply this year, we see opportunity for gains with reduced downside risk, particularly for those stocks with quality characteristics. We see a benefit in getting involved in the microcap space now, while this opportunity still exists. More volatility may lie ahead over the next few months, but we think there is excellent potential for investors if they know how to uncover it.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investing in smaller-company securities that may have limited liquidity involves additional risks, such as relatively small revenues, limited product lines and small market share. Historically, these stocks have exhibited greater price volatility than larger-company stocks, especially over the short term. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Value securities may not increase in price as anticipated or may decline further in value. Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

1. Source: Bloomberg, as of July 31, 2022. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

2. Source: FTSE Russell, as of May 6, 2022.

3. Sources: Bloomberg, Russell Investment Group. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment