Mario Tama/Getty Images News

PVH Corp. (NYSE:PVH) is bombarded with multiple headwinds which started from the pandemic. This eventually turned into the company facing a high inflationary pressure and today, a portion of its operation is affected due to the Russia and Ukraine crisis. On the other hand, we are now seeing improvements from the pandemic, with global Covid-19 cases declining and experts anticipating an 8.5% inflation peak this year, followed by 5.5% inflation by the end of the year. This opens a turnaround opportunity for the company, especially with its improved operation and efficiency backed with a solid outlook from the management. PVH is currently trading at a logical support and is fundamentally undervalued, unlocking a good long opportunity at today’s price.

Company Background

PVH is one of the world’s largest apparel companies and is also one of the companies hit negatively by the pandemic. In fact, risk from the pandemic is ignited with the ongoing Russia and Ukraine conflict where it affects a portion of its revenue. However, PVH flexed its resiliency once again, where the management provided a good outlook for its fiscal 2023 and a roadmap towards a $12.5 billion total revenue in fiscal 2025. This will result in a huge upside compared to its current revenue level which is only around $9.15 billion recorded in its fiscal year 2021.

The company operates through five reportable segments: Tommy Hilfiger North America, Tommy Hilfiger International, Calvin Klein North America, Calvin Klein International, and Heritage Brands Wholesale. It has ceased operations in its Heritage Brands Retail segment. This is aligned with PVH’s long term strategy to set its business towards profitability which promotes cost savings. The company still has not fully recovered from its temporary headwinds, as proven with its current revenue level of $9.15 billion, still down compared to its pre-pandemic of $9.9 billion, however, it made a meaningful growth of 28% on a YoY basis. Additionally, there is a huge improvement in its current operating margin of 10.6%, better than -1% recorded in fiscal 2020 and 8.2% recorded in fiscal 2019, despite a $0.75 billion discrepancy in its fiscal 2021 and fiscal 2019 total revenue.

This efficiency comes from its successful initiative of cost savings from its reduced workforce which is currently expected by the company to produce annual cost savings of $60 million. Both of PVH’s cost savings initiatives and segment divestitures helped the company to generate an all-time record of net income amounting to $952.3 million. This is a strong catalyst on top of its strong $1 billion buyback program. PVH ended its strong fiscal 2021 with an outstanding growth in its EPS which totaled $13.45, up from -$15.96 recorded in fiscal 2020 and $5.62 recorded in fiscal 2019. Looking at its normalized figure, which excludes non-recurring events, PVH still produced outstanding growth with $8.94 recorded this fiscal year, up from -$1.74 last fiscal year and $5.98 recorded in fiscal 2019. Additionally, the management provided an okay outlook on its future EPS despite multiple headwinds.

For the full year in 2022, we are projecting earnings per share to be approximately $9. While we are projecting underlying double-digit growth in revenue and business earnings, our overall earnings per share reflects a decrease compared to $10.15 in 2021. Due to the negative impact of approximately $1.35 per share due to FX translation and our decision to temporarily close our stores and pause commercial activity in Russia and Belarus, along with a reduction in wholesale shipments to Ukraine, and also negatively impacting 2022 is $1.55 from taxes. Partially offsetting these negative impacts is a positive impact of approximately $0.70 due to lower interest in shares. Source: Q4 2021 Earnings Call

Positive Catalyst Continues

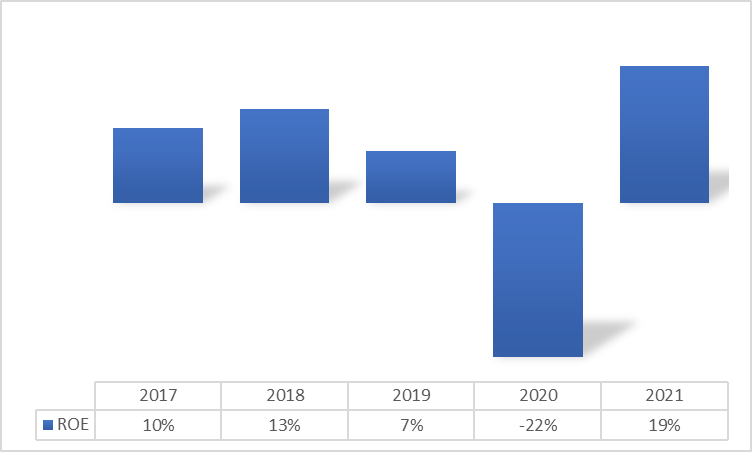

PVH: Improving ROE Trend (Source: Data from SeekingAlpha. Prepared by InvestOhTrader)

PVH’s ROE this fiscal year entered positive territory again and came stronger than its previous figures as shown in the image above. This is thanks to its record bottom line and continued share buybacks by the company. As of today, PVH has a better ROE compared to its bigger peer, Ralph Lauren Corporation (NYSE:RL). Lastly, with the forecasted EPS and buyback catalyst, I will not be surprised to see positive growth in its ROE in the next fiscal year.

Relatively Undervalued Against Its Peers

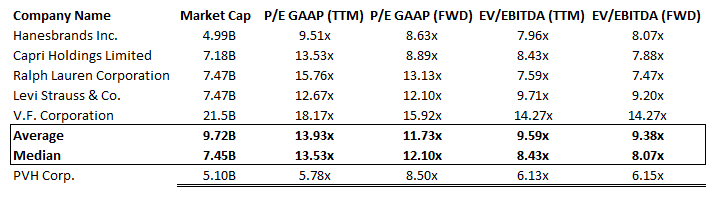

PVH: Relative Valuation (Source: Data from SeekingAlpha.com. Prepared by InvestOhTrader)

In the image above, PVH is so cheap compared to its peers with its trailing P/E ratio of 5.78x compared to its peers’ average of 13.93x. Due to its bloated EPS today, it produces a -11.16% decelerating growth compared to its forward EPS consensus of $9.02 next fiscal year. This, in my opinion, is not the optimal way to view PVH’s current valuation; rather, we should use normalized figures that exclude non-recurring accounts, resulting in a 9.02x current P/E ratio which shows a positive comparison to its current forward P/E of 8.50x. Additionally, looking at the figures like its forward EV/EBITDA of 6.15x which is unfavorable compared to its trailing counterpart of 6.13x, against its peers’ average of 9.38x and peers’ mean of 8.07x, tells a different story. To sum it up, PVH is relatively undervalued compared to its peers.

A Better PVH

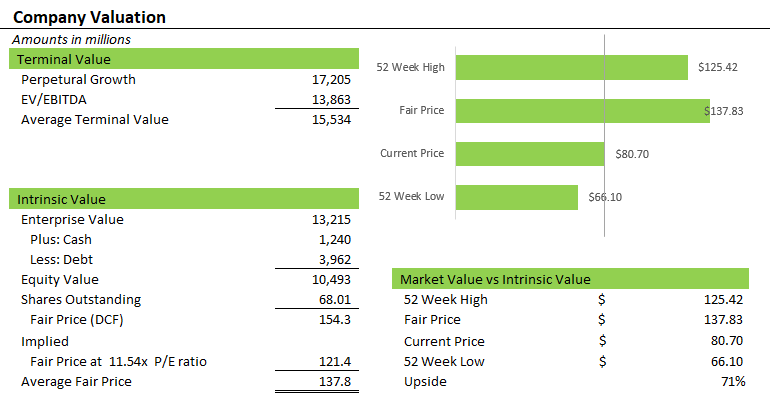

PVH: Company Valuation (Source: Prepared by InvestOhTrader)

I made very conservative assumptions such as ignoring the $12.5 billion revenue in fiscal 2025 and operating margin expanding to 15%. Despite a conservative assumption, PVH is currently undervalued compared to my average fair price of $137.8, which can provide a potential 71% upside potential as of today’s price.

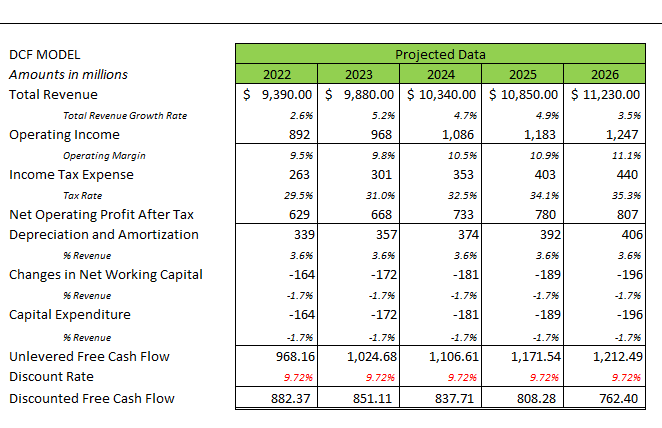

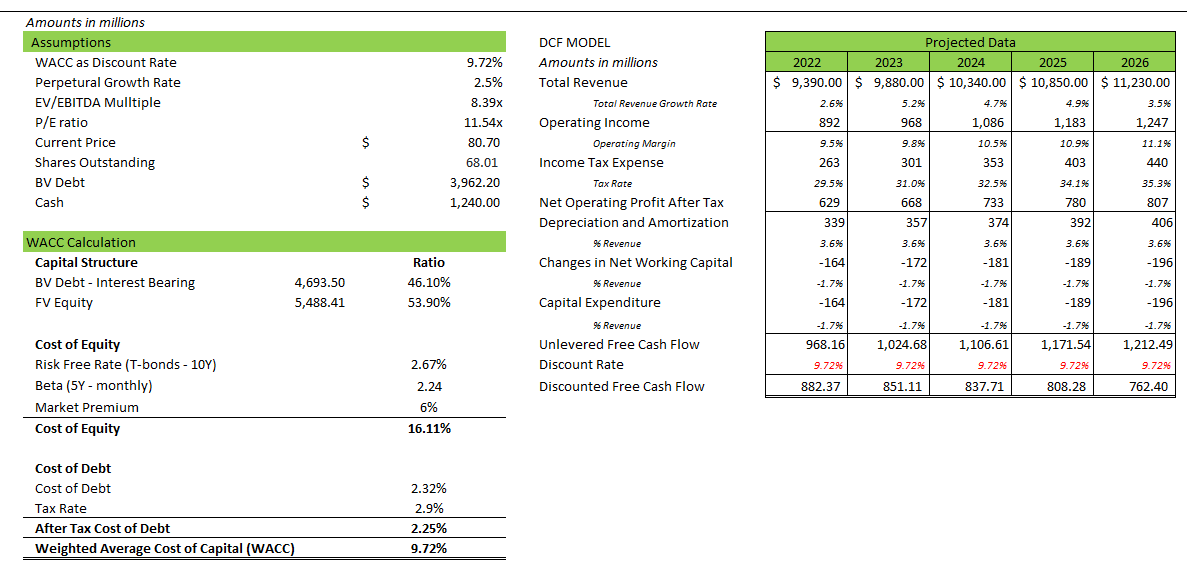

PVH: DCF Model (Source: Prepared by InvestOhTrader)

I completed my DCF model with the help of experts’ forecasts. I assumed a slower growth rate on its operating margin, growing only to 11.1% by the end of the model. This is aligned with the continued inflationary pressure and operational disruption brought by the Russia-Ukraine war. Despite being conservative compared to the management guidance, it will still produce strong free cash flow growth as shown in the image above. This will be enough for a consistent growth on its dividend payment and buyback transaction, especially while looking at its declining long-term debt commitment of $2,318 million, down from $3,514 million last fiscal year.

PVH: DCF Model (Source: Data from SeekingAlpha and Yahoo!Finance. Prepared by InvestOhTrader)

Above are my assumptions I used to complete my DCF model. I used WACC as my discount rate and chose conservative multiples compared to its peers’ median as discussed earlier.

At A Strong Support

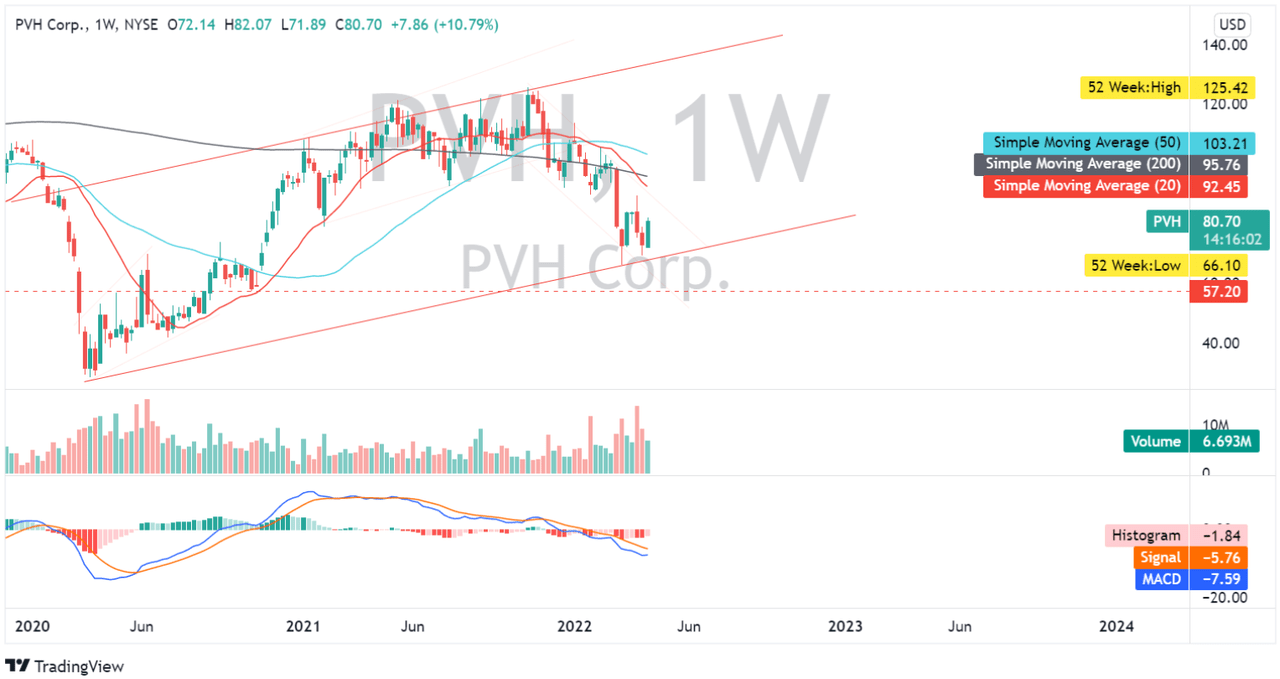

PVH: Weekly Chart (Source: TradingView.com)

After a huge drop of more than 40% from November last year, PVH is currently sitting at a strong support as shown in the image above. We might see a potential double bottom with a resistance of $89ish. A breakthrough of it may change its current sentiment from its simple moving averages indicator. Looking at its simple moving averages, we have seen its 20 day sma cross below its 200 day sma on March 28, 2022, implying a short-term bearish sentiment. A break of its current support at $70ish may imply a deeper pullback and I believe the next support should be around $57ish.

Additional Key Points

PVH’s potential return outweighs its current risks which include:

- Its current top line remains below its pre pandemic

- Approximately 2% of its total revenue is affected by the Russia-Ukraine war

- The rising inflation pressure as of today which may negatively affect the company’s top line

Additionally, the company is on the move to deleverage and improve shareholder value as quoted below.

In addition, underscoring our strong financial position and cash flow generation, we paid down over $1 billion of debt to reduce our leverage to below pre-pandemic levels. We reinstated our quarterly cash dividend and repurchased approximately $350 million of stock. Moving forward, we will continue investing in our business to fuel our growth, while at the same time deploying our excess cash to maximize shareholder returns. Source: Q4 Earnings Call 2021

To summarize, PVH is undervalued in light of its operational efficiency improvements and is trading near a logical support level, making this stock a good buy at today’s price.

Thank you for reading and stay safe everyone!

Be the first to comment