SanderStock/iStock via Getty Images

In this informative Q&A session, we had the opportunity to speak with Chart Industries CEO, Jillian Evanko, about the energy transition and Ms. Evanko’s thoughts on energy solutions for the future. For a full transcript of the Q&A, please read below.

The energy transition is a big topic of conversation lately, with a lot of countries setting aggressive net-zero emissions targets over the next few decades. How would you evaluate the progress made so far and which countries or regions are ahead of the curve?

There has been meaningful progress in both public and private sector setting goals/targets both for steps toward 2030 as well as carbon neutrality. For example, less than two years ago there were a few dozen countries with that target and now hundreds have some form of a publicized goal. Additionally, looking at National hydrogen strategies, in 2020 there were 11 countries that had adopted some form of hydrogen strategy (Canada, Chile, France, Germany, the Netherlands, Norway, Portugal, Russia, Spain and the European Union (France had already adopted a Plan for Deploying Hydrogen for the Energy Transition in 2018)). The end of Q3 2021, four more adopted strategies and since then more than 20 other countries have stated they are developing their own.

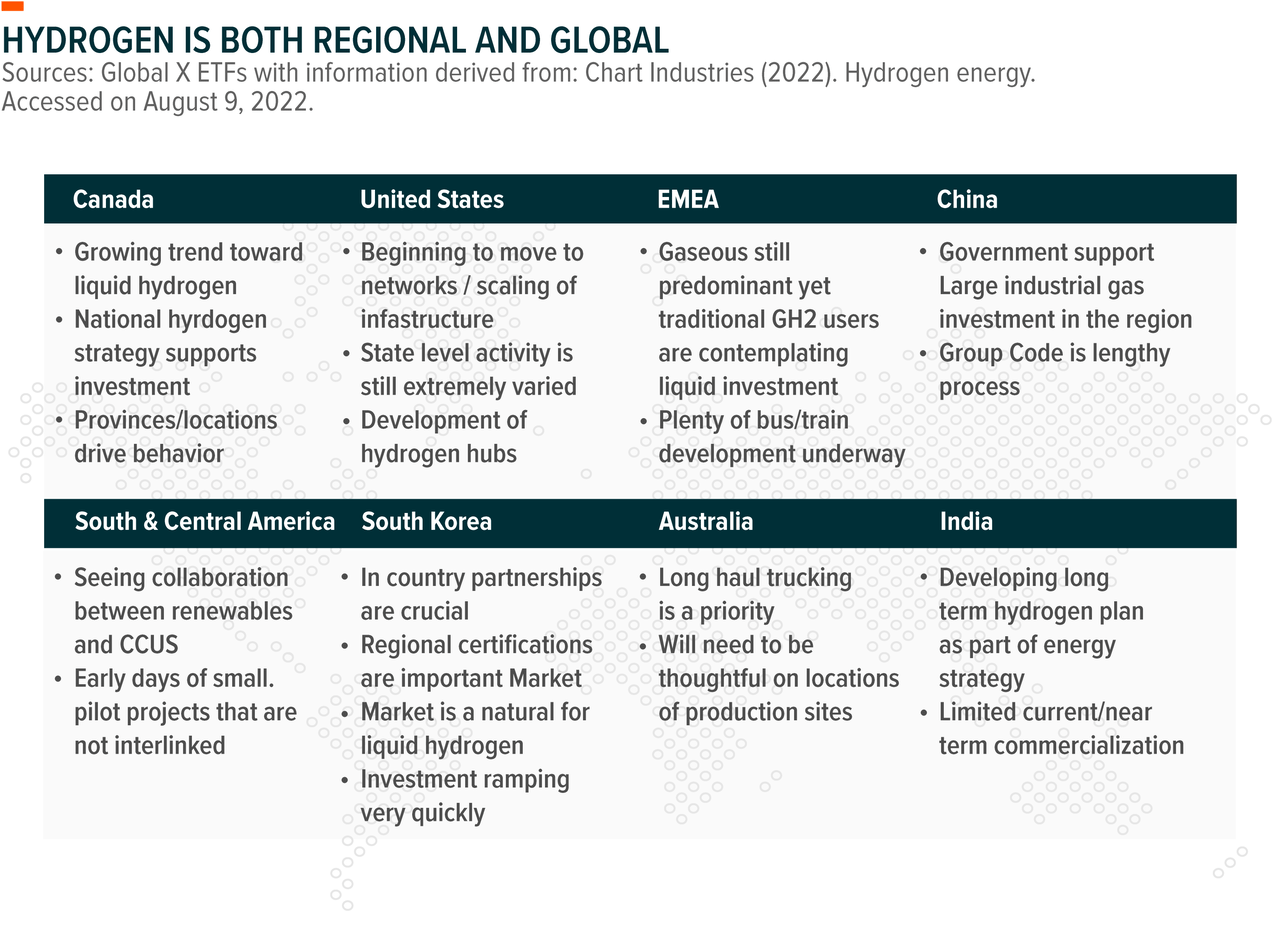

We also have seen progress in the number of regions / countries starting to execute hydrogen projects specifically, with countries like South Korea, Canada and China taking steps forward both from a certification perspective of equipment (defining that) as well as from actual projects moving to the commercialization stage. This slide may be helpful to give you a sense:

With all of that said, more execution and speed are needed to get close to the goals, and in particular, to get to the 2030 goals, there needs to be faster implementation of larger scale carbon capture and storage projects.

We also have seen over the past 2 years and continue to see in the current environment, the desire and action of collaborations / partnerships – this is prominent in hydrogen, CCUS [carbon capture, utilization and storage], and water treatment. These types of partnerships are important to driving cost down and scale as the industries need to be self-sustaining over time (i.e. public sector help works to kickstart but cannot be relied upon forever).

Given the current energy crisis in Europe, what do you believe are realistic solutions both in the short term and long term to solve the European energy shortfall?

