JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis: PVH Corp. (NYSE:PVH) could see a longer-term upside from here, as a result of a more attractive EV/EBITDA ratio as well as strong sales growth across the Tommy Hilfiger International segment.

In a previous article back in June, I made the argument that PVH Corp. could have the potential for a significant rebound despite the current macroeconomic risks.

My reason for making this argument was that the company was in a good cash position to handle a short-term decline in sales growth, as well as having managed to significantly reduce its long-term debt.

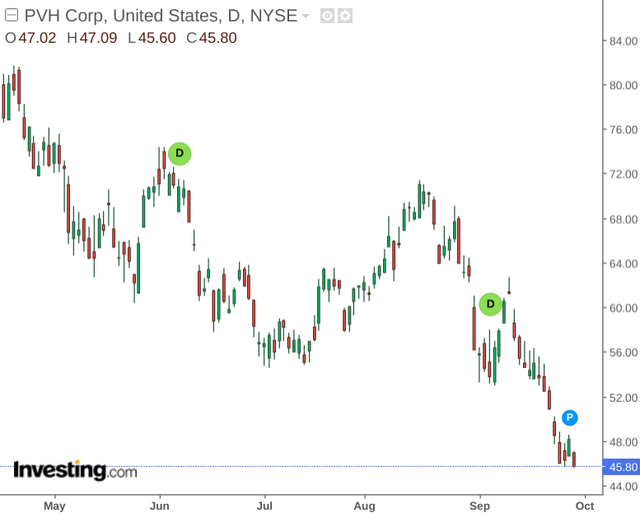

With that being said, the stock has declined by over 20% since my last article:

The purpose of this article is to assess whether the recent decline has been market-driven and whether the stock could have scope to see a significant rebound from here.

Performance

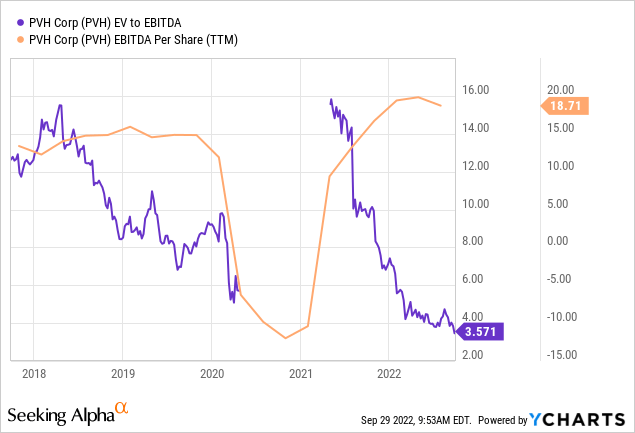

When looking at the company’s EV to EBITDA ratio – we can see that the ratio is still trading near 5-year lows – albeit with EBITDA per share showing signs of plateauing of late:

YCharts.com

In terms of the company’s revenue performance, net sales across the most recent quarter (for the thirteen weeks ended 31st July 2022) were highest for the Tommy Hilfiger International brand:

| Segment | Net sales for the 13 weeks ended 31st July 2022 |

| Tommy Hilfiger North America | 288.2 |

| Tommy Hilfiger International | 749.5 |

| Calvin Klein North America | 301.0 |

| Calvin Klein International | 549.2 |

| Heritage Brands Wholesale | 143.2 |

| Heritage Brands Retail | – |

Source: Figures sourced from PVH Corp. Form 10-Q: July 31, 2022. Figures provided in millions USD, except quick ratio.

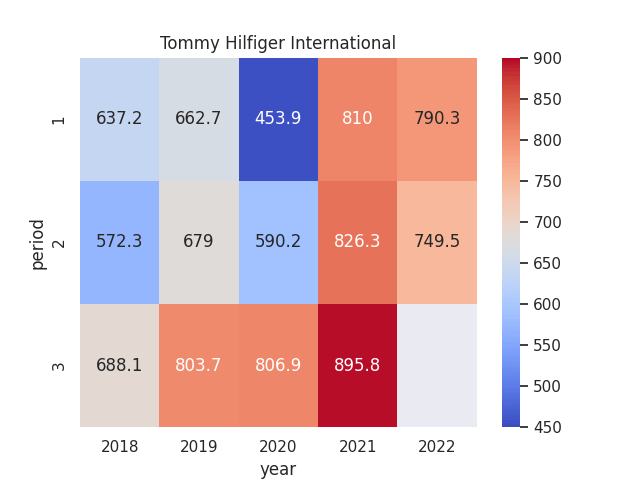

To assess further the degree to which net sales across Tommy Hilfiger International have recovered post-COVID, I decided to generate a heatmap of net sales for the segment from 2018 to the most recent quarter (May 2018 to July 2022):

Figures sourced from historical quarterly reports of PVH Corp. Heatmap generated by author using Python’s seaborn library.

From looking at the above, we can see that the recovery in net sales peaked near the end of 2021 – with net sales for the first two periods of 2022 significantly above those seen in 2018 and 2019.

In this regard, while PVH Corp. may have missed earnings expectations in the most recent quarter, sales across the Tommy Hilfiger International brand are still significantly above pre-COVID levels.

Looking Forward

Heading into the winter months – there is a risk that net sales could see a decline owing to inflation and the potential for a recession.

However, when looking at the net sales heatmap above once again – it is notable that the highest sales for Tommy Hilfiger International from 2019 to 2021 actually came near the end of the year. In this regard, it is not implausible that we could still see a surprise boost in net sales to the upside – if sales from Tommy Hilfiger International can drive overall sales growth in the upcoming quarter.

An ongoing concern for investors will be whether PVH Corp. can continue to maintain a solid financial position to withstand a potential decline in sales going forward.

We can see from the most recent quarter that while the quick ratio (calculated as cash plus receivables all over total current liabilities) has declined from last year, long-term debt for PVH Corp. has also fallen significantly.

| August 2021 | July 2022 | |

| Cash and cash equivalents | 1152.6 | 699.3 |

| Trade receivables | 824.1 | 804.6 |

| Other receivables | 23.1 | 32.9 |

| Total current liabilities | 2531.4 | 2656.5 |

| Quick ratio | 0.79 | 0.58 |

| Long-term debt | 2782.5 | 2155.5 |

Source: Figures sourced from PVH Corp. Form 10-Q, July 31, 2022. Figures provided in millions USD, except quick ratio. Quick ratio calculated by author.

In this regard, should we see a continued decline in long-term debt – then I take the view that investors might be more willing to tolerate a decline in the quick ratio for as long as sales growth remains resilient.

Conclusion

To conclude, I take the view that PVH Corp. is trading at significant value at this time and the market may be overreacting to the recent revenue miss. As a result, while there may be some downside in the short to medium-term owing to inflationary pressures, I take the view that the stock is more attractively valued than previously and as such, I take a long-term bullish view on PVH Corp.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment