truelight/iStock via Getty Images

30 Big Banks

This post covers 30 big banks.

Assets as of 6/30/22 ($ Billions)

| (ALLY) | Ally Financial Inc | $ 186 |

| (AXP) | American Express Co | $ 205 |

| (BAC) | Bank of America Corp | $ 3,112 |

| (BK) | Bank of New York Mellon Corp | $ 453 |

| (C) | Citigroup Inc | $ 2,381 |

| (CFG) | Citizens Financial Group Inc | $ 227 |

| (CMA) | Comerica Inc | $ 87 |

| (COF) | Capital One Financial Corp | $ 440 |

| (DFS) | Discover Financial Services | $ 115 |

| (EWBC) | East West Bancorp Inc | $ 62 |

| (FITB) | Fifth Third Bancorp | $ 207 |

| (FRC) | First Republic Bank | $ 198 |

| (GS) | The Goldman Sachs Group Inc | $ 1,601 |

| (HBAN) | Huntington Bancshares Inc | $ 179 |

| (JPM) | JPMorgan Chase & Co | $ 3,841 |

| (KEY) | KeyCorp | $ 187 |

| (MS) | Morgan Stanley | $ 1,174 |

| (MTB) | M&T Bank Corp | $ 204 |

| (NTRS) | Northern Trust Corp | $ 158 |

| (NYCB) | New York Community Bancorp Inc | $ 63 |

| (PNC) | PNC Financial Services Group Inc | $ 541 |

| (RF) | Regions Financial Corp | $ 161 |

| (SBNY) | Signature Bank | $ 116 |

| (SCHW) | Charles Schwab Corp | $ 638 |

| (SIVB) | SVB Financial Group | $ 214 |

| (STT) | State Street Corporation | $ 300 |

| (SYF) | Synchrony Financial | $ 95 |

| (TFC) | Truist Financial Corp | $ 545 |

| (USB) | U.S. Bancorp | $ 591 |

| (WFC) | Wells Fargo & Co | $ 1,881 |

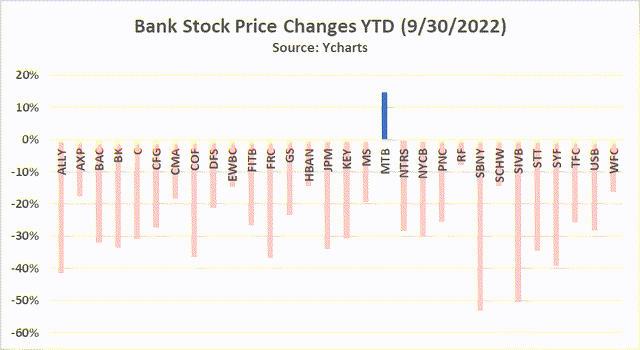

YTD Stock Prices

Big banks are down 27% on average year-to-date (-28% median).

Only Buffalo-based M&T is up YTD (15%), climbing back from a rough down spell after its 2021 acquisition of People’s United.

Two banks are down 50%+: New York City lender, Signature Bank, and one of my long-term holdings, Silicon Valley Bank.

As they say at the poker table, “read ’em and weep.”

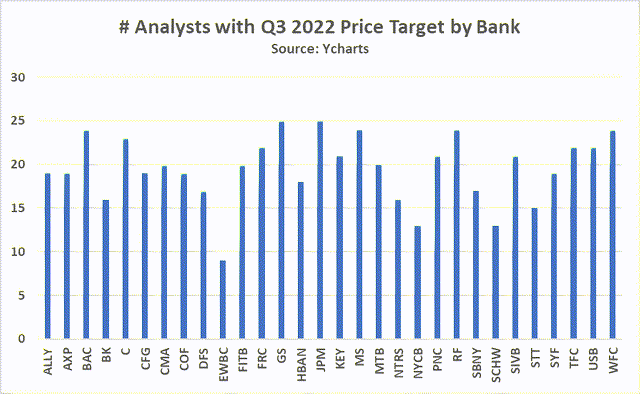

Analyst Coverage

Analyst coverage for large banks remains impressive, if not in quality, in quantity.

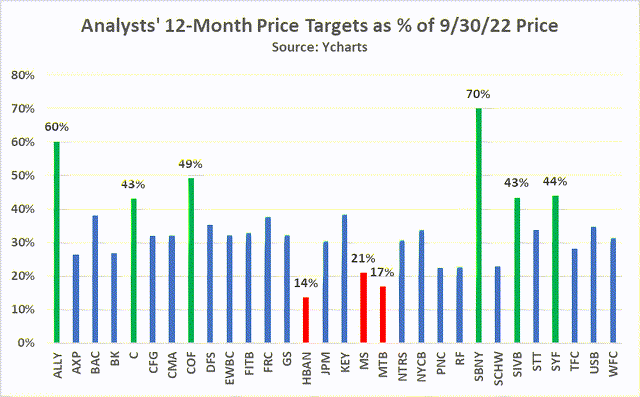

Price Targets: 32% Appreciation

Bank analysts are bullish. Very bullish. On average, analysts see bank stocks up 32% a year from now. (Median is +34% among big banks).

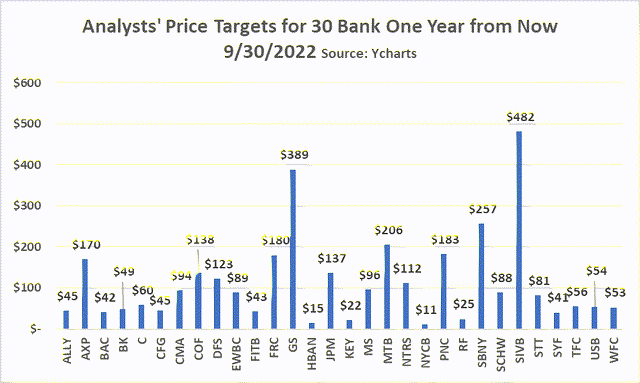

The first chart shows consensus analysts’ price targets a year from now compared to each bank’s stock price as of September 30, 2022.

Leading the way is Signature Bank followed by mass market lenders Ally, Capital One, and Synchrony.

Citi bulls should take comfort in analyst expectations of a 43% price appreciation for the year ahead.

Two banks at the back of the pack were engaged recently in sizable mergers: Ohio-based Huntington and M&T.

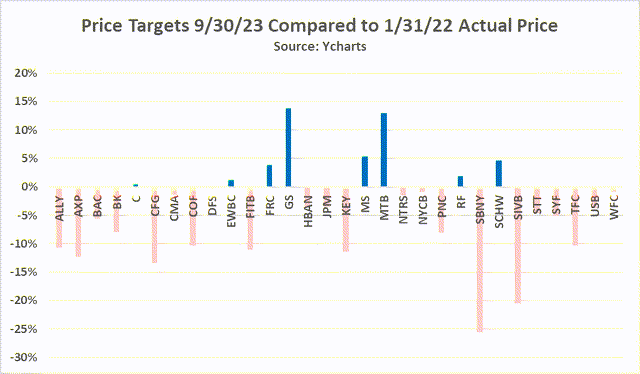

You might think analysts’ targets are outlandish given the uncertainties facing the global economy. But this next chart puts the bullish price forecasts in perspective.

Below is a comparison of 9/30/23 price targets to actual prices at the end of January 2022 when bank stock prices peaked. The price targets on average are 4% lower than January 2022 actuals. I am reminded by this chart of the simple math of stock price declines: A 20% drop in price requires a 25% subsequent appreciation just to break-even.

Here are consensus September 2023 price targets for each bank.

How Much Consensus Is There In The Consensus?

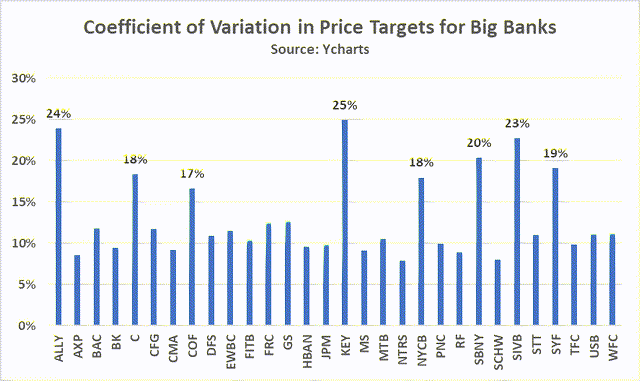

Let me throw in a bonus chart on Price Targets.

We know that these banks are followed by a lot of analysts. Each analyst has his or her price target for each bank. The price targets represent an average of the price targets.

But how much consensus is there in the consensus? In other words, how much confidence can an investor have that there is strong and common conviction among analysts in the price target?

To answer this question, we turn to a statistical measure of the dispersion of price targets called the Coefficient of Variation.

This next chart tells investors that there is greater diversity of views about the future stock prices of certain banks compared to others.

Analysts’ forward-view of KeyBank‘s stock price shows little consensus. The same can be said of the mass market lenders as well as New York Community, Citi, and Silicon Valley Bank.

On the other end of the spectrum, analysts following American Express, Northern Trust, and Schwab show little variation in their price targets.

Consensus Ratings

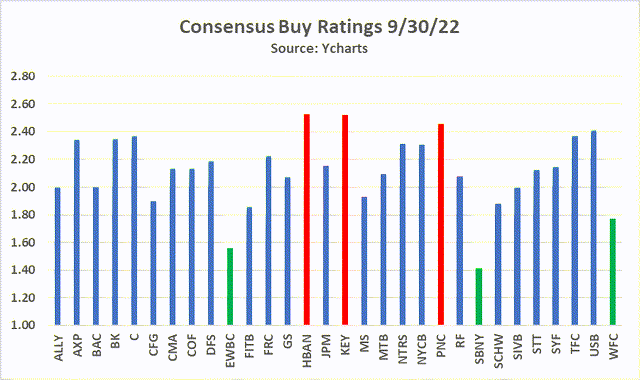

As the next chart shows, the average big bank is currently rated a “Buy” (average rating, a bullish 2.12).

Analysts are least bullish on two Ohio regional banks, KeyBank and Huntington, as well as Pittsburgh’s PNC. On the other hand, they favor two California banks, Wells Fargo and East West, as well as beaten-down Signature.

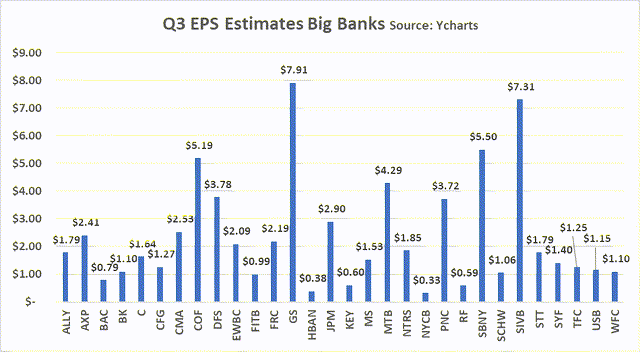

3Q 2022 EPS Estimates

Here are 3Q 2022 EPS estimates as of 9/30/22.

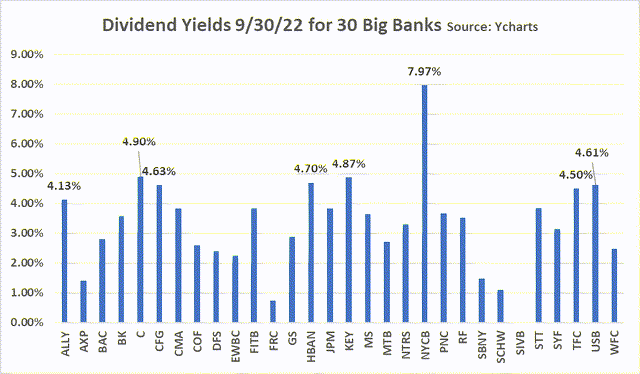

Total Return: Don’t Forget Dividends

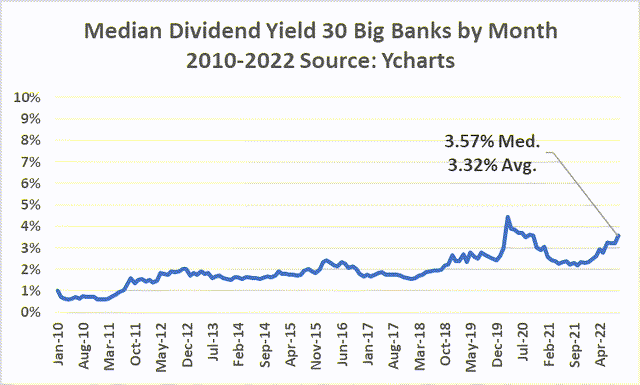

Banks are paying decent dividends. The average current dividend yield for the big banks is 3.32% and the median is 3.57% as the next chart shows. These div yields are nearly as good as what investors saw when stock prices collapsed in 2Q 2020 amidst COVID worries.

Median Div Yield 30 Banks (Ycharts)

Eight of the banks have dividend yields greater than 4%. New York Community and Citi lead the way at 7.97% and 4.90% respectively. That said, once bank dividend yields eclipse 6%, I get skittish. I would need to do a deep dive on NY Community before offering a view on the durability of its current dividend.

Risks, Momentum, And A Mountain Of Worries

I have no trouble finding risks that could get in the way of bullish bank earnings and price targets. Here is a short list:

- Market momentum has completely turned the wrong way for equities. Banks cannot swim upstream.

- Fed is ruling the roost and today controls sentiment which is negative.

- Bank regulators seem today to be over-influenced by the Democrat crowd, claiming banks cannot ever have too much capital; buyback pause could last longer than anticipated.

- A slowing economy, especially if nominal GDP joins real GDP in showing the economy is in a recession, bodes badly for bank earnings.

- Provision is once again terribly low, suggesting a reversion to the mean is inevitable; Provision will pop if the economy goes into recession.

- Everything Europe: Currency uncertainties, Energy access, Political turmoil, Central bank worries.

- Ukraine-Russia.

- Biden and Putin saber-rattling.

- Anti-China bias growing in US will impede trade and accelerate inflation.

- Bank labor costs, fueled by inflation and a War for Talent, could prove greater than gains in net interest margin for many banks.

- Banks face significant investment in emerging technologies (artificial intelligence/machine learning) that require not only capital but a new generation of expensive talent.

Caveats

Every investor needs to understand goals and appetite for risk before investing. Investors considering any investment should do their own due diligence.

Be the first to comment