ohmygouche

The cycle never changes, only the players do. Each time every new set of players/investors, becomes convinced that an asset class is doomed for extinction. Of course, if they all collectively believe and act on that, the net result is that that very class becomes destined for superlative performance.

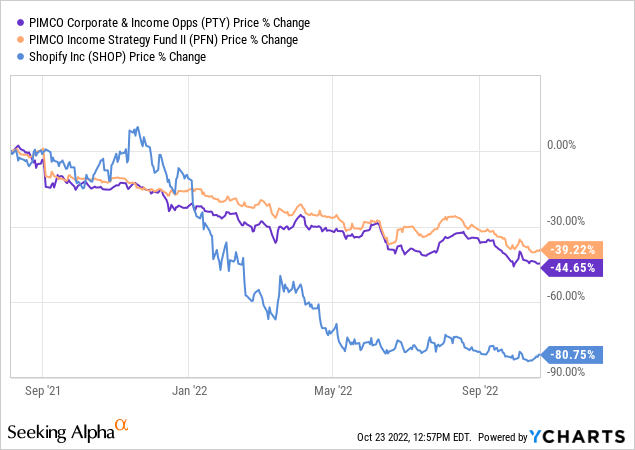

Cash is trash. You heard that for most of 2021 and investors used that mantra to chase speculative bubbles in growth and fixed income. The two fed on each other. What could go wrong with buying Shopify Inc. (SHOP) at 100X sales? The response was that if you used a discount rate of 1%, it would grow into that valuation by the late 2030s. The investor who saw the stupidity of chasing that growth promise convinced themselves that buying closed end funds like PIMCO Corporate & Income Opportunity Fund (NYSE:PTY) and Pimco Income Strategy Fund II (NYSE:PFN) yielding 7%-8% at the time, at massive premiums to NAV was a good deal. At least they were not getting suckered into that “growth” garbage can.

The latter group did better, but cash was the best asset of all. Even if you spent 8% or 15% of your capital to forego income, you could come back today and pick up each of these assets (and we use that word loosely), far cheaper.

What You Get Today?

There are three great positives about PTY and PFN that investors should keep in mind. The first is that you are no longer paying top dollar for trashy assets. Let’s face it, PTY and PFN buy and hold junk bonds and when you are getting it at a discount on NAV, it does warm your soul.

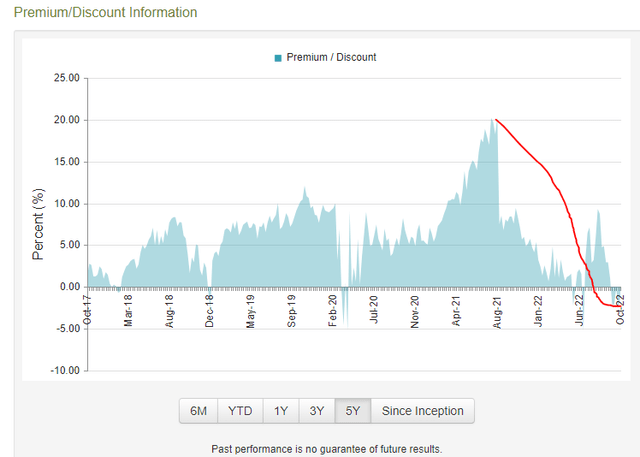

CEF Connect-PFN

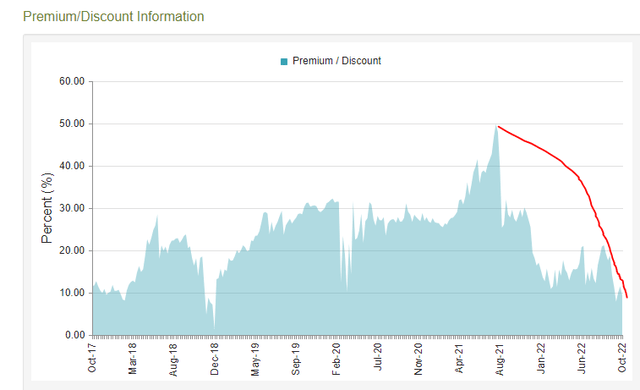

That’s PFN’s premium/discount move. PTY still, and it pains us to say this, trades at a premium. But its premium/discount journey has been just as harrowing for anyone that bought into this new paradigm.

CEF Connect-PTY

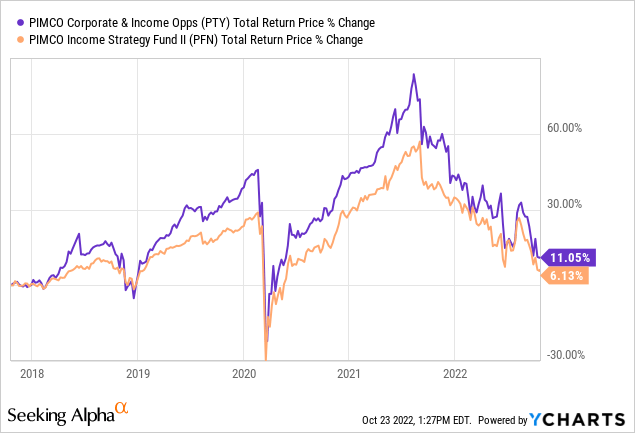

The second thing you are getting is that you are buying these funds after a really bad run. On a total return basis, including distributions and assuming you paid no tax on those distributions, you made 11% total in PTY and 6% total in PFN. That is over the last five years.

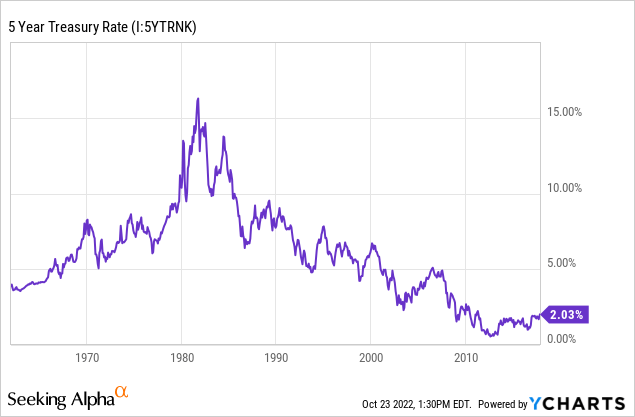

The 5-year Treasury yielded 2.03% exactly five years back. So if you embraced that bond, you did better than PFN and just about 1% worse than PTY in total.

Things mean revert, so one generally assumes that great managers will deliver more than their fair share after such a bad performance. So, you have that going for you, which is nice.

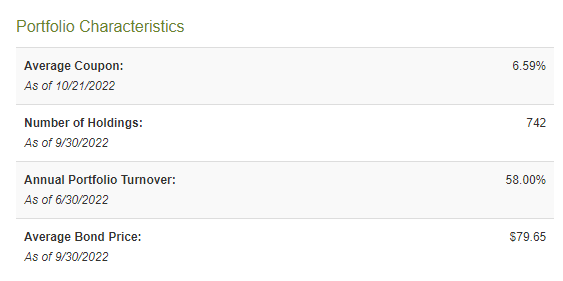

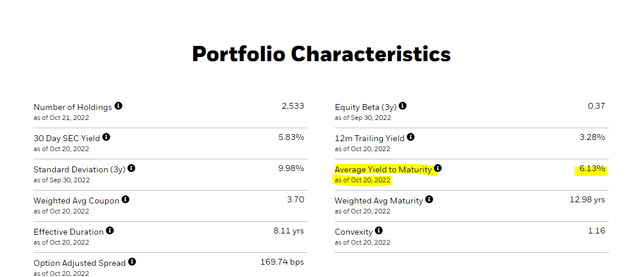

Finally, all bond holdings of these two funds are extremely distressed from both credit and interest rate risks and trading well under par. Here are PTY’s portfolio characteristics. $79.65 for a $100 par valued bond makes you feel warm and tingly all over.

CEF Connect-PTY

PFN is similar with an $80.96 value in the same spot.

Things To Consider If You Bite

Today we think the odds of you making 7%-8% in total returns on PTY and PFN are exceptionally high. Yes the distribution yield is higher, but you will deal with forced selling and credit losses. Total return likely comes in far lower. While that may sound great to some, it might also sound horrible to those that bought at the peak. If we are right about 7%-8% in total returns, then (the top tickers) they would break even after taxes, in about eight years. Break even. Nonetheless, even today this is not a slam dunk case. Here are three things to consider before you bite.

