DNY59

Thesis

The Invesco QQQ ETF (NASDAQ:QQQ) has underperformed the S&P 500 ETF (SPY) (VOO) since we updated its bottoming process in early October. We noted that investors have remained tentative over the more richly-valued tech sector, preferring the more defensively-configured SPY.

With the market expecting the Fed to remain hawkish through at least H1’23, QQQ’s momentum could remain in the doldrums for a while longer. Moreover, last week’s employment report suggests that the Fed could force a repricing of the Fed fund rate (FFR) forward curve if the market anticipates a further steepening of the projected terminal rate.

Notwithstanding, investors should also bear in mind that the QQQ has outperformed the SPY consistently exiting every bear market/significant pullback over the last 15 years. Hence, we believe the pessimism in the QQQ could be reversed quickly if the market anticipates a less hawkish Fed moving ahead.

However, the 5Y breakeven inflation rate has crept up recently, likely reflecting the market’s concerns over the recent employment report. Hence, we assess that QQQ should remain in a consolidation zone above its November lows as its leading constituent stocks could continue to struggle for momentum.

Still, we parsed that analysts have already turned increasingly pessimistic over the QQQ’s leading sectors, which augurs well for a re-rating moving ahead. We believe the bar has been significantly lowered for QQQ’s leading sector constituents, which should improve its ability to outperform the Street’s estimates in 2023/24.

Hence, we remain constructive over QQQ’s buying sentiments and price action, despite its relative underperformance to the market.

Maintain Buy.

QQQ: Wall Street Increasingly Pessimistic

| Sector | Weighting % | Forward P/E |

| Technology | 47.7% | 21.7x |

| Consumer Discretionary | 15.4% | 23.2x |

| Communication | 14.9% | 15.1x |

| S&P 500 | N.A. | 17.7x |

QQQ ETF leading sector weightings %. Data source: S&P Cap IQ

QQQ is a tech-heavy ETF with a tech sector weighting of nearly 48%. Consumer discretionary and communications accounted for another 30% weighting. As such, QQQ’s top three sectors accounted for nearly 78% of its total weighting.

However, the performance of the three sectors in Q3 was relatively poor, with forward guidance also tepid. As such, analysts have turned increasingly pessimistic in their prospects through CY23, as they lowered their earnings estimates markedly.

Notably, technology, communication, and consumer discretionary were among the top four sectors that saw the largest earnings estimates cuts for CY23.

But QQQ’s Leading Companies Continue To Push Ahead

| Name | % Weight |

|---|---|

| Apple (AAPL) | 12.95% |

| Microsoft (MSFT) | 10.37% |

| Amazon (AMZN) | 5.23% |

| Google (GOOG) | 3.39% |

| Tesla (TSLA) | 3.30% |

| Google (GOOGL) | 3.28% |

| NVIDIA (NVDA) | 3.22% |

QQQ leading stock holdings by weighting. Data source: S&P Cap IQ

Accordingly, the performance of its leading constituent in Q3 has been subpar. Investors and analysts are increasingly concerned over Apple’s ability to post a solid CQ4 as it faces significant delays over its iPhone Pro series production in Zhengzhou, China.

Microsoft and Amazon demonstrated that even cloud computing wasn’t spared from more scrutiny by its enterprise customers as they curtailed consumption-related cloud spending.

However, Amazon’s optimism over the secular growth drivers in cloud computing remains resilient. The company updated recently that it’s committed to increasing its hiring for AWS, even as it commenced its layoff recently in other divisions.

Moreover, by collaborating with Nvidia, Microsoft has continued to drive further commitment toward its cloud-based AI supercomputer ambitions. Therefore, Stratechery stressed that Nvidia bears could be calling for the company’s demise too early as it demonstrated its AI-driven competitive moat to drive hyperscaler demand for its A100 and H100 chips.

Moreover, Microsoft CEO Satya Nadella emphasized that the company’s well-integrated multi-cloud offering has a distinct competitive edge against its keen rivals. Nadella highlighted:

The strength of Microsoft’s cloud business is its ability to offer a wide range of products, including infrastructure services like Azure and the business chat service Teams, to companies under one roof. Instead of buying 15 different subscriptions, [the customer can] get more value out of what you already have. – Nikkei Asia

As discussed in a recent article, Google has also demonstrated a willingness to improve its operating leverage. Some investors could be concerned with its “bloated” cost base as Google navigates a significant ad downturn. However, it has demonstrated its ability to pull levers relating to its YouTube segment to elevate its competitiveness against TikTok (BDNCE).

Management also seems to be accelerating Google Cloud toward profitability. Notwithstanding, Google Cloud remains in a “catch-up” phase. Hence, the company’s focus remains penetrating further into critical industry verticals and improving its market share gains against AWS and Azure.

And if any Tesla bears need a reminder that the company is far from finished, China’s media just reported that the company posted record China-manufactured deliveries in November. Hence, it augurs well for the leading EV maker’s push toward a record Q4 as it accelerates deliveries in December.

Is QQQ ETF A Buy, Sell, Or Hold?

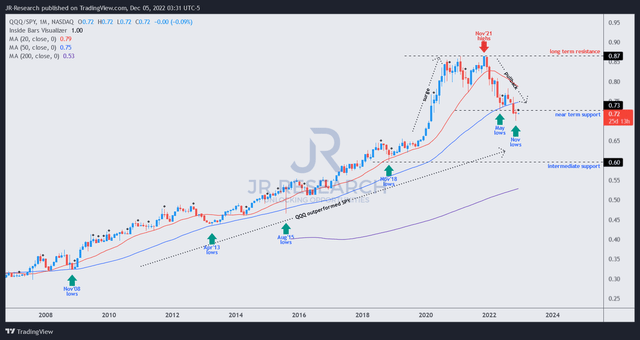

QQQ/SPY price chart (weekly) (TradingView)

Much depends on whether the Fed would play ball here. However, as seen above, we postulate that the market had already reflected the QQQ’s underperformance against the SPY.

Therefore, we believe the QQQ/SPY is well-primed to retake its potential outperformance initiative, as it remains well-supported along its long-term uptrend.

While the price action remains tentative for now, investors who have firm conviction over QQQ’s medium-term recovery should find the current levels attractive.

Maintain Buy.

Be the first to comment