AlexSecret/iStock via Getty Images

Investment Thesis

PubMatic (NASDAQ:PUBM) is an ad tech company that hasn’t seen much love from the market for a while. And there’s a lot to like about the company, such as it carries no debt, and it’s clearly profitable.

However, the unavoidable fact here is that its growth rates are meaningfully slowing down. Even though PubMatic is quite a small operation. This is, without doubt, the main blemish in this investment thesis.

As you’ll see, there are many positive aspects to consider, particularly given that the stock is priced at 11x this year’s EBITDA.

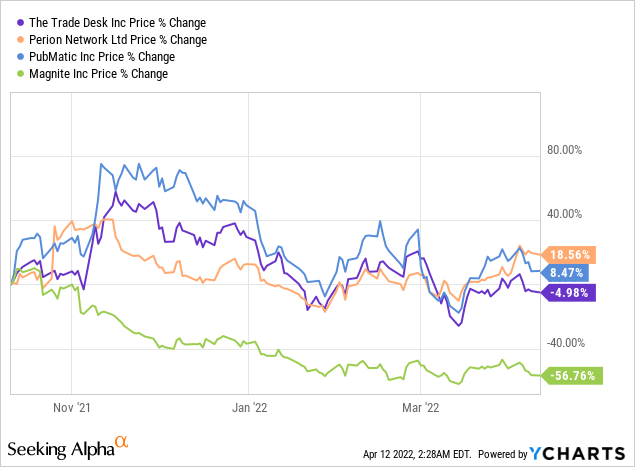

Investor Sentiment Facing Ad Tech Stocks

The past 6 months have been seriously unkind to small and midcap companies. And surprisingly, ad tech companies have been particularly badly affected.

I say surprisingly because these tech companies have all one thing in common. They are all meaningfully profitable. Admittedly, some more than others, but compared to other spaces in tech, these are ”highly” profitable.

Now, let’s discuss the blemish in the bull case.

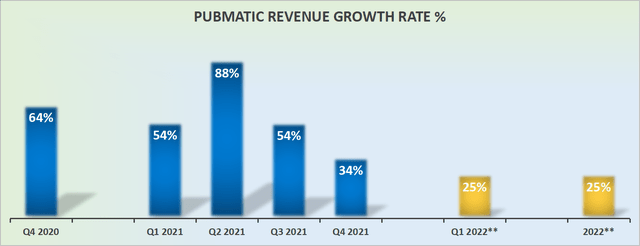

PubMatic’s Revenue Growth Rates Decelerate

Here’s the unavoidable fact that’s plaguing PubMatic. As you can see above, for 2021 PubMatic’s revenues were strong.

More specifically, 2021 saw its revenues increase by 53% y/y. That’s clearly very strong growth. However, looking out to 2022, PubMatic guides for approximately 25% CAGR.

Even if we make the argument that management is lowballing its estimates, there’s no getting around that PubMatic is going from mid-50s% revenue growth rates, to perhaps, in the best-case scenario approximately 30% CAGR. Thus, this is clearly a stark deceleration.

Accordingly, we can football this fact around all day, but there’s no getting around that 2021 saw PubMatic’s strongest near-term growth rates, and that’s now in the rearview mirror.

Why PubMatic? Why Now?

PubMatic is a supply-side platform. What this means is that it’s an advertising company that enables digital assets to be monetized. Through PubMatic’s independent platform, publishers’ digital advertising surfaces can be monetized and controlled.

This allows websites and other digital content, such as mobile apps or CTVs, to monetize their inventory and maximize their return on investment (”ROI”).

From PubMatic’s perspective, it can embrace Supply Path Optimization (”SPO”) agreements that are fully scalable, meaning that increased advertising volume can go through PubMatic without a proportional increase in technology costs.

Hence, there’s clearly a lot to like about PubMatic. Indeed, we’ll next discuss its robust profitability profile, while putting a spotlight on what investors need to think about.

Spotlight on PubMatic’s Profitability Profile

For 2021, PubMatic’s EBITDA margin was 42%. And that’s pretty robust, you’ll no doubt agree?

But if you remember, Q4 2021 is the high season for advertisers. Thus, this is a period of meaningful strength for ad tech companies in general.

In that light, given that Q4 2021 saw its operating margins reach 53%, that’s without doubt a terrific result! And for further perspective, keep in mind that for Q4 2020, PubMatic’s EBITDA margin were ”only” 48%.

Accordingly, not only was PubMatic’s EBITDA really high in Q4 2021, but it was 500 basis points higher than the same period in the prior year.

All this taken together, we could see a company that was moving in the right direction. That’s the good news.

But now, all of a sudden, its EBITDA margins are guided to be around 37%, compared with 42% of EBITDA margins in 2021.

Consequently, the argument that inevitably surfaces is, that PubMatic’s EBITDA margins are now moving in the wrong direction, and are expected to compress by approximately 500 basis points y/y.

All this taken together leads me to discuss its valuation.

PUBM Stock Valuation – Attractively Priced

Before focusing on its valuation, allow me to remind you that PubMatic carries no debt and more than $160 million of cash and equivalents at the time of writing.

This means that more than 10% of its market is made up cash.

Now, let’s get into the valuation in earnest. PubMatic is valued at 11x this year’s EBITDA. You are going to immediately retort that this is cheap, right?

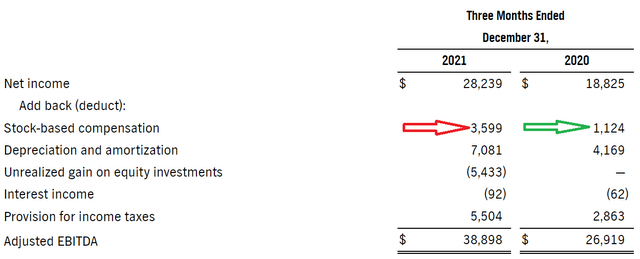

Here’s the thing, in Q4 2020, PubMatic’s stock-based compensation made up 4% of its adjusted EBITDA. Then, for Q4 2021 this more than doubled to 9% of its adjusted EBITDA.

And with its stock going nowhere fast in 2021, I fully suspect that in order to retain high-quality management, PubMatic will have to offer its C-suit executives significantly more stock-based compensation in 2022.

The Bottom Line

I’ve highlighted a balance point of view, with some positive and negative considerations for investors.

Ultimately, there’s a lot to like from PubMatic. However, there’s simply no getting around the fact that its revenue growth rates are decelerating in 2022 and this is something that investors will struggle to get behind.

To be clear, I’m not referring to shareholders that are fully entrenched and committed to the bullish thesis already. But for new investors appraising the stock objectively, rationally, and without prior biases, they’ll be quick to highlight that its revenue growth rate guidance leaves much to be desired.

In sum, there’s a lot to like here and it’s easy to understand why the stock is cheap.

Thus, I believe that there are better opportunities elsewhere. Whatever you decide, good luck and happy investing.

Be the first to comment