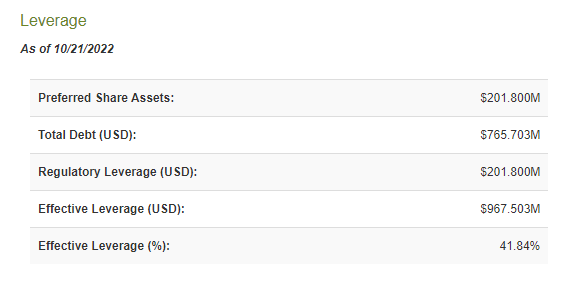

The first is that leverage risk for PTY and PFN is really high. As closed end funds they stay within their mandated margin levels and that requires forced selling when prices drop. This creates a different dimensional risk than what we see for a simple unleveraged buy and hold. Leverage is lower today than what it was at previous times.

CEF Connect-PTY

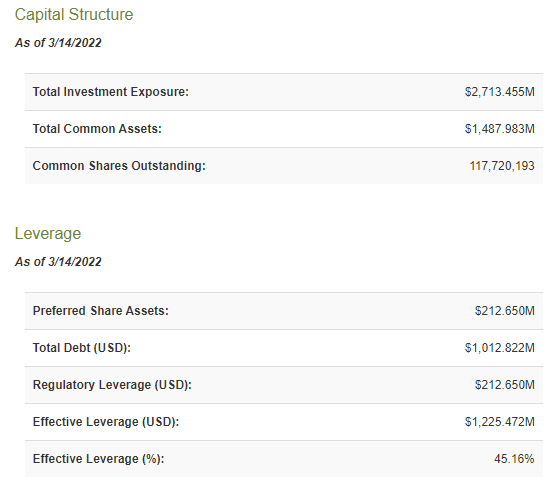

For example, here is the data from our March 2022 article.

Seeking Alpha

But that risk has not gone away and can keep hurting your returns if we have a long-drawn-out bottoming process for junk debt.

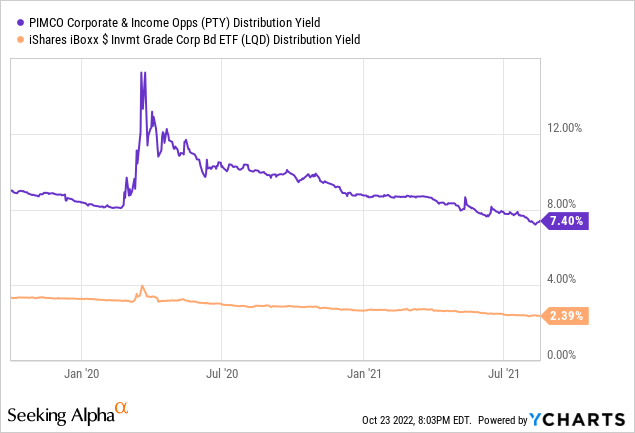

The second aspect here is that there are just a lot of good choices today unlike 18 months back. iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) now yields 6.13% based on yield to maturity.

iShares LQD

This is quite the irony as at the peak of this insanity, people were ready to accept just 7.4% from PTY.

Today we are getting 6.13% from investment grade credit without leverage. If you actually had cash, instead of believing that it was trash, you could just jump into that. Our bigger point is that there are a lot of great choices. We bought a preferred stock the other day with an almost 8% yield, where we personally view zero risk of problems with the company. This raised our fixed income allocation to a total of 9.00% in our 60:40 model. We are finding so many 7% plus yields with zero credit or virtually zero credit risk, that we find it difficult to jump into leveraged closed end funds.

Verdict

We have generally given you a negative to extremely negative view on PTY and PFN. If you agreed then you stayed out and now have cash to buy many amazing deals with great yields. If you disagreed then you are holding these, and we can bring you the proverbial stork with good news.

Things will get better from here.

No, you won’t make back your losses but you should start seeing total returns in the positive column. We are also upgrading PTY from a Strong Sell to A Hold while maintaining PFN at a Hold.

There is still a lot of uncertainty in the outlook. We can tell you that every single one of our fixed income picks is also down. We have been fortunate to have started buying recently. That helped. But it’s still the toughest market we have navigated, and our high cash allocation was the only real SWAN (sleep well without narcotics).

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment