Kevork Djansezian/Getty Images News

While low-end smartphone demand has apparently fallen, the market is far too negative on the prospects of Qualcomm (NASDAQ:QCOM). The recent negativity in the stock is pricing in some substantial weakness in the current period for demand. My investment thesis remains ultra Bullish on the wireless chip company trading at just $120 now with an expanding product portfolio pushing Qualcomm far beyond the handsets market.

Focus On Premium Chips

A lot of the issues with sudden weakness in smartphones are more low end phones, primarily in China. Samsung (OTC:SSNLF) had apparently called out weakness in the sector recently along with other electronic devices including TVs and home appliances leading to an order cut for July by the electronics giant.

The key here is that Qualcomm focuses heavily on the premium chips sold in Apple (AAPL), Samsung and other smartphones that can compete with the technology demands in this area. The company has more competition for chips in the more medium to high end of smartphones. As consumers in emerging markets shift from feature or low end handsets to premium smartphones, especially 5G, Qualcomm obtains more content in each phone along with higher license fees usually capped at a percentage of up to $400.

At the recent Bank of America Global Tech. conference, CFO Akash Palkhiwala confirmed the chip supplies are only heading towards an equilibrium with demand after the slowdown in China due to covid lockdowns:

One is second half of the year, we expect demand and supply to reconcile to a large extent. And we always thought it would be a combination of two things. It would be a combination of supply improving and demand declining a bit. And those two were required to get to equilibrium. And so really no change to our view there. We’re seeing both of those things happen. The China situation obviously very unfortunate what’s going on there, but it has impacted demand to an extent as we’ve talked about it. And that helps us get into supply equilibrium sooner.

Qualcomm continues to build in areas such as mixed reality where demand will soar in the next few years. Again, per the CFO, the mobile chip company has chips in all of the XR products and the only question on revenues is how many products the likes of Meta Platforms (META) are going to sell on an annual basis:

…significant upside opportunities to Qualcomm stock is first one is XR. If you believe in the Metaverse version, and you can pick how big your view of Metaverse is.

You can say it’s going to be 50 million devices, 100 million devices, 1 billion devices, pick a number you like. Each one of those numbers, because of where we are at and we have pretty much all the designs that are in the market using our chip.

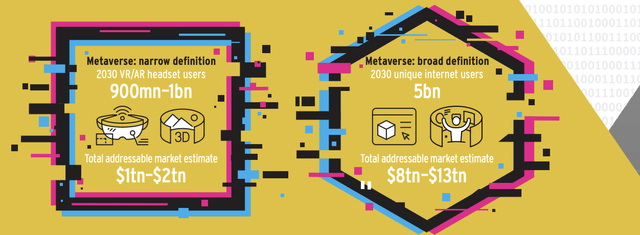

According to research from Citigroup, the demand for AR and VR devices will easily top 900 million units and might reach a billion by 2030. Qualcomm is likely to eventually lose lower end sockets in the future, but these devices fall into the similar requirements of smartphones with connectivity via 5G and Wi-Fi, AI and low power processing.

Source: Citi GPS report

Qualcomm forecasts the market will sell 750 million 5G smartphones this year in a sign of the enormous opportunity in the AR/VR headset market by 2030. This new XR market is set to match the current 5G smartphone opportunity, though over time these devices might converge to a certain extent.

Either way, Qualcomm is likely to garner additional content most definitely via consumers owning multiple devices, but also in a scenario where the headsets turn into smart glasses able to handle the features included in current smartphones.

The IoT market is vast and growing by leaps and bounds. Any item in retail or the industrial world needing connectivity is a candidate for a Qualcomm chip solution.

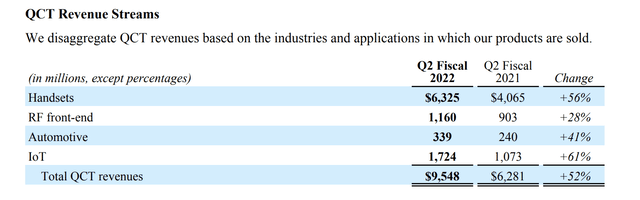

In Q1’22, Handset revenues were $6.3 billion with additional RF front-end revenues mostly from handsets at $1.2 billion. The IoT market revenues were only $1.7 billion. In the future, this category could generate similar revenue totals as the Handset segment.

Source: Qualcomm FQ2’22 earnings release

Recession Baked In

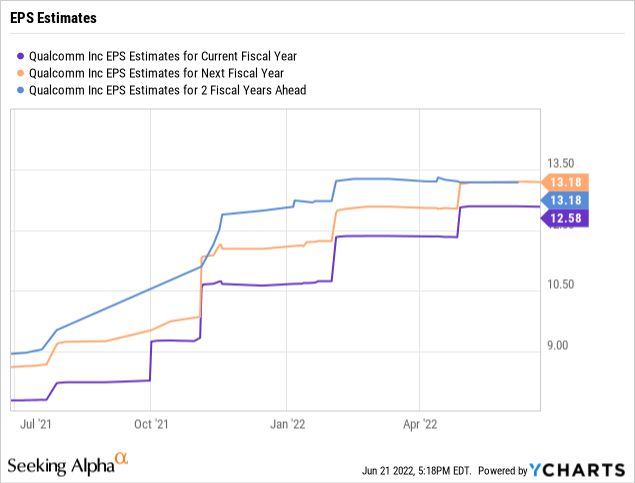

Only a couple of weeks ago, the CFO of Qualcomm made a very good case for the mobile chip company continuing to hit prescribed financial targets. The company was already on pace to reach an EPS target of $12 to $13 over the next year or so.

If an investor wants to assume a global recession reduces earnings by 20%, Qualcomm would still generate a 2022 EPS of ~$10. The stock only trades at 12x these adjusted EPS targets.

Of course, this is only an exercise in the downside risk of the stock in the current weak economic environment. The base case remains that Qualcomm hits current EPS targets and trades at only 10x analyst targets despite this strong future in the IoT sector discussed above and a growing backlog in the Automotive segment that likely matches the potential in Handsets and IoT.

At one point, Qualcomm didn’t have much of an opportunity outside of smartphones, but now the business has multiple growth pillars. Though, the stock is still valued based on limited future growth which is no longer the case.

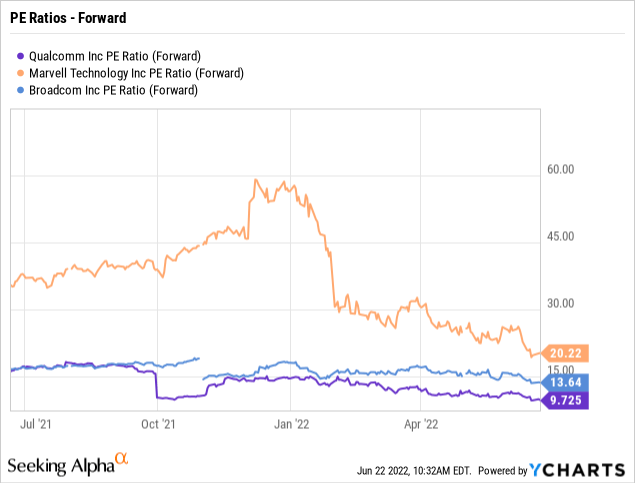

Stocks such as Broadcom (AVGO) with similar, if not lower, growth potential trades at closer to 14x forward EPS targets while a semi. company such as Marvell Technology (MRVL) trades at more than double the P/E multiple of Qualcomm.

Takeaway

The key investor takeaway is that Qualcomm is far too cheap whether one adjusts EPS targets for a recession or not. The mobile chip company still appears poised for strong long-term growth, warranting a much higher P/E multiple.

Be the first to comment