It is two-fold – how do we ensure energy access, resiliency, security in the near-term while not forgoing the carbon emission reduction targets and other cleaner means of energy. In the short-term, multiple sources need to be used and that includes more traditional forms of energy in addition to the LNG [liquefied natural gas] and renewable activities that we are actively involved in today. For LNG, floating and small-scale LNG can be brought online quicker than larger facilities, yet there are a variety of considerations (i.e. access to water, pipeline constructs, etc.). We are hearing that some EU member states are looking at how they ensure access to energy for next winter but not moving away from their people’s desire to have more sustainable sources in the future (so a two-fold approach). Additionally, EU member states may also need to start redeveloping their own gas resources whether that be onshore or in the North Sea. Other things like increased pipeline gas from Africa and other supplies from the Middle East are all in play. These take time to build the infrastructure/ develop, but that is where we (Chart) can offer short-term and long-term solutions such as mobile regasification units, ISOs [intermodal containers], and Floating liquefaction, to name a few.

How big do you think the market opportunity is for Liquified Natural Gas (LNG) and where do you think the biggest sources of demand for LNG will come from globally?

For Chart equipment, we believe the opportunity exceeds $6 billion, the majority of which will likely be in North America. Yet we are also seeing numerous opportunities outside of the US Gulf Coast as movement to modular mid-scale (versus stick built base load) facilities is becoming the normal. This estimate speaks more to the liquefaction opportunity so important to note that it does not include potential for other Chart infrastructure equipment like traditional storage & distribution products, fueling stations, vehicle tanks and other ancillary equipment we manufacture. In terms of demand sources, obviously Europe will be a major driver for the next several years but longer term, we believe developing markets will represent major sources of demand growth: India, Asia and parts of Africa.

We think of the LNG space that we serve in three parts – BigLNG [big-scale LNG], ssLNG [small-scale LNG] / FLNG [floating liquefied natural gas], and LNG infrastructure.

Do you think natural gas will become a bigger part of the US and global energy mix, or are there other sources of traditional or clean energy that are better positioned for this?

Over the near-term, gas will likely become a greater part of the mix both globally and domestically. Longer term, the natural gas mix is likely to go down modestly in developed markets but I would expect it to increase in the developing world between now and the medium-term.

Hydrogen energy is coming up more in conversation as a potential energy solution that can be used across a broad number of applications. What do you believe needs to happen to make this a reality, and do you think costs will decline in the long-term?

As an industry, we need to better develop the infrastructure (scale) and we also now need to see greater acceptance or adoption for various end market applications. We do see a number of them that could benefit from the transition. Costs need to come down but with time, that will happen and the reality is that with the price of oil and gas today, hydrogen is much closer to parity with many of those other competing fuels. With as many people, companies, institutions and governments committed to developing the hydrogen economy, there’s no question that over time costs will come down materially.

Take our 2021 as an example – hydrogen orders were greater than $280 million, about half liquefaction and half equipment. These were primarily for the first 2 buckets of the hydrogen value chain – production (1) and storage and transport (2). We are seeing more interest in the third bucket, the end user category, which I believe is a function of the hydrogen economy starting to get more linked together from an infrastructure perspective. All three of these areas are areas that Chart serves and as we see end use continue to gain steam, we expect this is a positive for our business.

What do you think is the biggest opportunity for hydrogen both in the short-term and over the next few decades?

Over the near term, we feel there’s a significant opportunity for hydrogen in transportation, and power. Energy storage and backup power also represent opportunities as do applications in some heavy industries like steel and fertilizer. There are specific applications where hydrogen makes sense as a solution and others where it might not make nearly as much sense as another alternative. I encourage people to think about the energy transition as a hybrid – it won’t be one answer for all applications.

I would also add that where hydrogen can be used with existing infrastructure is under-discussed, in my opinion. The world is not going to rip out all of the existing infrastructure and replace it with “green” answers. So hydrogen becomes a good option for blending with gas, for adding to an existing heavy duty fueling station where there may already be LCNG options, etc.

How quickly do you envision hydrogen pipelines can come to market at scale, and do you believe they can be effectively converted from traditional pipelines?

Regional or industrial center distribution lines could be put into service in relatively short-order, likely within the next few years. However, I would think longer-haul dedicated pipes whether new or retrofitted are later this decade to get started.

What are your thoughts on carbon capture and how has the technology evolved over time?

Carbon capture is most certainly part of the solution and absolutely necessary for the world to even come close to achieving emission goals that have been stated by public and private sector participants. On the smaller scale side of things, in particular for the food & beverage industry, it is highly economic today and we’re seeing rapid deployment of our Earthly Labs equipment that enables customers to both capture and reuse the CO2 generated in their processes. On the larger industrial scale, there are more options for users beyond the typical amine based solutions that may be better suited to certain applications. Our Sustainable Energy Solutions (SES; which we purchased in December 2020) cryogenic carbon capture (CCC ™) technology offers the CO2 generated can be of very high quality, capable of being reused. Our CCC process is also highly efficient as it recovers much of the energy that is put into cooling the CO2. We believe our process technology results in significant savings relative to traditional amine solutions, whether for a cement plant or power generation facility. A study released last year by MIT and Exxon (XOM) actually found that the cost to produce cement and capture CO2 using our CCC technology is 24% higher than producing cement with no CO2 capture (not accounting for any value for the CO2 being captured), comparing quite favorably to other capture technologies.

Can you tell us about Chart Industries (GTLS) and the solutions your company offers?

Chart is a molecule agnostic company that’s core expertise is in cryogenic engineering, design and manufacturing. We serve a variety of end applications and markets, which we refer to as The Nexus of Clean™ – clean power, clean water, clean food & clean industrials. Our process technologies and equipment serve the range of the “value chain of a molecule” – whether production/separation/liquefaction of various molecules to storage and transportation as well as carbon capture and water treatment. The beauty of our equipment is that it is truly molecule agnostic which results in a multitude of end market applications, many of which are growing at a very healthy pace. And not to be forgotten is that our equipment and process technology helps our customers achieve their own sustainability goals.

Related ETFs

HYDR: The Global X Hydrogen ETF (HYDR) seeks to invest in companies that stand to benefit from the advancement of the global hydrogen industry. This includes companies involved in hydrogen production; the integration of hydrogen into energy systems; and the development/manufacturing of hydrogen fuel cells, electrolyzers, and other technologies related to the utilization of hydrogen as an energy source.

MLPA: The Global X MLP ETF (MLPA) invests in some of the largest, most liquid midstream Master Limited Partnerships (MLPs).

MLPX: The Global X MLP & Energy Infrastructure ETF (MLPX) is a tax-efficient vehicle for gaining access to MLPs and similar entities, such as the General Partners of MLPs and energy infrastructure corporations.

SEI Investments Distribution Co. (1 Freedom Valley Drive, Oaks, PA, 19456) is the distributor for the Global X Funds.

Investing involves risk, including the possible loss of principal. Hydrogen companies typically face intense competition, short product lifecycles and potentially rapid product obsolescence. They may be significantly affected by fluctuations in energy prices and in the supply and demand of renewable energy, tax incentives, subsidies and other governmental regulations and policies. Investments in smaller companies typically exhibit higher volatility. HYDR is non-diversified.

International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Investments in securities of MLPs involve risk that differ from investments in common stock including risks related to limited control and limited rights to vote on matters affecting the MLP. MLP common units and other equity securities can be affected by macro-economic and other factors affecting the stock market in general, expectations of interest rates, investor sentiment towards MLPs or the energy sector, changes in a particular issuer’s financial condition, or unfavorable or unanticipated poor performance of a particular issuer (in the case of MLPs, generally measured in terms of distributable cash flow).

MLPA and MLPX invest in the energy industry, which entails significant risk and volatility. MLPA and MLPX are non-diversified. MLPA and MLPX invest in small and mid-capitalization companies, which pose greater risks than large companies. MLPA has a different and more complex tax structure than traditional ETFs and investors should consider carefully the significant tax implications of an investment in the Fund.

MLPA is taxed as a regular corporation for federal income tax purposes, which differs from most investment companies. Due to its investment in MLPs, the Fund will be obligated to pay applicable federal and state corporate income taxes on its taxable income, as opposed to most other investment companies. The Fund expects that a portion of the distributions it receives from MLPs may be treated as tax-deferred return of capital. The amount of taxes currently paid by the Fund will vary depending on the amount of income and gains derived from MLP interests and such taxes will reduce an investor’s return. The Fund will accrue deferred income taxes for any future tax liability associated certain MLP interests. Upon the sale of an MLP security, the Fund may be liable for previously deferred taxes which may increase expenses and lower the Fund’s NAV.

The potential tax benefits from investing in MLPs depend on them being treated as partnerships for federal income tax purposes. If the MLP is deemed to be a corporation then its income would be subject to federal taxation at the entity level, reducing the amount of cash available for distribution to the Fund which could result in a reduction of the Fund’s value.

MLPX also expects to pay distributions, which will be treated as a return of capital for tax purposes rather than from net profits and shareholders should not assume that the source of distributions is from the net profits of the Fund. The Fund derives substantially all of its cash flow from investments in equity securities of MLPs. The amount of cash that the Fund will have available to pay or distribute to you depends entirely on the ability of the MLPs that the Fund owns to make distributions to their partners and the tax character of those distributions. Neither the Fund nor the Adviser has control over the actions of underlying MLPs. The amount of cash that each individual MLP can distribute to its partners will depend on the amount of cash it generates from operations, which will vary from quarter to quarter depending on factors affecting the energy infrastructure market generally. Available cash will also depend on the MLPs’ level of operating costs (including incentive distributions to the general partner), level of capital expenditures, debt service requirements, acquisition costs (if any), fluctuations in working capital needs, and other factors. The MLP holdings of the Fund expect to generate significant investment income, and the Fund’s investments may not distribute the expected or anticipated levels of cash, resulting in the risk that the Fund may not have the ability to make cash distributions as investors expect from MLP-focused investments. Past distributions are not indicative of future distributions. There is no guarantee that dividends will be paid.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Carefully consider the funds’ investment objectives, risks, and charges and expenses. This and other information can be found in the funds’ full or summary prospectuses, which may be obtained at globalxetfs.com. Please read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC or Mirae Asset Global Investments. Global X Funds are not sponsored, endorsed, issued, sold or promoted by Solactive AG, nor does Solactive AG make any representations regarding the advisability of investing in the Global X Funds. Neither SIDCO, Global X nor Mirae Asset Global Investments are affiliated with Solactive AG.

For information purposes only. Jillian Evanko of Chart Industries is not affiliated with or clients of Global X and her statements and opinions should not be construed as an endorsement or recommendation of Global X products or services.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment