Nikolay Tsuguliev/iStock via Getty Images

Introduction

Public Storage (NYSE:NYSE:PSA.PK) is one of the largest storage REITs in the world and about half of the equity portion on the balance sheet is funded by about a dozen issues of preferred shares. While those preferred shares offer a 5.4-5.55% preferred dividend yield with a very healthy preferred dividend coverage ratio as well as a good asset coverage ratio, the perpetual nature of these securities only offers a sub-100 base point yield bump over the 9-year debt securities, despite ranking junior to said debt securities.

The preferred dividends are well-covered thanks to the solid performance

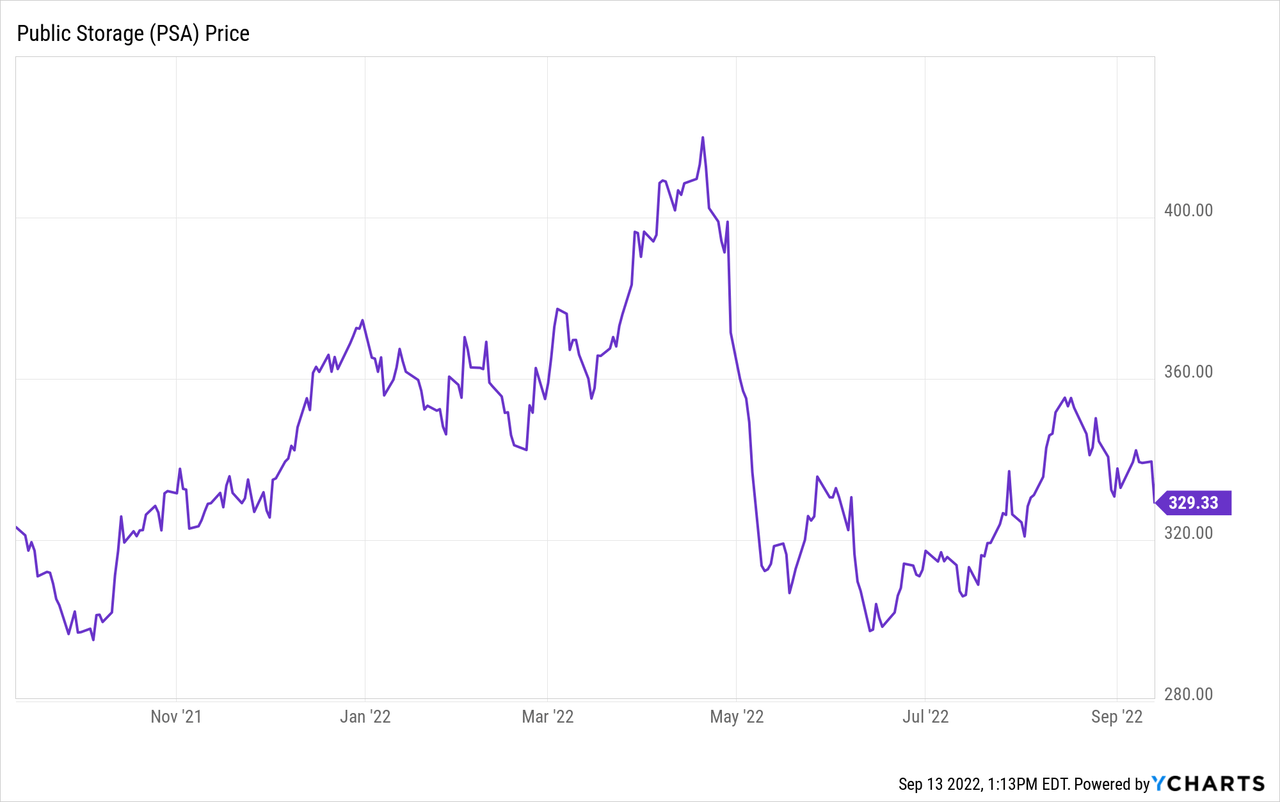

During the second quarter, Public Storage generated total revenue of approximately $1.03B including the almost $59M in revenue from ancillary operations. As anticipated, the operating costs to run a self-storage service are relatively low and the total operating expenses came in at just under $536M. This includes the almost $33M in interest expenses and perhaps even more important, it also includes the almost $220M in depreciation and amortization expenses.

PSA Investor Relations

PSA also recorded a $102M FX gain and almost $60M in interest income and equity income from investments. This resulted in a bottom line of $654M and after covering the almost $49M in preferred dividend payments, the net income attributable to the common shareholders of Public Storage was just over $603M or $3.44 per share.

Looking at the H1 results, we see a similar performance although the FX gain in the first quarter was substantially lower, resulting in a lower contribution in the first half of the year. Nonetheless, with an EPS of just under $6.10, Public Storage had a good first semester.

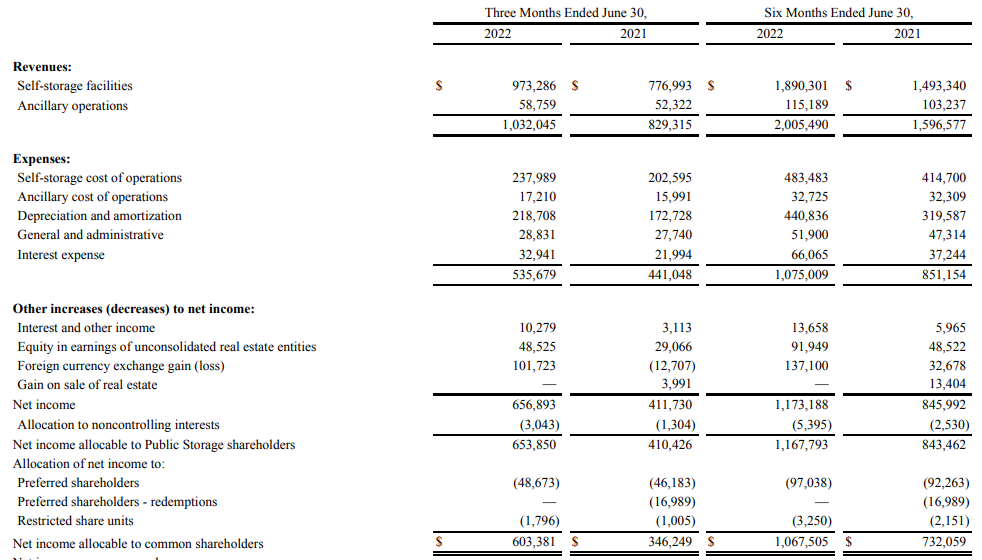

While an income statement is interesting, it does include the non-cash depreciation and amortization expenses and when looking at a REIT, the FFO likely provides a better overview of the situation.

As you can see below, the $234M in depreciation and amortization expenses is added back to the result, but subsequently the gains on the sale of real estate as well as the almost $102M in FX gains have been deducted again. The FFO in the second quarter came in at about $704M and divided over the current share count of 175.5M shares, the FFO/share was roughly $4.01.

PSA Investor Relations

This already includes the almost $49M in preferred dividend payments which means these preferred dividends require Public Storage to spend just 6.5% ($49M of the $753M) of its operating FFO on the preferred dividends. A low payout ratio, indeed.

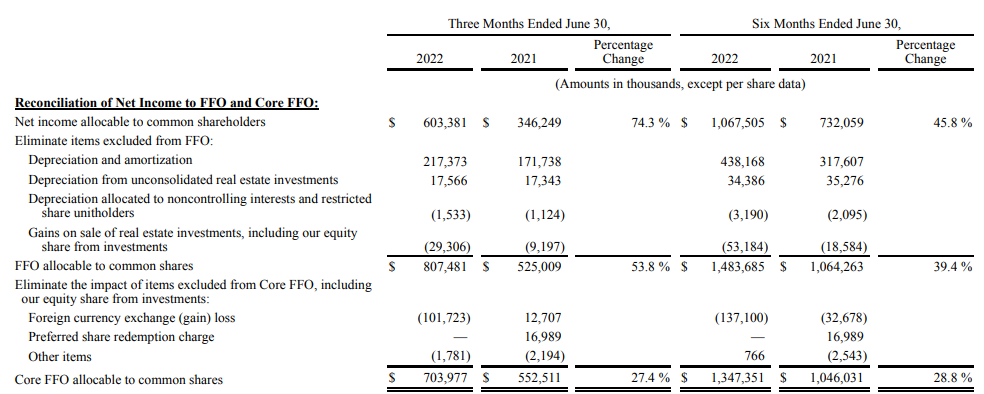

I also enjoy PSA’s solid balance sheet. The total amount of assets was approximately $17.9B but keep in mind this includes the stake in PS Business Parks which was sold subsequent to the end of the quarter. As the taxable gains of this sale were distributed to the common shareholders of Public Storage (see later) I don’t anticipate seeing any massive changes when the Q3 results will be released.

PSA Investor Relations

As you can see above, PSA had only $7.34B in debt (and $1B in cash for a net financial debt of $6.34B) versus $15.5B in real estate assets which already include an accumulated depreciation of in excess of $8B. Even if we leave the investments in unconsolidated entities out of the equation, that is a robust balance sheet with an LTV ratio of about 40% based on the book value of the assets and less than 30% based on the acquisition value of the assets.

As of the end of June, PSA had about 174 million preferred shares outstanding for a total of $4.25B. It is clear the REIT likes to use preferred equity as a source of funding to boost the returns for the common equity. Based on the equity value of the balance sheet, there’s about $5.6B in equity junior to the preferred shares (based on the net book value of the assets, thus including the $800M+ in accumulated depreciation).

A look at the preferred shares series K and the publicly traded debt

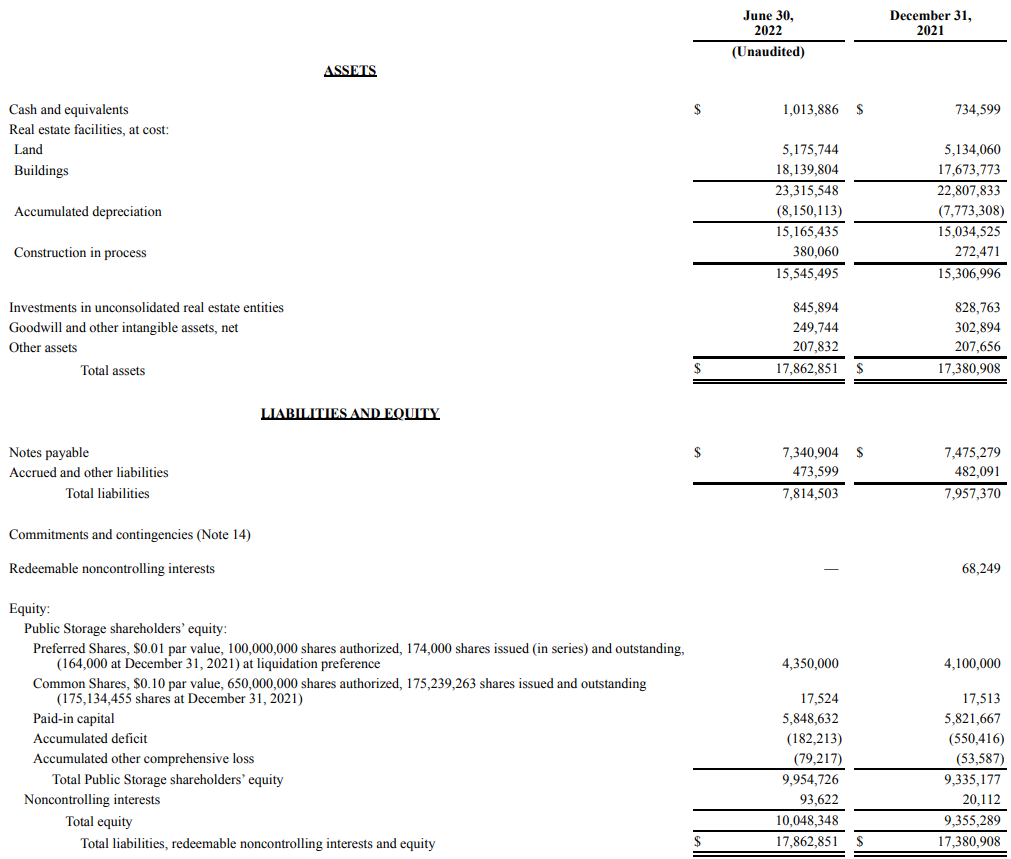

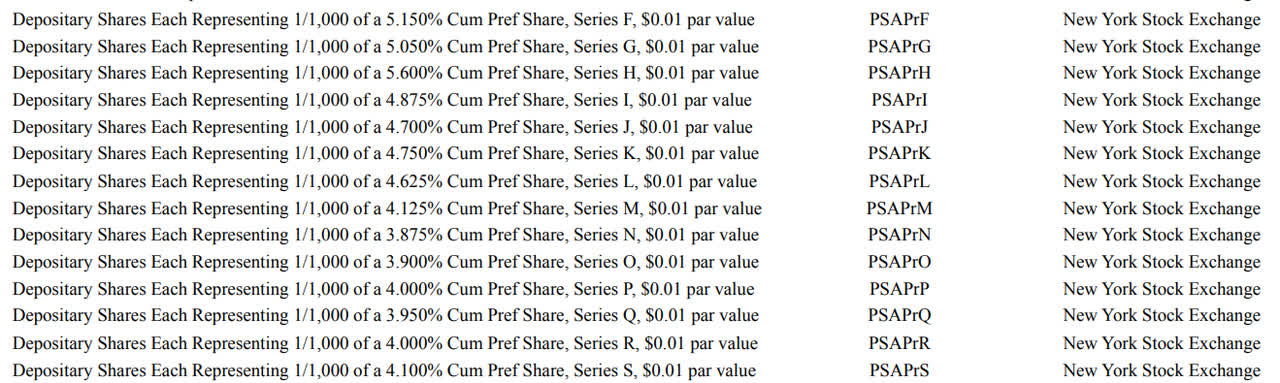

As you can see below, Public Storage has a wide range of options available to preferred stock investors.

PSA Investor Relations

While all preferred yields are pretty close to each other, I wanted to zoom in on the K-series (NYSE:PSA.PK). Mainly because they have an attractive preferred dividend on the principal, but just in case Public Storage starts to call some preferred shares, it will call the more expensive ones first.

The K-shares offer a cumulative dividend of $1.1875 per share per year paid in quarterly installments, and based on the current share price of $21.40, the dividend yield has increased to 5.55%. These preferred shares can be called by PSA from December 2024 on. Should that happen, the yield to call jumps to 10.75% but given the current situation on the markets and seeing the interest rate swings, I sincerely doubt that will happen. So using a 5.38% yield and looking at the security from a perpetual point of view seems to be the logical approach here. And given the very strong preferred dividend coverage ratio and the strong asset coverage ratio, 5.38% seems to be okay from a risk/reward perspective.

Subsequent to the end of the second quarter, the acquisition of PS Business Parks by Blackstone (BX) was completed and Public Storage received a cash payout for selling the PSB shares it owned. A portion of the proceeds were distributed to the common unitholders of Public Storage with a $13.15 special dividend.

Of course the downside of investing in preferred shares is that in return for getting preferred dividends which are more senior compared to the distribution on the common units is that you are essentially investing in a potentially perpetual equity security. And while a preferred dividend of 5.55% sounds ‘good enough’ given the strong balance sheet, the question could be if 5.55% is really good enough if you look at it from a perpetual basis. After all, if the interest rates remain at the current level, the odds of Public Storage calling the preferred shares are rather slim.

While a 5.55% preferred dividend yield is not bad, one could wonder if that is sufficient for a security which A) is perpetual in nature and B) ranks junior to the debt.

A quick glance at the PSA issued debt shows the 2.25% bonds maturing in November 2031 are currently trading at less than 83 cents on the dollar for a yield to maturity of 4.6%. That’s just 95 base points below the preferred dividend yield while not having to deal with a perpetual security. Additionally, as debt ranks senior to preferred equity, a 4.6% yielding bond is per definition safer than the preferred shares.

Investment thesis

While the preferred dividend yield is ‘okay’, it’s not as high as other REITs are offering mainly due to PSA’s excellent financial history and robust balance sheet. However, if I would be interested in fixed income from PSA, I think I would prefer the debt securities rather than the preferred shares. The yield is only slightly lower and the fixed end date and seniority versus preferred equity may be of more interest to some investors.

I used to own the F-series of the preferred shares but sold those a few months ago above par. I like PSA as a REIT and love the strong balance sheet and no-nonsense management style. But a 5.5% preferred dividend yield isn’t exactly spectacular.

Be the first to comment