Ethan Miller/Getty Images News

Chip giant Qualcomm (NASDAQ:QCOM) is seeing an acceleration of its design-win pipeline as the auto industry gears up for a secular software-defined shift in semi-autonomous and autonomous vehicles. Qualcomm CEO Cristiano Amon highlighted that the chipmaker’s automotive pipeline has risen to $30 billion from a previously-announced $19 billion in June. Amon said this rapid acceleration of the pipeline demonstrates “how fast all of the automakers in the industry are embracing the Qualcomm digital chassis.” With the adoption of semi-autonomous and fully-autonomous vehicles still in the very early innings, Qualcomm’s automotive pipeline looks poised for substantial long-term growth and further acceleration over the course of the decade.

Solid Performance In Q3

Although Qualcomm’s automotive segment contributed approx. 3.7% of revenues during the chipmaker’s Q3, the segment performed about on par with the company’s broader growth. However, revenues are on the cusp of $1 billion, and an acceleration in design wins combined with high-volume vehicle launches over the next couple of years paves the way for rapid revenue growth moving forward.

Qualcomm witnessed +38% y/y growth for FQ3 ’22 in the automotive segment, reaching ~$350 million in revenues. Revenues for the 9M period increased +34% y/y to $945 million. Qualcomm pointed to “continued traction and design wins across global automakers and Tier-1 customers” for its Snapdragon Digital Chassis, as well as an “increase in demand for digital cockpit products” as factors driving the growth.

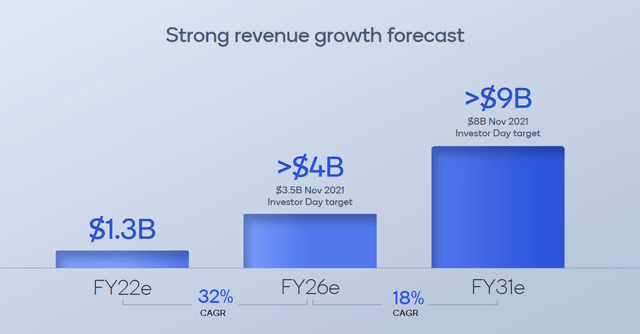

For FY22, Qualcomm is guiding for about $1.3 billion in revenues, representing about 33% y/y growth with a slightly slower sequential growth rate of ~2.7% in Q4, with about $359 million in projected revenues. However, there is potential for Qualcomm to exceed these targets – customer NIO (NIO) is scaling the ET7 and ES7 in the back half of the year, while GM (GM) is likely scaling production of the new Cadillac Lyriq, aiming to reach 25,000 units volume this year before ramping to 200,000 annually. FY22 is just the start of an impressive run of growth ahead for Qualcomm, with over $4 billion in revenue forecast for FY26, a 32% CAGR, and over $9 billion by FY31, an 18% CAGR from FY26.

Over the long run, the growth in connected vehicle volumes and market share, along with the growth of semi-autonomous and autonomous driving, are expected to drive Qualcomm’s revenues ahead of current targets.

Autonomous Driving Opportunity

The autonomous driving industry, from semi-autonomous ADAS to fully-autonomous robotaxis and trucks, presents a long-term, multi-billion dollar opportunity up for grabs.

BloombergNEF’s 2022 EV outlook projected that China “will operate the world’s largest robotaxi fleet with about 12 million units by 2040, followed by the US which operates around 7 million autonomous vehicles.” In total, robotaxi fleets are likely to be in excess of 22 million, considering that other nations aside from the US and China are developing AV plans.

Although market reports vary on the outlook for the industry, Allied Market Research projected the autonomous vehicle industry to rise at a ~40% CAGR from $76 billion in 2020 to $2.1T in 2030; Precedence Research forecast a 39% CAGR from $94 billion in 2021 to $1.9T in 2030. Again, the accuracy of these forecasts may vary depending on the pace of autonomous vehicle development, commercialization, and policy support, and may not be realized.

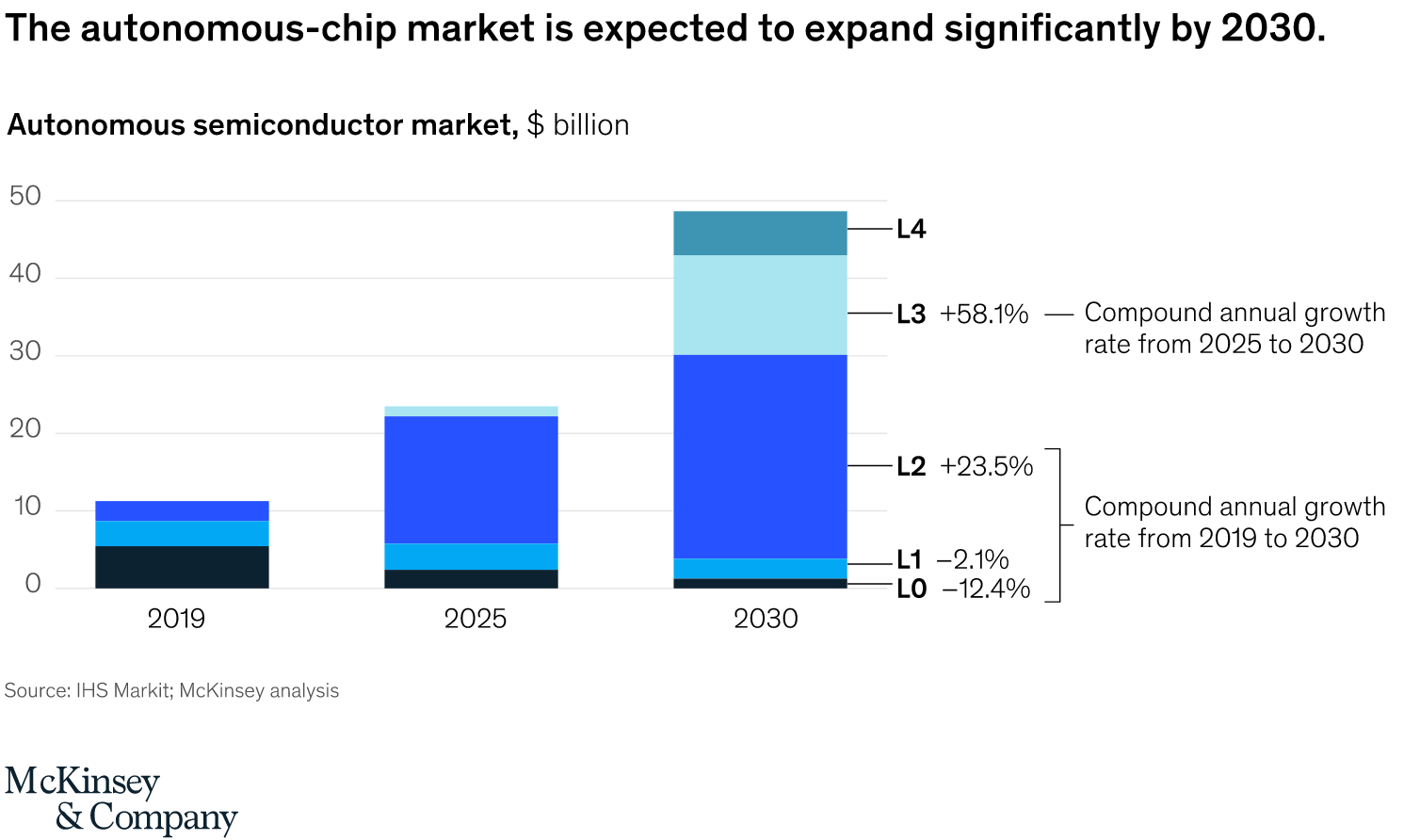

Even so, powerful AI and autonomous driving chips like Qualcomm’s and rival Nvidia’s are crucial in order to spur the autonomous vehicle market to such strong growth over the course of the decade. McKinsey projects the autonomous chip market to witness substantial growth, from ~$11 billion in 2019 to nearly $50 billion by 2030, with L3-tailored semiconductors witnessing a nearly 60% CAGR to ~$10 billion market size, while L2 remains the largest segment.

McKinsey

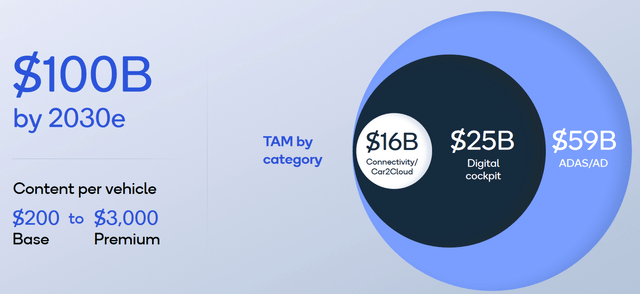

Internally, Qualcomm is projecting its automotive opportunities to reach a $100 billion TAM by 2030: nearly 60% of this opportunity stems from ADAS and autonomous driving, which is expected to kick into high gear later in the decade. With revenues projected past $9 billion by 2031, Qualcomm is targeting nearly 10% market share.

Aside from AV developers and OEMs developing chips in-house, such as what GM’s Cruise recently chose to do, Qualcomm faces competition from Nvidia (NVDA), Mobileye (INTC), and Renesas (OTCPK:RNECY) among others.

However, Qualcomm commands an enviable position as the major threat to Nvidia and others gaining market share in the connectivity/ADAS/AD chip market due to the growth rate of its pipeline, up over $10 billion since June and more than doubling since last year.

$4B By FY26: Is More Possible?

Qualcomm is confident that it can surpass $4 billion in automotive revenues by 2026, with 90% of that revenue forecast covered by its existing design wins. Qualcomm is seeing digital cockpit sales ramping in FY22, with ADAS and autonomous driving solutions ramping in FY26. However, given the explosiveness of Qualcomm’s pipeline over the past four months, $4 billion may easily be exceeded by FY26, given that connected vehicle volumes within major OEM partners are ramping up, along with the high possibility for more growth in the pipeline during FY23, funneling into sales in FY24 and beyond.

Qualcomm’s relationships with OEMs are key to driving growth above and beyond these forecasts. For example, Qualcomm’s recently announced partnerships with Mercedes (OTCPK:MBGAF) will see chips featuring in new vehicles starting in 2023; the OEM is aiming to shift to 50% EVs by 2025 and 100% electric by 2030, necessitating a massive volume of chips to meet high EV production targets. GM is kicking off use of Snapdragon in the Lyriq but has “said it will be expanding to other models from next year.” BMW (OTCPK:BMWYY) and Volkswagen (OTCPK:VWAGY) are reportedly planning to shift to Qualcomm by 2025. These shifts to Qualcomm’s portfolio as well as increasing vehicle models and vehicle volumes with Qualcomm’s solutions are expected to push revenues higher; combining that with an increasing content value per vehicle, Qualcomm could see revenues reach $4.3 billion to $4.8 billion by FY26.

Looking For 45% Growth For FY23

For FY23, it’s likely that automotive segment revenues will see an acceleration, given the range of OEMs adopting the technology and building out new models equipped with Qualcomm’s tech.

A handful of the models and OEMs accelerating growth into FY23 include:

- Renault (OTCPK:RNLSY) – using Digital Chassis for connectivity, digital cockpit, driver assistance, and cloud services

- Polestar (PSNY) – adopting Qualcomm for its upcoming Polestar 3 SUV, rolling out next month

- GM – ramping up Lyriq production, adding Qualcomm tech to more models, adding three Qualcomm chips to its Ultra Cruise ADAS for a 2023 launch

- Mercedes – recently partnered to adopt Qualcomm tech for infotainment and connectivity, with the first set of equipped vehicles launching in 2023

- Honda – adopting Snapdragon Cockpit for vehicles in late 2022, early 2023

- JiDU (BIDU) – adopting Digital Chassis for intelligent EVs in 2023

- XPeng (XPEV) – using Snapdragon Cockpit, recently unveiled plans to launch one vehicle per quarter, suggesting significant growth ahead of prior targets for 2023

- NIO – scaling up ET7 and ES7 production and capacity during 2023

With all of these different growth opportunities stemming from Qualcomm’s OEM partners, revenue growth is expected to accelerate into FY23, up from about +33% growth in FY22 to about +45% y/y growth in FY23. Revenues are projected to come in around $1.88 billion for the segment, around 4% of total revenues.

Long Term Outlook

Automotive’s long-term potential for Qualcomm is substantial, to say the least. Revenues are expected to surge from just under $1 billion last year to over $4 billion by FY26, with high-volume platforms and multiple OEMs already planning on using Qualcomm’s tech. Growth in autonomous driving and ADAS is expected to provide a massive opportunity for Qualcomm to tap into. Although Qualcomm is targeting over $4 billion in revenues by FY26, revenues could easily exceed that target given the breadth of OEMs joining Qualcomm’s ranks. In addition, Qualcomm’s tech is not exclusive — OEMs can adopt Snapdragon and its solutions while also relying on high-power chips from Nvidia, for example; this angle allows Qualcomm to avoid being locked out of the market. Automotive revenues are expected to play a major role in Qualcomm’s future as the auto industry continues along its intelligent, connected shift. Revenues are projected to rise ~45% in FY23 to $1.9 billion before expanding to nearly 10% of revenues by FY26. Shares are particularly attractive at just under a 10x PE supported by a 2.5% yield.

Be the first to comment